Crypto Metrics: Understand What Really Matters in Blockchain and Crypto

When you hear crypto metrics, quantifiable data points used to evaluate the health, usage, and value of blockchain networks and digital assets. Also known as on-chain metrics, they’re the real pulse of crypto—not the noise from Twitter or TikTok. Most people chase price charts, but smart users look at what’s happening under the hood: who’s sending coins, how much is locked up, how many wallets are active, and whether the network is actually growing or just spinning its wheels.

These metrics aren’t just for analysts. If you’re holding Bitcoin, staking Ethereum, or trying to pick the next real project, you need to know what on-chain data, raw transaction records stored publicly on a blockchain that reveal user behavior and network activity is telling you. A coin with high trading volume but zero new wallet addresses? That’s not growth—it’s recycling. A token with low volume but steady daily active addresses? That’s real adoption. crypto valuation, the process of estimating the true worth of a cryptocurrency based on usage, supply, and network strength, not just market hype starts with these numbers. You don’t need a finance degree. You just need to know what to look for: transaction count, holder distribution, network hash rate, staking ratios, and burn rates. These are the signals that separate projects with real tech from those built on promises and memes.

Look at the posts below. You’ll see how crypto metrics expose scams like TRO and PKG—tokens with zero activity, no wallets, and no future. You’ll see how metrics prove Nigeria’s crypto boom isn’t just speculation—it’s survival, with $59B in on-chain volume. You’ll learn why Bitfinex stays relevant not because of ads, but because of deep liquidity and high trade volume. And you’ll spot the red flags in exchanges like BitxEX and DubiEx—no audits, no user data, no transparency. These aren’t guesses. They’re facts pulled from the blockchain itself. Whether you’re new or experienced, the right metrics turn confusion into clarity. Below, you’ll find real breakdowns of what works, what doesn’t, and why.

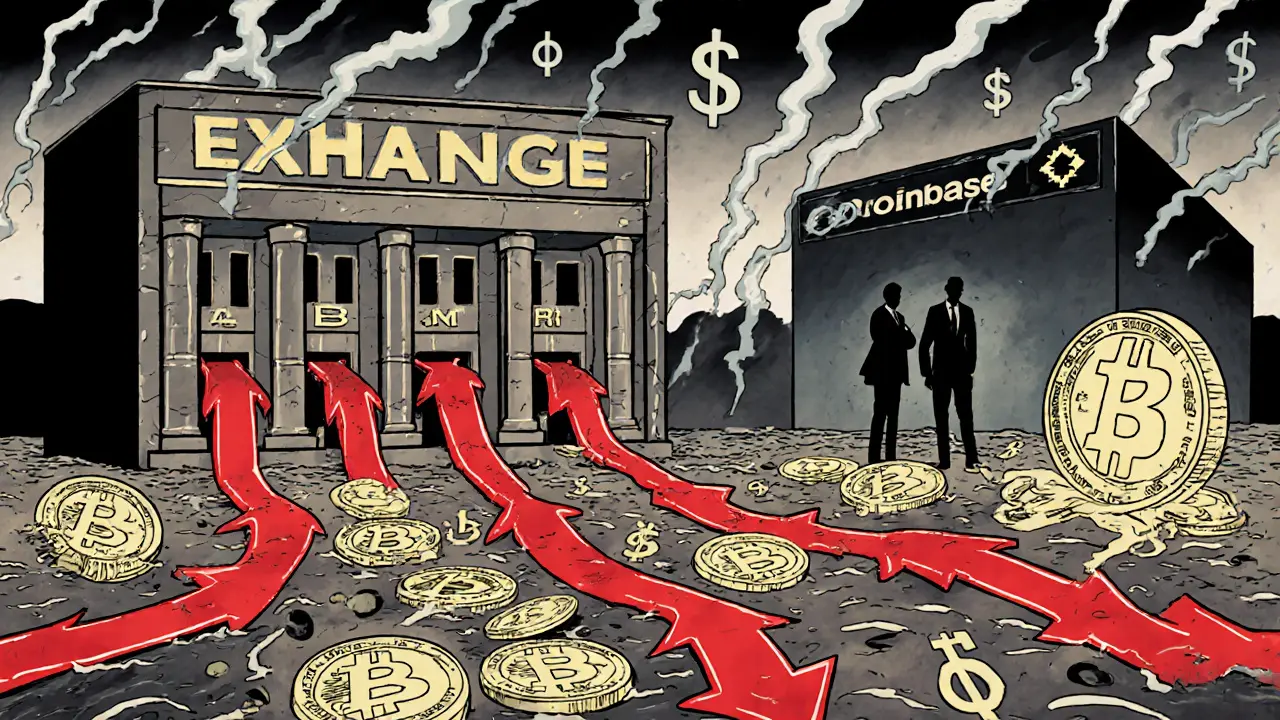

Exchange Inflow and Outflow Metrics: What They Really Tell You About Crypto Markets

- 10 Comments

- Oct, 16 2025

Exchange inflow and outflow metrics reveal whether crypto holders are preparing to sell or hold long-term. Learn how these on-chain signals predict market moves and what institutions are watching.