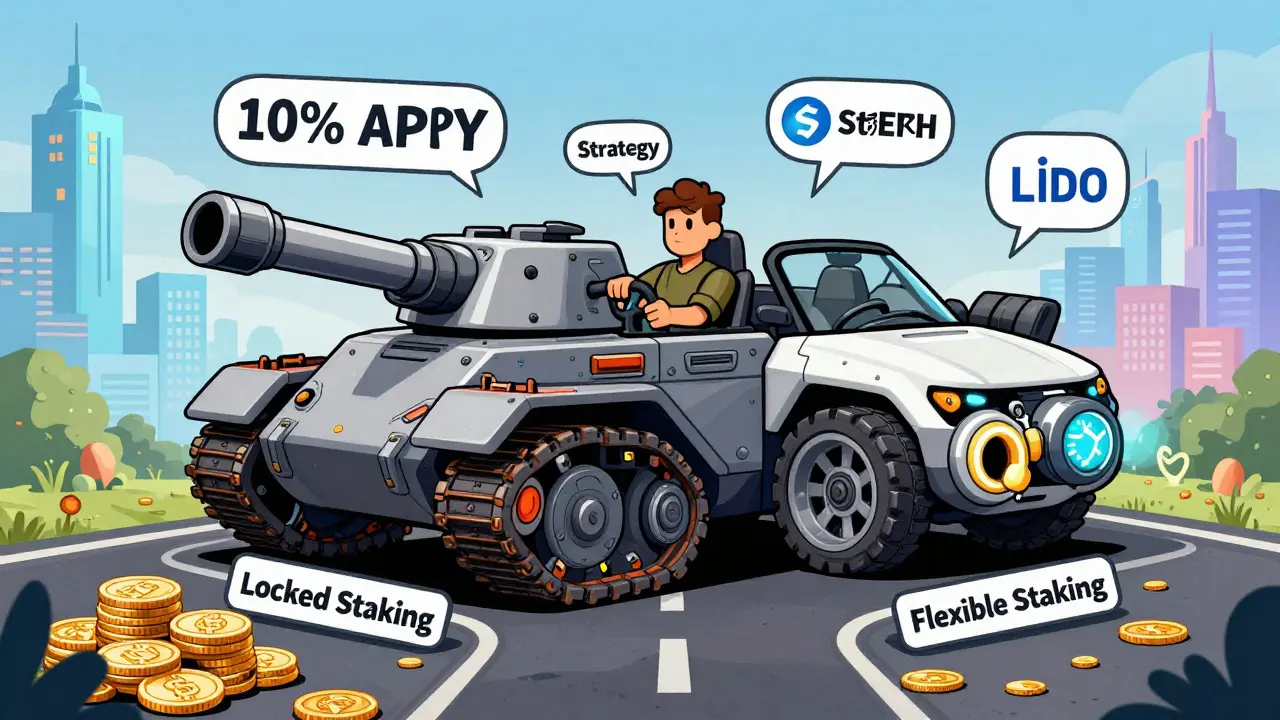

When you stake your cryptocurrency, you're not just sitting on your coins-you're helping keep the blockchain secure. In return, you earn rewards. But here’s the catch: not all staking is the same. Some platforms make you lock your tokens for weeks or months. Others let you pull them out anytime. The difference between locked staking and flexible staking isn’t just about convenience-it’s about your money, your risk, and your goals.

What Is Locked Staking?

Locked staking means you commit your crypto for a set time. You can’t touch it. Not for a week, not for 30 days, not until the lock period ends. In exchange, you get higher rewards. On Binance, for example, locking ETH for 90 days might earn you 4.5% APY, while the same amount in flexible staking might only give you 2.8%. Some coins even offer over 20% APY for longer locks, like 180 or 365 days.This isn’t just a bonus-it’s a trade-off. The network needs predictability. When validators know they can’t pull their stake out suddenly, they’re more likely to act honestly. If they try to cheat or go offline, they risk losing part of their locked coins. That’s why locked staking makes blockchains like Ethereum, Solana, and Polygon more secure.

But here’s the downside: markets don’t wait. What if Bitcoin drops 20% next week and you’ve got 10,000 ADA locked up? You can’t sell. You can’t move. You’re stuck. And if you try to withdraw early? You lose all the rewards you’ve earned so far. Some platforms even charge a penalty on your principal. Binance, for instance, forfeits all interest if you exit before maturity. No exceptions.

What Is Flexible Staking?

