Mining Pool: How Crypto Mining Pools Work and Why They Matter

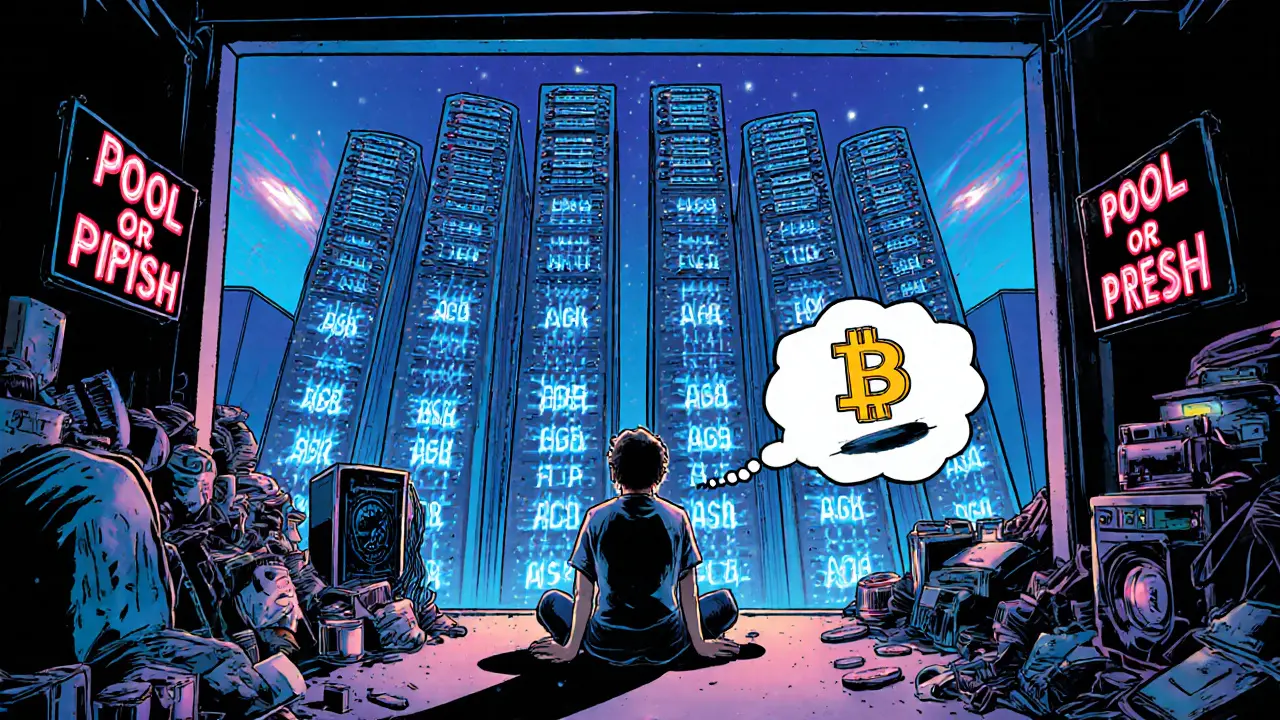

When you mine cryptocurrency, you’re solving complex math problems to verify transactions and secure the network. But doing that alone? It’s like trying to win the lottery with one ticket. That’s where a mining pool, a group of miners who combine their computing power to increase their chances of earning rewards. Also known as mining collective, it lets small players compete with big mining farms by pooling resources and splitting payouts. Without a mining pool, most home miners would wait months—or years—for a single block reward. With one, you get small, regular payments instead of long waits and zero returns.

Bitcoin mining runs on proof of work, a system where miners compete to solve cryptographic puzzles using specialized hardware. As the network got harder, single miners couldn’t keep up. Mining pools changed that. They distribute the workload, so every participant contributes hash power, and when the group finds a block, rewards are shared based on how much work each person did. Some pools use pay-per-share, others use proportional or PPS+ models—each with different risk and payout trade-offs. You don’t need a data center to join; just a decent GPU or ASIC, mining software, and a pool address.

Not all mining pools are equal. Some charge fees, others offer better payout structures or lower latency. A few even let you mine multiple coins at once. But watch out—some shady pools disappear with your earnings, or manipulate the payout system. Always check reputation, fee structure, and payout history before signing up. And remember: mining pools don’t make crypto mining profitable by themselves. Electricity costs, hardware efficiency, and coin price matter just as much.

Even with the rise of Ethereum’s proof-of-stake, Bitcoin and other coins like Litecoin and Bitcoin Cash still rely on mining pools. They’re the backbone of decentralized mining. If you’re serious about earning crypto through mining, joining a reliable pool isn’t optional—it’s the only realistic way to get paid regularly. Below, you’ll find real-world examples of how mining pools connect to crypto regulation, exchange trends, and even government crackdowns—like Venezuela’s state-controlled mining or how on-chain metrics track miner behavior. These aren’t abstract ideas. They’re the practical realities shaping what you earn, when, and how safely.

Future of Mining Pool Industry: How Bitcoin Pools Are Evolving in 2025 and Beyond

- 9 Comments

- Oct, 2 2025

In 2025, mining pools are the only way to profitably mine Bitcoin. Discover how Neopool, ViaBTC, and F2Pool are leading the industry with smarter tech, lower fees, and new features like staking and AI-driven optimization.