Bitfinex Trading Fee Calculator

Based on Bitfinex's fee structure: 0.2% taker fee, 0.1% maker fee. 6% discount applies for volumes over $1M in 30 days.

Fee Calculation Results

Bitfinex isn’t the easiest crypto exchange to use. If you’re just starting out, you’ll probably feel lost. But if you’ve traded before-especially with leverage, derivatives, or large volumes-you might find it one of the most powerful tools available. Founded in 2012, Bitfinex has survived market crashes, hacks, and regulatory crackdowns. It didn’t just survive; it adapted. Today, it’s a platform built for traders who need speed, depth, and control-not hand-holding.

What Makes Bitfinex Different?

Most exchanges try to be everything to everyone. Bitfinex doesn’t. It focuses on one thing: giving experienced traders the tools they need to execute complex strategies. The platform supports over 170 cryptocurrencies and 400 trading pairs. That’s more than most competitors. BTC/USD is the most active pair, but you can trade everything from SOL to lesser-known altcoins with high volatility. If you’re chasing quick moves, Bitfinex gives you the liquidity to enter and exit without slippage. It’s not just about coin selection. Bitfinex offers margin trading with up to 5x leverage. You can also fund your margin positions by lending your crypto to other traders through its peer-to-peer funding system. That’s rare on retail platforms. Derivatives traders get perpetual contracts and futures with USDT as collateral. You don’t need to own Bitcoin to bet on its price. You just need enough USDT to cover your position. The charting tools are professional-grade. Twelve timeframes, over 50 technical indicators, and customizable layouts make it feel like a trading terminal, not a mobile app. There’s even a demo account that never expires. You can test strategies without risking real money. Most exchanges charge for this. Bitfinex gives it away.Trading Fees and Discounts

Fees on Bitfinex are competitive, especially for high-volume traders. The standard taker fee is 0.2%, and the maker fee is 0.1%. But here’s the catch: if you trade more than $1 million in 30 days, you get a 6% discount off those rates. That’s not a typo. It’s a real incentive for serious traders. The discount stacks with volume tiers, so the more you trade, the cheaper it gets. Fiat deposits and withdrawals are supported in USD, EUR, GBP, JPY, and CNH. But you can’t just deposit cash. You need to complete full KYC verification. That means uploading ID, proof of address, and sometimes a selfie. It’s not fast, but it’s standard for regulated platforms. Once verified, you can move money in and out via wire transfer or SWIFT. Processing times vary from 1-5 business days.Security: Strong Infrastructure, No Insurance