Flexible staking is the opposite. You stake your coins, and you can unstake them anytime-within minutes, sometimes seconds. No lock periods. No penalties. No waiting. Kraken, Crypto.com, and Binance’s Flexible Savings all offer this. You get rewards daily, and you can pull your funds out the same day you stake them.This is perfect for traders. Maybe you’re watching Ethereum’s price and think it’s about to spike. You don’t want to miss your window because your coins are locked away. Or maybe you’re using crypto for everyday expenses and need quick access to cash. Flexible staking gives you the best of both worlds: passive income without giving up control.

But there’s a cost. Rewards are lower. Why? Because the network can’t rely on you. If everyone pulls their stake at once during a market crash, validators could vanish overnight. That’s why flexible staking APYs are usually 30-60% lower than locked options. On Binance, you might earn 1.5% on USDT with flexible staking versus 10% on a 30-day locked term. That’s a big gap.

Security Differences: Why Locked Staking Strengthens the Network

It’s not just about your money-it’s about the whole system. Locked staking gives blockchains stability. Validators with locked funds have skin in the game for the long haul. They’re not going to abandon the network just because the price dips. They’re invested in its success.Flexible staking, while user-friendly, creates uncertainty. Validators can leave anytime. That’s fine in normal conditions. But during a panic sell-off, if 30% of stakers pull out at once, the network’s security drops. Fewer validators mean slower transaction times and higher risk of attacks. That’s why Ethereum’s core team designed its staking system around 32 ETH commitments with long lock periods-because security trumps speed.

Platforms like Lido DAO tried to fix this with liquid staking. You stake your ETH, and they give you a token (stETH) that represents your stake. You can trade stETH like regular crypto, use it in DeFi, or even sell it on exchanges-all while still earning staking rewards. It’s locked staking with flexible access. But even Lido’s model has risks: if the underlying network fails, so does stETH. It’s not risk-free, but it’s a smart middle ground.

Real-World Use Cases: Who Should Choose What?

Think about your lifestyle. Are you a long-term holder who bought Bitcoin five years ago and plans to hold for ten more? Locked staking is your friend. You don’t need the cash. You’re not trading. You want maximum returns. Locking your SOL for 180 days at 12% APY? That’s free money you’re not touching anyway.What if you’re an active trader? You use TradingView, set alerts, and jump on every 5% swing? Flexible staking is better. You can earn 2% while you trade. When a good opportunity hits, you unstake, buy in, and restake later. No missed chances. No penalties. Kraken’s flexible staking lets you do this with over 30 coins, including ADA, DOT, and AVAX.

Or maybe you’re somewhere in between. You’ve got $10,000 in crypto. Put $7,000 into a 90-day locked staking deal for higher returns. Keep $3,000 flexible for emergencies or quick trades. That’s a hybrid strategy many experienced users use. You get the best of both worlds: security and flexibility.

Crypto.com does this well. Their locked staking tiers reward loyalty. Stake CRO for 180 days? You get 8% APY. Stake for 30 days? Only 4%. It’s designed to encourage patience. But they still let you unstake anytime-if you’re willing to accept the lower rate.

Platform Comparison: Binance, Kraken, and Others

Not all platforms treat locked and flexible staking the same.

| Platform | Locked Staking APY (Example) | Flexible Staking APY (Example) | Min Lock Period | Early Withdrawal Penalty |

|---|---|---|---|---|

| Binance | 10%-30% (varies by coin) | 1.5%-4.5% | 15-365 days | Full forfeiture of rewards |

| Kraken | 5%-12% | 2%-7% | 7-180 days | Penalty on rewards only |

| Crypto.com | 4%-10% | 1%-4% | 1-180 days | Reduced rewards, no principal loss |

| Lido DAO | 3%-5% (via stETH) | 3%-5% (liquid staking) | None (liquid tokens) | None |

Lido stands out because it doesn’t fit neatly into either category. You’re still locked in-your ETH is staked on Ethereum-but you get a liquid token (stETH) in return. You can use it in DeFi, sell it, or trade it. It’s the closest thing to a win-win.

What’s Next? The Future of Staking

The line between locked and flexible is blurring. Platforms are experimenting with dynamic staking: rewards that adjust based on network demand. If fewer people are staking, the APY goes up. If too many join, it drops. That’s already happening on some smaller chains.Some are adding auto-relock features. You pick a 30-day term. When it ends, your stake auto-renews unless you opt out. It’s locked staking with a safety net.

And then there’s the rise of DeFi integrations. Soon, you might stake your tokens directly in a wallet like Phantom or MetaMask, earn rewards, and use them in lending protocols-all without moving your coins off-chain. The future isn’t locked vs flexible. It’s smart, layered, and automated.

