Morocco Remittance Savings Calculator

Calculate how much you could save when sending money to Morocco using crypto compared to traditional banking services. Based on data from Morocco's underground crypto market.

Your Savings Comparison

Traditional Banking

Fees: 0 MAD

Total Cost: 0 MAD

Crypto

Fees: 0 MAD

Total Cost: 0 MAD

You save

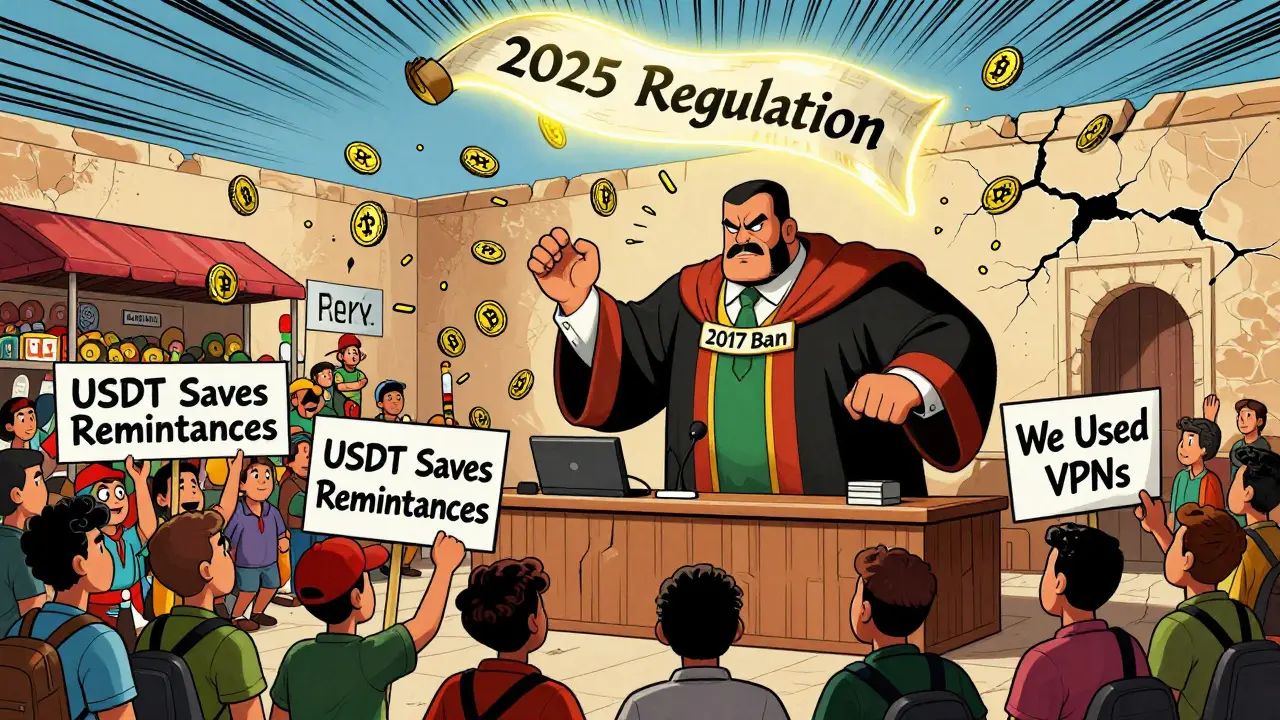

0

On November 21, 2017, Morocco made it illegal to use Bitcoin, Ethereum, or any other cryptocurrency. The central bank, Bank Al-Maghrib, and the Exchange Office shut down all crypto activity-trading, mining, even holding digital assets-calling it a threat to national currency control. At the time, it seemed like the end of the road for crypto in the country. But five years later, something unexpected happened: Morocco’s underground crypto market grew bigger than ever.

