Crypto Transfer Feasibility Checker

Check Transfer Feasibility

Test if your crypto transfer from ARzPaya to another platform is possible based on international restrictions and regulatory compliance.

If you're looking to trade Bitcoin or Tether in Iran, you've probably heard of ARzPaya. It’s one of the biggest crypto platforms in the country, claiming millions of users and 24/7 support. But with Iran’s murky crypto laws and international restrictions, is ARzPaya actually safe-or just another risky gamble?

What Is ARzPaya?

ARzPaya is a cryptocurrency exchange based in Iran, offering trading for Bitcoin, Ethereum, Cardano, Binance Coin, SHIB, Chainlink, and Rune. It works through a website (arzpaya.com) and a mobile app on Google Play. The platform markets itself as Iran’s largest digital asset marketplace, focusing on fast Tether trades and low fees.

Unlike many global exchanges, ARzPaya doesn’t require identity verification to trade in Tether. That makes it attractive for users who want to move quickly without paperwork. But if you want to deposit or withdraw Iranian Rials, you must complete full KYC. That’s a common setup in countries with strict financial controls.

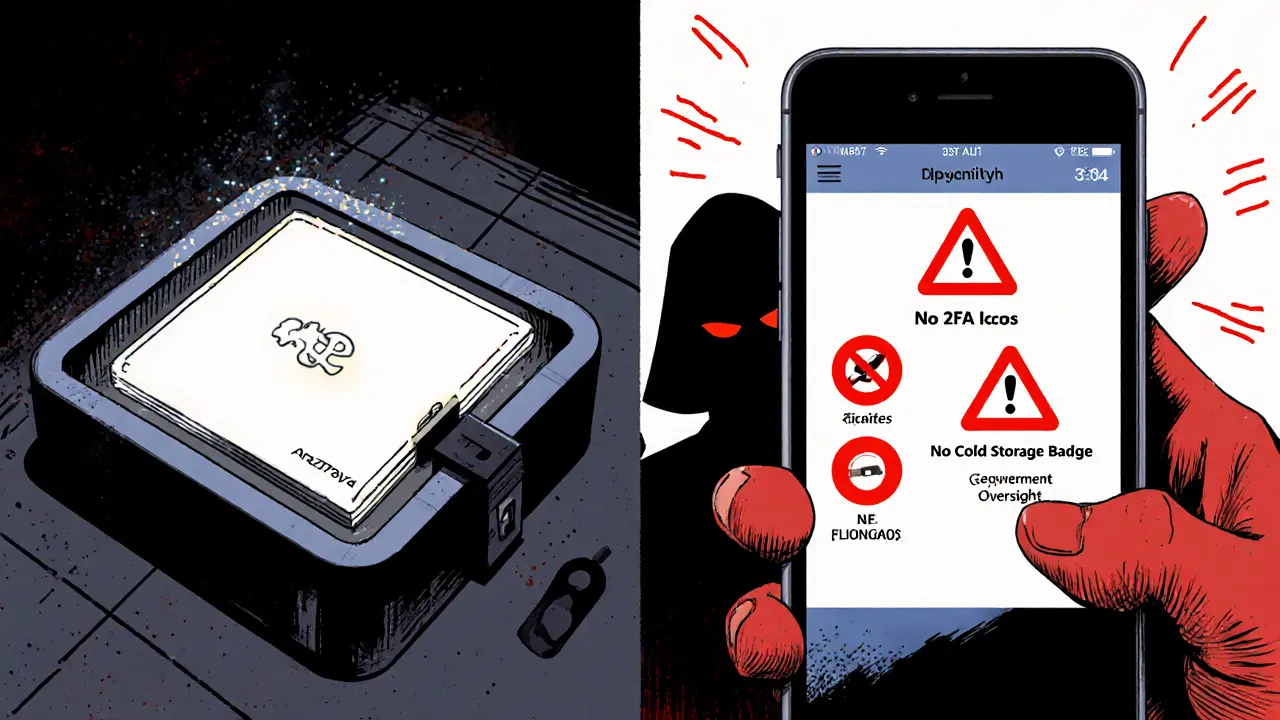

ARzPaya connects directly to Iran’s Shetab banking network, letting users deposit Rials using local bank cards. This integration is rare among crypto platforms in Iran and gives it an edge for domestic users. But it also ties the exchange to Iran’s regulated financial system-which means it’s subject to government oversight and sudden policy shifts.

Trading Features and Interface

ARzPaya offers two trading interfaces: a simple mode for beginners and a professional mode for experienced traders. The simple interface shows basic price charts, buy/sell buttons, and your wallet balance. It’s clean and easy to use-no confusing indicators or advanced tools.

The professional mode gives you order books, limit orders, and market orders. You can set stop-losses and take-profit levels, which is essential for anyone trading beyond small, casual bets. But there’s no mention of margin trading, futures, or leverage. That’s a big gap compared to global exchanges like Binance or Bybit.

