Crypto Exchange Safety Checker

Is This Exchange Safe to Use?

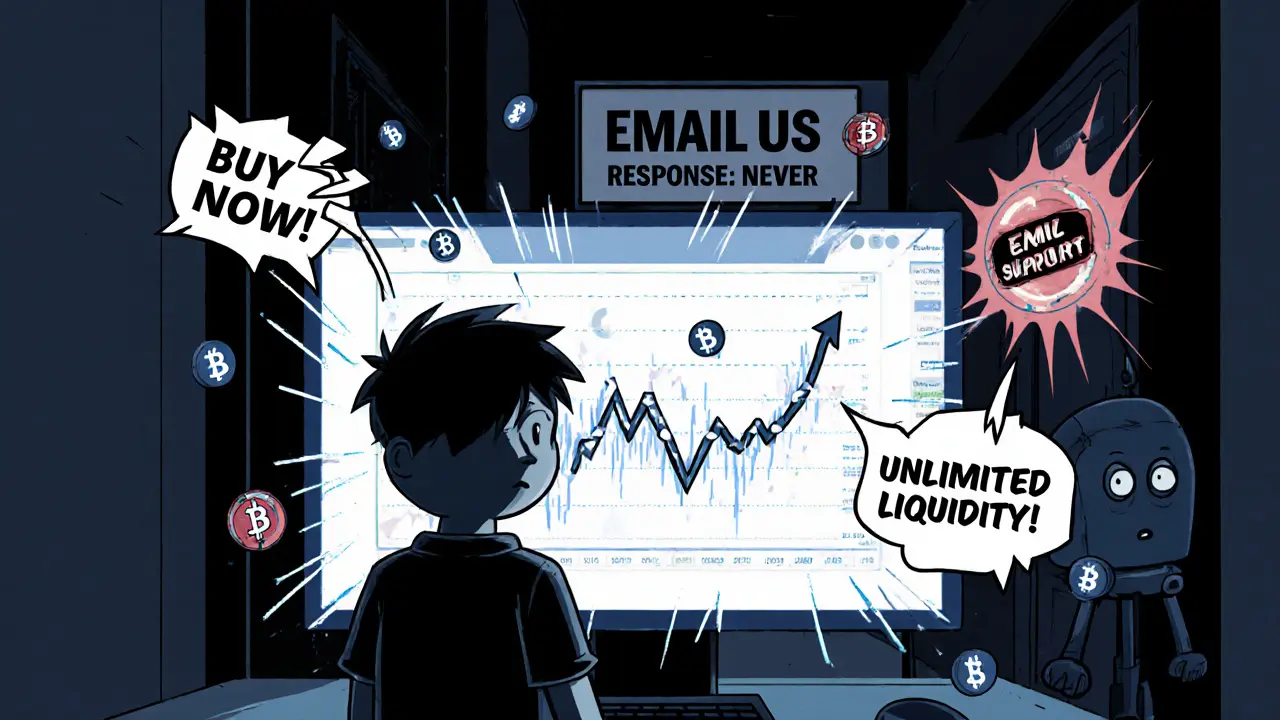

Based on your answers, we'll evaluate the exchange's safety and transparency. This tool helps identify red flags like those that doomed ChainX.

Your Safety Score

ChainX isn’t just another crypto exchange. It’s a ghost town with a website. If you’re wondering whether to deposit funds into ChainX, the short answer is: don’t. This isn’t a case of poor performance or slow customer service. This is a project that stopped evolving years ago, left users stranded, and has all the hallmarks of a failed experiment wrapped in misleading marketing.

What ChainX Actually Is (Not What They Claim)

ChainX markets itself as a cross-chain bridge that lets you move Bitcoin, Ethereum, and Polkadot assets directly between blockchains without wrapping them. Sounds useful, right? But here’s the catch: the technology never worked reliably, and the exchange side of the platform was always the real focus - not the interoperability. The team behind it remains anonymous. No founders, no company registration, no public roadmap. Just a whitepaper from 2019 and a mainnet launch in April 2020 that quickly turned into a cautionary tale.Their native token, PCX, was supposed to secure the network through staking. But as of November 2025, PCX trades at just $0.022 with a daily volume under $150,000. That’s less than what a single popular meme coin moves in an hour. The market cap? Around $2.1 million. Compare that to Chainlink’s $6.8 billion. ChainX didn’t just fall behind - it vanished from the conversation.

The Exchange That Couldn’t Handle Withdrawals

If you thought the technical side was bad, wait until you hear about the exchange. Users who tried to withdraw funds in 2020 reported delays of up to 72 hours - far beyond the advertised 24 hours. Some never got their money back. One user, ‘Hodl4Life’, lost $3,200 when ChainX froze withdrawals during a Bitcoin price spike in June 2020. That’s not a glitch. That’s a pattern.Bitcointalk forums from that time are filled with similar stories: 278 withdrawal complaints in just two months. The platform had no public proof of reserves. No third-party audits. No transparency. Yet they claimed to hold 95% of user funds in cold storage. How do you verify that if they won’t show you the wallets? You can’t. And no one has since.

Fake Volume, Manipulated Listings

The trading volume on ChainX? Mostly fabricated. A Bitcointalk user known as ‘CryptoSkeptic42’ analyzed the data back in 2020 and found that 95% of trades were wash trades - the same accounts buying and selling to each other to create fake demand. This isn’t rare in shady exchanges, but ChainX took it to another level.New tokens listed on ChainX followed a predictable cycle: a sudden 500% to 2000% price spike, followed by an 80% crash within 24 hours. Multiple users reported identical patterns across 12 different token launches. That’s not market movement - that’s algorithmic pump-and-dump. And the platform did nothing to stop it.

