Buda Trading Fee Calculator

Calculate Your Buda Trading Costs

Estimate your trading fees and referral income based on your activity volume in Latin American currencies (CLP, COP, PEN, ARS).

If you're in Chile, Argentina, Colombia, or Peru and want to buy Bitcoin or Ethereum without jumping through international banking hoops, Buda is one of the few exchanges that actually works for you. It’s not the biggest global platform, but it’s the most trusted local one. Founded in 2015 as SurBTC and rebranded to Buda in 2020, it was built from the ground up to solve a real problem: South Americans needed a way to trade crypto using their own pesos, soles, and pesos - not dollars or euros. Today, it handles over 65% of all crypto trading volume in Chile, and it’s the top choice in Colombia and Peru too.

What You Can Trade on Buda

Buda doesn’t try to be everything to everyone. It keeps things simple with just six cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), USDC, and Tether (USDT). That’s it. No Solana, no Dogecoin, no Shiba Inu. If you’re looking for hundreds of altcoins, you’ll need to go elsewhere. But if you only care about the big ones - especially if you’re trading in Chilean pesos (CLP), Colombian pesos (COP), Peruvian soles (PEN), or Argentine pesos (ARS) - then this limited selection is actually a strength.

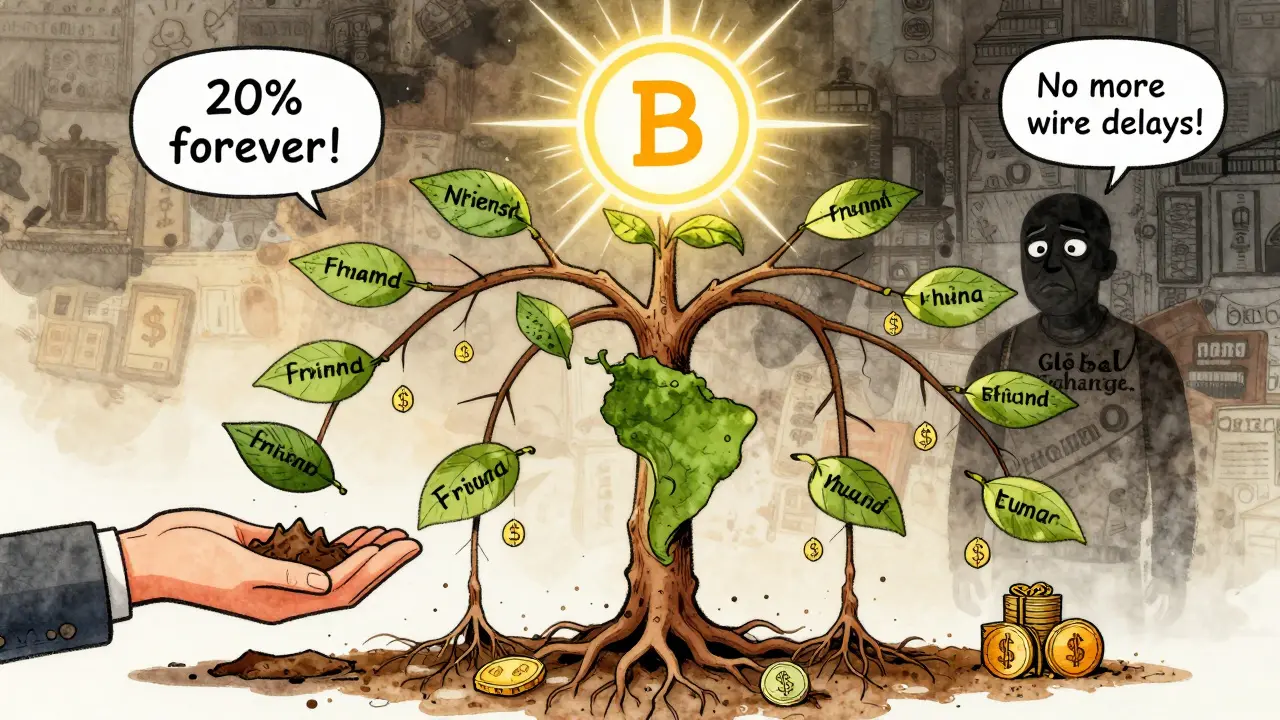

You get 20 trading pairs, all tied to local currencies. That means you can buy BTC with CLP directly from your bank account. No need to first buy USDT on Binance and then transfer it over. Buda handles the entire bridge between your local bank and the crypto market. For users in Latin America, that’s a game-changer. Most global exchanges either don’t support these currencies at all or charge insane fees for wire transfers. Buda makes it seamless.

