When you trade Bitcoin or swap Ethereum on an exchange, you probably don’t think about who’s watching the rules. But behind the scenes, a quiet but powerful shift is happening: self-regulatory organizations (SROs) are stepping in to fill the gap left by slow-moving governments. These aren’t government agencies. They’re industry-built groups, made up of exchanges, wallet providers, and compliance firms, working together to set rules for how crypto should operate. And they’re becoming the real enforcers of fairness in a market that’s too fast for traditional regulators to keep up with.

Why Crypto Needs Its Own Rulebook

Traditional financial markets have regulators like the SEC and FINRA. They’ve been around for decades. Crypto? It’s still wild west territory. In 2022, over $15.8 trillion in crypto transactions happened globally. But there were no unified rules for how exchanges should handle customer funds, report suspicious activity, or prevent money laundering. That’s where SROs come in. The idea started gaining traction in 2018 when Brian Quintenz, a commissioner at the U.S. Commodity Futures Trading Commission (CFTC), pointed out a clear problem: regulators were playing catch-up while crypto innovation raced ahead. He suggested a Cryptocurrency Self-Regulatory Organization-a group made by the industry, for the industry-to set standards. The goal? Faster rules, clearer expectations, and less chaos. Unlike government bodies that need years to draft laws, an SRO can move in months. For example, the Travel Rule-a FATF requirement that exchanges share sender and receiver info on transactions over $3,000-took governments over four years to implement in the U.S. But the Travel Rule Information Sharing Alliance (TRISA), an industry group, built a working system in just 18 months. That’s the power of SROs: speed without sacrificing compliance.How Crypto SROs Actually Work

A crypto SRO isn’t just a club. It’s a functional regulator with teeth. Think of it like FINRA, but for digital assets. It sets rules, checks if members follow them, and punishes those who don’t. The proposed Virtual Commodity Association (VCA), for instance, planned to:- Require all members to follow AML and KYC rules

- Conduct regular audits of exchange systems

- Impose fines or suspend members who break rules

- Create a dispute resolution process for users

The Big Players and Their SROs

There’s no single global SRO. Instead, there are several competing efforts:- TRISA: A technical alliance focused on making the Travel Rule work. By December 2023, it connected 87 exchanges and processed over 1.2 million compliant transactions.

- Blockchain Association: A U.S.-based group pushing for a national CSRO. They’ve drafted a model that mirrors FINRA’s structure but is tailored for crypto.

- Swiss SROs: Six recognized bodies overseeing all regulated crypto firms in Switzerland. They’re small-fewer than 150 staff total-but highly effective.

- Global Digital Finance (GDF): A new initiative launching in Q1 2025 aiming to create cross-border standards for crypto SROs.

What They’re Doing Right

Crypto SROs aren’t perfect, but they’ve already solved problems governments couldn’t touch:- Travel Rule Implementation: Before TRISA, most exchanges had no way to securely share customer data. Now, 87 of them do. That’s a massive step toward global AML compliance.

- Standardized Compliance: Instead of each exchange building its own rules, SROs offer a playbook. Exchanges save time and money. A 2022 survey found it takes 120-150 hours to train staff under an SRO framework-compared to 500+ hours under traditional finance rules.

- Industry Buy-In: Reddit users in March 2023 overwhelmingly favored SROs over direct government control. Why? Because they trust the people who built the tech to understand it best.

