Ring AI Price & Liquidity Calculator

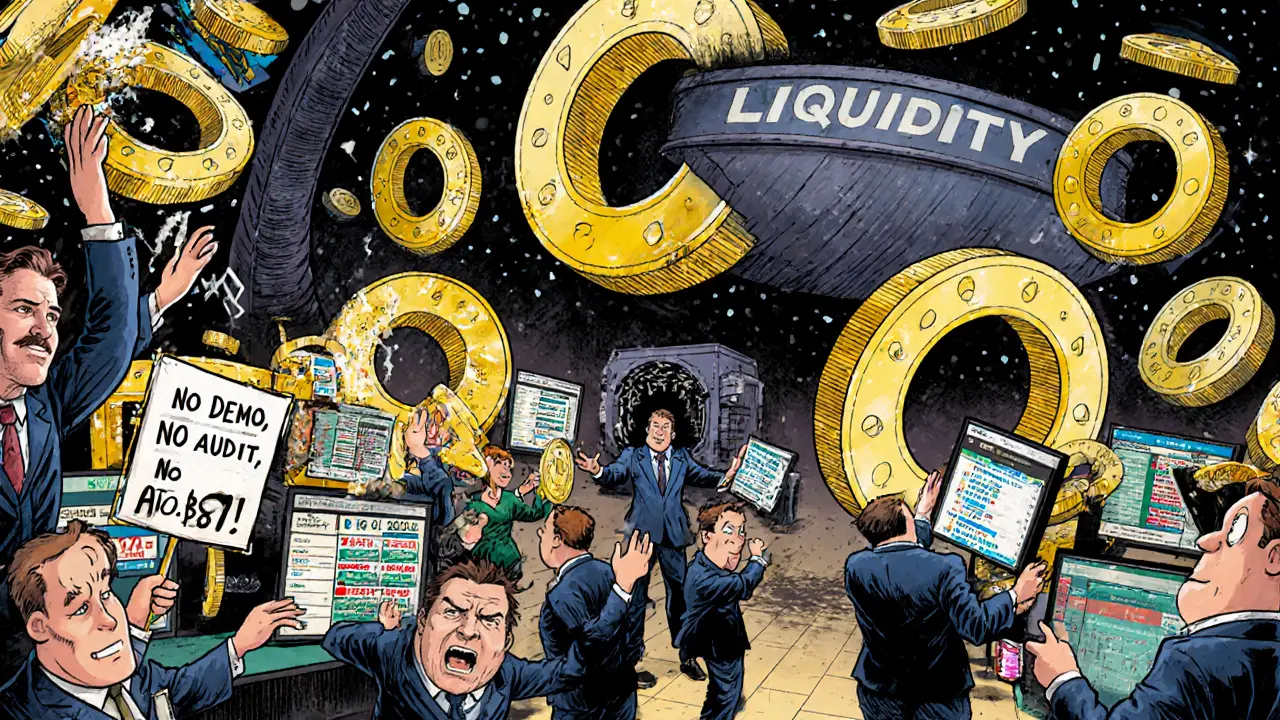

See how much RING you can buy on different exchanges based on current prices and liquidity. The price of RING varies significantly across exchanges due to extremely low trading volume, which can cause large price impacts when trading.

Current RING Prices

Coinbase

24h Volume: $1,200

Binance

24h Volume: $1,500

CoinMarketCap

24h Volume: $3,000

Gate.io

24h Volume: $5,000

⚠️ Liquidity Impact Warning: RING has extremely low trading volume (under $5,500 24h on Gate.io). Trading large amounts can cause massive price swings. Your purchase might move the market significantly, resulting in a much lower effective price than shown.

Ring AI (RING) isn’t another meme coin pretending to be AI. It’s a real token built for a very specific job: powering phone-based AI agents that handle customer service calls automatically. But here’s the catch - while the idea sounds promising, the reality is far from polished. If you’re wondering whether RING is worth your time, you need to know what’s working, what’s broken, and who’s actually using it.