Fees and Trading Costs

Trading fees start at 0.4% per trade for basic users. That’s higher than Binance’s 0.1% or Coinbase’s 0.5%, but here’s the catch: Buda offers steep discounts for higher volume traders. Once you hit $10,000 in monthly volume, fees drop to 0.2%. And if you refer friends, you can get up to 50% off your trading fees during promotional periods. That’s rare in this space.

Referrals are one of Buda’s best features. You earn 20% of the trading fees your referred users pay - forever. Users report earning $15-$20 a month just by sharing their link with friends who trade regularly. No other exchange in Latin America offers this kind of ongoing incentive.

Withdrawal fees are clearly listed and reasonable. For Bitcoin, it’s 0.00011 BTC. For Ethereum, it’s 0.00053418 ETH for standard priority or 0.0006944 ETH for fast. USDC withdrawals cost 1.38 USDC normally, or 2 USDC if you need it urgent. These aren’t the lowest in the world, but they’re fair for a localized exchange.

Security: Cold Storage and Compliance

Buda takes security seriously. 90% of user funds are stored in offline cold wallets - the same level as Coinbase and better than most regional competitors. They partner with Chainalysis to monitor suspicious transactions, which helps them comply with anti-money laundering rules in Chile, Colombia, and Peru.

All users must complete KYC: email confirmation, government ID upload, biometric face scan, and proof of address. Once verified, you can trade up to $10,000 per month. That’s enough for most retail traders but too low for institutions. Still, it’s a solid setup for everyday users.

One red flag: Buda shut down its Bug Bounty Program in early 2023. Previously, it paid up to $5,000 to ethical hackers who found vulnerabilities. Its removal suggests less transparency around security testing. No breaches have been reported, but the absence of external oversight is concerning.

Platform and User Experience

Buda’s interface is built on TradingView, which means it’s powerful but not beginner-friendly. The charts are professional-grade, with indicators, drawing tools, and real-time data - perfect for active traders. But if you’ve never traded before, you’re on your own. There’s no demo account. No video tutorials. No educational hub.

Most users say it takes 3-5 trades to get comfortable. The mobile apps for iOS and Android are solid, with push notifications and quick buy/sell buttons. But the desktop version feels cluttered to newcomers. There’s no simplified mode. You get the full trading terminal or nothing.

Customer support is only in Spanish. Email responses take 12-24 hours on weekdays. Phone support exists in Chile, but not in other countries. During major market swings - like when the Argentine peso crashed in June 2025 - users reported delays of up to 48 hours on withdrawals. That’s not normal, but it happens during extreme volatility.

Who Is Buda For? Who Should Avoid It?

Buda is perfect for:

- Residents of Chile, Argentina, Colombia, or Peru

- People who want to trade BTC or ETH directly with local currency

- Traders who value security over coin variety

- Those who want to earn passive income through referrals

Buda is NOT for:

- Users outside Latin America - you can’t even sign up

- Advanced traders wanting margin, futures, or staking - Buda offers none of these

- People who want 100+ altcoins

- Beginners who need hand-holding or tutorials

If you’re new to crypto and live in Santiago or Bogotá, Buda gives you a safe, regulated way to get started. But if you’re looking to leverage your positions or trade lesser-known tokens, you’ll outgrow it fast.

How Buda Compares to Global Exchanges

Binance and Coinbase dominate globally, but they’re not built for Latin America. Binance launched peso-denominated trading in Colombia in early 2025, but it still doesn’t offer direct bank deposits in CLP or PEN. Coinbase doesn’t support these currencies at all. Kraken has margin trading and staking, but no local fiat on-ramps in South America.

Buda’s edge isn’t features - it’s access. It connects directly to Chile’s Transbank, Colombia’s Daviplata, Peru’s Interbank, and Argentina’s Mercado Pago. You can deposit pesos via bank transfer, debit card, or even mobile wallets. No third-party processors. No delays. No surprise fees.