How Crypto Survived a Total Ban

You wouldn’t know it from official reports, but crypto is everywhere in Morocco’s cities. In Casablanca, Rabat, and Marrakech, young people are trading Bitcoin through WhatsApp groups. In Fes, students use Telegram channels to find OTC traders who’ll exchange cash for USDT. These aren’t tech elites or hackers-they’re students, freelancers, and small business owners who just want a way to get paid from abroad without waiting weeks for bank transfers. The ban didn’t stop demand. It just pushed it underground. By 2024, an estimated 1.2 million Moroccans-about 3.2% of the population-had used crypto in some form. That’s more than the number of people who own a car in the country. And it’s growing. Between 2018 and 2024, transaction volumes jumped from $8.2 million per month to nearly $48 million. That’s a 480% increase, even with no legal protection, no exchanges, and no consumer safeguards.How It Actually Works

There’s no official crypto app in Morocco. No local exchange. No ATM that spits out Bitcoin. So how do people do it? First, they use a VPN. About 82% of users rely on NordVPN or ExpressVPN to bypass geo-blocks on international platforms like Binance, Bybit, and OKX. Monthly cost? Around 120 to 180 MAD-less than a phone bill. Then comes the real work: finding a human to trade with. Most transactions happen through peer-to-peer (P2P) networks. WhatsApp groups with 50 to 200 members act as local marketplaces. Someone posts: “I have 0.5 BTC, need 10,000 MAD cash.” Another replies: “I’m in Rabat, can meet at Starbucks.” They meet, exchange cash, and the Bitcoin is sent instantly over the blockchain. It’s messy. It’s risky. But it works. Stablecoins like USDT are the most popular because they’re tied to the U.S. dollar. That means less price swing than Bitcoin and more reliability when you’re trying to send money to a cousin in Spain or pay for a Shopify store in the U.S.Why People Risk It

The main reason? Remittances. Morocco is one of the top recipients of foreign remittances in Africa-over $9 billion a year. Most of that comes from workers in Europe. Traditional banks charge up to 10% in fees and take 3 to 7 days. Crypto cuts that to under 24 hours and less than 2% in fees. A 28-year-old freelance graphic designer in Tangier told me (through a Reddit comment): “I get paid in crypto from clients in Germany. I convert to USDT, send it to my brother in Marseille, he cashes it out at a local exchange, and sends me MAD via Western Union. I save 30% compared to using banks.” Speculative trading is the second biggest driver. With inflation hovering around 5% and savings accounts paying less than 1%, crypto looks like the only real chance to grow money. And with the Moroccan Dirham losing value against the dollar, many see Bitcoin as a better store of value than cash.

The Hidden Costs

This system isn’t free. It’s expensive and dangerous. Transaction fees average 3.8% to 5.2%-way higher than the 0.1% you’d pay on Binance in the U.S. Why? Because every trade needs a middleman. Someone has to hold the cash, verify the buyer, and risk getting scammed. That’s why most trades include a 1.5% to 2.5% “network fee” paid to the person who connects the buyer and seller. Scams are common. About 32% of users have been burned by non-delivery scams. One Reddit user, u/CryptoDarija, lost 3,500 MAD after sending cash to a seller who vanished. Another 27% deal with payment delays longer than four days. And if you’re caught? There’s no legal recourse. The government doesn’t recognize your trade. You can’t file a complaint. You’re on your own.The Government Is Changing Its Mind

By 2024, the central bank realized the ban wasn’t working. Crypto wasn’t disappearing-it was thriving. And with Algeria and Tunisia still blocking it, Morocco was falling behind Egypt, which had launched a regulatory sandbox in late 2023. In November 2024, Bank Al-Maghrib’s governor announced a draft law to regulate crypto. It’s not a reversal-it’s a surrender with structure. The new rules, expected to take effect in Q3 2025, will allow licensed exchanges, wallet services, and custodians to operate-but only under strict conditions:- All users must pass KYC (Know Your Customer) checks

- Exchanges must pay MAD 150,000-200,000 for a license

- 15% capital gains tax on profits

- Strict AML/CFT reporting for any suspicious activity

- Only institutional players can handle large volumes

What This Means for Users

For most Moroccans, the new rules won’t change much right away. The underground market will keep running. Why? Because the regulated system will be slow, expensive, and limited. A licensed exchange might require you to visit a physical office, show ID, and wait weeks to get approved. Meanwhile, your WhatsApp group lets you trade in 10 minutes. But the shift does two important things:- It reduces risk. Once exchanges are licensed, they’ll have to follow security standards. Your funds won’t vanish if the platform collapses.