What Ring AI Actually Does

Ring AI isn’t trying to be the next Bitcoin or even the next Fetch.ai. It’s built for one narrow use case: replacing human call center workers with AI that answers phones, books appointments, handles complaints, and even upsells products - all without a person ever picking up. The platform, accessible at tryring.ai, claims to let businesses deploy these AI agents in minutes. You don’t need to code. You just describe the kind of calls you get - like “customers asking about delivery times” or “people wanting to cancel subscriptions” - and the AI learns how to respond. The RING token is the fuel. Every time an AI agent makes a call, it costs a small amount of RING to run. That’s the theory. In practice, there’s no public demo. No video walkthrough. No case studies from real companies using it. The website looks like a landing page from 2021. No sign of actual customers. No testimonials. Just promises.How the RING Token Works

RING is an ERC-20 token on the Ethereum blockchain. That means it’s compatible with most wallets like MetaMask, Trust Wallet, or Coinbase Wallet. Total supply? Fixed at 100 million tokens. No mining. No staking. No more will ever be created. Here’s how the supply is split:- 90% (90 million RING) went to decentralized exchanges (DEX) like Uniswap for public trading

- 10% (10 million RING) was allocated to centralized exchanges (CEX) like Gate.io and Binance

Price History and Market Reality

RING hit its all-time high of $0.8774 on April 4, 2024. That was a frenzy. People saw “AI” and “crypto” and bought in. Since then, it’s crashed hard. Right now, prices vary wildly depending on where you look:- On Coinbase: $0.0122

- On Binance: $0.001645

- On CoinMarketCap: $0.003107

Who’s Buying RING? And Why?

There are only 8,410 wallet addresses holding RING. That’s tiny. Most of them are speculators, not users. Reddit threads show people buying RING because it’s cheap. One user bought 50 million RING at $0.0015, hoping for a 10x return. But they said it took three days to sell half their position. That’s not investing - that’s gambling with liquidity risk. The few users who actually tried the platform report the same thing: it’s hard to tell if the AI works because you can’t test it. No free trial. No sandbox. No video of the AI answering a real call. The website doesn’t even show a login button for businesses.Big Risks You Can’t Ignore

There are three major red flags:- No smart contract audit - CertiK, a top blockchain security firm, says Ring AI has never been audited. That means there could be hidden flaws in the code. Someone could drain the treasury. Or the token could be frozen. No one knows.

- No development activity - The last code commit on GitHub was in February 2024. The Twitter account (@TryRingAI) hasn’t posted anything meaningful since May 2024. That’s six months of silence.

- No real adoption - Zero public clients. Zero partnerships. Zero enterprise use cases. If no business is paying for this AI, why would the token have value?

Is Ring AI Worth It?

If you’re looking for a long-term crypto investment? Skip it. There’s no evidence the product works. No team updates. No users. No audits. It’s a token with no foundation. If you’re a crypto trader who likes high-risk, low-cap plays? Maybe. RING has seen 40%+ spikes in a week before. But those moves are driven by social media hype, not real demand. You’d be betting on noise. The only scenario where RING makes sense: you believe the team will suddenly deliver a working product, get a major client, and attract serious exchange listings. That’s a 1-in-100 shot. Right now, Ring AI feels like a PowerPoint presentation with a token attached. The idea is interesting. The execution? Nonexistent.How to Buy RING (If You Still Want To)

If you’re set on buying, here’s the only realistic way:- Get a Web3 wallet like MetaMask

- Buy Ethereum (ETH) on Coinbase or Kraken

- Send ETH to your wallet

- Go to Uniswap or Gate.io

- Swap ETH for RING

What Comes Next?

Ring AI’s future depends on one thing: proving it works. If they release a live demo next month, show real call transcripts, and announce a pilot with a small business, then RING could wake up. But if the silence continues? The token will keep sinking. For now, treat RING like a high-risk experiment. Not an investment. Not a tool. Just a bet on whether a team can turn a vague idea into something real - and whether anyone will care when they do.Is Ring AI (RING) a good investment?

Ring AI is not a good investment for most people. It has no proven product, no audits, no real users, and extremely low liquidity. The token’s value is based purely on speculation. While it’s possible to make quick gains from its volatility, the risk of losing your entire investment is very high. Only consider it if you’re comfortable gambling on unproven crypto projects.

Can I use RING to pay for AI customer service calls?