There’s also no API access for automated trading bots. If you’re a serious trader looking to code strategies or use third-party tools, ARzPaya won’t help you. It’s built for retail users who want to buy, hold, and sell-not algorithmic trading.

Wallets and Security

ARzPaya gives you a separate wallet for each cryptocurrency you hold. You can store your assets on the platform or withdraw them to any external wallet at any time. Withdrawals are processed within 24 hours, which is faster than many regional exchanges.

But here’s the catch: ARzPaya doesn’t publicly disclose its security practices. No cold storage percentages, no multi-sig setups, no insurance fund details. That’s a red flag. Most reputable exchanges publish these details to build trust. ARzPaya doesn’t.

There’s also no two-factor authentication (2FA) mentioned in their official guides. If you’re storing more than a few hundred dollars’ worth of crypto, you need 2FA. Without it, your account is vulnerable to phishing, SIM swapping, or employee theft.

Iran has seen major exchange collapses before. In 2022, Cryptoland-another Iranian platform-lost $6.5 million in user funds after a hack and internal fraud. Users never got their money back. ARzPaya isn’t immune to that risk.

Regulatory Risks and International Restrictions

Cryptocurrencies aren’t illegal in Iran-but they can’t be used to pay for goods or services in Rials. The government allows trading, but not spending. That creates a strange gray zone where people buy crypto as a savings tool, not a currency.

ARzPaya operates under this system. But internationally, it’s treated as high-risk. The peer-to-peer platform NoOnes has blocked all transfers to and from ARzPaya. If you try to send crypto from ARzPaya to NoOnes, your account gets flagged or suspended. That’s not a minor inconvenience-it’s a major red flag.

NoOnes isn’t some obscure site. It’s one of the largest P2P crypto networks in the Middle East. If they blacklist you, it means they believe ARzPaya has serious compliance issues. That could be sanctions violations, money laundering risks, or lack of KYC controls.

Other Iranian exchanges like Bitpin, Arzplus, and BIDARZ face the same restrictions. That tells you it’s not just ARzPaya-it’s the whole Iranian crypto ecosystem that’s under international suspicion.

Education and User Support

One thing ARzPaya does well is education. The platform has a full magazine section with articles on blockchain, Proof of Stake vs. Proof of Work, how wallets work, and how to avoid scams. That’s rare in regional exchanges. Most just throw you into trading with zero guidance.

They even explain why PoS is more energy-efficient than PoW-something even some global exchanges skip. That shows they’re trying to build smarter users, not just more traders. For beginners in Iran, this is valuable. The country’s crypto scene is still young, and many people don’t know how to protect themselves.

Support is available 24/7 via live chat and email. Response times are usually under an hour during business hours in Iran. But if you’re outside Iran, time zones might delay help. And again-no phone support. If you’re locked out of your account, you’re stuck waiting for an email reply.

Who Is ARzPaya For?

ARzPaya makes sense for one group: Iranians who want to buy Tether or Bitcoin with their Rials and hold them as a hedge against inflation. If you’re in Iran, have a local bank card, and want to avoid the complexity of international exchanges, ARzPaya is one of the few options that works smoothly.

It’s not for people who:

- Want to trade with USD, EUR, or other foreign currencies

- Need margin trading, futures, or API access

- Plan to send crypto to international platforms like Coinbase or Kraken

- Hold more than a few thousand dollars in crypto

- Want full transparency on security practices

If you’re outside Iran, ARzPaya isn’t worth touching. The restrictions from NoOnes and other global services make it a dead end. You can’t move your crypto out easily, and you can’t trust its security.

Alternatives in Iran

ARzPaya isn’t the only game in town. Other Iranian exchanges include:

- Bitpin - More user-friendly interface, better mobile app

- Arzplus - Lower fees, faster withdrawals

- AbanTether - Focuses only on Tether trading, very fast

- BIDARZ - Strong customer support, good for beginners

Some users switch between platforms based on price differences. Tether can vary by 5-10% between exchanges due to liquidity issues. Smart traders monitor multiple sites and move funds when spreads widen.

But none of them are safer than ARzPaya. They’re all in the same regulatory boat.

Final Verdict: Use With Caution

ARzPaya is functional for Iranians who need a local, Rial-based crypto gateway. It’s easy to use, has decent educational content, and connects to the banking system. But it’s not secure, not transparent, and not internationally recognized.

If you’re in Iran and want to buy Tether to protect your savings from inflation, ARzPaya works. Withdraw your crypto to a hardware wallet as soon as possible. Don’t leave it on the exchange.

If you’re outside Iran, avoid it entirely. The restrictions make it useless. And even if you’re inside Iran, treat it like a temporary holding spot-not a long-term home for your assets.

The Iranian crypto market is growing. But it’s still a wild west. ARzPaya isn’t the villain-it’s just another player in a system where rules change overnight.