Crypto Exchanges in Russia: What’s Allowed, What’s Risky, and Where to Trade

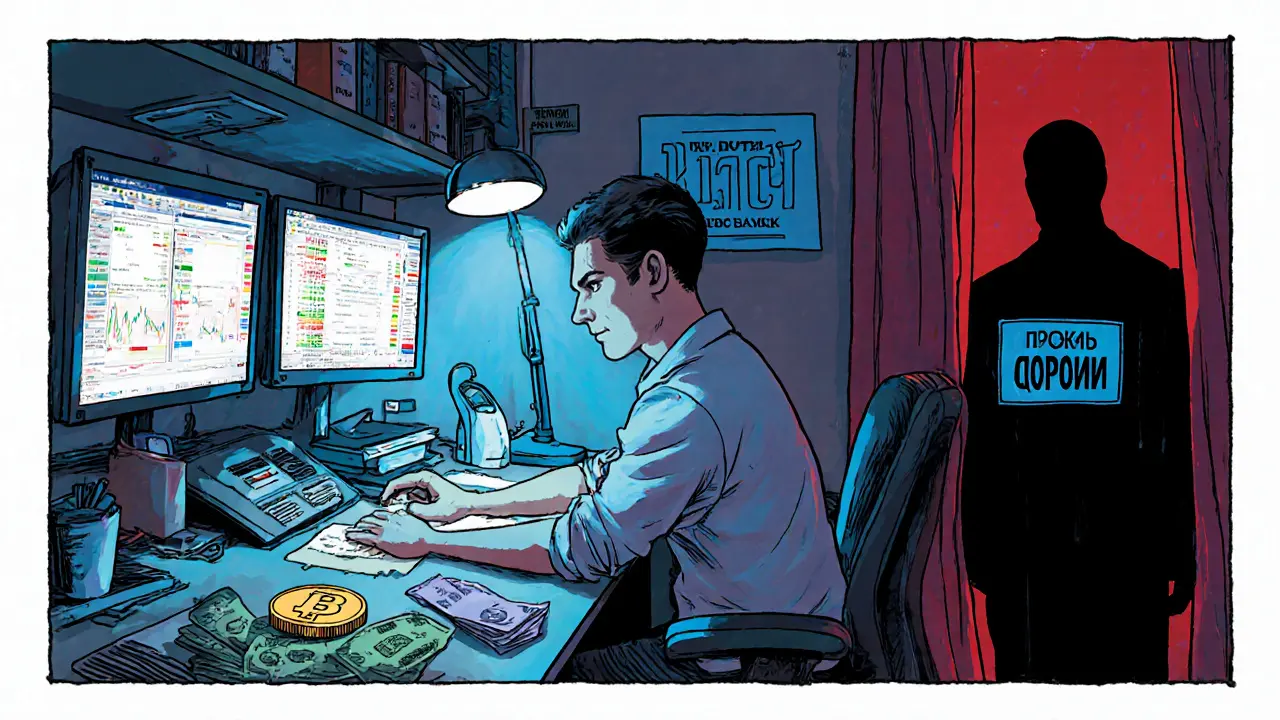

When it comes to crypto exchanges in Russia, platforms where users buy, sell, and trade digital assets under Russia’s legal and financial restrictions. Also known as Russian crypto trading platforms, these services operate in a gray zone—officially restricted, but still used by millions to protect savings from inflation and bypass Western sanctions. The Russian government doesn’t ban crypto outright, but it makes trading through local exchanges nearly impossible. Banks are forbidden from handling crypto transactions, and exchanges must register with Rosfinmonitoring. Only a handful of platforms even try to comply—and most of them don’t accept Russian rubles anymore.

That’s why Russians turned to foreign crypto exchanges, overseas platforms like Binance, Bybit, and KuCoin that allow Russian users to trade without local banking ties. Also known as offshore crypto platforms, they became lifelines after 2022, letting people convert rubles into Bitcoin or stablecoins via peer-to-peer (P2P) deals. But even these aren’t safe. The government can block websites, freeze accounts linked to foreign services, and pressure payment processors to cut off Russian users. Some traders use VPNs, but that adds risk—especially if you’re storing large amounts on an exchange without full control of your keys.

Then there’s the crypto wallet Russia, non-custodial tools like Trust Wallet, MetaMask, or Ledger that let Russians hold assets outside exchange control. Also known as self-custody wallets, these are the only truly secure option if you’re serious about keeping your crypto. Exchanges can disappear overnight, get hacked, or be forced to freeze funds. But if you hold your own seed phrase, no government or platform can take it away. That’s why more Russians are moving from exchange balances to cold storage, even if it means learning how to send Bitcoin manually or using P2P apps like LocalBitcoins or Paxful.

What you won’t find are Russian-based exchanges with full licenses and transparent operations. The few that tried—like CEX.IO’s Russian branch or local startups—either shut down or moved overseas. The state prefers the digital ruble, a central bank-controlled token with no anonymity and full tracking. It’s not crypto as most people understand it—it’s a surveillance tool dressed up as innovation. Meanwhile, Bitcoin and USDT keep flowing through P2P networks, often traded in cash or via mobile payment apps like Sberbank Online or Tinkoff, with buyers and sellers meeting in person or using escrow services.

So if you’re in Russia and want to trade crypto, you’re not choosing between platforms—you’re choosing between risk levels. Do you trust a foreign exchange with no legal protection? Do you rely on P2P deals with strangers? Or do you hold your own keys and wait for better days? There’s no perfect answer, but the safest path is clear: use non-custodial wallets, avoid exchanges that ask for your ID, and never store more than you can afford to lose. The posts below cover real cases: exchanges that vanished, wallets that saved people’s savings, and the quiet underground network keeping crypto alive in Russia despite everything.

Crypto Exchanges That Accept Russian Citizens in 2025

- 9 Comments

- Oct, 14 2025

In 2025, Russian citizens use offshore exchanges like Bybit, Gate.io, and KuCoin to trade crypto, while avoiding government restrictions. A7A5 stablecoin and peer-to-peer platforms have become essential tools for bypassing sanctions and banking limits.