Thailand’s Crypto Crackdown Is Real - And It’s Getting Harsher

If you’re trading crypto in Thailand or targeting Thai users from abroad, you’re playing in one of the strictest regulatory environments in Southeast Asia. As of April 13, 2025, the Thailand Securities and Exchange Commission (SEC) has full legal power to shut down platforms, freeze assets, and throw people in jail for non-compliance. This isn’t a warning. It’s already happening.

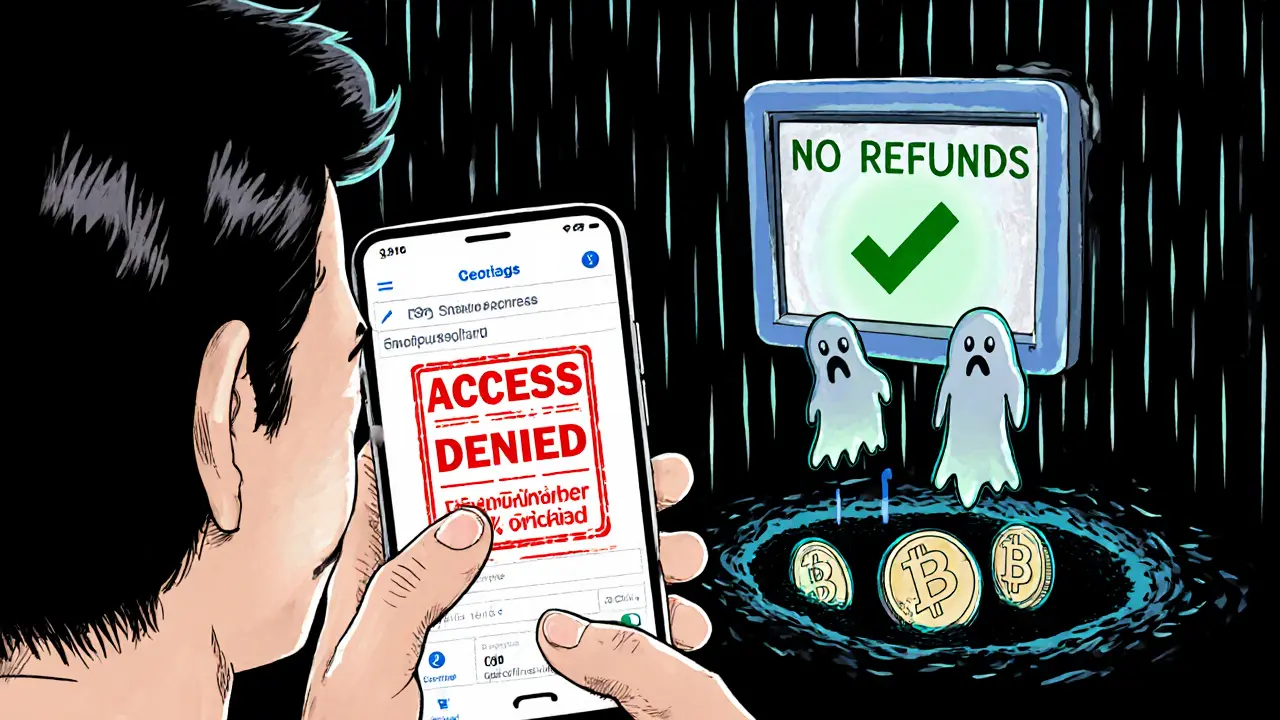

On June 28, 2025, the SEC blocked access to five major unlicensed crypto exchanges used by Thai traders. Users were given a deadline to withdraw their funds - and many didn’t make it in time. Now, those funds are locked. Forever. No appeals. No refunds. Just silence.

Who Gets Punished - And How Badly?

It’s not just platforms that are at risk. Individuals face serious consequences too.

Using a crypto wallet or bank account to receive money from a scam? That’s called operating a "mule account." In Thailand, that’s a criminal offense. You could spend up to three years in prison and pay a fine of up to THB 300,000 (about $8,400 USD). No exceptions. No "I didn’t know" defense.

For platforms - whether local or foreign - the penalties are even more brutal. If your exchange gets hacked and users lose money to fraud, you could be held legally responsible for the losses. Not just the hackers. You. Even if you didn’t cause the breach. This is called joint liability, and it’s the same standard applied to banks and telecom companies. Most small operators can’t afford that kind of risk.

Platforms that fail to block known scam wallets, freeze suspicious accounts, or report activity to the Anti-Money Laundering Office (AMLO) risk having their license revoked. Operators can be criminally prosecuted. That means jail time for founders, CEOs, and compliance officers.

