If you’ve ever bought a crypto token hoping it would go up in value, the SEC Howey Test might be deciding whether your investment is legal-or even classified as a security. It’s not a law passed by Congress. It’s not a new rule from the SEC. It’s a 78-year-old court decision that’s now being used to decide if your favorite altcoin is a stock in disguise.

What Is the Howey Test?

The Howey Test comes from a 1946 U.S. Supreme Court case: SEC v. W.J. Howey Co. Back then, a Florida company was selling citrus groves to investors. Buyers didn’t farm the land themselves. They paid for the land, then leased it back to Howey, who handled all the planting, harvesting, and selling. The SEC stepped in and said: this isn’t a real estate deal. It’s an investment contract-and that means it’s a security. The Court agreed. And it laid out four simple questions to figure out if something is a security:- Is money being invested?

- Is there a common enterprise?

- Do investors expect to make a profit?

- Is that profit coming mostly from someone else’s work?

Why Does This Matter for Crypto?

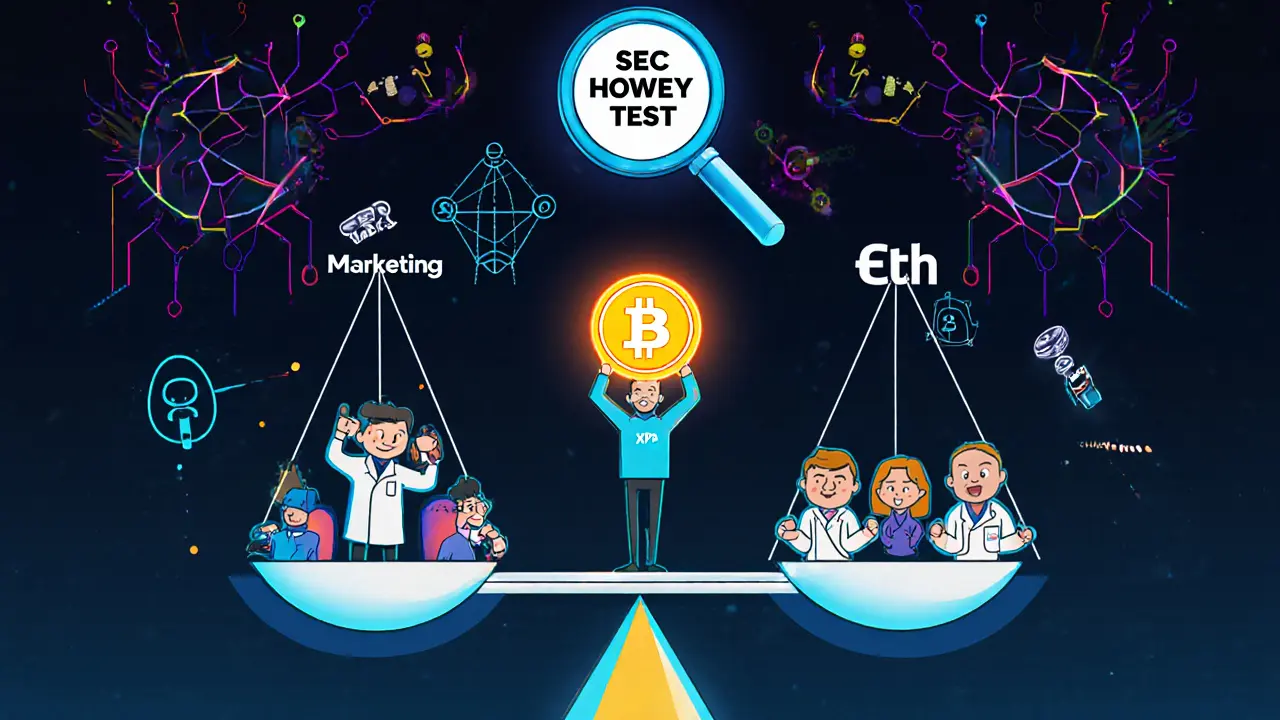

Most cryptocurrencies aren’t like stocks. You don’t get dividends. You don’t own part of a company. You just hold a digital token. So why is the SEC using a 1940s test on them? Because a lot of crypto projects don’t look like tech products-they look like investment schemes. Take an ICO (initial coin offering) from 2017. A team raises $50 million by selling tokens. They promise you’ll earn returns when the network launches. They run marketing campaigns. They control the code. They update the protocol. You’re not using the token to pay for a service-you’re buying it because you think it’ll go up. That’s exactly what the Howey Test was designed to catch. In 2017, the SEC applied the test to the DAO (Decentralized Autonomous Organization) token sale and concluded it was a security. That was the first time the test was used on crypto. Since then, it’s become the SEC’s main tool to police the industry.The Four Prongs of the Howey Test-Applied to Crypto

