Naira vs. Stablecoin Value Calculator

In Nigeria, with 24% annual inflation and 75% naira devaluation since 2016, many Nigerians use stablecoins like USDT to preserve savings. Calculate how much your naira would lose versus holding stablecoins.

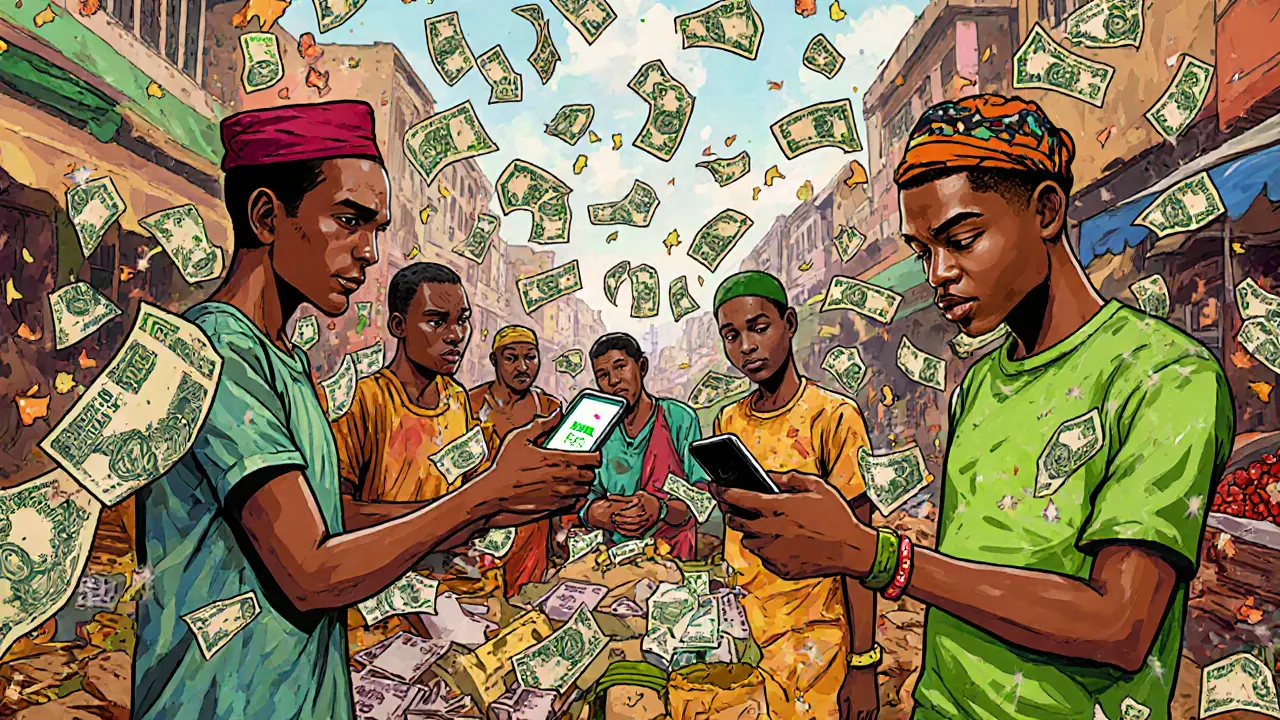

Nigeria isn’t just using cryptocurrency-it’s relying on it. With inflation hitting 24% and the naira losing over 75% of its value since 2016, millions of Nigerians have turned to crypto not as a speculative investment, but as a survival tool. Between July 2023 and June 2024, over $59 billion in crypto transactions flowed through the country. That’s not just trading-it’s people paying bills, sending remittances, saving money, and paying freelancers using Bitcoin, USDT, and other digital assets because the system designed to serve them has failed.

Why Nigeria Chose Crypto Over Banks

In Nigeria, 36% of adults have no bank account. Even for those who do, access to foreign currency is tightly controlled. Want to pay a freelancer in the U.S.? Traditional wire transfers cost up to 8% in fees and take days. The Central Bank of Nigeria (CBN) used to block banks from dealing with crypto exchanges. That didn’t stop people-it just pushed them underground. Peer-to-peer (P2P) trading exploded. Platforms like Binance P2P became lifelines. Nigerians bought USDT with naira, then sent it overseas. Recipients cashed out locally. No bank approval needed. No middleman taking a cut.The Regulatory Shift That Changed Everything