The Real Problems

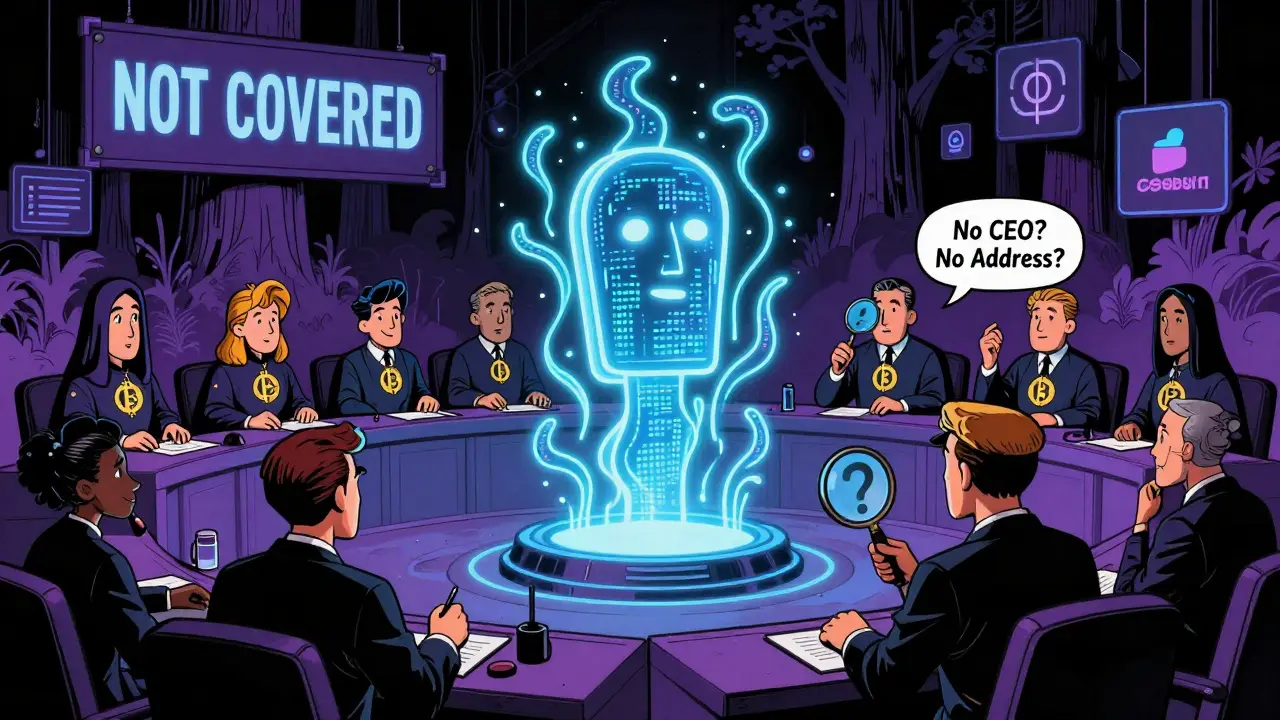

But here’s the catch: SROs can’t fix everything. First, they’re voluntary. If a crypto exchange doesn’t want to join, there’s no legal way to force them. That means a huge chunk of the market-maybe 60% or more-stays outside the system. That’s dangerous. One rogue platform can ruin trust for everyone. Second, they don’t cover DeFi. Over half of the $50 billion locked in decentralized finance (DeFi) protocols operates without any legal entity behind it. No company. No CEO. No address. How do you audit that? SROs can’t. That’s a blind spot. Third, there’s the conflict of interest problem. Critics worry SROs will be controlled by big exchanges-Coinbase, Binance, Kraken-and used to crush smaller competitors. A July 2022 poll showed 57% of respondents believed SROs would serve large players, not the market as a whole. And then there’s cost. Small exchanges told 21 Analytics in 2019 that membership fees could hit $50,000 a year. For a startup with a $187,000 annual compliance budget, that’s more than a quarter of their entire spending. That’s not regulation-it’s exclusion.

What’s Next for Crypto SROs

The tide is turning. In May 2024, the U.S. House passed the FIT21 Act, which explicitly encourages crypto SROs. The Senate hasn’t followed yet, but the writing is on the wall. The European Union’s MiCA regulation, effective June 30, 2024, requires all crypto firms to be under “adequate regulatory oversight.” That’s a green light for SROs across 27 countries. Fidelity International predicts this will trigger a wave of new SRO formations in Europe. The SEC is also watching. In April 2024, they asked the public for feedback on how to structure a crypto SRO. Responses closed in September 2024. If they endorse the model, it could become official. Long-term, experts are split. Guidehouse predicts a 75% chance that at least one major U.S. SRO will reach FINRA-level status by 2030. Duke University’s researchers warn: without strong government backing, fragmentation could kill the idea. They point to Japan’s failed Virtual Currency Exchange Association after the $630 million Ronin hack-when regulators lost trust in industry-led oversight.What This Means for You

If you’re a trader: SROs mean safer exchanges. Fewer scams. More transparency. You’ll know which platforms are audited and which aren’t. If you’re a developer: SRO standards will shape the tools you build. Compliance features like Travel Rule integration will become mandatory in new wallets and dApps. If you’re a small exchange owner: The cost is high, but the alternative is worse. Operating outside an SRO means you’re seen as risky. Banks may cut you off. Users will avoid you. Joining might be expensive-but not joining could kill your business. The future of crypto regulation isn’t just about laws. It’s about who gets to write them. Right now, it’s the industry. Whether that’s a good thing depends on whether they choose to build a fair system-or just protect their own.What is a crypto SRO?

A crypto SRO, or Self-Regulatory Organization, is a non-governmental group created by crypto companies to set and enforce rules for the industry. Examples include TRISA and the proposed Virtual Commodity Association. They handle compliance, audits, and dispute resolution-acting like FINRA but for digital assets.

