On-Chain Analysis: What It Is and How It Powers Crypto Decisions

When you hear on-chain analysis, the practice of examining live blockchain data to understand market behavior and wallet activity. It’s not about rumors or tweets—it’s about counting actual transactions, tracking large wallet movements, and spotting patterns no one else sees. This is how pros know when big players are buying or dumping, before prices move. You don’t need to guess what’s coming—you can see it happening in real time on Bitcoin, Ethereum, and other chains.

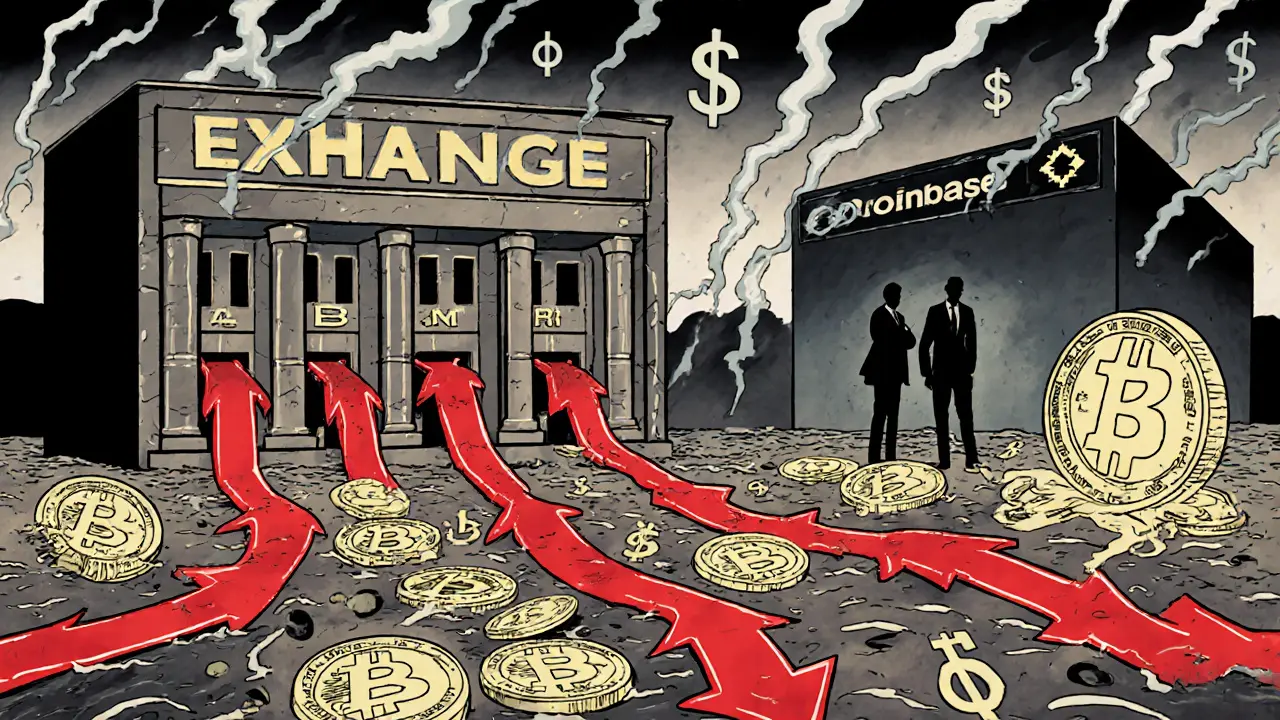

On-chain analysis relies on tools that track blockchain data, the permanent, public record of every transaction across a crypto network. Every time someone sends ETH or moves BTC, it’s written into a block, forever. Analysts use this data to spot trends: Are whales accumulating? Are exchanges seeing heavy outflows? Is a new address suddenly buying millions in stablecoins? These aren’t just numbers—they’re signals. For example, when Bitcoin holders start moving coins off exchanges, it often means they’re preparing to hold long-term, which can signal upward pressure. On the flip side, if a lot of coins suddenly hit exchanges, it might mean selling is coming.

It’s not magic. It’s math. And it’s getting more precise. Tools now track transaction tracking, the process of following specific wallets or coin movements across multiple blocks to uncover behavior patterns with alarming accuracy. You can see if a single wallet has held coins for five years and just moved them—that’s often a sign of a long-term holder making a move. You can also spot blockchain metrics, quantifiable indicators like NVT ratio, SOPR, or MVRV that measure market sentiment using on-chain data—numbers that tell you if the market is overbought or undervalued, based on real activity, not hype.

This is why posts here cover everything from TRO airdrop scams to Venezuela’s state-run mining. If a project claims to be huge but shows zero on-chain activity? It’s likely fake. If Nigeria’s crypto adoption hits $59 billion? You can see it in the transaction volume. If Bitfinex users are moving millions? That’s not speculation—it’s data. On-chain analysis cuts through the noise. It tells you what’s real, what’s fading, and what’s about to explode.

Below, you’ll find real examples of how this works—how people used on-chain data to spot dead coins like Quotient and PKG, how they caught fake exchanges like BitxEX, and how they tracked institutional buys before ETFs even launched. No fluff. No guesswork. Just what’s on the chain—and what it means for your wallet.

Exchange Inflow and Outflow Metrics: What They Really Tell You About Crypto Markets

- 10 Comments

- Oct, 16 2025

Exchange inflow and outflow metrics reveal whether crypto holders are preparing to sell or hold long-term. Learn how these on-chain signals predict market moves and what institutions are watching.