PancakeSwap v3 Liquidity Calculator

Concentrated Liquidity Calculator

Most decentralized exchanges still charge $1.50 or more per trade. On PancakeSwap v3 running on Linea, you can swap tokens for under $0.02. That’s not a promotional offer-it’s the new reality for DeFi users who know where to look. If you’ve ever been priced out of trading on Ethereum because of gas fees, or tired of waiting minutes for a simple swap, PancakeSwap v3 on Linea isn’t just an upgrade-it’s a different experience entirely.

Why Linea Makes PancakeSwap v3 Feel Like a New DEX

PancakeSwap didn’t just move to another blockchain. It moved to Linea, a Layer 2 solution built by Consensys that uses zero-knowledge Ethereum Virtual Machine (zkEVM) technology. This means every trade you make on PancakeSwap v3 is processed off-chain, then bundled into a single cryptographic proof verified on Ethereum. The result? Ethereum-level security without Ethereum-level costs. Linea’s architecture cuts transaction fees by up to 99% compared to the mainnet. Before March 2025, gas fees on Ethereum were already high. After EIP-4844 and blob data rollout, Linea dropped average swap costs to under $0.02. That’s 75 times cheaper than Uniswap V3 on Ethereum, which still averages $1.50-$2.00 per trade. For users who trade multiple times a day, that adds up to hundreds of dollars saved annually. And unlike some Layer 2s that require custom wallets or rewrites, Linea is fully EVM-compatible. If you use MetaMask, you don’t need to learn anything new. Just add Linea to your network list, connect your wallet, and start trading.Concentrated Liquidity: How It Actually Works