Foreign Platforms? You’re Not Safe Just Because You’re Overseas

Many thought they could ignore Thailand’s rules by hosting servers in Singapore or operating from the U.S. That’s over.

Since January 2025, any crypto platform that offers Thai-language support, accepts Thai baht payments, or runs ads targeting Thai users is considered to be operating in Thailand - no matter where it’s registered. The SEC doesn’t care if your headquarters is in Dubai. If you’re serving Thai customers, you’re under their jurisdiction.

To legally operate, you must:

- Establish a Thai legal entity

- Appoint a Thai national as your local director

- Open a corporate bank account in Thailand

- Integrate with Thailand’s national AML system

- Pass SEC licensing and join the regulatory sandbox

- Implement FATF-compliant transaction monitoring tools

It’s not optional. And it’s not cheap. Legal firms in Bangkok charge between THB 500,000 and THB 2 million ($14,000-$56,000 USD) just to help you navigate the process. Most foreign startups can’t afford it. That’s why the number of licensed platforms dropped from 12 to 7 in just six months.

What Licensed Platforms Must Do - And Why It’s a Burden

Being licensed doesn’t mean you’re safe. It means you’re under constant surveillance.

Every transaction must be monitored in real time. If someone sends funds from a wallet linked to a scam, your system must freeze it. You must blacklist that wallet. You must report it to law enforcement. And here’s the kicker: you may be required to refund the victim, even if you didn’t cause the fraud.

That’s right. If a Thai user gets scammed and sends crypto to your platform, and your system didn’t catch it, you could be forced to pay them back out of your own pocket. This has never been required of exchanges anywhere else in the world. It’s a massive financial risk.

KYC rules are also brutal. You must verify identity down to the national ID number, proof of address, and source of funds. No anonymous wallets. No privacy coins. No workarounds. The system tracks everything - and shares data with police and tax authorities.

The Tax Incentive That’s Not Really an Incentive

Thailand’s government tried to make compliance look attractive by offering a five-year capital gains tax exemption for trades on licensed exchanges - from January 1, 2025, to December 31, 2029.

At first glance, that sounds great. But look closer. The exemption only applies if you trade on a licensed platform. And there are only seven of them now. Fewer platforms mean higher fees, slower withdrawals, and less competition. You’re trading freedom for a tax break.

And after 2029? The exemption disappears. There’s no guarantee the tax rate will stay low. That means you’re being lured into a system with a hidden expiration date.

What Happens to Users Who Ignore the Rules?

Many Thai traders still use unlicensed platforms because they’re faster, cheaper, or offer better features. But they’re playing Russian roulette.

Once a platform is blocked, users lose access to their funds. There’s no legal recourse. No customer support. No refunds. The SEC doesn’t help you recover your money - they warn you not to use those platforms in the first place.

Some users report that their accounts were frozen even after they withdrew funds - because the platform was flagged after the fact. Others say their bank accounts were flagged for crypto activity, triggering investigations by the AMLO.

There’s no gray area anymore. If you’re using an unlicensed platform, you’re not just risking your money - you’re risking your freedom.

What’s Next for Thailand’s Crypto Market?

Thailand is betting that fear will drive compliance. So far, it’s working.

Trading volume on licensed platforms rose 23% in the first half of 2025, even as the number of platforms dropped. People are moving to the legal side - not because they love regulation, but because they have no choice.

Stablecoins like USDT and USDC are now allowed under limited conditions, but only for specific use cases. They can’t be used to pay for coffee, rent, or groceries. Thailand still bans crypto as payment. Instead, the Bank of Thailand is testing its own digital currency, the CBDC, which gives the government full control over every transaction.

Industry analysts predict unlicensed crypto activity will vanish from Thailand within 12 to 18 months. The market will be smaller, but more stable. And more controlled.

But there’s a cost. Innovation is slowing. Startups are leaving. Investors are wary. Thailand may become a model for other ASEAN countries - but it’s becoming a hard place to build a crypto business.

What Should You Do?

If you’re a Thai trader: Use only SEC-licensed platforms. Accept the slower KYC, higher fees, and strict monitoring. It’s the only way to protect your funds - and your legal safety.

If you’re a foreign platform operator: Don’t assume you’re safe because you’re not based in Thailand. If you’re targeting Thai users, you’re already in violation. Get legal help. Start the licensing process now - it takes 6 to 12 months. Or walk away.

If you’re just curious: Don’t use mule accounts. Don’t trade on blocked platforms. Don’t think you can outsmart the system. Thailand’s regulators have tools no one else in the region has - and they’re not afraid to use them.