Final Decision: Pick Based on Your Goals, Not Hype

Don’t chase the highest APY. That’s how people get burned. If you need your money accessible, go flexible. If you’re in it for the long haul, lock it up. There’s no right answer-only the right choice for your situation.Ask yourself:

- Do I trade crypto often? → Flexible

- Am I holding for years? → Locked

- Do I want to use my staked coins in DeFi? → Try Lido or similar liquid staking

- Am I worried about market crashes? → Keep some flexible, lock the rest

Staking isn’t a one-size-fits-all. It’s a tool. Use it wisely.

Can I lose my crypto by staking?

You won’t lose your principal just by staking-unless the blockchain itself fails or you use a custodial platform that gets hacked. With non-custodial staking (like Lido or direct Ethereum validator), your coins stay in your wallet. The risk comes from slashing penalties if you run a validator poorly, or if you’re on a platform that locks your coins and you try to withdraw early. Always check the terms.

Is flexible staking safe?

Yes, as long as you use a reputable platform. Flexible staking on Binance, Kraken, or Coinbase is secure. The network still validates transactions-you’re just not locked in. The only downside is lower rewards and slightly less network security, which matters more for large chains than for individual users.

What’s the best locked staking period?

It depends on the coin and the platform. For most users, 30-90 days offers the best balance of reward and flexibility. Longer locks (180+ days) give higher APYs, but if you’re unsure about the project’s future, don’t lock too long. Start with 30 days, see how it goes, then relock if you’re happy.

Can I stake on multiple platforms at once?

Absolutely. Many users split their holdings. Stake 60% on Binance locked for 90 days, 30% on Kraken flexible, and 10% in Lido for DeFi exposure. Diversifying your staking strategy reduces risk and maximizes returns.

Do I need to manage my own validator for locked staking?

No. Most users use exchange-based staking (like Binance or Kraken), which handles everything for you. You just stake and earn. Running your own validator requires 32 ETH, technical knowledge, and constant monitoring. For 99% of users, exchange staking is the way to go.

Are staking rewards taxed?

In the U.S., staking rewards are treated as ordinary income when you receive them. If you later sell them for a profit, you may owe capital gains tax. Keep records of your rewards and their USD value at the time you received them. Tax software like Koinly or TokenTax can help automate this.

Katie Teresi

February 1, 2026 AT 22:56Locked staking is for suckers who think crypto is a savings account. If you’re not ready to move when the market flips, you don’t belong here. APY is just a sugar rush-real traders know liquidity is power.

Moray Wallace

February 2, 2026 AT 23:39I appreciate the breakdown, especially the platform comparisons. I’ve gone with a hybrid approach-most of my portfolio in 90-day locks on Kraken, but kept 20% flexible for volatility plays. It feels balanced. Still, I wish more platforms offered auto-relock without forcing long terms.

Dahlia Nurcahya

February 3, 2026 AT 22:53There’s no one-size-fits-all here, and I love how this post laid it out without pushing a single answer. I’ve got 60% locked for 180 days on Binance for the higher yield, 30% flexible on Crypto.com for breathing room, and 10% in stETH because I’m dipping toes into DeFi. It’s not perfect, but it’s mine. Keep experimenting, folks-crypto rewards adaptability.

William Hanson

February 4, 2026 AT 08:42Flexible staking is a scam disguised as convenience. You think you’re winning by keeping access but you’re just funding the platform’s liquidity crisis. That 1.5% APY? It’s a bribe to keep you complacent while the chain weakens. Locked staking isn’t just better-it’s the only responsible choice. Anyone who disagrees hasn’t seen a real bear market.

Lori Quarles

February 4, 2026 AT 10:30Why are we still arguing about this? Locked staking is the future. The network needs stability, and if you can’t commit, maybe crypto isn’t for you. I locked my SOL for a year and didn’t blink when ETH dropped 30%. That’s discipline. That’s power. Stop chasing pennies and start building wealth.

Jeremy Dayde

February 6, 2026 AT 07:18I’ve been staking since 2021 and I’ve tried everything from Binance locked to solo validator on Ethereum and let me tell you the real issue isn’t locked vs flexible it’s the tax nightmare that follows every reward you get and nobody talks about that the IRS doesn’t care if your coins are locked or not they just want the USD value at the time you got them and if you’re using a platform like Kraken they don’t even send you a 1099 so you’re on your own to track every single reward across dozens of coins and I’ve spent more hours in TokenTax than I have sleeping last year and honestly I wish someone had told me this before I started because now I’m buried in spreadsheets and I’m not even rich just really really tired