Ethereum Gas Fee Estimator

Understand Ethereum Transaction Costs

The London Hard Fork (EIP-1559) changed how Ethereum calculates fees. This tool estimates transaction costs based on network conditions after the upgrade.

Enter Your Transaction Details

How Fees Work

After the London Hard Fork, fees have two components:

- Base Fee - Automatically adjusted fee that gets burned

- Priority Fee - Extra fee to speed up your transaction

Estimated Transaction Costs

Base Fee

0.000000000 ETH

Priority Fee

0.000000000 ETH

Total Fee

0.000000000 ETH

When you send ETH from one wallet to another, you’re not just moving money-you’re interacting with a living, breathing system that can change its own rules. That’s where Ethereum hard forks come in. They’re not updates you click ‘install’ on like a phone app. They’re full-scale surgical interventions on the blockchain itself-breaking old rules, rewriting how transactions work, and forcing everyone to upgrade or get left behind.

What Exactly Is a Hard Fork?

A hard fork is a permanent split in the Ethereum blockchain caused by a change to the protocol that’s not backward compatible. Think of it like changing the language everyone speaks. If you suddenly switch from English to Spanish, everyone who doesn’t learn Spanish can’t understand the new conversations. The same thing happens on Ethereum. Nodes (computers running the network) that don’t upgrade their software stop recognizing new blocks as valid. They keep following the old rules, creating a separate chain. This isn’t like a soft fork, where older nodes can still accept new blocks. Hard forks demand action. If you’re running a wallet, exchange, or smart contract, you have to update your code-or risk losing access to your assets on the new chain. The old chain doesn’t disappear, but it becomes irrelevant unless people choose to keep using it.Why Can’t Ethereum Just Update Without Breaking Things?

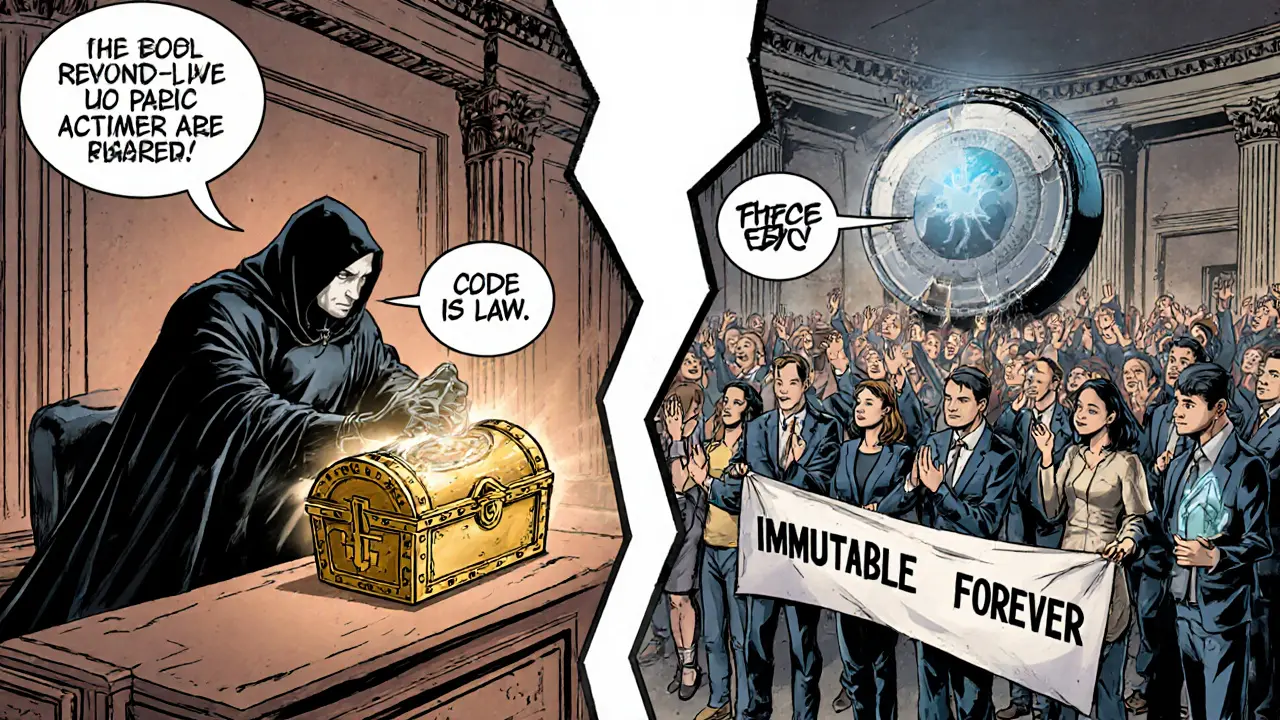

Some changes can be made without breaking compatibility. Those are soft forks. But Ethereum’s evolution has required deeper changes-ones that touch the core of how the network validates transactions, handles fees, or secures itself. For example, switching from Proof of Work (PoW) to Proof of Stake (PoS) isn’t just tweaking settings. It’s replacing the entire security model. Miners with powerful GPUs can’t suddenly become validators with staked ETH. The rules are too different. That’s why The Merge, in September 2022, had to be a hard fork. There was no way to make it backward compatible. Same with EIP-1559. Before this upgrade, gas fees were chaotic. Users bid against each other like an auction, and fees could spike from $1 to $100 in minutes. EIP-1559 introduced a base fee that burns a portion of every transaction, making prices more predictable. But to make this work, the protocol had to change how fees are calculated at the lowest level-something that old nodes couldn’t understand. So, a hard fork was the only option.The DAO Fork: Ethereum’s First Major Split