In late 2023, the CBN reversed course. It lifted its ban on banks servicing licensed crypto businesses. That wasn’t a gift-it was a recognition. The government couldn’t stop crypto. So it decided to regulate it. By 2025, major exchanges like Quidax and Yellow Card were fully licensed. Banks began opening accounts for them. The Nigeria Inter-Bank Settlement System (NIBSS) partnered with Zone’s blockchain network to make interbank payments faster and fraud-resistant. This wasn’t just policy-it was infrastructure modernization. Nigeria didn’t reject crypto. It integrated it into the backbone of its financial system.How Nigerians Are Actually Using Crypto

Most people aren’t day-trading Ethereum. They’re using stablecoins like USDT to protect their savings. When the naira drops 10% in a week, holding cash means losing money. Holding USDT means your buying power stays the same. Freelancers on Upwork and Fiverr receive payments in USDT, then convert to naira when they need to pay rent or buy food. Small business owners use crypto to import goods without going through the broken foreign exchange system. A Lagos vendor might buy Chinese electronics using USDT sent from a supplier in Shenzhen-no Naira conversion, no delays, no hidden fees.

The Retail Explosion: Crypto for the People, Not Just the Rich

Unlike in the U.S. or Europe, where crypto adoption is driven by institutional investors and tech elites, Nigeria’s market is built from the ground up. Over 8% of all crypto transactions in Sub-Saharan Africa are under $10,000. That’s retail. That’s daily life. In March 2025, when the naira suddenly dropped again, Nigeria’s monthly on-chain volume spiked to nearly $25 billion-while most other regions saw declines. People didn’t wait for news reports. They opened their apps and bought crypto within minutes. This isn’t speculation. It’s a reaction to economic collapse.The Rise of Local Fintech Giants

Moniepoint, a Nigerian fintech startup that lets small merchants accept digital payments, hit a $1 billion valuation in 2025 after securing funding from Google and other global investors. Its platform integrates crypto payouts for freelancers and supports USDT deposits. This isn’t an outlier-it’s proof that Nigeria’s crypto ecosystem is maturing. Local platforms are building tools tailored to Nigerian needs: Pidgin English interfaces, WhatsApp-based customer support, low-data trading apps for areas with spotty internet. You don’t need to be a tech expert. You just need a smartphone and a data plan.

Challenges Still Linger

It’s not perfect. Exchanges still crash during spikes in demand. Some users lose access to funds because they didn’t secure their private keys. Scams targeting new users are common. Regulatory clarity is still evolving. The CBN has said it’s open to a central bank digital currency (CBDC), which could compete with crypto. There’s also pressure from international bodies like the IMF to tighten controls. But the genie is out of the bottle. Over 22 million Nigerians-10.3% of the population-now hold crypto. That’s more than the entire population of Sweden. Reversing that would require shutting down the internet.What’s Next for Nigeria’s Crypto Future

The trend is clear: crypto adoption will keep growing. More Nigerians are learning about DeFi, staking, and yield farming, though most still stick to buying and holding stablecoins. Local startups are building crypto-based microloans for small businesses. Schools are starting to teach digital finance in economics classes. The government is exploring blockchain for land registries and tax collection. The real question isn’t whether crypto will survive in Nigeria-it’s how fast the rest of the world will catch up to what Nigerians already know: when traditional systems fail, people find a way to build their own.Is crypto legal in Nigeria?

Yes, crypto is legal in Nigeria. The Central Bank of Nigeria lifted its 2021 ban on banks servicing crypto businesses in late 2023. Licensed exchanges like Binance, Quidax, and Yellow Card now operate openly. While the CBN doesn’t recognize crypto as legal tender, it no longer blocks financial institutions from working with crypto firms. The government is also exploring a CBDC, but that doesn’t mean crypto will be banned-it’s more likely to coexist.

Why do Nigerians prefer USDT over Bitcoin?

USDT (Tether) is a stablecoin pegged to the U.S. dollar, so its value stays steady. Bitcoin’s price swings wildly-useful for speculation, risky for daily use. Nigerians use USDT to preserve savings, pay for imports, or receive international payments without losing value to inflation. Bitcoin is still traded, but USDT is the workhorse of everyday crypto use.

Can I buy crypto in Nigeria without a bank account?

Yes. Many P2P platforms let you buy crypto using cash deposits, airtime, or even mobile money. You don’t need a traditional bank account. You do need a smartphone and access to a crypto exchange like Binance P2P. Sellers accept naira through bank transfers, mobile wallets, or even direct cash handoffs. The system is built for people excluded from formal banking.

How do Nigerians protect their crypto from scams?

