China Crypto Payment Checker

⚠️ Important Legal Notice

As of 2025, accepting cryptocurrency in mainland China is a criminal offense with severe consequences including fines, asset seizure, and imprisonment. There are no exceptions.

Check Your Business Compliance

RMB

As of 2025, businesses in mainland China cannot legally accept cryptocurrency under any circumstances. It’s not a gray area. It’s not a matter of compliance or paperwork. It’s a criminal offense.

There’s No Loophole, No Exception

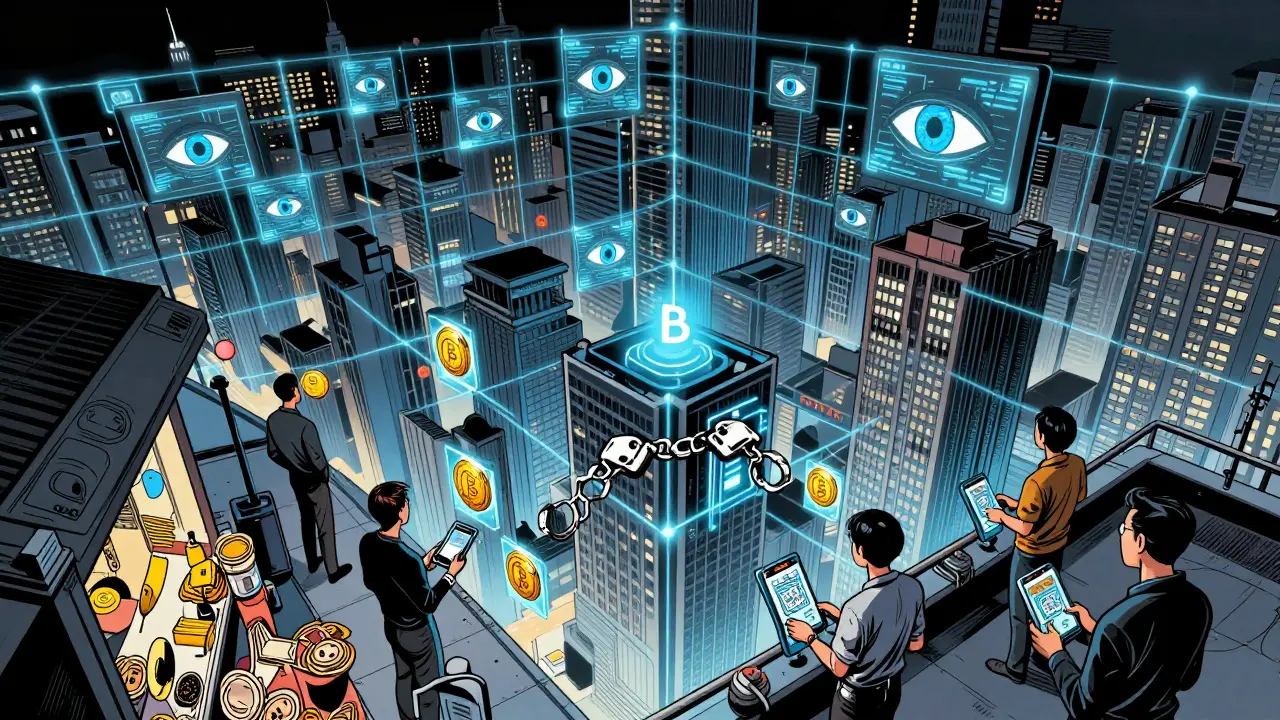

If you run a store, an online shop, a restaurant, or a service business in mainland China, and you try to accept Bitcoin, Ethereum, or any other cryptocurrency as payment-you’re breaking the law. Not just breaking rules. Breaking criminal statutes. The government doesn’t just discourage it. It punishes it. The rules changed in May 2025, when China passed new legislation that made it illegal to even own cryptocurrency. That means holding it in a wallet, trading it, mining it, or accepting it as payment-all of it is now a crime. Before, businesses were blocked from using crypto for payments. Now, the very act of receiving it puts you at risk of arrest, fines, asset seizure, and even imprisonment. This isn’t a minor policy tweak. It’s the final step in a 12-year campaign to wipe cryptocurrency out of China’s financial system. The government didn’t just shut down exchanges in 2017 or ban mining in 2021. It built a surveillance system to track every digital transaction, then made owning digital assets a criminal act.How Enforcement Works

Financial institutions in China are required to monitor every transaction for signs of cryptocurrency activity. Banks, payment processors like Alipay and WeChat Pay, and even fintech startups must flag any movement of funds linked to crypto wallets or exchanges. If your business receives a payment that traces back to Bitcoin, the system automatically alerts authorities. The Ministry of Public Security, the People’s Bank of China, and the Cyberspace Administration all work together. They don’t wait for complaints. They actively scan blockchain data, cross-reference bank records, and use AI tools to detect patterns that suggest crypto use. Even if you think you’re hiding it by using a peer-to-peer transfer or a privacy coin, the system still finds it. There’s no KYC for crypto because there’s no legal crypto. Instead, there’s a blacklist of known crypto addresses. If your customer sends money from one of those addresses-even if they’re just a friend paying you back for dinner-you’re on the radar.Why China Did This

China’s goal isn’t to stop innovation. It’s to control money. The government launched the digital yuan (e-CNY) in 2020 as its own state-backed digital currency. Unlike Bitcoin, the digital yuan is fully traceable. The central bank knows who sent it, who received it, and what it was spent on. Cryptocurrencies threaten that control. They let people move money outside the system. They let businesses bypass capital controls. They let individuals store value without government oversight. That’s dangerous to a regime that wants every yuan accounted for. By banning crypto, China removes competition to its own digital currency. It prevents capital flight. It stops people from using Bitcoin as a hedge against inflation or currency devaluation. And it ensures that all digital financial activity flows through state-monitored channels.