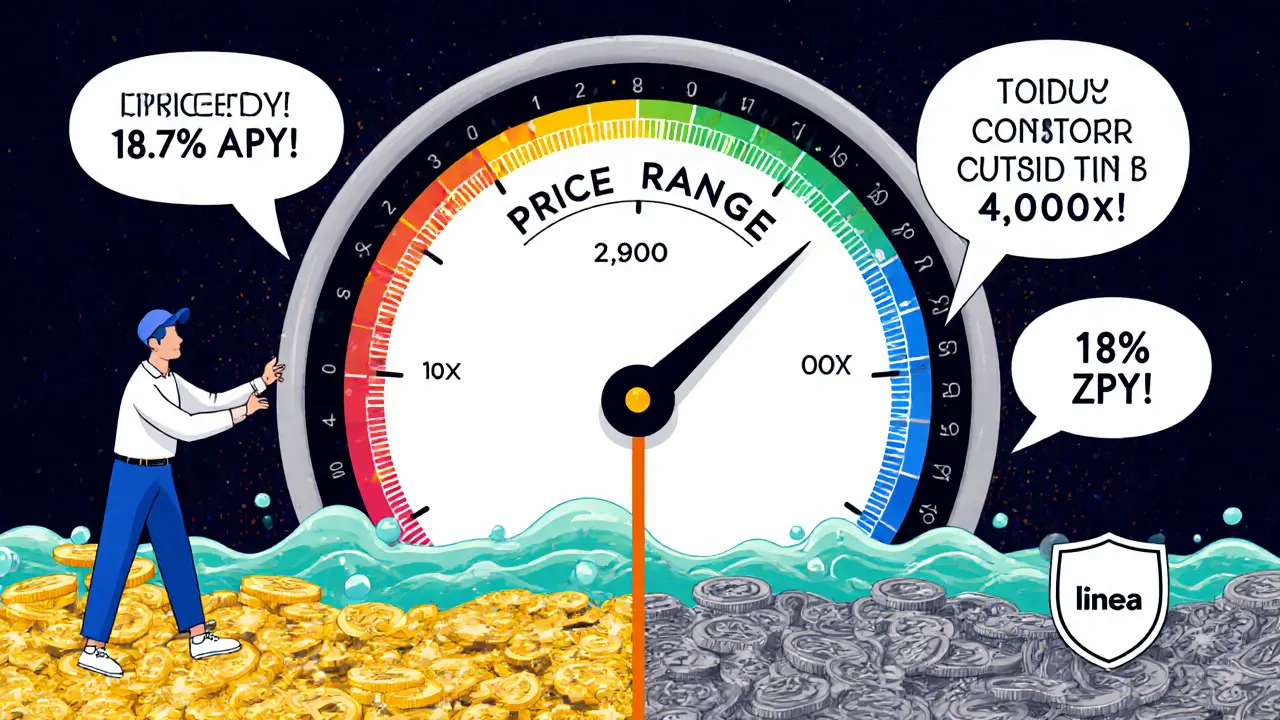

PancakeSwap v3’s biggest innovation isn’t the speed-it’s concentrated liquidity. Traditional DEXs like PancakeSwap v2 spread your tokens across the entire price range. If you deposit ETH and USDC, your capital is evenly distributed from $1,000 to $3,000-even if 90% of trading happens between $1,800 and $2,200. That’s inefficient. v3 lets you choose your own price range. You can put all your capital between $1,900 and $2,100 for ETH/USDC. That means your liquidity is 4,000x more efficient. You earn more fees per dollar invested. Some users on Linea report earning 18.7% APY on stablecoin pairs like USDC/USDT with a 0.01% fee tier. On BSC, the same pair yields around 5.2%. That’s not a typo. But this power comes with complexity. You’re no longer just depositing and earning. You’re managing positions. If the price moves outside your range, your tokens stop earning fees until it returns. This isn’t passive yield. It’s active trading with capital.Fees That Fit Your Trade

PancakeSwap v3 on Linea offers four fee tiers: 0.01%, 0.05%, 0.25%, and 1%. This isn’t just a menu-it’s a strategy tool. - 0.01%: Best for stablecoins (USDC/USDT, DAI/USDC). Low volatility, high volume. Most popular on Linea. - 0.05%: Good for major tokens with low swings (WBTC/ETH, WETH/USDT). - 0.25%: For mid-cap tokens with moderate volatility. - 1%: Reserved for new or highly volatile tokens. Rarely used on Linea due to low volume. Most traders on Linea stick to 0.01% or 0.05%. The 0.25% tier sees little use because there’s not enough liquidity in volatile pairs yet. The 1% tier is practically unused. This tells you something: Linea’s ecosystem is still dominated by stablecoins and blue-chip assets.

How It Compares to Other DEXs on Linea

Linea has other DEXs: Aerodrome, SushiSwap, and a few smaller ones. But PancakeSwap dominates. As of November 2025, PancakeSwap controls 58.7% of all DEX volume on Linea. It processes $665,601 in 24-hour trading volume, with USDC/MUSD as the top pair. That’s impressive for a relatively new chain. But here’s the catch: that’s still less than 0.1% of PancakeSwap’s total volume across all chains. On BSC, it moves over $1 billion daily. Linea is a tiny fraction. That means fewer tokens, less depth, and higher slippage on obscure pairs. If you’re trading ETH, USDC, or WBTC-great. You’ll get tight spreads and fast execution. But if you’re trying to swap a new memecoin with 200k market cap? You might get a 5% slippage. That’s not because the DEX is bad-it’s because there’s not enough liquidity.What Users Are Saying

User feedback is split between those who love the savings and those frustrated by the learning curve. On Reddit, users like ‘CryptoFarmer88’ report earning 18.7% APY on USDC/USDT with concentrated liquidity. Others praise the speed: swaps take 1.2 seconds on average. MetaMask works flawlessly. Gas fees are transparent and predictable. But Trustpilot reviews (average 3.8/5) show a pattern: bridge delays. Transferring assets from Ethereum mainnet to Linea can take 15-22 minutes and cost up to 0.87% in fees. That’s not PancakeSwap’s fault-it’s the bridge. But it’s the first thing new users hit. A PancakeSwap usability study found 63% of first-time Linea users took over 15 minutes to set up their first liquidity position. That’s because concentrated liquidity isn’t intuitive. You have to understand price ranges, fee tiers, and impermanent loss. It’s not like clicking “Add Liquidity” on v2.What’s Missing (and Coming)