Brian Bernfeld

November 27, 2025 AT 04:30Man, Thailand’s going full surveillance state with crypto. I get wanting to stop scams, but forcing platforms to refund victims? That’s not regulation-that’s turning exchanges into banks with zero liability protection. No other country does this. You’re basically forcing startups to carry the weight of every dumb user who got phished. It’s unsustainable.

And don’t even get me started on the $2M legal fees just to apply. This isn’t protecting users-it’s creating a cartel of seven licensed giants who can charge whatever they want. Welcome to crypto… but make it boring.

Ian Esche

November 27, 2025 AT 17:12Good. Let the criminals rot. If you’re using unlicensed exchanges, you’re already part of the problem. Thailand’s not being harsh-they’re being smart. The U.S. lets people lose millions to rug pulls and calls it ‘free market.’ Meanwhile, Thailand actually enforces consequences. Maybe we should copy them instead of whining about ‘freedom.’

Felicia Sue Lynn

November 28, 2025 AT 10:45There’s a profound tension here between security and autonomy. Thailand’s approach prioritizes collective safety over individual financial sovereignty-a philosophical shift that mirrors broader global trends toward state-mediated economic control. While the intention-to protect citizens from predatory actors-is noble, the mechanism risks normalizing a level of financial surveillance previously reserved for authoritarian regimes.

One must ask: Is the trade-off of personal privacy and entrepreneurial freedom worth the reduction in fraud? And if so, who defines the threshold of acceptable loss? These are not technical questions. They are existential.

Christina Oneviane

November 29, 2025 AT 00:35Oh wow, so now you get jailed for being a ‘mule’? Cool. I’m sure the 19-year-old Thai student who got scammed out of $200 and then used his mom’s account to buy ramen is now doing hard time. Classic case of punishing the victim while the real criminals laugh from a beach in Bali.

Also, ‘joint liability’? So if my coffee shop gets robbed, I have to pay back the customer’s stolen cash? No? Then why crypto? Oh right-because it’s easier to blame the tech than fix the system. 🙄

fanny adam

November 29, 2025 AT 01:37This is not regulation. This is a coordinated psychological operation. The SEC is using fear as a weapon to eliminate decentralized finance and replace it with a state-controlled CBDC. The five-year tax exemption? A bait-and-switch. The real goal is to track every transaction, freeze accounts at will, and eventually phase out cash entirely. This is the first domino in a global financial lockdown. The U.S. and EU are watching. They’re learning. They’re preparing. Don’t be fooled by the ‘anti-scam’ rhetoric. This is control. Pure and simple.

They’re calling it ‘compliance.’ We call it totalitarianism with a user-friendly interface.

Eddy Lust

November 30, 2025 AT 18:47bro i just tried to send some usdt to a friend in bangkok and my wallet got flagged for ‘suspicious activity’… i didn’t even know what i did. now my bank’s asking me for ‘source of funds’ for a $50 transfer. i’m just trying to buy weed and pay rent, not run a bank.

thailand’s system feels like a digital prison with free wifi. i get they wanna stop scammers, but now even normal people are getting treated like criminals. it’s exhausting. i miss when crypto was just… weird internet money.

also why does every licensed exchange have the same logo? it’s like they all got their design from the same 1998 PowerPoint template.

Casey Meehan

December 1, 2025 AT 12:19THAILAND JUST TURNED CRYPTO INTO A DRAMA SERIAL 😱💸

So if you get scammed, the exchange pays you back? 😳 That’s like if your car got stolen and the dealership had to give you a new one. 🤯

Also, 7 exchanges? That’s less than the number of Starbucks in my city. And they’re all using the same KYC form that looks like it was made in Word 2003. 📄😭

At least the tax break is nice… until it’s not. 👀

Also, no privacy coins? So… no Monero? 😭 I’m crying. 🥲

Susan Dugan

December 3, 2025 AT 00:15Let’s flip the script: What if Thailand’s model is the future? Imagine if every country demanded real accountability-not just from users, but from platforms. No more ‘oops, our API got hacked, sorry for your $2M loss.’ No more offshore shell companies hiding behind ‘jurisdictional arbitrage.’

Yes, it’s heavy. Yes, it’s expensive. But it’s also honest. The days of crypto being a Wild West are over. You want decentralization? Fine. But you still have to answer for your actions. That’s not oppression-that’s maturity.

And hey, if you’re a founder who can’t afford compliance? Maybe you weren’t ready to build something real. The market’s filtering out the fluff. That’s not a bad thing. The survivors will be stronger. The users will be safer. And the scams? They’ll finally have nowhere to hide.