Ethereum’s first hard fork happened in 2016 after a hacker exploited a flaw in The DAO-a decentralized investment fund-and stole $60 million worth of ETH. The community was split. Some believed blockchain code was law: what happened, happened. Others argued that reversing the theft was the moral thing to do. The result? A hard fork that rolled back the stolen funds and created two chains:- Ethereum (ETH)-the new chain with the reversal

- Ethereum Classic (ETC)-the original chain, unchanged

The London Hard Fork: Taming Gas Fees

Before August 2021, Ethereum’s fee system was broken. Users paid unpredictable gas prices. Developers couldn’t build reliable apps because they didn’t know how much a transaction would cost. The London Hard Fork, activated at block 12,965,000, changed all that with EIP-1559. Here’s how it worked:- A base fee is automatically calculated based on network demand. If the block is full, the fee goes up. If it’s empty, it drops.

- This base fee is burned-destroyed-instead of going to miners.

- Users can add a tip (priority fee) to get their transaction processed faster.

The Merge: Killing Proof of Work

The biggest hard fork in Ethereum’s history wasn’t about fees or fixes-it was about survival. Before The Merge, Ethereum used Proof of Work. Miners solved complex math puzzles using massive amounts of electricity. The network consumed as much energy as a small country. Environmental groups called it unsustainable. Critics said Ethereum was a climate liability. The Merge, completed on September 15, 2022, replaced mining with staking. Validators lock up 32 ETH to participate in block creation and validation. Instead of using electricity, they use economic incentives. If they act dishonestly, they lose their stake. The impact? Ethereum slashed its energy use by 99.95%. The network became faster, cheaper to secure, and more environmentally viable. It also changed how new ETH is issued-mining rewards disappeared. Now, new ETH comes only from staking rewards and is often offset by burned fees. The Merge didn’t just upgrade Ethereum. It redefined what a blockchain could be.How Hard Forks Are Planned and Executed

Hard forks don’t happen overnight. They’re the result of months, sometimes years, of work. The process starts with an Ethereum Improvement Proposal (EIP). Anyone can submit one. If it’s accepted, developers draft the code, test it on testnets like Goerli or Sepolia, and run simulations for months. Then comes community discussion-on forums, Discord, Twitter, and at conferences. No single person decides. It’s a decentralized vote by nodes, developers, exchanges, and users. Once consensus is reached, a specific block number is chosen for activation. Everyone gets a deadline: upgrade by block X, or be left on the old chain. Exchanges and wallet providers announce the upgrade weeks in advance. Users are told to update their software. Some even get email reminders. The activation itself is silent. No ceremony. No fireworks. Just a block number. At that exact moment, the network splits. Nodes that upgraded follow the new rules. Those that didn’t keep mining or validating on the old chain.Security Risks: Replay Attacks and Chain Confusion

Hard forks aren’t risk-free. One major danger is replay attacks. After a fork, transactions on the new chain can be copied and replayed on the old chain. If you send 1 ETH on the new Ethereum chain, someone could copy that transaction and send another 1 ETH on the old chain-effectively stealing from you. To prevent this, developers added replay protection to EIP-1559 and The Merge. Transactions now include a chain ID that tells nodes which chain they belong to. Without it, the transaction gets rejected. Wallets and exchanges also add extra layers of protection. Still, users who hold ETH on exchanges or wallets that don’t update properly can get caught in the middle. That’s why it’s critical to check if your service supports the upgrade before it happens.

What’s Next? Sharding and Beyond

The Merge didn’t solve everything. Ethereum still struggles with high fees during peak usage. That’s why the next major upgrade-sharding-is already in motion. Sharding splits the Ethereum blockchain into 64 smaller chains (shards), each processing its own transactions. This increases throughput from 15 transactions per second to over 100,000. But sharding requires deep changes to how data is stored and verified. It can’t be done with a soft fork. It needs another hard fork. Future upgrades like Verkle Trees will make the blockchain lighter and faster to sync. Account abstraction will let users pay gas fees in tokens instead of ETH. All of these require hard forks. Ethereum’s roadmap is built on hard forks. They’re not a bug-they’re the engine of progress.Who Benefits From Hard Forks?

