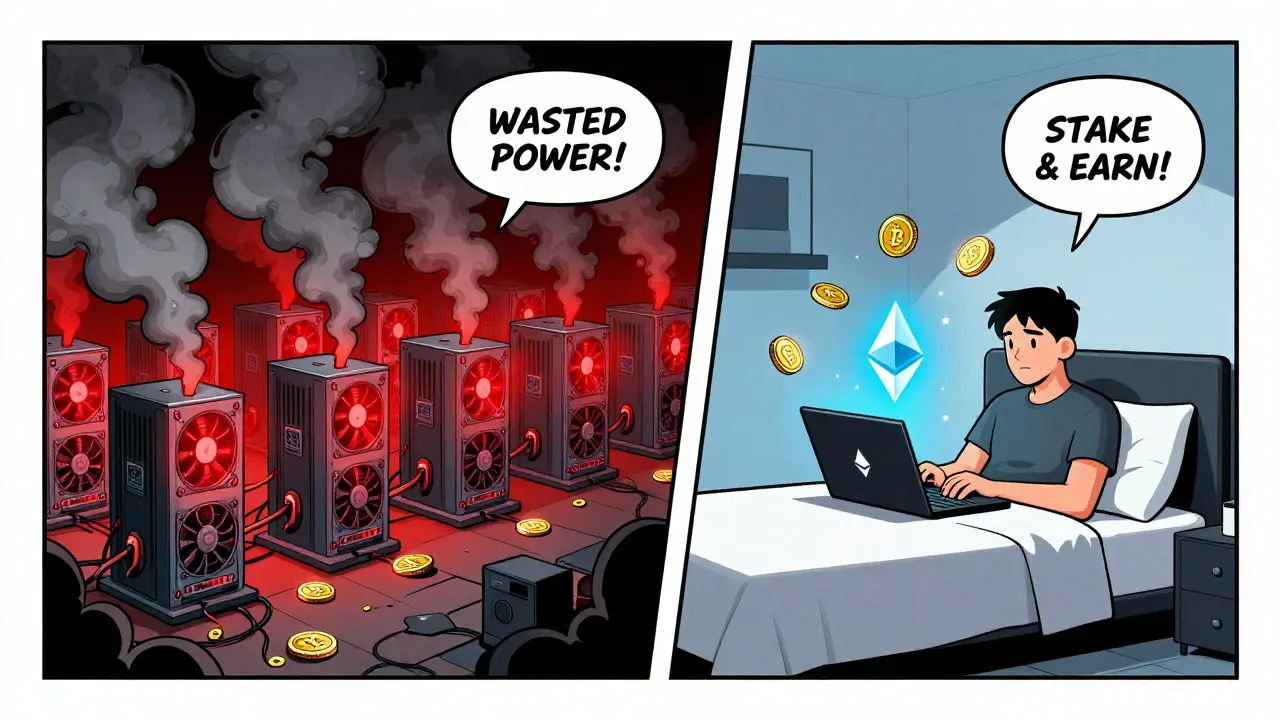

For years, Bitcoin miners ran racks of powerful computers, burning through electricity to solve math puzzles and secure the network. It was expensive, noisy, and wasteful. But today, that model is fading - not because it broke, but because something better came along. Staking is replacing mining in modern blockchains, and it’s changing everything about how crypto networks stay secure.

What Mining Actually Did

Proof of Work (PoW), the original consensus method, relied on miners competing to solve cryptographic puzzles. The first one to crack it got to add the next block and collect rewards - new coins plus transaction fees. It worked, but it had a massive flaw: energy use. Bitcoin mining alone uses more electricity than entire countries. That’s not because the puzzles are hard - it’s because the system is designed to be wasteful. The more power you throw at it, the better your odds. That led to centralized mining farms in places with cheap power, pushing out small players.How Staking Works Instead

Proof of Stake (PoS) throws out the computers and replaces them with coins. Instead of racing to solve puzzles, you lock up your cryptocurrency - your stake - as collateral. The network then picks validators randomly, but with a twist: the more coins you stake, the higher your chance of being chosen. No mining rigs. No fans blowing hot air. Just your wallet connected to the internet. When you’re selected as a validator, you verify transactions and propose new blocks. If you do it right, you earn rewards - more of your own crypto. If you go offline or try to cheat, you lose part of your stake. That’s called slashing. It’s not about brute force anymore. It’s about skin in the game.Ethereum’s Big Switch

