Exchange Inflow: What It Means and Why It Matters in Crypto

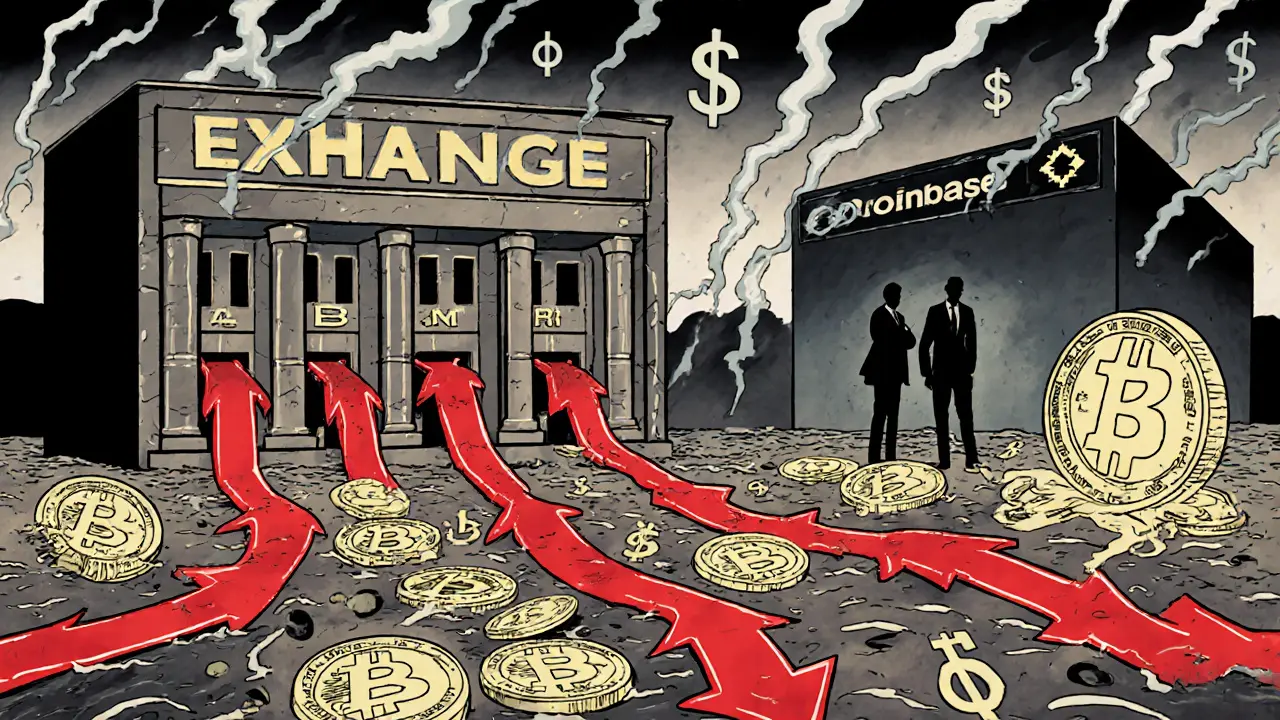

When you hear exchange inflow, the movement of cryptocurrency from personal wallets into trading platforms like Bitfinex, Binance, or KuCoin, don’t just think of trading. This isn’t just activity—it’s a hidden signal. Every time someone sends Bitcoin, Ethereum, or even a niche altcoin to an exchange, they’re making a choice: they’re either ready to sell, or they’re preparing to trade. And that choice shows up in the data, loud and clear. crypto exchange, a platform where users buy, sell, or trade digital assets is the gatekeeper. When inflow spikes, it often means more sellers are lining up. When it drops, holders might be holding tight—maybe because they believe the price will rise, or because they’re storing coins long-term.

Think of blockchain, a public, decentralized ledger that records every crypto transaction as a giant public logbook. Every coin that moves from a personal wallet to an exchange leaves a trace. Analysts watch these trails like weather patterns. A sudden flood of Dogecoin into Bitfinex? That could mean holders are cashing out after a hype spike. A steady trickle of CAD Coin into PayTrie’s platform? That’s real adoption—Canadians using a regulated stablecoin for daily transactions. token movement, the flow of digital assets between wallets and exchanges isn’t random. It’s driven by fear, opportunity, or regulation. In Nigeria, where people use crypto to survive inflation, exchange inflow drops because users keep coins in wallets to avoid seizure. In China, where owning crypto is banned, inflow vanishes entirely—because there’s no legal place to send it.

What you’ll find below isn’t just news about exchanges. It’s a collection of real stories where exchange inflow plays a role—whether it’s a scam platform like BitxEX with fake trading volume, a licensed exchange like HashKey that attracts institutional deposits, or a dead token like Quotient (XQN) that no one moves anymore. You’ll see how inflow exposes shady exchanges, confirms real adoption, and even warns you when a project is dead. Some posts show you how to spot when a coin is being dumped. Others reveal why certain exchanges get flooded while others sit empty. This isn’t theory. It’s what’s happening right now, in real time, across the crypto world. Pay attention to where the coins are going—and you’ll know what’s really happening before the price moves.

Exchange Inflow and Outflow Metrics: What They Really Tell You About Crypto Markets

- 10 Comments

- Oct, 16 2025

Exchange inflow and outflow metrics reveal whether crypto holders are preparing to sell or hold long-term. Learn how these on-chain signals predict market moves and what institutions are watching.