Users benefit from lower fees, faster transactions, and more reliable apps. Developers get a stable, scalable platform to build on. Investors see a network that evolves and adapts-making ETH more valuable over time. Miners lost out after The Merge. But validators now earn rewards from staking. And exchanges, wallets, and dApps all benefit from a smoother, more predictable network. Even critics of hard forks admit they’ve saved Ethereum. Without the DAO fork, the network might have collapsed under the weight of a major exploit. Without The Merge, Ethereum might have been abandoned for greener alternatives.Final Thoughts: Hard Forks Are the Price of Progress

Hard forks are messy. They divide communities. They scare users. They require perfect timing and flawless execution. But without them, Ethereum would be stuck in 2016-slow, expensive, and energy-hungry. Every hard fork is a vote. A vote for progress over stagnation. For adaptability over dogma. For a blockchain that learns, grows, and improves-even if it means breaking the old rules to do it. The next fork is coming. And when it does, you’ll need to be ready.What’s the difference between a hard fork and a soft fork in Ethereum?

A hard fork creates a permanent split in the blockchain because the new rules aren’t compatible with the old ones. Everyone must upgrade or be left behind. A soft fork is backward compatible-older nodes still accept new blocks, even if they don’t understand all the new rules. Hard forks are used for major changes like switching consensus mechanisms; soft forks are for smaller improvements.

Do I need to do anything when Ethereum has a hard fork?

If you use a wallet or exchange, you usually don’t need to do anything-they handle the upgrade for you. But if you run your own node, validator, or smart contract, you must update your software before the fork activates. Otherwise, you’ll be stuck on the old chain and won’t be able to interact with the new Ethereum network.

What happened to Ethereum Classic after the DAO fork?

Ethereum Classic (ETC) continued as the original Ethereum chain after the 2016 DAO fork. It kept the stolen funds and maintained the principle that blockchain code is law. Today, ETC is a separate cryptocurrency with its own community, developers, and miners. It’s much smaller than ETH but still active and secure.

Did The Merge make Ethereum cheaper to use?

The Merge didn’t directly lower gas fees-it removed mining and switched to staking. But it paved the way for future upgrades like sharding that will reduce fees. Before The Merge, fees were high because of network congestion. After The Merge, fees stayed volatile until EIP-4844 (Proto-Danksharding) started reducing data costs in 2024. So while The Merge didn’t fix fees, it made future fixes possible.

Can a hard fork be reversed?

Once a hard fork is activated and blocks are built on the new chain, it can’t be undone. The old chain becomes obsolete unless people keep running it independently (like Ethereum Classic). But if a fork causes major problems, developers can propose another hard fork to fix it. Ethereum has done this multiple times-each fork builds on the last.

Savan Prajapati

November 27, 2025 AT 22:33Hard forks are just chaos with a roadmap. Why can't they just build new chains instead of breaking the old one? ETC exists for a reason.

Janice Jose

November 28, 2025 AT 00:30I get why people freak out about forks, but honestly? If you're holding ETH in a wallet or exchange, you're fine. The devs got your back. Just don't run your own node and forget to update.

Joel Christian

November 28, 2025 AT 13:34the merge was a joke. miners worked so hard and now theyre just... gone? what a waste. and who says energy use matters anyway? we got air conditioning and netflix, who cares if the blockchain uses more than a small country?

Vijay Kumar

November 29, 2025 AT 07:33You think this is progress? You're just trading one tyranny for another. Now it's not miners controlling the chain, it's the rich with 32 ETH. The real power is always in the hands of the few.

Brian Bernfeld

November 30, 2025 AT 13:19Let me tell you something real quick - hard forks are the only reason Ethereum hasn't died a thousand deaths already. The DAO fork? Saved the whole thing. The Merge? Saved it from becoming a climate punchline. EIP-1559? Made gas fees stop feeling like a casino. This isn't some tech glitch - it's evolution. If you're mad about it, you're mad at progress itself. And honestly? That's on you.

Ian Esche

November 30, 2025 AT 14:03Why does the whole world care about what some code does? We got real problems - inflation, borders, crime. But no, we gotta sit here and debate whether burning ETH is 'deflationary.' This is why America's falling behind.

Felicia Sue Lynn

December 1, 2025 AT 05:10It's fascinating how the philosophical tension between immutability and adaptability plays out in blockchain governance. One could argue that the DAO fork established a precedent where moral imperatives supersede algorithmic absolutism - a deeply human decision encoded in machine logic.

Christina Oneviane

December 1, 2025 AT 17:04Oh wow, another 'progress' story. Next they'll tell us the blockchain is going to start doing yoga and meditating to reduce its carbon footprint. Can't wait for the TED Talk.

fanny adam

December 2, 2025 AT 21:02Are you aware that the chain ID replay protection was implemented after the DAO fork, but before The Merge? There is documented evidence that some exchanges failed to implement it properly, leading to multiple user fund losses on the old chain. This is not a feature - it's a systemic vulnerability masked as innovation.

Kristi Malicsi

December 3, 2025 AT 16:42hard forks are just the blockchain's way of saying 'grow up or get out' and honestly i kinda love that. no hand holding no babysitting just upgrade or get left in the dust like a flip phone. sharding next?? bring it. im ready