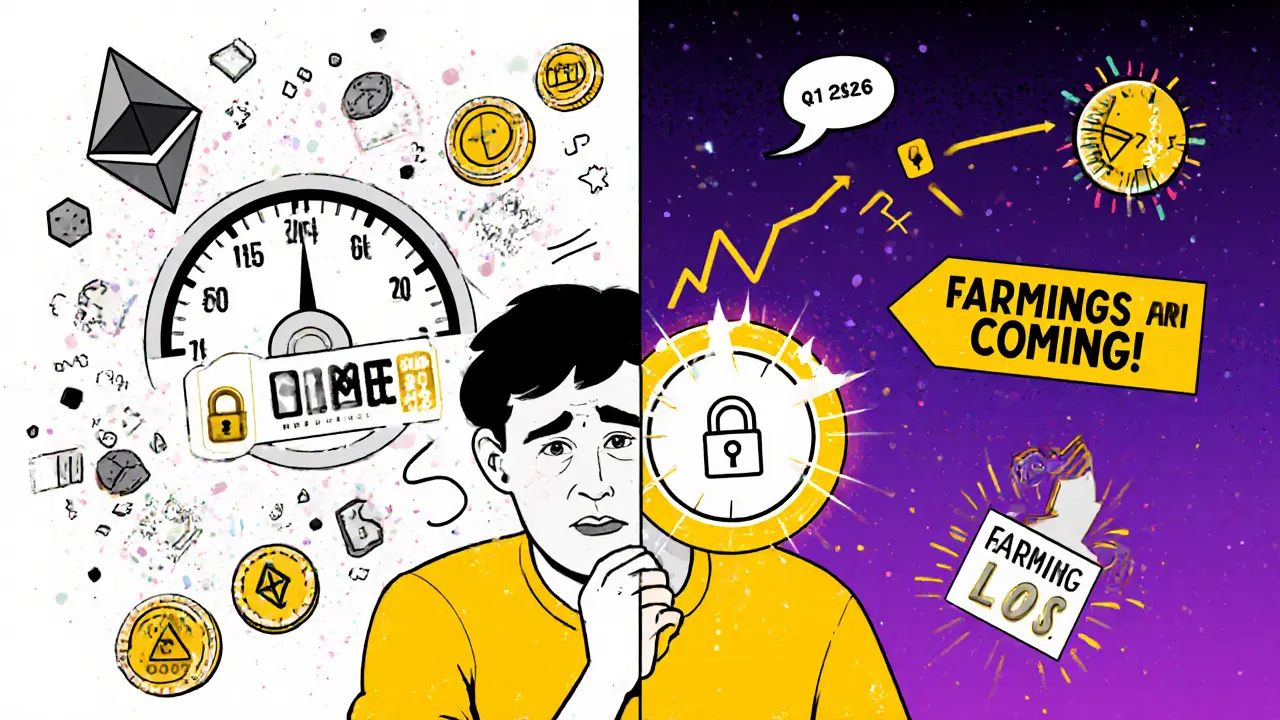

Right now, PancakeSwap v3 on Linea doesn’t have farming. You can trade. You can provide liquidity. But you can’t stake your LP tokens to earn CAKE rewards. That’s a big gap. Farming is what drives most users to PancakeSwap. The roadmap says farming will arrive in Q1 2026. That’s the missing piece. Without it, liquidity providers have less incentive to lock up capital. Right now, they’re earning only trading fees. On BSC, they earn fees + CAKE. That’s why BSC still has 1,000x more liquidity. Linea’s own roadmap is promising: a new burn mechanism for ETH and LINEA tokens, higher gas limits, and a transition to Type 1 zkEVM by 2026. If successful, Linea could hit 5,000 TPS-417x faster than today. That could make PancakeSwap v3 on Linea the fastest, cheapest DEX on Ethereum’s ecosystem.