Most new users learn through Telegram and WhatsApp groups where experienced traders warn against fake exchanges and phishing links. The best practice is to use licensed platforms, never share private keys, and store large amounts in hardware wallets. Many also use multi-signature wallets for added security. Community education is the strongest defense-Nigerian crypto users are some of the most resourceful in the world.

Is crypto adoption in Nigeria slowing down?

No. Adoption is accelerating. Even during global crypto downturns, Nigeria’s transaction volume keeps rising because economic pressure hasn’t eased. Inflation is still above 20%, the naira remains unstable, and remittance costs are still high. As long as those problems exist, crypto will be the go-to solution. The number of users is projected to grow beyond 25 million by 2026.

What’s the biggest risk to crypto in Nigeria?

The biggest risk isn’t technology-it’s politics. If the government reverses its regulatory stance under international pressure, or if a new CBDC is forced on users without choice, adoption could slow. But the economic drivers are too strong. Banning crypto would mean cutting off millions from their only reliable way to save and transact. That’s not politically feasible.

Felicia Sue Lynn

November 27, 2025 AT 18:40This is one of those rare cases where technology didn’t just adapt to human need-it revealed how broken the system truly was. Nigeria’s crypto revolution isn’t about blockchain hype or Wall Street fantasies. It’s about mothers feeding their children, freelancers paying rent, and small vendors surviving when the state failed them. There’s a quiet dignity in this movement: people building dignity with code when institutions refused to grant it. The world watches as Nigeria redefines financial sovereignty-not with protests, but with QR codes and private keys.

It makes you wonder: if the system works better without permission, why do we still demand it?

Christina Oneviane

November 27, 2025 AT 18:46Oh wow, look at the noble Africans using Bitcoin to buy rice while the IMF cries in their champagne.

Meanwhile, in America, we’re still debating whether to put crypto on our taxes. 🙃

Casey Meehan

November 29, 2025 AT 02:31Bro, USDT is the real MVP here 🚀💸

Imagine your savings don’t evaporate every time the government prints more naira. That’s not crypto-that’s sanity. And don’t even get me started on P2P trading-no bank approval, no 8% fees, no waiting 5 days. Just tap, send, cash out. 🤯

Also, 22M Nigerians holding crypto? That’s more than Sweden. Sweden has IKEA. Nigeria has *survival*. 😎

And Moniepoint hitting $1B? That’s not a startup-that’s a revolution with a mobile app. 📲🔥

Tom MacDermott

November 29, 2025 AT 11:23Let’s be honest-this isn’t innovation. It’s desperation dressed up like a TED Talk.

Nigeria didn’t ‘adopt’ crypto. It was forced into it because its currency is a joke and its banks are corrupt. Calling this ‘infrastructure modernization’ is laughable. You don’t build a financial system on P2P trades and WhatsApp groups-you build it with institutions, regulation, and trust.

And don’t act like this is unique. Venezuela’s been doing this for a decade. Argentina too. It’s not a blueprint-it’s a burnout. The fact that people are proud of surviving economic collapse doesn’t make it progress. It makes it tragic.

Also, ‘crypto for the people’? Please. The people who succeed here are the ones who already had smartphones, data plans, and friends who could explain what a private key is. The rest? They’re just one phishing link away from losing everything.

And the government ‘embracing’ crypto? Don’t be naive. They’re just trying to tax it before they ban it.

Meanwhile, the real story? The IMF is already whispering about CBDCs. Nigeria’s crypto boom? It’s not the future. It’s the last gasp before the state reclaims control.

Susan Dugan

November 29, 2025 AT 16:19Let me tell you something-this isn’t just about money. It’s about agency.

Every time a Nigerian mom buys USDT to protect her savings from inflation, she’s saying: ‘I won’t be erased by your broken system.’ Every freelancer getting paid in crypto instead of waiting weeks for a wire? That’s dignity.

And yeah, scams exist. People lose keys. Exchanges crash. But here’s the thing-Nigerians aren’t waiting for someone to fix it. They’re fixing it themselves. Through Telegram groups. Through community warnings. Through trial, error, and sheer grit.

Moniepoint isn’t just a fintech company-it’s a movement. Pidgin interfaces? WhatsApp support? Low-data apps? That’s not ‘adaptation.’ That’s *brilliance*. Someone actually listened to what real people need-not investors, not regulators, not Silicon Valley.

And guess what? The world is watching. Because when the system fails, humans don’t wait for permission to rebuild. They just start building.

So yeah-Nigeria’s crypto story isn’t about technology.

It’s about the unbreakable human spirit.

And honestly? We could all learn from that.