Are crypto SROs mandatory?

No, not everywhere. In Switzerland, all regulated crypto firms must join an approved SRO. In the U.S., membership is voluntary. Only about 22 of the top 100 U.S. exchanges have joined any SRO so far, leaving a large portion of the market unregulated.

How do SROs enforce rules?

SROs enforce rules through contracts, audits, and sanctions. Members agree to follow standards as part of their membership. If they break the rules, the SRO can fine them, suspend their access to trading systems, or expel them. Unlike government agencies, they can’t arrest people-but they can cut off access to the financial system.

Do crypto SROs cover DeFi?

Not yet. Most SROs focus on centralized exchanges and wallet providers. DeFi protocols-like Uniswap or Aave-operate without legal entities, making them impossible to regulate the same way. This is one of the biggest gaps in current SRO models.

Why do some people oppose crypto SROs?

Critics worry SROs will be dominated by big exchanges and used to stifle competition. There’s also concern that voluntary membership creates loopholes-bad actors stay outside the system. Plus, high membership fees could push small players out. Without strong governance, SROs risk becoming cartels, not regulators.

Will the U.S. government recognize a crypto SRO?

It’s likely. The U.S. House passed the FIT21 Act in 2024, which supports industry-led SROs. The SEC has also requested public input on how to structure one. While no official SRO exists yet, government backing is growing. The next few years will determine if a U.S. SRO becomes a formal part of crypto regulation.

nayan keshari

December 31, 2025 AT 14:51Crypto SROs are just big exchanges buying legitimacy so they can keep their monopoly while pretending to be the good guys. If you think this is about fairness, you haven’t been paying attention. The same players who got rich off unregulated chaos now want to write the rules to keep everyone else out. Call it what it is: regulatory capture dressed up as progress.

Alexandra Wright

January 2, 2026 AT 02:26Oh sweet mercy, we’re giving the same people who ran FTX into the ground a badge and a microphone to ‘self-regulate’? 🤦♀️ Let me guess - the next SRO standard will be ‘Don’t steal user funds unless you’re registered.’ At this point, I’d trust a toddler with a ledger over these ‘industry leaders.’

Michelle Slayden

January 2, 2026 AT 15:05It is imperative to acknowledge that the emergence of self-regulatory organizations within the cryptocurrency ecosystem represents a paradigmatic shift in governance architecture - one that prioritizes operational agility over procedural rigidity. Nevertheless, the absence of statutory authority, coupled with the inherent conflict of interest arising from industry-dominated oversight, introduces epistemic and ethical vulnerabilities that cannot be mitigated through mere technical compliance frameworks. The legitimacy of such entities hinges not upon their efficiency, but upon their accountability - a criterion currently unmet.

christopher charles

January 4, 2026 AT 14:17Look, I get the frustration - but honestly? SROs are the only thing keeping half of us from getting shut down by the feds tomorrow. Yeah, they’re not perfect. Yeah, the fees are insane for small guys. But if you want to keep your exchange alive and your users safe, you join. No SRO? Good luck getting a bank account. Good luck getting users to trust you. It’s not ideal - but it’s better than waiting for Congress to do something.

Vernon Hughes

January 6, 2026 AT 00:39Switzerland got it right. Mandatory SROs. No loopholes. No drama. If you operate here you follow the rules. Simple. The US is still stuck in debate mode while the world moves on. We’re not innovating. We’re just arguing.

Amy Garrett

January 7, 2026 AT 00:37im so tired of hearing about how ‘industry knows best’ when the same people who made all the mistakes are the ones writing the rulebook. like bro… if you were the ones who caused the fire, why are you in charge of the fire department??

Haritha Kusal

January 7, 2026 AT 12:38i think this could actually work if we make it fair for small players too. maybe if fees were based on revenue instead of flat rates? or if there was a gov subsidy for indie devs? i believe in this idea - just not the way its being done now.

Brooklyn Servin

January 8, 2026 AT 18:22Let’s be real - SROs are the only thing keeping crypto from collapsing into a 2022-style dumpster fire. TRISA? Brilliant. The Travel Rule? Long overdue. Yeah, big players dominate - but that’s because they have the resources to comply. The solution isn’t to scrap SROs, it’s to subsidize small exchanges, create tiered compliance tiers, and force DeFi protocols to adopt on-chain KYC. This isn’t about control - it’s about survival. And if you’re still saying ‘decentralization means no rules,’ you’re not helping. You’re just being a liability.