Compare that to Binance, where verified volume is around 85% genuine. ChainX didn’t even come close. And with only 42 tokens listed as of late 2024, compared to Binance’s 1,500+, it’s clear nobody trusted the platform enough to list anything meaningful.

Security? There Wasn’t Any

In March 2020, blockchain security firm PeckShield published an audit that found critical vulnerabilities in ChainX’s relay system. The flaw? It could allow attackers to double-spend assets across chains. That’s not a minor bug. That’s a catastrophic flaw that could wipe out user funds. ChainX never acknowledged it. Never patched it. Never told users.Even worse, the platform never obtained any security certifications. No SOC 2. No ISO 27001. No independent penetration test. Nothing. Meanwhile, even smaller exchanges like KuCoin and Bybit publish regular proof-of-reserves reports. ChainX? Radio silence.

No Updates. No Support. No Future

The last GitHub commit was on October 12, 2022. The official Twitter account (@ChainX_Official) hasn’t posted since June 15, 2021. The Telegram group has over 3,200 members - but 98% are bots. No developers, no moderators, no answers. If you have a problem, your only option is to email support. And from user reports, responses took 72+ hours - if they came at all.Their documentation is outdated. Half the API endpoints listed on GitHub don’t work. The UI is clunky and inconsistent. New users struggled with basic cross-chain transfers - 65% of them couldn’t complete the process without help. And there was no help to give.

Why No One Uses It Anymore

ChainX launched during the 2019-2020 crypto boom, when dozens of cross-chain projects popped up. Most of them failed. But ChainX didn’t just fail - it was actively avoided. DappRadar shows an average of just 142 daily active users on the ChainX exchange. Uniswap? 500,000. Thorchain? Over 100,000. ChainX has less than 0.01% of the cross-chain DEX market share.Enterprise adoption? Zero. Institutional partnerships? None. Regulatory compliance? Absolutely none. The SEC’s 2021 ‘Project Columbia’ targeted exactly this kind of opaque cross-chain platform - and ChainX was on the list. Not because it was dangerous, but because it was invisible. No one knew who ran it. No one could verify its claims. And no one wanted to touch it.

What Happens If You Still Try to Use It?

Let’s say you’re tempted. You’ve heard the price might go up. You’ve seen someone claim it’s “undervalued.” Here’s what you’re signing up for:- You deposit crypto - maybe BTC or ETH - to trade on ChainX.

- You try to withdraw. It takes days. Or weeks. Or never.

- You find out your trading pair has no real liquidity. Your order gets filled at a terrible price because the depth vanished.

- You check the official website. It still says “24-hour withdrawals.” It’s a lie.

- You try to contact support. No reply.

- You realize your funds are stuck in a dead project with no team, no updates, and no hope.

This isn’t speculation. This is what happened to hundreds of users in 2020. And nothing has changed since.

Is ChainX a Scam?

It’s not a scam in the traditional sense - no one was caught stealing funds outright. But it’s worse. It’s a slow-motion collapse. A project that raised expectations with bold claims, delivered nothing but broken promises, and then disappeared. The team vanished. The code stopped updating. The community died. And the users? Left holding tokens worth pennies.ChainX isn’t a crypto exchange you can trust. It’s a graveyard of failed ambitions. If you’re looking for a cross-chain solution, go with Thorchain, LayerZero, or even Polygon’s Bridges. They have teams, audits, transparency, and active development. ChainX has none of that.

Don’t be the next person who loses money because they thought, “It’s cheap - maybe it’ll bounce back.” It won’t. And you won’t get your money back if you deposit now.

Is ChainX still operational?

Technically, yes - the website and blockchain still exist. But there’s no active development, no team engagement, and no meaningful user activity. The last GitHub commit was in 2022. The official Twitter account has been silent since 2021. It’s a zombie protocol with no future.

Can I withdraw my funds from ChainX?

Some users have successfully withdrawn small amounts in recent years, but many others report indefinite delays or complete withdrawal failures. There’s no guarantee you’ll get your money out, especially if you’re depositing now. The platform has no customer support, no transparency, and no track record of reliable withdrawals.

Is PCX token worth buying?

No. PCX has a market cap of under $3 million and negligible trading volume. It’s not listed on any major exchanges. Its value is based entirely on speculation from people hoping for a revival that will never happen. There’s no utility, no demand, and no team to drive adoption.

Why did ChainX fail?

ChainX failed because it had no real team, no transparency, and no user trust. Its technology was unproven, its security was flawed, and its exchange practices were manipulative. While other cross-chain projects improved and scaled, ChainX went silent. It didn’t adapt - it disappeared.

Are there safer alternatives to ChainX?

Yes. Thorchain, LayerZero, and Polygon’s Bridges are all actively developed, audited, and used by thousands daily. They have transparent teams, public roadmaps, and real liquidity. If you need cross-chain swaps, use one of these instead. ChainX is not an option - it’s a risk with no upside.

Did ChainX ever get audited?

PeckShield audited ChainX in March 2020 and found critical vulnerabilities that could allow double-spending. ChainX never fixed these issues or disclosed them to users. No other audits have been published since. There is no proof of reserves, no security certifications, and no transparency.

Final Verdict: Avoid ChainX Completely

ChainX isn’t a crypto exchange you can learn from. It’s not a project you can invest in. It’s not even a platform you can use safely. It’s a relic of a bygone crypto era - one where anonymity and hype replaced accountability and execution.If you’re looking for a cross-chain solution, there are dozens of better options. If you’re looking for a place to trade crypto, stick with exchanges that have public teams, verified volume, and active support. ChainX has none of those things. And if you deposit now, you’re not betting on a comeback - you’re betting that no one else has noticed it’s already dead.