Let’s break down each part and see how it plays out in real crypto cases.1. Investment of Money

This one’s easy. If you paid for a token-whether with USD, Bitcoin, or Ethereum-you’ve met this criterion. Even if you got the token for free in an airdrop but later sold it for profit, the SEC might still argue you were part of an investment scheme.2. Common Enterprise

This is where things get fuzzy. A common enterprise means your financial success is tied to others’. There are two legal interpretations:- Horizontal commonality: All investors pool their money into one project. If the project fails, everyone loses.

- Vertical commonality: Your profit depends on the promoter’s efforts. If the team behind the token does their job, your token goes up.

3. Reasonable Expectation of Profits

This is the most subjective part. Did you buy the token because you wanted to use it-or because you thought it would make you rich? The SEC looks at marketing materials. If the project’s whitepaper says “potential for 10x returns” or “early investors will benefit from network growth,” that’s a red flag. If the team posts on Twitter about “price targets” or “moon missions,” that’s evidence. But if you bought Bitcoin because you wanted to send money across borders without banks? That’s utility. If you bought Chainlink because you needed it to pay for decentralized oracle services? Also utility. The problem? Most people buy crypto hoping for price gains. Even if they say they’re using it, the SEC often sees the profit motive as dominant.4. Profits Derived Primarily from the Efforts of Others

This is the heart of the test-and the biggest battleground in crypto. The SEC says: if the value of your token depends on a team’s ongoing work-like coding updates, marketing, partnerships, or protocol upgrades-then it’s a security. That’s why Bitcoin doesn’t qualify. No company runs Bitcoin. No team controls it. Miners and developers contribute, but no single group drives its value. That’s decentralization. Ethereum is trickier. In 2018, former SEC official William Hinman said Ethereum wasn’t a security because it was “sufficiently decentralized.” But the SEC never officially changed its stance. Now, with staking pools, validator operators, and core developers still shaping the network, the line is blurry. Ripple’s XRP is the most famous case. The SEC sued Ripple in 2020, claiming XRP was a security. In 2023, a judge ruled that public exchange sales of XRP weren’t securities-because buyers didn’t know they were investing in Ripple’s efforts. But institutional sales to hedge funds? Those were securities. Why? Because Ripple directly marketed to those buyers, promising network growth and value appreciation. The lesson? Context matters. Who you sold to, how you marketed it, and whether you still control the network-all affect the outcome.

What About Bitcoin and Ethereum?

Bitcoin is the exception. The SEC has publicly said Bitcoin is not a security. Why? Because:- No central team controls it.

- No one promises returns.

- Its value comes from network adoption, not a company’s efforts.

What Happens If the SEC Says Your Token Is a Security?

If the SEC decides your token is a security, you have two choices:- Register it. That means filing detailed disclosures, audited financials, and ongoing reporting. For a startup? Impossible. The cost can be $200,000 or more.

- Stop selling it. Shut down the token sale. Refund investors. Face potential fines.

Who’s Winning? Who’s Losing?

The SEC under Gary Gensler has been aggressive. In 2023 alone, they filed 78 crypto enforcement actions-up from 46 in 2022. They’ve targeted Coinbase, Binance, Kraken, Ripple, and even Uniswap Labs, a decentralized exchange. The industry is fighting back. Ripple’s partial win in 2023 showed courts might not always side with the SEC. Judge Analisa Torres ruled that XRP sales on public exchanges weren’t securities because buyers didn’t know they were investing in Ripple. But here’s the reality: most crypto startups don’t have $10 million to spend on lawyers. Small teams get scared off. Venture funding in U.S. crypto dropped 37% in 2023, according to PitchBook. Many projects are moving to Europe, Singapore, or Switzerland-places with clearer rules. Retail investors are caught in the middle. Some say the Howey Test protects them from scams like the $2.4 billion Terra/Luna collapse. Others say it’s crushing innovation. A July 2023 Grayscale survey found 58% of U.S. crypto investors support regulation-but only if it’s clear and fair.What Can You Do?