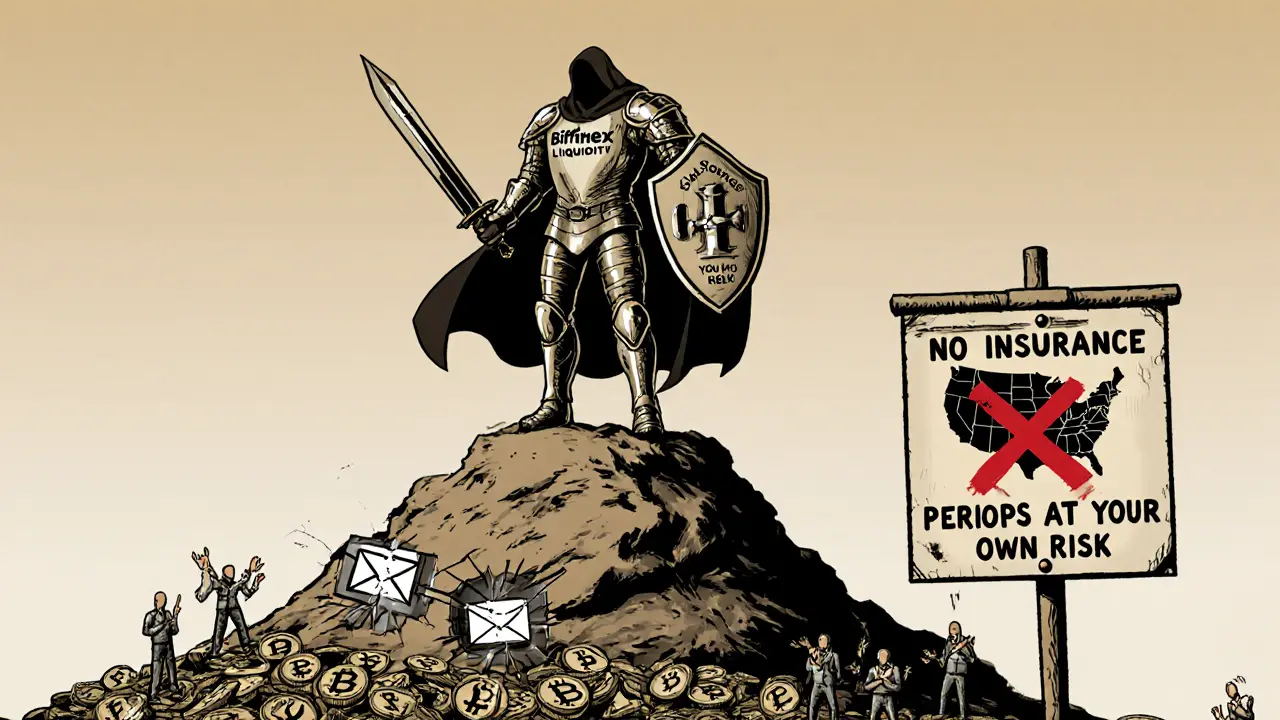

Bitfinex has been hacked before. In 2016, over 120,000 BTC were stolen. That’s the kind of history that sticks. But since then, the platform has rebuilt its security from the ground up. Server infrastructure is hardened. Penetration tests show perfect scores. Two-factor authentication is mandatory. Cold storage holds the majority of funds. CertiK, a top blockchain security firm, gives Bitfinex a Skynet score of 86.33%. That’s above average. The CER security rating is B (65%), which is decent but not elite. The biggest missing piece? Insurance. Unlike Coinbase or Kraken, Bitfinex doesn’t insure user funds. If another major breach happens, you could lose everything. That’s a risk you have to accept.

Customer Support: The Weak Spot

This is where most users get frustrated. Bitfinex doesn’t offer live chat. No phone support. No 24/7 help desk. If you have an issue-whether it’s a frozen account, a delayed withdrawal, or a technical glitch-you email support. Response times average 12 hours. Sometimes it’s longer. Users report waiting days for simple answers. There are stories of accounts being frozen without warning. Some users say they were asked to deposit more funds to “unlock” their accounts. These aren’t rumors. Multiple Reddit threads and forum posts confirm this pattern. While some users eventually get their money back after contacting external help groups, the process is stressful and unpredictable. If you need quick help, Bitfinex isn’t the place.Who Is Bitfinex For?

Bitfinex isn’t for beginners. If you’re buying Bitcoin once a year and storing it in a wallet, skip it. The interface is overwhelming. The features are complex. The support is slow. You’ll spend more time figuring out how to place a limit order than you will making profits. But if you’re trading multiple times a day, using leverage, or managing derivatives positions? Bitfinex is one of the few platforms that can keep up. The liquidity is deep. The order execution is fast. The tools are unmatched. It’s the exchange professional traders choose when they need precision, not simplicity. Compare it to Kraken or Coinbase Pro. Both are solid. But Kraken has better support. Coinbase Pro has a cleaner UI. Bitfinex wins on raw trading power. If you’re trading $10,000+ positions regularly, the extra complexity pays off.

Mobile App and Accessibility

The Bitfinex mobile app works. You can check prices, place orders, and view your portfolio. But it’s stripped down. Many advanced features-like margin funding, derivatives trading, and detailed charting-are missing or limited. You’ll still need the desktop version for serious trading. The platform is blocked in the U.S., Bangladesh, Bolivia, Ecuador, and Kyrgyzstan. If you’re in the U.S., you can’t sign up, even with a VPN. That’s a big limitation. The U.S. market is the largest in crypto. Bitfinex chose to stay out rather than comply with complex regulations. That says something about its priorities: power over accessibility.Alternatives to Consider

If Bitfinex feels too intimidating or risky, here are better options based on your needs:- For beginners: eToro or Gemini. Simple UI, regulated, insured funds.

- For U.S. users: Kraken or Coinbase. Full fiat support, better customer service.