- It opens doors. If you’re a freelancer or small business owner, you might soon be able to legally receive crypto payments without fearing a police raid.

Who’s Using Crypto-and Who Isn’t

Crypto isn’t for everyone in Morocco. It’s concentrated in cities with over 500,000 people. 83% of users live in urban areas. 68% are under 35. 72% earn more than 10,000 MAD per month. That’s not poverty-it’s the middle class trying to build wealth. Rural areas? Almost none. Older generations? Rarely. People without smartphones? Not possible. This isn’t a mass movement. It’s a smart, tech-savvy minority finding a workaround to a broken financial system.What Comes Next

By 2026, Morocco’s crypto market is projected to hit $292.4 million-even with the ban still technically in place. Once regulation kicks in, analysts expect a 35-40% surge as people move from shady WhatsApp groups to licensed platforms. But the real win won’t be in the numbers. It’ll be in the freedom. For the first time, Moroccans will have a legal way to use crypto without risking jail or losing everything to a scammer. The government didn’t win by banning it. They won by finally admitting the ban failed-and choosing to fix it instead of fighting it.Frequently Asked Questions

Is cryptocurrency still illegal in Morocco?

Yes, technically. The 2017 ban is still on the books. But the government is preparing to replace it with a regulatory framework expected to launch in Q3 2025. Until then, using crypto is not legal-but it’s widespread and largely ignored by authorities unless it involves large-scale fraud or money laundering.

Can I open a crypto account in Morocco?

Not through a local bank or exchange. All Moroccan financial institutions are banned from dealing with crypto. But you can open an account on international platforms like Binance or Bybit using a VPN. Once regulation starts in 2025, licensed local exchanges may become available-but they’ll require strict KYC and high fees.

What’s the most popular crypto in Morocco?

Bitcoin leads at 57.3% of trading volume, followed by Ethereum at 22.1%. But USDT (Tether) is the most practical-it’s stable, easy to convert to cash, and widely accepted in P2P networks. Most people use USDT to send money abroad or avoid Dirham depreciation.

How do Moroccans cash out crypto?

Through informal OTC traders in person or via WhatsApp/Telegram groups. You send crypto to a seller, they hand you cash. Some use trusted intermediaries who charge a 1.5-2.5% fee. Once regulation starts, licensed exchanges will offer bank transfers-but they’ll be slower and more expensive than current methods.

Is it safe to trade crypto in Morocco?

It’s risky. About 32% of users have been scammed, mostly through fake sellers who take cash and disappear. 18% have lost funds to fraud, and 12% had accounts frozen when trying to convert crypto to cash. Using a VPN, meeting in public, and starting with small trades reduces risk. Once regulation arrives, safety will improve-but until then, trust only people you’ve vetted over time.

Can I mine Bitcoin in Morocco?

Mining is banned under the 2017 law. While enforcement is rare, it’s still illegal. Most miners have stopped or moved operations abroad. The high cost of electricity and lack of cooling infrastructure also make mining unprofitable in Morocco compared to countries with cheaper power.

Why hasn’t the government shut down WhatsApp crypto groups?

Because they’re decentralized, encrypted, and spread across thousands of small groups. Shutting them down would require mass surveillance, which the government hasn’t pursued. Also, these groups are mostly used for personal remittances and small trades-not large-scale crime. Authorities focus on bigger targets like money laundering rings, not casual traders.

Annette LeRoux

December 5, 2025 AT 04:17It’s wild how human ingenuity outsmarts bureaucracy. 🌍 The ban didn’t kill crypto-it just made it more intimate. People aren’t trading for speculation; they’re trading to survive. That WhatsApp group in Casablanca? That’s not a black market. That’s a community bank built on trust and Telegram. I’m not even Moroccan, but I respect this more than any central bank policy.

