HYDRA Dex Slippage Calculator

HYDRA Dex has no meaningful liquidity, which means traders experience extreme slippage. This calculator demonstrates how much you'd lose on trades due to lack of liquidity, based on real-world data from the article showing 10%+ spreads on HYDRA/ETH.

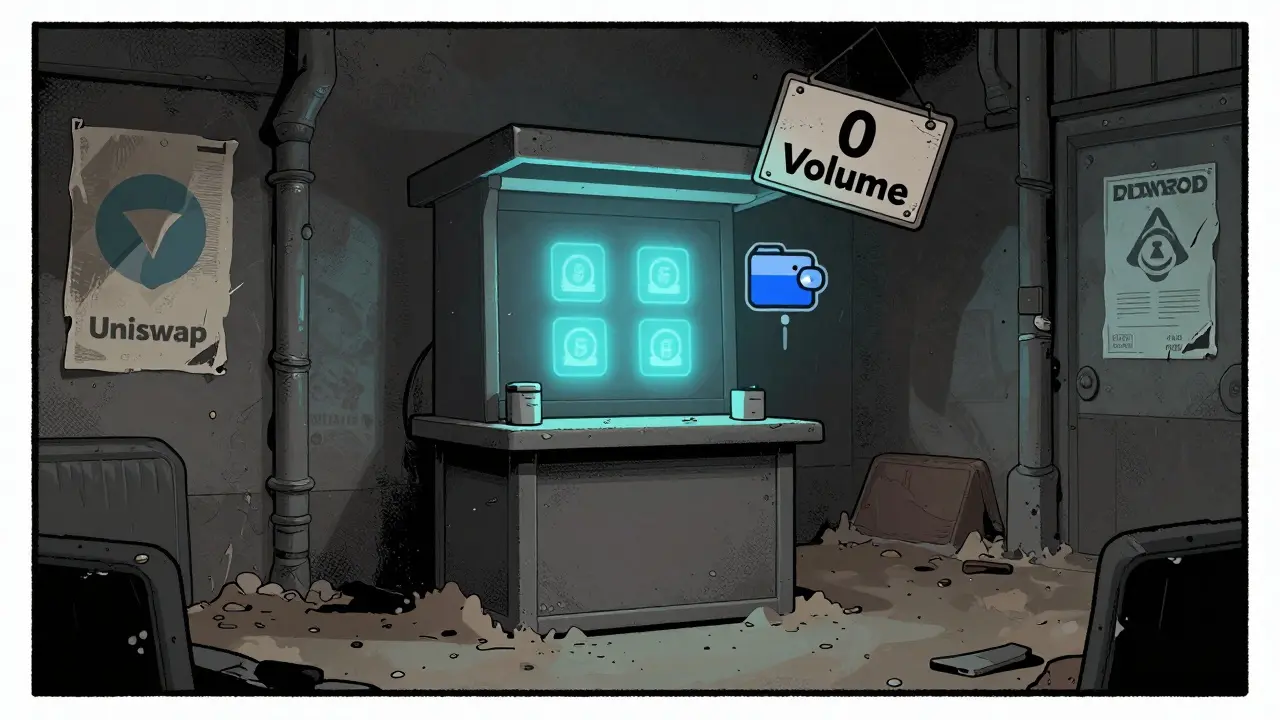

When you hear "decentralized exchange," you probably think of Uniswap, PancakeSwap, or maybe dYdX-platforms where real money moves, thousands of tokens trade daily, and liquidity isn’t an afterthought. Now imagine a DEX with only four coins listed, no measurable trading volume, and a website that hasn’t been updated in over a year. That’s HYDRA Dex.

Launched in 2023 as the flagship DEX of the Hydra Chain blockchain, HYDRA Dex was built with an interesting idea: burn half of every transaction fee and give the other half to developers who build apps on the chain. Sounds fair, right? A sharing economy for DeFi. But ideas don’t pay bills. Liquidity does. And HYDRA Dex has none.

What HYDRA Dex Actually Offers

HYDRA Dex runs on the Hydra Chain, an EVM-compatible blockchain that tries to solve gas fee volatility by pegging transaction costs to a fixed USD value. It’s clever in theory-if gas fees rise in ETH terms, the chain adjusts so you still pay $0.10 in real value. But that only matters if people are using it. And they aren’t.

As of late 2024, HYDRA Dex supports just four tokens: HYDRA (its native token), and three others that barely trade. Compare that to Uniswap, which lists over 1,200 tokens with daily volumes in the billions. HYDRA Dex doesn’t even show up on CoinMarketCap’s main exchange rankings. It’s labeled as "Untracked Listing," meaning no volume data exists because there’s literally nothing to track.

There are no margin trades. No limit orders. No order books. No maker-taker fees. No API for bots. No mobile app worth using. The interface is basic, clunky, and often fails to connect to wallets like MetaMask. Users on GitHub reported transactions failing because there wasn’t enough liquidity to fill even small swaps. One user said the effective spread on HYDRA/ETH was over 10%-meaning you lose 10% of your money just by hitting "swap."