Technically, yes - RING is designed to be the payment token for Ring AI’s phone-based agents. But in practice, you can’t. The platform has no public demo, no sign-up for businesses, and no documentation on how to actually use the service. Without a working product, the token has no utility beyond trading.

Why is the price of RING so different on different exchanges?

Because trading volume is extremely low. On exchanges like Binance and Coinbase, only a few trades happen each day. When one person buys or sells a large amount, it moves the price dramatically. This creates big gaps between platforms. It’s not a pricing error - it’s a sign of poor liquidity and market fragmentation.

Is Ring AI audited by a security firm?

No. According to CertiK’s public risk assessments, Ring AI has never undergone a smart contract audit. This means the code could have vulnerabilities that allow hackers to steal funds, freeze tokens, or manipulate the system. Without an audit, investing in RING carries significant technical risk.

Where can I buy Ring AI (RING) crypto?

RING is primarily traded on decentralized exchanges like Uniswap and centralized exchanges like Gate.io and Binance. You’ll need a crypto wallet (like MetaMask) and some Ethereum (ETH) to swap for RING. Avoid smaller, unknown exchanges - they’re riskier and may not be legitimate.

Does Ring AI have a whitepaper?

No. There is no publicly available whitepaper for Ring AI. The official website (tryring.ai) offers no technical documentation, roadmap details, or architecture diagrams. All information comes from token data sites and social media posts, not official project documentation.

Is Ring AI listed on major exchanges like Coinbase and Binance?

Yes, RING is listed on both Coinbase and Binance, but only as a minor token. Trading volume is extremely low - often under $20,000 per day. This means it’s not a core asset on these platforms. It’s treated like a speculative micro-cap, not a mainstream cryptocurrency.

What’s the difference between Ring AI and other AI crypto coins like Fetch.ai?

Fetch.ai and SingularityNET are established AI platforms with real products, enterprise clients, and millions in market cap. Ring AI is a micro-cap token with no proven product or users. While both focus on AI automation, Fetch.ai has been operating for years with open-source tools and active development. Ring AI has no code updates in months and no public demos.

How many people are holding Ring AI (RING)?

As of mid-2024, only 8,410 unique wallet addresses hold RING tokens. That’s extremely low for a crypto project, even a small one. For comparison, Ethereum has over 100 million holders. This low adoption suggests the token is mostly held by speculators, not users or long-term believers.

Will Ring AI’s price go up in 2025?

There’s no reliable way to predict it. Analysts like CoinCheckup forecast a 25% drop by the end of 2025 due to lack of development. Others argue that if the team suddenly launches a working product, the price could spike. But without evidence of progress, the odds of a major price increase are very low. Treat any prediction as speculation, not fact.

George Kakosouris

November 27, 2025 AT 04:21This RING token is a classic pump-and-dump dressed up as AI innovation. No audit, no code commits in six months, and liquidity so thin you could sneeze and crash the price. The fact that it's listed on Binance doesn't make it legitimate - they list garbage because it brings in trading fees. Anyone buying this isn't investing, they're just hoping to be the last one standing before the rug gets pulled.

And don't get me started on the ‘90% to DEX’ narrative. That’s not decentralization - that’s a deliberate exit liquidity strategy. The team walked away with zero reserve and left retail holders holding the bag. Classic.

Compare this to Fetch.ai: actual product, real partnerships, audited contracts. RING? A PowerPoint slide with a smart contract attached. If you’re not laughing, you’re losing money.

Also, CoinMarketCap showing $0.003? That’s a joke. The real price is what you get when you actually try to sell - and you’ll be lucky to get 10% of that.

Don’t confuse low price with opportunity. Low price + zero utility = red flag on steroids.

Ben Costlee

November 28, 2025 AT 20:36I get why people are drawn to this - the idea of AI answering customer calls is powerful. But you can’t build trust on promises alone. There’s a difference between being early and being fooled.

I’ve seen this movie before. Tokens with cool concepts, no product, and a website that looks like it was built in 2017. The silence from the team is louder than any whitepaper.

If you’re thinking of investing, ask yourself: would you hand over your money to a startup that won’t even show you a demo? Would you trust a car salesman who won’t let you take it for a test drive?