Yzak victor

December 5, 2025 AT 19:14Same. I’ve seen this in Nigeria too-people using crypto to bypass broken systems. The real story isn’t the tech. It’s the people refusing to be locked out. Morocco’s middle class didn’t rebel with protests-they rebelled with QR codes and VPNs. Quiet. Effective. Unstoppable.

Josh Rivera

December 7, 2025 AT 04:44Oh please. Let’s not romanticize criminal activity. These people are playing Russian roulette with their life savings. One wrong WhatsApp contact and poof-$5,000 gone. And you call that ‘ingenuity’? No. That’s desperation dressed up as rebellion. The government’s not the villain here. The people who scam them are.

Thomas Downey

December 8, 2025 AT 14:50While I admire the resilience of these individuals, one must consider the broader implications of circumventing sovereign monetary policy. The integrity of a nation’s currency is not a mere technicality-it is the foundation of economic order. To glorify this underground ecosystem is to endorse chaos masquerading as innovation. The Moroccan state, though slow, is attempting to reintegrate this phenomenon into the rule of law. That is not surrender. It is statesmanship.

Holly Cute

December 9, 2025 AT 00:21Okay but let’s be real-this whole thing is just a glorified Ponzi scheme with better UX. 3.2% of the population? That’s 1.2 million people who are either delusional or desperate. And guess what? Most of them will lose everything when the government finally cracks down. The ‘regulation’ they’re talking about? It’s a trap. KYC means they’ll track every transaction. The ‘safe’ licensed exchanges? They’ll be owned by the same banks that charge 10% for remittances. This isn’t freedom-it’s rebranding. 😒

Madison Agado

December 9, 2025 AT 18:12There’s something deeply poetic about this. A generation, locked out of traditional finance, builds its own economy in the cracks. No permission. No approval. Just code, cash, and courage. The state didn’t lose because they were outsmarted-they lost because they forgot that money is a social contract, not a monopoly. Maybe the real revolution isn’t blockchain-it’s the quiet refusal to accept broken systems.

Billye Nipper

December 11, 2025 AT 05:27Y’all need to stop acting like this is just about money. This is about dignity. 🫂 Imagine being a freelancer in Tangier, working for clients in Berlin, and having your paycheck take a week and cost you 10% just because your country won’t let you use the tools the rest of the world uses. This isn’t crypto. This is justice. And if you’re not rooting for them, you’re rooting for the system that left them behind.

Chris Jenny

December 11, 2025 AT 08:51MARK MY WORDS: THIS IS A COVERT OPERATION. WHY DO YOU THINK THE GOVERNMENT IS ‘REGULATING’ NOW? THEY’RE NOT TRYING TO HELP-THEY’RE PREPARING TO TRACK EVERY SINGLE TRANSACTION. THE VPNs? FAKE. THE WHASTAPP GROUPS? INFILTRATED. THE ‘STABLECOINS’? BACKDOORED. THIS ISN’T FREEDOM-IT’S A DIGITAL TRAP. THE CIA, THE IMF, THE BANK OF ENGLAND-THEY’RE ALL IN THIS TO CONTROL THE AFRICAN FINANCIAL FLOW. THEY LET IT GROW… SO THEY CAN CRUSH IT WHEN THEY’RE READY. WATCH. THEY’LL ARREST THE ‘TRADERS’ AND CONFISCATE EVERYTHING. I’VE SEEN THIS PATTERN BEFORE. DON’T BE A SHEEP.

Roseline Stephen

December 12, 2025 AT 14:50I’m not sure I agree with the romanticization, but I also can’t ignore the human cost of this ban. Maybe the real question isn’t whether crypto should be legal-it’s why the financial system failed them so badly in the first place.

Vincent Cameron

December 13, 2025 AT 11:29It’s ironic. The same people who scream about ‘financial sovereignty’ in the U.S. are the first to mock this as ‘third-world crypto nonsense.’ But here’s the truth: Morocco’s underground market is more decentralized, more community-driven, and more honestly peer-to-peer than 90% of the ‘legit’ exchanges in Silicon Valley. They built something real without VC money or influencer hype. Maybe we should be learning from them-not pitying them.