Why No One Uses It

HYDRA Dex doesn’t have a community. It doesn’t have traction. It doesn’t have even the bare minimum of users needed to survive.

Search Reddit for "HYDRA Dex"-you’ll find zero active threads. Check Trustpilot, CryptoSlate, or WalletExplorer-no reviews. Twitter? Less than 100 real posts in the last year. The official Twitter account hasn’t posted since August 2023. The Hydra Chain Discord has under 3,000 members, and the #hydra-dex channel has maybe a dozen active people, mostly asking why their swaps aren’t working.

There are no success stories. No traders bragging about profits. No YouTube tutorials showing how to make money on it. No influencers promoting it. No institutional interest. Nansen and Glassnode show zero meaningful on-chain activity. Even the most obscure DEXes have at least $100,000 in daily volume. HYDRA Dex? Zero.

It’s not just unpopular-it’s practically invisible in the crypto world. And when a project disappears from public view like this, it’s not because it’s ahead of its time. It’s because it failed.

The HYDRA Token: A Dead End Investment

The HYDRA token is the backbone of this ecosystem. It’s used for governance, staking, and paying fees. But here’s the problem: the token has no real demand.

CoinCodex’s October 2024 analysis gave HYDRA a bearish outlook, predicting a price drop to $0.1034 by November 2025. The RSI sits at 32-technically neutral, but in a market where most tokens are either surging or crashing, neutral means sinking. The 200-day moving average is declining. No analyst from Cointelegraph, Decrypt, or The Block has ever covered it. SwapSpace called price predictions for HYDRA "contradictory" and warned investors to do their own research-because no one else is.

And even if you believe in the token’s long-term potential, you can’t use it effectively. There’s nowhere to trade it meaningfully. Exchanges that list HYDRA are either tiny, low-liquidity DEXes like itself-or centralized exchanges that barely support it. You can’t buy it on Coinbase. You can’t find it on Binance. You can’t even get reliable price data from CoinGecko without digging into the blockchain directly.

How It Compares to Real DEXes

Let’s put HYDRA Dex next to the real players:

| Feature | HYDRA Dex | Uniswap | PancakeSwap | Hyper Liquid |

|---|---|---|---|---|

| Trading Pairs | 6 | 1,200+ | 800+ | 50+ |

| Daily Volume | Untracked (Zero) | $1.2B | $780M | $420M (futures) |

| Liquidity Depth | None | High | High | Very High |

| Margin Trading | No | No | No | Yes |

| Mobile App | Buggy, unreliable | Yes | Yes | Yes |

| Developer Incentives | 50% fee share | None | None | None |

| Community Size | <10 active users | 100K+ on Reddit | 50K+ on Twitter | 20K+ on Discord |

HYDRA Dex’s only advantage is its economic model-sharing fees with developers. But without users, that model is meaningless. You can’t build apps on a platform with no traffic. And without apps, you can’t attract users. It’s a dead loop.

Can You Even Use HYDRA Dex Right Now?

Technically, yes. But you shouldn’t.

If you still want to try it, here’s what you’ll face:

- Connect your wallet (MetaMask, Trust Wallet)-expect connection errors.

- Find one of the four tokens listed-HYDRA is the only one with any semblance of activity.

- Try to swap HYDRA for ETH or USDT-your transaction may fail or take 10+ minutes.

- Check the price impact-chances are, you’ll lose 5-15% just from slippage.

- Wait for confirmation-no one else is trading, so your swap might sit unprocessed.

- Realize you can’t withdraw your funds faster than the blockchain allows.

Support? There is none. The official website links to a Discord server with 2,847 members. Ask a question about HYDRA Dex there, and you’ll likely get ignored. No email. No help center. No FAQ. No documentation beyond "connect your wallet and swap."

Is There Any Future for HYDRA Dex?

Right now, the answer is no.

The last code commit to its GitHub repo was in December 2023. The Twitter account has been silent since August 2023. No new features have been announced. No liquidity incentives have been launched. No partnerships. No marketing. No press. No updates.

Even the most optimistic analysts agree: HYDRA Dex’s economic model only works if adoption grows. But adoption hasn’t grown. It hasn’t even started.

Compare that to other projects that launched around the same time-like Arbitrum, Base, or zkSync Era. They had tiny beginnings too. But they had teams that pushed, marketed, partnered, and built. HYDRA Dex has done none of that.

Unless there’s a surprise relaunch with real liquidity mining, a major exchange listing, or a viral marketing push, HYDRA Dex will remain a footnote-a cautionary tale of a good idea that never found its audience.

What Should You Do Instead?

If you’re looking for a decentralized exchange in 2025, here’s what actually works:

- For Ethereum: Use Uniswap or SushiSwap-they have deep liquidity and tons of tokens.

- For BNB Chain: PancakeSwap is still the king.