Who Should Use It? Who Should Avoid It?

Use PancakeSwap v3 on Linea if: - You trade stablecoins or major tokens (ETH, WBTC, USDC, DAI) - You want to minimize gas fees below $0.05 per trade - You’re comfortable managing price ranges and fee tiers - You already use MetaMask and don’t want to learn a new wallet - You’re looking for higher yield than BSC’s standard pools Avoid it if: - You trade obscure tokens with low liquidity - You want passive yield without managing positions - You’re impatient with bridge delays (15+ minutes) - You expect 100+ trading pairs like on BSC or Uniswap - You’re not ready to learn how concentrated liquidity worksThe Bigger Picture

PancakeSwap v3 on Linea isn’t trying to beat BSC. It’s trying to beat Ethereum mainnet. And it’s winning. Ethereum’s high fees and slow speeds have pushed DeFi to Layer 2s. Linea is one of the few that combines security, speed, and compatibility. PancakeSwap is the first major DEX to fully embrace it. JPMorgan’s research gives it a 68% chance of sustained growth through 2027-if Linea’s burn mechanism works as planned. Citibank warns of liquidity fragmentation across PancakeSwap’s nine chains, but that’s a problem for the whole ecosystem, not just Linea. The real question isn’t whether Linea is good. It’s whether you’re ready to trade like a professional.How to Get Started

1. Open MetaMask and click the network dropdown. 2. Select “Add Network” and enter Linea’s details (RPC: https://linea-mainnet.infura.io/v3/YOUR_INFURA_KEY, Chain ID: 59144, Symbol: ETH, Block Explorer: https://lineascan.build). 3. Bridge ETH or USDC from Ethereum mainnet using the official Linea bridge (linea.build/bridge). Wait 15-22 minutes. 4. Go to pancakeswap.finance and select Linea from the network selector. 5. Swap tokens or add liquidity. When adding liquidity, choose your price range carefully. Use the calculator tool to see potential fees. 6. Monitor your position. If the price moves too far, adjust your range or withdraw to avoid impermanent loss. Start with a small amount. Test the bridge. Try a $100 swap. Then try a liquidity position. You’ll learn faster by doing than by reading.Is PancakeSwap v3 on Linea safe?

Yes. Linea uses zkEVM technology to verify every transaction on Ethereum mainnet. This means your funds are protected by Ethereum’s security, not a sidechain. PancakeSwap v3 has been audited by multiple firms, including CertiK and PeckShield. The code is open-source on GitHub. The biggest risk isn’t hacking-it’s user error. Missetting your price range can lead to impermanent loss. Always test with small amounts first.

How do I get CAKE rewards on Linea?

You can’t yet. As of November 2025, PancakeSwap v3 on Linea doesn’t offer farming or staking for CAKE. You only earn trading fees from liquidity provision. The farm feature is scheduled for Q1 2026. Until then, if you want CAKE rewards, use PancakeSwap on BSC or Ethereum. But you’ll pay higher gas fees.

Why are bridge times so slow on Linea?

Linea’s bridge connects Ethereum mainnet to its zkEVM layer. It needs to wait for Ethereum blocks to finalize and generate cryptographic proofs. This process takes 15-25 minutes on average. It’s not a bug-it’s how zk-rollups work. There’s no way to speed it up without compromising security. Some users use third-party bridges like Across or Synapse, but they charge higher fees and aren’t as trusted. Stick with the official Linea bridge.

Can I use PancakeSwap v3 on Linea with a hardware wallet?