There’s a lot of pain in crypto, but this one feels unnecessary. Maybe wait until they release a live call transcript. Until then, it’s just noise.

Mark Adelmann

November 30, 2025 AT 11:56Hey, I’m not saying don’t look into it - but if you’re gonna throw money at RING, treat it like a $20 lottery ticket, not a portfolio move.

I checked the site yesterday - still no login button. Still no video. Still no real customers listed. The whole thing feels like a draft that got published by accident.

But hey, if you wanna gamble, go for it. Just don’t cry when it goes to zero. And maybe keep a backup plan - like, I dunno, actually working for a living?

ola frank

December 2, 2025 AT 00:39Let’s analyze the economic structure of RING through the lens of tokenomics and network effects. The token’s sole utility function is transactional payment for AI-agent invocation, yet there exists zero measurable demand-side traction. The absence of a whitepaper, audit trail, or development activity implies a breakdown in the fundamental assumptions of cryptographic value accrual.

Furthermore, the 90/10 DEX/CEX allocation without a team reserve constitutes a violation of the principle of sustainable incentive alignment. In traditional venture capital models, founders retain equity to align long-term performance - here, the complete dilution of ownership suggests either extreme confidence or extreme negligence.

The liquidity fragmentation across exchanges, with price discrepancies exceeding 500%, indicates severe market inefficiency and the absence of arbitrage mechanisms - a condition typically found in micro-cap tokens with negligible trading volume and no institutional backing.

Therefore, RING does not meet the threshold of a viable asset class under any conventional financial framework. It is, at best, a speculative instrument with negative expected value under rational risk assessment.

imoleayo adebiyi

December 2, 2025 AT 07:06It’s sad to see how many people are chasing something that doesn’t exist yet. I’ve been in crypto since 2017, and I’ve seen projects die because they didn’t deliver. This one feels like it’s already dead.

There’s no harm in dreaming big, but there’s responsibility in how we spend our money. If you’re putting your savings into this, you’re not just risking funds - you’re trusting a ghost.

I hope the team comes back with something real. Until then, I’ll be watching from the sidelines. No judgment, just caution.

Angel RYAN

December 3, 2025 AT 23:12stephen bullard

December 5, 2025 AT 22:06I think there’s something beautiful about the idea - AI that answers phones, no humans needed. That’s the future, right?

But beauty doesn’t pay bills. And neither does a token with no product.

Maybe the team is working in silence. Maybe they’re building something huge. But silence isn’t a strategy. Action is.

If they drop a live demo next month, I’ll be the first to say ‘I told you so.’ But until then? I’m keeping my ETH and waiting to see if they can turn this dream into something real.

Hope they pull it off. But hope isn’t an investment strategy.

SHASHI SHEKHAR

December 7, 2025 AT 08:15Bro, let me break this down for you in simple terms 😊

Ring AI = AI that calls people for businesses 💬

RING token = fuel for that AI 🛢️

Problem? No one can actually USE it 😅

Imagine buying a car key but the car doesn’t exist. You have the key, you know it’s supposed to start the engine, but there’s no car in the garage. That’s RING right now.

And the price differences? Yeah, that’s because nobody is buying or selling - just a few people spamming trades to make it look active. On Gate.io, the volume is less than what I spent on coffee this week 😂

Also, no audit? That’s like driving a Tesla with no brakes and hoping the GPS works.

But hey - if you’re into high-risk stuff, maybe throw 1% of your portfolio in. Just don’t quit your job. And if you do buy, please screenshot your purchase and post it in 6 months. I’ll be here cheering for you… or laughing at you. Either way, I’ll know you tried 🤝

And yes, I checked the GitHub - last commit was Feb 2024. That’s longer than my last relationship 😅

Vaibhav Jaiswal

December 8, 2025 AT 05:48Man, I saw this and thought ‘this could be legit’ - until I realized the website doesn’t even have a ‘Sign Up’ button for businesses.

It’s like a restaurant with a menu but no kitchen. You can read about the food all day, but you ain’t eating.

I’ve got friends who bought RING because it was under a penny. One of them lost his rent money. Don’t be that guy.

Still, I’m keeping an eye on it. If they drop a demo video next week, I’m buying 500k just to see if it works. Until then? I’m scrolling past it like a spam ad.