The biggest shift happened in September 2022, when Ethereum - the second-largest crypto network by market cap - shut down its mining operation. Over 20 million ETH were staked by more than 800,000 validators. Overnight, Ethereum’s energy use dropped by 99.95%. Miners vanished. In their place, everyday people with 32 ETH (or less, through staking pools) started securing the network. This wasn’t a small experiment. It was the largest blockchain ever to make the switch. And it worked. No downtime. No major hacks. Just cleaner, cheaper, more efficient validation.

Why Staking Is More Efficient

Mining needs hardware. You need ASICs, cooling systems, power supplies, and a constant stream of electricity. Even the best mining rigs use 3,000 watts or more - that’s like leaving 30 LED bulbs on 24/7. Staking? A Raspberry Pi or a $5/month cloud server can run a validator node. The energy cost is negligible. You’re not running a factory. You’re just holding coins and staying online. That’s why new blockchains like Solana, Cardano, and Polkadot launched with PoS from day one. They didn’t waste time building mining infrastructure. They skipped straight to the efficient version.Who Gets to Stake?

You don’t need to be a tech expert to stake. If you have 32 ETH, you can run your own validator. But most people don’t. That’s where staking pools come in. Platforms like Coinbase, Kraken, and Lido let you deposit any amount of ETH and earn rewards proportionally. Your 0.5 ETH? It gets pooled with thousands of others. The platform runs the node for you. You get paid. No setup. No risk of slashing. This democratized access. Before, mining was only for people who could afford $10,000 in hardware and $500/month in electricity bills. Now, you can stake with $100 worth of crypto and still earn passive income.Security: Coins Over Hashrate

In PoW, a 51% attack means controlling more than half the mining power. That’s expensive, but possible - and has happened on smaller chains. In PoS, a 51% attack means owning more than half the total supply of the coin. That’s nearly impossible on major networks. Imagine trying to buy 51% of all Ethereum. You’d drive the price up so high, you’d bankrupt yourself before you finished buying. Plus, once you control the chain, your own coins lose value because everyone knows the network is compromised. You’d be destroying your own investment. That’s the real innovation: the attacker’s goals are misaligned. In mining, you profit from chaos. In staking, you profit from stability.

The Downsides - And How They’re Being Fixed

Staking isn’t perfect. One risk is centralization. If only big players can afford to stake large amounts, they end up controlling the network. That’s why most PoS systems use random selection and penalties to prevent dominance. Also, when you stake your coins, they’re locked up. You can’t sell them instantly. That reduces liquidity. But solutions are already here. Liquid staking lets you stake your ETH and get a token (like stETH) in return that you can trade, lend, or use in DeFi. Your coins are still locked for validation, but you get the flexibility to use their value elsewhere.What This Means for You

If you hold crypto, staking turns your idle coins into income. You’re not just a holder anymore - you’re a part of the network’s security. You earn rewards without buying gear, without paying bills, without burning the planet. For developers and projects, PoS means lower costs, faster innovation, and better public perception. No more environmental backlash. No more mining rig shortages. Just clean, economic consensus.The Future Is Staked

Mining isn’t dead everywhere - Bitcoin still runs on PoW, and it’s not going anywhere. But for new blockchains, and even legacy ones like Ethereum, staking is the default. It’s cheaper. It’s greener. It’s easier. And it gives everyday users real power over the network. The shift from mining to staking isn’t just a technical upgrade. It’s a cultural one. It moves control from industrial operators to individual holders. It turns energy waste into economic participation. And it proves that blockchain doesn’t need to burn the world to secure itself.Is staking safer than mining?

Staking is safer in terms of network security because attacking it requires owning a majority of the coin supply - which is far more expensive and self-defeating than controlling mining hardware. In mining, you can rent hashpower for a short-term attack. In staking, you’d have to buy up most of the supply, which would spike the price and collapse your own investment. Plus, staking has slashing: if you misbehave, you lose part of your stake. Mining has no such penalty.

Can I stake any cryptocurrency?