That’s why Buda still holds 65% of Chile’s crypto market share, even as global giants try to break in. Local trust beats global scale every time in this region.

Recent Updates and Future Outlook

In Q4 2024, Buda added USDT trading pairs to all four local markets. In January 2025, it integrated with Chile’s Transbank system, cutting deposit times from 2 days to under 10 minutes. That’s a huge upgrade.

They’ve also started testing crypto-backed loans, though details are scarce. Interest rates? Loan-to-value ratios? No public info yet. But the direction is clear: Buda wants to be more than an exchange. It’s building a financial ecosystem for Latin America.

Analysts predict 15-20% annual growth through 2027. Crypto adoption in Latin America jumped 1,200% from 2020 to 2023, according to Chainalysis. Buda is positioned to capture most of that growth - not because it’s the most advanced, but because it understands the region better than anyone else.

Final Verdict

Buda isn’t the flashiest crypto exchange. It doesn’t have staking, futures, or a hundred coins. But if you live in Chile, Argentina, Colombia, or Peru, it’s the most practical, secure, and reliable way to trade Bitcoin and Ethereum using your local money. The fees are fair for what you get, the security is solid, and the referral program is one of the best in the region.

For beginners, the learning curve is steep. For advanced traders, the feature set is too limited. But for everyday users who just want to buy crypto without jumping through hoops - Buda delivers.

It’s not the future of global crypto. But for Latin America, it’s already the present.

Jon Visotzky

December 5, 2025 AT 03:01So Buda actually lets you buy BTC with CLP directly from your bank? That’s wild. I’ve been using Binance for years and still have to jump through hoops with Wise or Paxful just to get pesos in. This feels like the kind of local solution that actually works for people, not just investors. I’m surprised more global exchanges haven’t copied this model.

Chris Mitchell

December 6, 2025 AT 09:20Local trust beats global scale. That’s the whole thesis right there. No one cares if you have 500 coins if you can’t get your money in or out without paying 10% in fees.

Martin Hansen

December 7, 2025 AT 03:38Wow, so this is the ‘Latin American crypto darling’? Cute. No margin trading? No staking? No futures? And you call this a ‘platform’? This is a glorified P2P gateway with a TradingView skin. If you’re not trading BTC and ETH, you’re already behind. Buda’s not the future, it’s a nostalgic footnote.

Lore Vanvliet

December 8, 2025 AT 23:29OMG I CAN’T BELIEVE THEY SHUT DOWN THE BUG BOUNTY 😭 THAT’S A RED FLAG 🚩 I’M SORRY BUT IF THEY DON’T LET HACKERS TEST THEM, HOW DO WE KNOW THEY’RE NOT STEALING OUR COINS?!?!? I’M SCARED 😫

Frank Cronin

December 10, 2025 AT 22:45‘Best for Latin America’? Sure, if your definition of ‘best’ is ‘lowest features, highest local monopoly’. You’re telling me a platform that doesn’t even support Solana is the gold standard? The fact that people are praising this like it’s a miracle just proves how underdeveloped the region’s crypto culture still is.

Shane Budge

December 11, 2025 AT 07:06Referral program paying 20% forever? That’s insane.

sonia sifflet

December 11, 2025 AT 11:19You people are missing the point. This exchange is only viable because Latin American governments have weak financial infrastructure. If they had proper banking systems, no one would need this. It’s a band-aid on a broken system. Also, why are you all ignoring that they only support 6 coins? This is crypto-lite for people who don’t understand blockchain.

Chris Jenny

December 12, 2025 AT 18:38Wait… Buda is owned by the IMF? Or is it a front for the CIA to monitor Latin American crypto users? Why would a local exchange have Chainalysis integration? That’s not security - that’s surveillance. And they shut down the bug bounty? That’s not negligence - that’s cover-up. I’ve seen this script before. They’re building a backdoor. They’re tracking every transaction. You think you’re buying BTC? You’re signing a digital confession.

Uzoma Jenfrancis

December 13, 2025 AT 08:18They’re not the best. They’re the only one. That’s the difference. In Nigeria we have to use P2P because banks block everything. In Chile, they built something real. I don’t care if it’s ‘limited’. It works. That’s more than I can say for 90% of the exchanges I’ve used.