KuCoin Russia: What You Need to Know About Using KuCoin in Russia

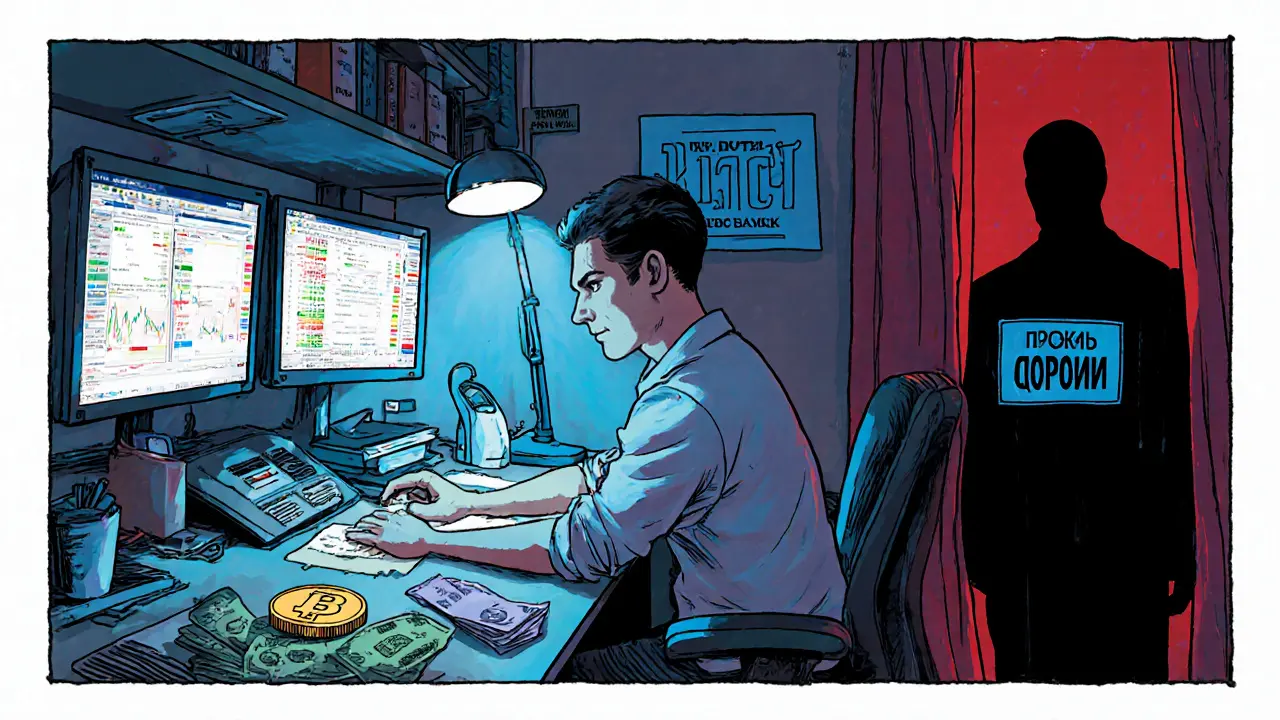

When it comes to KuCoin, a global cryptocurrency exchange offering hundreds of coins, low fees, and margin trading. Also known as KuCoin Exchange, it's popular among traders worldwide—but not in Russia. Since 2022, Russia has cracked down on unlicensed crypto platforms, and KuCoin is not on the official list of approved exchanges. That means using it there isn’t just risky—it could get your funds frozen or seized.

Many Russian users still access KuCoin through VPNs, thinking it’s a workaround. But the government tracks on-chain activity, and banks now flag transactions linked to unregistered exchanges. SEC Russia, the federal body regulating financial markets, including digital assets only approves a handful of platforms like Quidax and Busha for local users. KuCoin doesn’t have that license. Meanwhile, Russian crypto regulations, a strict set of rules requiring exchanges to register, report user data, and comply with anti-money laundering laws make it nearly impossible for foreign platforms to operate legally.

Even if you’re not caught, using KuCoin in Russia means you’re trading without legal protection. No official support, no dispute resolution, and no recourse if withdrawals fail. That’s why many Russians have moved to licensed local exchanges or peer-to-peer markets. The truth? KuCoin isn’t banned outright in Russia—but it’s effectively blocked by law, banking restrictions, and surveillance. You can still log in, but you’re on your own.

Below, you’ll find real user experiences, regulatory updates, and safer alternatives for trading crypto in Russia. No fluff. No guesses. Just what’s working—and what’s not—right now.

Crypto Exchanges That Accept Russian Citizens in 2025

- 9 Comments

- Oct, 14 2025

In 2025, Russian citizens use offshore exchanges like Bybit, Gate.io, and KuCoin to trade crypto, while avoiding government restrictions. A7A5 stablecoin and peer-to-peer platforms have become essential tools for bypassing sanctions and banking limits.