- For low fees and fast swaps: Try 1inch or ParaSwap-they aggregate liquidity across dozens of DEXes.

- For futures and leverage: Hyper Liquid or dYdX are the only serious options.

None of these have the "developer fee share" gimmick. But they all have something far more valuable: users. And users mean liquidity. And liquidity means you can actually trade without losing half your money to slippage.

HYDRA Dex isn’t the future of DeFi. It’s a ghost town.

Is HYDRA Dex safe to use?

Technically, yes-it’s non-custodial, so you keep control of your keys. But safety isn’t just about code. If there’s no liquidity, your trades won’t go through. If no one’s trading, your tokens are stuck. If the platform is abandoned, you can’t get help. It’s safe in theory, but practically useless.

Can I make money trading on HYDRA Dex?

Almost certainly not. The spreads are too wide, the volume is zero, and the token is in a bearish trend. Even if you buy HYDRA at a low price, you won’t be able to sell it without taking massive losses. There are no success stories, no profitable trades documented, and no market makers supporting it.

Why doesn’t HYDRA Dex show up on CoinMarketCap?

Because CoinMarketCap only lists exchanges with measurable trading volume. HYDRA Dex has none. It’s labeled as "Untracked Listing"-meaning no data exists to track. It’s not hidden; it’s irrelevant to the market.

Is HYDRA Dex a scam?

It’s not a scam in the traditional sense-there’s no evidence of theft or rug pull. But it’s a failed project. The team stopped developing it, stopped communicating, and stopped building. That’s not fraud-it’s abandonment. And in crypto, abandonment is just as dangerous as a scam.

Should I buy the HYDRA token?

No. The token has no utility outside its own failing ecosystem. There’s no demand, no liquidity, no adoption, and no development. Even if you believe in the concept, the execution has collapsed. Investing in HYDRA is betting on a dead project to come back to life-and there’s zero sign that’s happening.

Final Verdict

HYDRA Dex isn’t a crypto exchange you should consider. It’s not a competitor to Uniswap. It’s not a hidden gem. It’s not even a niche player. It’s a project that launched with ambition but failed to deliver anything real.

The idea of sharing transaction fees with developers is smart. But without users, it’s just a whitepaper. Without liquidity, it’s just code. Without community, it’s just a ghost.

If you’re looking to trade crypto on a decentralized exchange, walk away from HYDRA Dex. Save your time, your gas fees, and your money. Go where the traders are. Go where the volume is. Go where the future is already happening.

Durgesh Mehta

December 5, 2025 AT 20:08hydra dex is just another project that looked cool on paper but forgot the most important thing - people need to use it to make it real

Jess Bothun-Berg

December 6, 2025 AT 21:00Zero volume? No updates since 2023? This isn’t a failed project - it’s a corpse with a website. If you’re still holding HYDRA, you’re not investing - you’re donating to a ghost.

Murray Dejarnette

December 8, 2025 AT 05:37Bro this is why crypto is a dumpster fire - some team thinks ‘fee sharing’ is magic sauce and forgets that liquidity = life. You can’t build an economy on wishful thinking and a GitHub repo that hasn’t been touched in 18 months.

Katherine Alva

December 10, 2025 AT 01:41it’s funny how we all chase the next big thing but ignore the quiet graves of projects that never got past the whitepaper phase 🌫️

hydra dex isn’t evil - it’s just… forgotten. like a library with no books and no readers.

Andrew Brady

December 10, 2025 AT 05:34Mark my words - this is a front for a state-sponsored crypto sabotage operation. Why else would a project with a legitimate fee-sharing model be left to rot? The real DEXes are funded by the same entities that want to kill decentralized competition. HYDRA Dex was too dangerous to let live.

Sarah Roberge

December 10, 2025 AT 23:59ok but like… if no one is trading why does the website even exist?? it’s like opening a restaurant with no food and then putting up a sign that says ‘we believe in flavor’ 🤡

also who designed the ui?? did they use microsoft paint in 2012??

Mark Stoehr

December 11, 2025 AT 08:09you think this is bad wait till you see the devs’ LinkedIn profiles - all of them moved to Web2 jobs in 2024. the whole thing was a 6-month sprint to cash out and disappear. they didn’t fail - they planned it.

Sarah Locke

December 13, 2025 AT 04:15to everyone still holding HYDRA - I see you. I’ve been there. But listen - this isn’t about loyalty. This is about self-preservation. Let go. Redirect that energy into something alive. Uniswap, Pancake, even Solana’s DEXes - they’re breathing. HYDRA? It’s in hospice.

you deserve better than a tombstone with a wallet address.

Philip Mirchin

December 13, 2025 AT 16:48as someone who’s lived in 5 countries and traded on 12+ DEXes - this is the saddest case of ‘good idea, no follow-through’ I’ve seen in years.

the fee-sharing model? genius. the execution? zero. no marketing, no community, no updates - just silence.

in crypto, silence = death. don’t romanticize abandonment. walk away. your future self will thank you.