If you’re a developer or founder:- Design for decentralization from day one. Don’t centralize control in your team.

- Avoid promising returns in marketing. Use words like “utility,” “access,” or “functionality,” not “returns,” “profits,” or “moon.”

- Document your path to decentralization. Show how control will shift to users over time.

- Don’t sell tokens to investors before the network is live. The SEC sees presales as investment contracts.

- Ask: “Am I buying this because I want to use it-or because I think it’ll go up?”

- Check if the project has a clear, public roadmap to decentralization.

- Look at whether the team still controls the protocol. If they’re pushing updates, managing wallets, or marketing the token, it’s a red flag.

Felicia Sue Lynn

November 26, 2025 AT 01:39The Howey Test, though born in the era of citrus groves, reveals something timeless about human nature: we are drawn to promises of effortless gain, regardless of the medium. Whether it’s land in Florida or tokens on a blockchain, the psychological architecture of investment remains unchanged. What’s fascinating is how we’ve built entire civilizations around digital abstractions while clinging to 1940s legal frameworks to make sense of them. Perhaps the real question isn’t whether crypto is a security-but whether our institutions are equipped to understand anything that doesn’t fit neatly into the boxes they built a century ago.

There’s beauty in decentralization, yes-but also a profound loneliness. When no one is in charge, who do we blame when things go wrong? Who do we thank when they go right? The Howey Test, for all its flaws, at least gives us someone to hold accountable. Maybe that’s the real comfort it offers-not legal clarity, but emotional closure.

Christina Oneviane

November 26, 2025 AT 22:33Oh wow, the SEC is using a 78-year-old court case to ruin my weekend moonboarding plans? 🤡

Next they’ll cite the Magna Carta to regulate NFTs of cats wearing top hats. At this rate, I’ll need a lawyer just to buy a meme coin.

Also, who wrote this article? A law professor who’s never touched crypto? 😴

fanny adam

November 27, 2025 AT 23:14Let us be precise: the SEC’s reliance on the Howey Test constitutes a gross constitutional overreach, predicated upon an archaic common-law doctrine that was never intended to govern digital assets. The Fourth Prong-'profits derived primarily from the efforts of others'-is particularly pernicious, as it conflates technical development with centralized control. This is a logical fallacy of the highest order. Decentralized protocols, by definition, distribute effort across thousands of nodes; to attribute profit-generation to a single entity is to ignore the fundamental architecture of blockchain.

Furthermore, the SEC’s selective enforcement-exempting Bitcoin while targeting Ethereum and XRP-demonstrates arbitrary application, violating the Equal Protection Clause. The DAO ruling was a precedent, yes, but it was based on incomplete evidence. The Ripple judgment, though partial, exposed the agency’s inconsistency: if public exchange sales are not securities, then why are all others? The answer lies not in law, but in political pressure from Wall Street.

This is not regulation. It is rent-seeking disguised as investor protection. The true victims are not the fraudsters-they are the innovators, the developers, the ordinary citizens who seek financial sovereignty. The Howey Test, in its current form, is a legal weapon, not a legal standard. And it is being wielded with terrifying precision against those who dare to build outside the system.

Eddy Lust

November 28, 2025 AT 01:53man i just bought some solana because i liked the logo and now i’m scared i’m gonna get sued or something 😅

like… i didn’t even know what the howey test was until like 3 days ago. i thought crypto was just… digital money? like paypal but cooler?

now i’m sitting here reading about vertical commonality like it’s a breakup conversation. ‘it’s not you, it’s me… but also the SEC says you’re a security’

the whole thing feels like trying to fit a square peg into a round hole that was made in 1946 and hasn’t been dusted since.

also… who’s gonna tell my grandma she can’t buy dogecoin anymore? she thinks it’s a new kind of dog treat.

Casey Meehan

November 28, 2025 AT 02:02Bro the SEC is just trying to keep the game fair 🤓

Bitcoin = not a security ✅

Ethereum = borderline 😅

XRP = SEC gotcha 🚨

Every new coin = ‘is this a stock or a meme?’ 🤔

Here’s the truth: if your token’s price goes up because your team does work? That’s a security. If it’s just because 10k people on Twitter think it’s cute? That’s a meme.

Stop crying. Go build something decentralized or get a real job 💪

Also, if you’re reading this and still holding XRP… you’re either brave or dumb. Either way, respect. 🙌