- For high-volume traders: Binance or Bybit. Higher leverage, lower fees, more coins.

- For derivatives: Bybit or OKX. More contract options, better funding rates.

Final Verdict

Bitfinex is a tool, not a toy. It’s built for traders who know what they’re doing. The liquidity is excellent. The trading pairs are deep. The advanced features are unmatched. But the support is unreliable. The security lacks insurance. The learning curve is steep. If you’re experienced and you’re trading large amounts, Bitfinex gives you the edge. If you’re new, or you want help when things go wrong, look elsewhere. The platform doesn’t care if you’re confused. It assumes you already know how to trade. It’s not the safest exchange. It’s not the easiest. But in 2025, for serious traders, it’s still one of the most capable.Is Bitfinex safe to use in 2025?

Bitfinex has strong technical security-server hardening, cold storage, and perfect penetration test scores. But it doesn’t insure user funds. That means if there’s a major hack, you could lose your money. The platform has recovered from past breaches, but insurance is missing. Only use it if you understand and accept this risk.

Can I trade Bitcoin with leverage on Bitfinex?

Yes. Bitfinex offers up to 5x leverage on BTC and other major cryptocurrencies. You can open margin positions by borrowing funds from other traders or using your own collateral. Leverage increases both profits and losses, so use it carefully. You must hold USDT or another supported asset as collateral to trade derivatives.

Why is Bitfinex not available in the U.S.?

Bitfinex is blocked in the U.S. because it hasn’t obtained the necessary regulatory licenses to operate there. After the 2016 hack and subsequent legal scrutiny, the platform chose to avoid the complex U.S. compliance landscape rather than invest in it. This means U.S. residents cannot sign up, even with a VPN.

Does Bitfinex have a mobile app?

Yes, Bitfinex has mobile apps for iOS and Android. You can place trades, check balances, and view charts. But the app lacks key features like margin funding, advanced charting tools, and derivatives trading. For serious trading, you’ll still need the desktop version.

How long does it take to get support from Bitfinex?

Bitfinex doesn’t offer live chat or phone support. All help comes through email. Response times average 12 hours, but can take several days during busy periods. Users report delays with account freezes, withdrawals, and technical issues. If you need fast help, this platform isn’t ideal.

What are the trading fees on Bitfinex?

The standard taker fee is 0.2%, and the maker fee is 0.1%. If you trade over $1 million in 30 days, you get a 6% discount on all fees. Fees drop further with higher volume tiers. There are no hidden fees for deposits, but withdrawal fees vary by cryptocurrency and network.

Can I use fiat currency on Bitfinex?

Yes, Bitfinex supports fiat deposits and withdrawals in USD, EUR, GBP, JPY, and CNH. You must complete full KYC verification before using fiat. Funds are transferred via bank wire or SWIFT. Processing times range from 1 to 5 business days. There are no instant deposit options like with PayPal or credit cards.

Christina Oneviane

November 27, 2025 AT 17:55Wow, so Bitfinex is basically the crypto equivalent of a high-end Swiss watch-beautiful, precise, and will shatter if you sneeze on it. 🤡

ola frank

November 27, 2025 AT 22:18The lack of insurance isn't a bug-it's a feature. Bitfinex filters out the retail noise and attracts only those who treat crypto like a zero-sum game. If you need hand-holding, you're already the liability the platform was designed to exclude. The 5x leverage, deep order books, and P2P funding mechanism aren't for casuals-they're for those who understand that capital efficiency is the only real edge in this market. Most exchanges are glorified ATMs; Bitfinex is a derivatives trading terminal with a 12-year war chest of institutional-grade infrastructure.

The 6% volume discount? That's not a promotion-it's a loyalty program for whales. You don't earn it by trading $10k-you earn it by moving $1M+ monthly. And yes, the UI is dense, but that's the point. Complexity is a barrier to entry that protects the ecosystem from noise traders who drain liquidity. If you can't navigate the 50+ indicators and 12 timeframes, you shouldn't be in the arena.

The U.S. ban? A strategic retreat. Regulatory capture is the death of innovation. Bitfinex chose sovereignty over compliance, and that's why it still leads in liquidity and execution speed. Kraken and Coinbase? They're regulated, safe, and slow. Bitfinex is unregulated, risky, and fast. Pick your poison.

