Russian Crypto Exchanges: What You Need to Know About Trading in Russia

When it comes to Russian crypto exchanges, crypto trading platforms operating within or targeting users in Russia. Also known as Russia-based crypto platforms, these exchanges operate under some of the strictest state controls in the world. Unlike in the U.S. or Europe, where crypto markets are often regulated but open, Russia has spent years walking a tightrope—banning crypto payments while quietly allowing mining and over-the-counter trading. The result? A fragmented, shadowy ecosystem where people still buy Bitcoin, but not on the apps you’d expect.

One major thing to understand: crypto regulations Russia, the government’s evolving legal stance on digital assets, including bans on payments and restrictions on exchanges. Also known as Russia’s crypto legal framework, it’s not a full ban—it’s a controlled cage. The Central Bank of Russia has repeatedly tried to block exchanges like Binance and Bybit from operating locally. But instead of disappearing, traders moved to peer-to-peer (P2P) markets, Telegram bots, and offshore platforms that don’t ask for ID. Meanwhile, crypto mining Russia, the practice of running Bitcoin and other crypto mining rigs in Russia using cheap electricity. Also known as Russian crypto mining operations, it’s still alive because the government sees it as a way to export power and earn foreign currency. In 2024, Russia was among the top 10 global mining nations, despite official rhetoric calling crypto a threat.

What’s missing from most headlines? The real stories. People aren’t just trading—they’re using crypto to send money to family abroad, buy groceries when the ruble drops, or pay for services when banks freeze accounts. Some use Bitcoin Russia, the widespread use of Bitcoin as a store of value and informal payment method in Russia. Also known as Russian Bitcoin adoption, it’s not about speculation—it’s survival. The government doesn’t track every wallet, so P2P trading on platforms like LocalBitcoins or Paxful thrives. Even if an exchange gets blocked, someone in Kazan or Novosibirsk will find a way to swap rubles for BTC through a neighbor or a Telegram group.

And then there’s the flip side: crypto ban Russia, the official policy that prohibits using crypto for payments and restricts financial institutions from dealing with digital assets. Also known as Russia’s crypto payment prohibition, it’s enforced unevenly. Banks don’t openly support crypto, but they also don’t always report small P2P transactions. The state’s focus is on stopping large-scale laundering, not stopping your neighbor from buying Dogecoin to pay for a haircut.

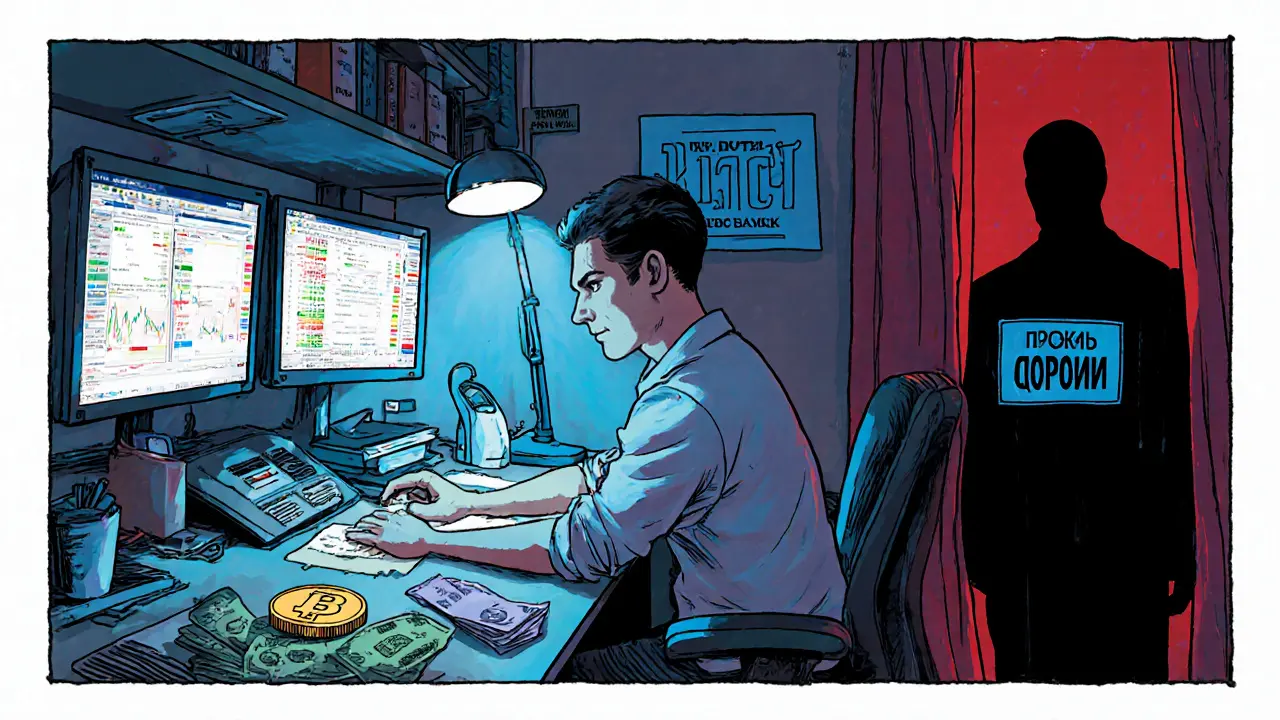

What you won’t find in official reports? The real tools people use. VPNs, anonymous wallets, cash deposits at ATMs, and local traders who meet in cafes. The Russian crypto scene isn’t dead—it’s underground, adaptive, and surprisingly resilient. The exchanges that survive aren’t the flashy ones with logos on billboards. They’re the quiet ones that don’t ask questions, move fast, and vanish when the crackdown comes.

Below, you’ll find real stories and warnings about what’s actually happening on the ground—fake airdrops pretending to be Russian-linked, exchanges that vanish overnight, and the few platforms still standing after years of pressure. This isn’t theory. It’s what people are doing right now to keep their money, their freedom, and their access to the global economy alive.

Crypto Exchanges That Accept Russian Citizens in 2025

- 9 Comments

- Oct, 14 2025

In 2025, Russian citizens use offshore exchanges like Bybit, Gate.io, and KuCoin to trade crypto, while avoiding government restrictions. A7A5 stablecoin and peer-to-peer platforms have become essential tools for bypassing sanctions and banking limits.