Yes. Ledger and Trezor users can connect via MetaMask. Just connect your hardware wallet to MetaMask, then select Linea as the network. All transactions will be signed on your device. The interface works exactly like it does on BSC or Ethereum. No extra steps needed.

Is Linea better than Arbitrum or Base?

It depends. Arbitrum and Base have more users and liquidity. Linea has lower fees and better EVM compatibility. If you care about cost and Ethereum-level security, Linea wins. If you want more tokens and deeper pools, Arbitrum or Base are better. Linea is newer, so it’s catching up. For stablecoin traders, Linea is currently the cheapest option.

What happens if the price moves outside my liquidity range?

Your liquidity stops earning fees. You still own your tokens, but they’re not being used for trades. If the price returns to your range, fees start again. If it doesn’t, you’ll need to adjust your range or withdraw. This is the trade-off for higher efficiency. It’s why experienced users monitor their positions daily. Tools like Zapper or DeBank can alert you when your range is at risk.

Are there any hidden fees on PancakeSwap v3 on Linea?

No. All fees are visible before you confirm a trade. The 0.01%-1% fee is the only trading fee. There’s no platform fee. The only other cost is the gas fee for the transaction-around $0.02. When bridging from Ethereum, you pay a bridge fee (up to 0.87%). That’s not PancakeSwap’s fee-it’s the bridge operator’s. Always check the total cost before confirming.

Savan Prajapati

November 27, 2025 AT 12:32This is insane. Under $0.02 per trade? I’ve been paying $2 on Ethereum for months. Time to move everything.

Janice Jose

November 27, 2025 AT 12:47I tried it last week. Bridge took 20 minutes but after that? Smooth as butter. Made five swaps under $0.10 total. Feels like cheating.

Vijay Kumar

November 28, 2025 AT 19:21You think this is revolutionary? Everyone’s just chasing cheap gas. Real traders are on Arbitrum with real volume. This is a toy chain.

Brian Bernfeld

November 30, 2025 AT 01:20Let me break this down real simple - if you trade stablecoins daily, Linea + PancakeSwap v3 is the only sane choice. $0.02 vs $2? That’s $500+ a month saved. And concentrated liquidity? If you know your range, you’re making 18% APY on USDC/USDT. No farming yet, but the math still crushes BSC. Stop complaining about bridge times - it’s a one-time 20-min wait to unlock endless cheap trades. This isn’t the future. It’s today.

Christina Oneviane

December 1, 2025 AT 21:29Of course it’s cheap… they’re just hiding the real fees in the bridge. And don’t tell me about ‘Ethereum security’ - if your money’s locked in a zkEVM proof for 20 minutes, that’s not security, that’s a hostage situation.

Joel Christian

December 3, 2025 AT 03:53wait so u mean i dont need to pay $1.50 every time i swap?? but i thought eth was the only real blockchain?? this feels like a scam… or a dream??

Kristi Malicsi

December 4, 2025 AT 19:02concentrated liquidity is wild i tried it with 100 usdc between 1850-2150 eth and it worked for 3 days then price dropped and i was just sitting there with idle tokens like a dumbass

Felicia Sue Lynn

December 5, 2025 AT 00:06While the economic efficiency is undeniably compelling, one must consider the psychological burden of active liquidity management. The shift from passive yield to position monitoring introduces a cognitive load that may not be sustainable for the average user. Is financial optimization worth the erosion of peace of mind?

fanny adam

December 6, 2025 AT 23:38Linea is a Fed-controlled surveillance layer disguised as decentralization. zkEVM is just a fancy way to make Ethereum transactions traceable. They’re collecting your trading patterns, your wallet addresses, your price ranges - all under the guise of ‘security.’ Wait until the government mandates KYC on Linea bridges. This isn’t DeFi. It’s DeFi-washing.

Ian Esche

December 7, 2025 AT 20:12USA built the internet, USA built Ethereum, and now USA built Linea. Other countries can keep their slow chains. If you’re not on Linea, you’re not serious about DeFi. Period.