Hong Kong Is Different-But Not a Workaround for Mainland Businesses

Hong Kong, as a special administrative region, operates under different rules. It has licensed crypto exchanges, allows stablecoin trading, and even permits crypto-linked investment products. Some mainland Chinese investors buy shares in Hong Kong-listed crypto firms to get exposure to digital assets. But here’s the catch: that doesn’t let you accept crypto as payment in Shanghai, Guangzhou, or Beijing. The ban applies to mainland China only. If you’re a business operating in mainland China, you can’t use Hong Kong’s rules as an excuse. Cross-border crypto payments are still illegal. If your online store ships to mainland customers and accepts Bitcoin, you’re violating the law-even if your company is registered in Hong Kong.What Happens If You Try?

In 2024, dozens of small businesses were raided for accepting crypto. One Beijing-based tech startup that started taking Ethereum for software subscriptions was shut down. The owners were fined 2 million RMB (around $275,000 USD) and banned from running any business for five years. Their bank accounts were frozen. Their domain names seized. In another case, a restaurant in Chengdu that accepted Dogecoin for coffee and dumplings had its owner arrested. The court ruled that accepting crypto was “illegal financial activity,” even though the amount was less than $500 total. There are no “small violation” exceptions. The law doesn’t care if you’re a one-person shop or a multinational. If you accept crypto, you’re breaking the law.What Can Businesses Use Instead?

The only legal digital payment method in China is the digital yuan. The government is pushing it hard. Major retailers, public transit systems, and even street vendors now accept e-CNY through QR codes. It works like a mobile wallet but is fully integrated with the banking system. Businesses that want to stay compliant have two options:- Use the digital yuan for all transactions

- Stick to traditional RMB payments via bank transfers, Alipay, or WeChat Pay

nicholas forbes

December 5, 2025 AT 08:01Man, I knew China was serious about control, but this is next level. They’re not just regulating money-they’re erasing an entire financial philosophy. It’s like they built a digital prison and called it progress.

And the worst part? People here in the US still act like crypto is some kind of rebellion. Meanwhile, in China, just holding a private key could land you in jail. That’s not freedom-that’s fear with a blockchain.

I don’t agree with it, but I can’t deny the efficiency. Their digital yuan moves faster than any crypto I’ve seen. It’s like watching a supercomputer run a bank.

Still… if you’re gonna erase freedom like this, you better be ready for the backlash when the next generation figures out what was taken from them.

Regina Jestrow

December 5, 2025 AT 17:27Okay but let’s be real-this isn’t just about money. It’s about control. The digital yuan isn’t a currency, it’s a surveillance tool with a QR code.

I read that one restaurant owner got arrested for accepting Dogecoin worth less than $500. That’s not law enforcement. That’s psychological warfare. They’re not trying to stop crime-they’re trying to stop thought.

And the fact that they’re blocking educational videos about Bitcoin? That’s textbook authoritarianism. You don’t ban ideas unless you’re terrified of them.

I’m not pro-crypto. I don’t own any. But I’m terrified of a world where the government decides what you’re allowed to think about money.

And now I’m wondering… what’s next? Will they ban private savings accounts next? Or just start assigning spending limits based on your social credit score?

Martin Hansen

December 6, 2025 AT 04:19Of course China banned crypto. Because only a bunch of libertarian crypto bros with their heads up their asses think decentralized money is a good idea.

Real economies need order. Real governments need control. You think Bitcoin is ‘freedom’? It’s chaos wrapped in a whitepaper. The digital yuan is the future-transparent, efficient, and actually usable.

Meanwhile, you Americans keep acting like crypto is the next gold rush. Newsflash: it’s not. It’s a speculative casino run by degens who can’t do math.

China didn’t ban innovation-they banned nonsense. And if you can’t see the difference between a state-backed digital currency and a meme coin, you shouldn’t be allowed to use a smartphone.

Stop romanticizing anarchy. The world is moving toward centralized digital finance. Get with it or get left behind.

Joe West

December 6, 2025 AT 19:03Just to clarify something real quick for anyone confused: if you’re a foreign business and you’re selling to customers in China, even if you’re based in the US, you can’t accept crypto from them. Period.

Payment processors like Stripe and PayPal have already started geo-blocking crypto for Chinese IPs. Even if your site says ‘Bitcoin accepted,’ it won’t work if the buyer is in Beijing.

And if you’re thinking of using a VPN or a Hong Kong shell company to bypass this? Don’t. The Chinese government has AI that traces payment patterns across borders. They don’t care if your business is registered in Singapore-what matters is where the money comes from.

The only safe path? Use the digital yuan QR code. It’s fast, cheap, and legal. Alipay and WeChat Pay are fine too.

Bottom line: don’t risk your business over a crypto fantasy. The penalties aren’t just fines-they’re career-ending.

Richard T

December 7, 2025 AT 04:18