No, only blockchains that use Proof of Stake let you stake. Bitcoin and Litecoin still use mining. But most newer coins do - Ethereum, Cardano, Polkadot, Solana, and Tezos are all staking networks. Always check if the coin you hold supports staking before you try. Some require you to use a specific wallet or exchange.

How much can I earn from staking?

Earnings vary by network. Ethereum staking currently pays between 3% to 5% annually. Cardano pays around 4%, and Polkadot offers up to 12%. These are annual percentage yields (APY), meaning you earn compounding rewards. But rewards depend on total staked supply - if more people stake, rewards go down slightly. Always check the latest rates on the official network site or your staking provider.

Do I need to lock up my coins forever?

No, but you can’t spend them immediately. On Ethereum, unstaking takes about 18-24 hours to process. On other chains, it can take days. Some platforms offer liquid staking, where you get a tradable token (like stETH) that represents your staked coins. That lets you use your staked assets in DeFi while still earning rewards. But be careful - liquid staking tokens carry extra risks, like smart contract bugs or depegging.

What happens if my validator goes offline?

If you’re running your own validator node and it goes offline for too long, you’ll get penalized - your stake gets reduced. This is called slashing. But if you’re using a staking pool like Coinbase or Lido, they handle uptime for you. You don’t get slashed. Your risk is limited to the pool’s reliability. Choose a reputable provider with a strong track record.

Is staking the same as earning interest?

It’s similar, but not the same. Interest from a bank is a loan - the bank uses your money and pays you back. Staking is participation - you’re helping secure a blockchain, and you’re rewarded for it. It’s more like owning a share in a company that pays dividends. Plus, staking rewards are paid in crypto, not fiat, and are subject to price swings. Your rewards could be worth more or less depending on the market.

Why did Ethereum switch from mining to staking?

Ethereum switched to reduce its massive energy footprint, lower costs for users, and improve scalability. Mining was slowing down the network and drawing criticism for environmental harm. Staking made Ethereum faster, cheaper, and greener. It also opened up participation - anyone with ETH could help secure the network, not just those with expensive mining rigs. The upgrade, called The Merge, was the most complex in crypto history - and it succeeded without a single second of downtime.

Can I lose money by staking?

You can’t lose your principal just by staking - your coins stay in your wallet. But you can lose part of your stake if you run your own validator poorly and get slashed. You can also lose money if the crypto’s price drops while your coins are locked. And if you use a third-party pool, there’s a small risk the platform gets hacked or goes offline. Always research your staking method and never stake more than you’re comfortable losing.

greg greg

January 10, 2026 AT 09:29Okay so let’s break this down real slow-staking isn’t just a technical upgrade, it’s a total paradigm shift in how we think about trust. In mining, you’re paying for computational power like it’s a utility bill, but with staking, you’re betting your own wealth on the system’s integrity. That’s wild when you think about it. Your coins aren’t just sitting there-they’re actively policing the network. And the slashing mechanism? That’s not just a penalty, it’s a behavioral nudge. It turns self-interest into network loyalty. Imagine if your bank did that-lose money if you try to cheat the system? Yeah, that’d be revolutionary. And the energy numbers? 99.95% drop? That’s not efficiency, that’s a miracle. We’re talking about replacing a global industrial operation with a laptop and a Wi-Fi connection. No wonder Ethereum’s devs called it The Merge-it didn’t just upgrade, it fused two worlds together. But here’s the kicker: most people still don’t get it. They think staking is like a savings account. Nah. It’s like becoming a cop and getting paid in the currency you’re protecting. You’re not just earning-you’re enforcing. And that’s why decentralization actually works here. You don’t need ASIC farms-you need trust, and trust is built when your skin’s in the game.

LeeAnn Herker

January 11, 2026 AT 19:08Oh wow, so now the rich get to be ‘validators’ instead of miners? Cute. 😏

Let me guess-next they’ll say ‘but anyone can stake!’ while the top 0.1% hold 70% of the supply. And don’t get me started on liquid staking tokens-those are just Ponzi wrappers with fancy names. stETH? More like ‘stolen ether’ when the smart contract gets hacked. And don’t tell me about ‘skin in the game’-if your coins get slashed because your Raspberry Pi lost power, you’re SOL. Meanwhile, Coinbase is collecting fees and laughing all the way to the bank. This isn’t decentralization-it’s Wall Street with a blockchain tattoo.