And let’s not ignore the elephant in the room: the support system is intentionally under-resourced. Why? Because if you're asking for help, you're probably already making bad decisions. The platform assumes competence. It doesn't coddle. That’s why the demo account never expires-it's a training ground for the disciplined, not a sandbox for the confused.

imoleayo adebiyi

November 29, 2025 AT 21:14I appreciate how honest this review is. Many people praise exchanges for being easy, but ease often comes at the cost of power. Bitfinex respects its users enough to not dumb things down. I’ve traded on Binance and Kraken, and while they’re more beginner-friendly, I always feel like I’m missing tools when I go back to them after using Bitfinex. The margin funding system is genius-it turns idle assets into income streams. I wish more platforms adopted that.

Yes, the support is slow, but I’ve learned to document everything and be patient. If you treat it like a professional tool-not a customer service portal-it works. And the security, despite the past hack, is now among the best in the industry. The fact that CertiK gives it an 86.33% Skynet score says a lot.

Michael Labelle

November 30, 2025 AT 19:24I’ve been using Bitfinex since 2020. I came in as a beginner, got overwhelmed, left, came back two years later with more experience-and now I wouldn’t trade anywhere else. It’s not about being ‘smart’ or ‘advanced.’ It’s about being ready. The platform doesn’t judge you for not knowing how to use it-it just doesn’t hold your hand. That’s the difference.

The mobile app? Use it to check your balance. Nothing more. I keep my laptop open 24/7 for real trading. And yeah, the U.S. ban sucks-but honestly, if you’re in the U.S., you’re probably better off on Kraken anyway. Less stress, better support, and you don’t have to worry about insurance.

Brian Bernfeld

December 2, 2025 AT 11:27Let’s be real-Bitfinex is the crypto equivalent of a Harley Davidson: loud, dangerous, and not for the faint of heart. 🏍️ But if you know how to ride it? Pure freedom. I’ve lost money on it. I’ve made bank on it. But I’ve never felt more in control of my trades than when I’m on this platform.

The P2P funding system? Absolute genius. I’ve lent out my ETH for weeks at a time and made 8% APR just sitting there. That’s passive income you won’t find on Coinbase. And the demo account? I tested a whole scalping strategy on it for 3 months before going live. No risk. No pressure. Just pure data.

Yeah, support is garbage. But I stopped expecting it. I learned to troubleshoot on my own, read the forums, and use the community. That’s part of the culture here. You don’t get helped-you get empowered. And honestly? I’d rather be empowered than coddled.

And the U.S. ban? Honestly? I’m glad they stayed out. If they had to comply with every state’s crypto law, they’d be stuck in bureaucratic quicksand. They chose to stay pure. That’s rare in this space.

Ian Esche

December 3, 2025 AT 01:18Bitfinex is the only exchange that doesn’t treat American traders like children. The U.S. government is a regulatory nightmare, and Bitfinex had the guts to say no. If you’re mad they’re not in the U.S., maybe you should stop whining and move to a country that respects free markets. This isn’t a customer service platform-it’s a trading battlefield. And the battlefield doesn’t care if you’re American, European, or Martian.

Felicia Sue Lynn

December 4, 2025 AT 13:26There’s something almost poetic about Bitfinex’s philosophy: it doesn’t seek to please. It exists to serve those who already know how to trade. In a world of gamified apps and TikTok finance influencers, this platform feels like a quiet library in the middle of a carnival. The silence isn’t indifference-it’s respect.

I’ve watched friends get crushed on platforms that promised ‘easy profits.’ But on Bitfinex, you don’t get rich by accident. You get rich by discipline. The lack of insurance is terrifying-but it’s also honest. No sugarcoating. No false promises. Just raw, unfiltered market access.

Maybe the real question isn’t whether Bitfinex is safe-but whether we, as traders, are mature enough to handle the truth it reflects back at us.

Casey Meehan

December 5, 2025 AT 17:04Bro, the demo account is 🔥. I used it to test a bot for 6 months. Made $12k paper profits. Then went live. Lost $8k in 2 weeks. 😭 But I learned more in that month than I did in 2 years on Coinbase. Bitfinex doesn’t care if you win or lose. It just wants you to learn. 🤓📈