Unregulated Crypto Exchange: Risks, Red Flags, and What to Avoid

When you use an unregulated crypto exchange, a cryptocurrency trading platform that operates without government oversight or licensing. Also known as unlicensed crypto exchange, it doesn’t answer to financial authorities, offer insurance, or follow anti-fraud rules—making it a high-risk choice for anyone holding digital assets. There’s no safety net if things go wrong. No FDIC insurance. No customer support that actually helps. No audit trails. Just a website, a wallet address, and a promise.

Many of these platforms look convincing. They offer low fees, big bonuses, or exclusive airdrops—like the BDCC BITICA EXCHANGE, a platform offering a free $8 sign-up bonus with no deposit required—but they leave out critical details. No security audits. No user reviews. No public team. That’s not innovation—it’s a warning sign. Compare that to HashKey Exchange, a licensed Hong Kong-based platform trusted by institutions and subject to strict financial compliance. One has rules. The other? Just a screen and a promise.

Unregulated exchanges often pop up in countries with weak enforcement, like Nigeria, where only Quidax and Busha are officially approved. If you’re using Bybit, KuCoin, or DubiEx there, you’re playing with fire. Your funds can vanish overnight—frozen, stolen, or disappeared with no recourse. That’s not speculation. That’s what happened to users of BitStorage, a crypto exchange with over 500 coins but zero independent reviews or security proof. No one knew who ran it. No one could verify its claims. And when users tried to withdraw, the site went dark.

These platforms thrive on hype. They lure you with free tokens, fake celebrity endorsements, or promises of instant riches. But behind the flashy ads? Empty code, anonymous teams, and zero accountability. The DubiEx exchange claims zero fees and free token creation—sounds great, right? But without transparency, it’s just vaporware. The same goes for ArcherSwap, a decentralized exchange on Core Chain that offers rewards but lacks audits and multi-chain support. Even DeFi platforms need checks and balances.

Regulation isn’t about stopping innovation—it’s about stopping fraud. When a platform doesn’t need a license, it doesn’t need to be honest. That’s why Nigeria’s SEC only approves two exchanges. That’s why China banned all crypto trading outright. And that’s why you should never trust an exchange that won’t tell you where it’s based, who runs it, or how your money is protected.

Below, you’ll find real reviews of exchanges that crossed the line—some with fake airdrops, others with hidden fees, and a few that vanished completely. You’ll also see which platforms actually have proof, transparency, and track records. Don’t guess. Don’t hope. Learn what to avoid before you lose your crypto to an unregulated exchange that doesn’t even have a physical address.

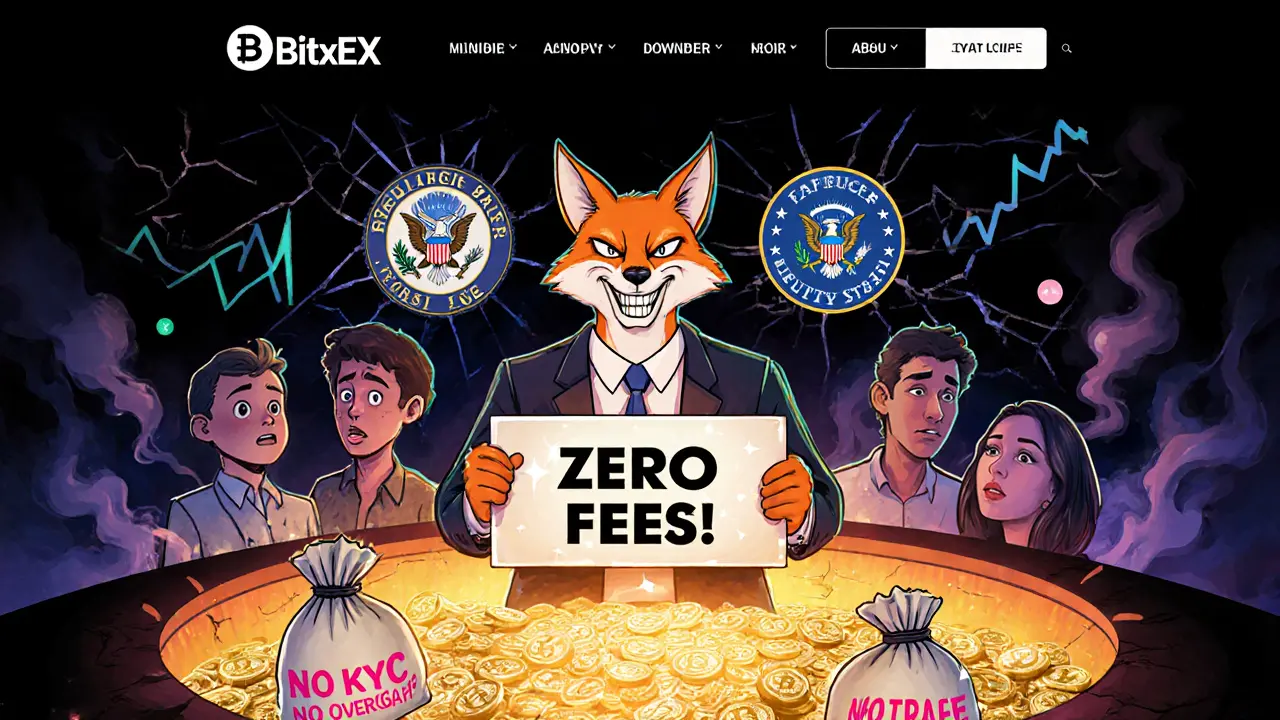

BitxEX Crypto Exchange Review: Red Flags, Scam Warning, and Safer Alternatives

- 8 Comments

- Feb, 13 2025

BitxEX is a high-risk crypto exchange with no regulatory oversight, fake traffic, and widespread withdrawal issues. Experts confirm it's a scam. Learn the red flags and find safer alternatives.