Sherry Giles

January 11, 2026 AT 22:33Staking? More like state-controlled crypto slavery. Who’s really running these ‘validators’? Big tech. Big finance. Big government. You think Canada or the US isn’t watching every staking transaction? They’re not here to empower you-they’re here to track you. And don’t even get me started on how easy it is to freeze staked assets if you say the wrong thing online. This isn’t freedom-it’s compliance with a 5% APY reward. And they call this progress? We used to mine with GPUs. Now we just hand over our coins and pray the algorithm doesn’t punish us for blinking. This is the new digital serfdom. 🇨🇦

Andy Schichter

January 12, 2026 AT 18:41So we replaced energy waste with… emotional waste? Congrats. Now instead of burning electricity, we’re burning anxiety over whether our 32 ETH will get slashed because we forgot to update a node. And don’t even get me started on ‘liquid staking’-that’s just borrowing your own money and calling it innovation. You’re not securing the network, you’re just renting out your wallet like a Airbnb for hackers. And the rewards? Barely more than inflation. At least mining gave you a physical thing-a rig you could touch. Now you’re just a number in a spreadsheet. I miss the days when crypto was about rebellion, not passive income.

Caitlin Colwell

January 13, 2026 AT 19:45Denise Paiva

January 15, 2026 AT 13:51One must observe with a discerning eye that the ostensible democratization of validation through staking is, in fact, a rebranding of capital concentration under the veneer of technological progress. The assertion that ‘anyone can participate’ is statistically disingenuous when 80% of staked ETH resides in fewer than 5,000 wallets. Furthermore, the introduction of liquid staking derivatives introduces systemic counterparty risk of unprecedented magnitude-unregulated, uncollateralized, and utterly opaque. One may be tempted to celebrate the reduction in energy consumption, yet one must not overlook the fact that centralization of control is the true cost of this ‘efficiency.’ The Merge was not a triumph of decentralization-it was a surrender to institutional capture disguised as innovation.

Calen Adams

January 16, 2026 AT 03:24Staking isn’t just the future-it’s the NOW. You’re not just holding crypto anymore, you’re running infrastructure. And if you’re not staking, you’re literally leaving money on the table. Ethereum’s APY? 4.5%? That’s better than your savings account, your bond fund, your dividend ETF. And with liquid staking, you can YIELD FARM it, lend it, use it as collateral-this is DeFi on steroids. Stop thinking like a miner. Think like a node operator. Think like a stakeholder. This isn’t passive-it’s PROACTIVE wealth generation. And yeah, there’s risk-but so is everything in crypto. You don’t get to win without playing. Get in. Stake. Earn. Repeat. #StakeSmart

Meenakshi Singh

January 17, 2026 AT 09:27my 0.3 ETH on Kraken gives me 4.2% APY and i dont even think about it 🤷♀️

but if the node goes down? oops 😱

so i just use pools. no stress. no sleepless nights. just free money. 🚀

Kelley Ramsey

January 19, 2026 AT 07:58Can I just say how amazing it is that regular people-like me, just holding ETH in my wallet-can now be part of something so fundamentally important? I used to feel so powerless in crypto, like I was just waiting for someone else to make it work. But now? I’m literally helping secure the network. I don’t need a degree. I don’t need a lab. I just need to keep my wallet connected. And the fact that it uses almost no energy? That’s the kind of progress I can get behind. I feel proud. I feel involved. I feel like I’m part of something bigger. Thank you, Ethereum. 🙏❤️

Sabbra Ziro

January 19, 2026 AT 09:58Hey everyone-just wanted to say I’ve been staking for over a year now, and I’ve seen so many people get scared off by the ‘slashing’ thing. But honestly? If you’re using a reputable pool like Coinbase or Lido, you’re not even touching the validator side. They handle it. You just earn. And if you’re worried about liquidity? Try stETH or aETH. Use it in DeFi. It’s like having your cake and eating it too. And if you’re new? Start small. $50. $100. Just get your feet wet. This isn’t a race. It’s a movement. And you don’t need to be a tech wizard to be part of it. We’re all in this together. Keep learning. Keep staking. You’ve got this. 💪🌈