Mining Pool Trends 2025: What’s Changing and Who’s Leading

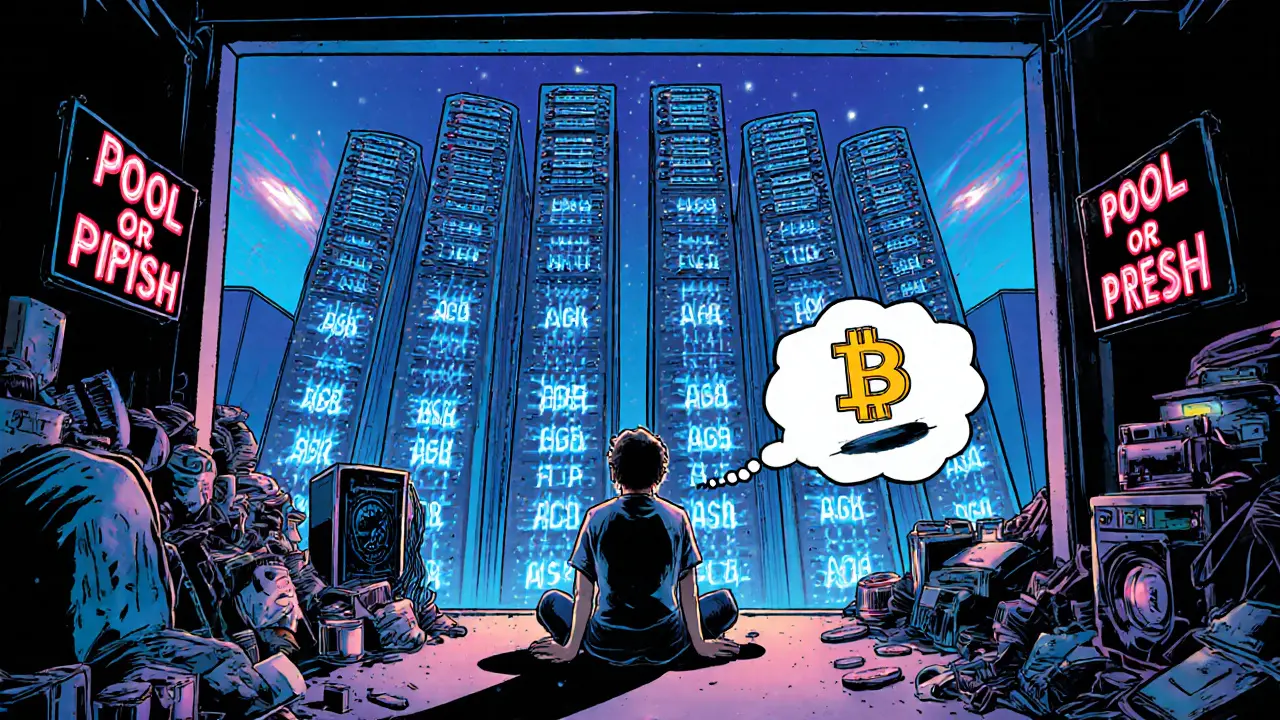

When you think about mining pool trends 2025, the collective behavior of groups of cryptocurrency miners pooling their computing power to earn rewards. Also known as crypto mining pools, these groups are no longer just about brute force—they’re now shaped by regulation, hardware costs, and who controls the power grid. In 2025, the old idea that mining is open to anyone with a GPU is gone. The real players now are big operators with access to cheap electricity, legal cover, and fleets of ASIC miners.

One major shift? hash rate distribution, how mining power is spread across different pools and regions. Also known as mining centralization, it’s getting worse, not better. Just three pools now control over 60% of Bitcoin’s total hash rate, and most of that power comes from places like the U.S., Kazakhstan, and parts of the Middle East where energy is cheap and rules are loose. Meanwhile, China’s ban in 2021 pushed mining out—but now countries like Venezuela and Iran are trying to bring it back under state control, with mixed results. This isn’t just a technical issue—it’s political. When governments start taxing mining or demanding a cut of the rewards, pools have to adapt fast or shut down.

ASIC miners, specialized hardware built only for mining cryptocurrencies like Bitcoin. Also known as mining rigs, these machines are expensive, loud, and power-hungry—but they’re the only way to compete today. Older GPUs? Useless for Bitcoin. Even Ethereum mining ended in 2022, forcing thousands of miners to either switch to other proof-of-work coins or leave the game entirely. Now, the winners are those who can buy ASICs in bulk, install them in warehouses with cooling systems, and keep the lights on 24/7. And here’s the catch: as mining gets harder, the pools that survive are the ones with the most capital. Small miners can’t afford the upgrades. They’re either joining larger pools or giving up.

What does this mean for you? If you’re still thinking about mining crypto on your laptop, stop. The era of casual mining is over. But if you’re watching the market, understanding these trends matters. The concentration of mining power affects Bitcoin’s security, its price volatility, and even how fast transactions confirm. And with new laws popping up in the EU, U.S., and Canada, mining pools are being forced to report their energy use, disclose ownership, and sometimes even share profits with regulators.

Below, you’ll find real stories from 2025: how Venezuela’s state-run mining system is falling apart, why some exchanges are quietly running their own pools, and which new mining coins are actually worth watching. No fluff. No hype. Just what’s happening on the ground, where the electricity flows and the rigs run.

Future of Mining Pool Industry: How Bitcoin Pools Are Evolving in 2025 and Beyond

- 9 Comments

- Oct, 2 2025

In 2025, mining pools are the only way to profitably mine Bitcoin. Discover how Neopool, ViaBTC, and F2Pool are leading the industry with smarter tech, lower fees, and new features like staking and AI-driven optimization.