When you're trading crypto in India, you don't want to waste time on a platform that’s slow, expensive, or unsafe. Bitbns is one of the most popular exchanges for Indian users, but is it actually any good? With over 641 cryptocurrencies listed, daily trading volumes hitting $2.1 million, and features like margin trading and crypto fixed deposits, it’s hard to ignore. But the real question isn’t what it offers-it’s whether it’s right for you.

What Bitbns Actually Offers

Bitbns isn’t just a simple buy-and-sell platform. It’s built for active traders. You can do spot trading, margin trading with up to 1:4 leverage, and futures contracts. If you’re not just holding Bitcoin but trying to make moves on altcoins like SOL, ADA, or DOT, Bitbns has them. It supports INR trading pairs for nearly all major coins, so you can deposit rupees directly and trade without converting to USDT first.

The interface is clean and fast. The mobile app gets consistent praise for being intuitive-even users who aren’t tech-savvy find it easy to place orders, check balances, or track price alerts. There’s no clutter. No confusing menus. You open it, see your portfolio, and trade.

Fees: One of the Best in India

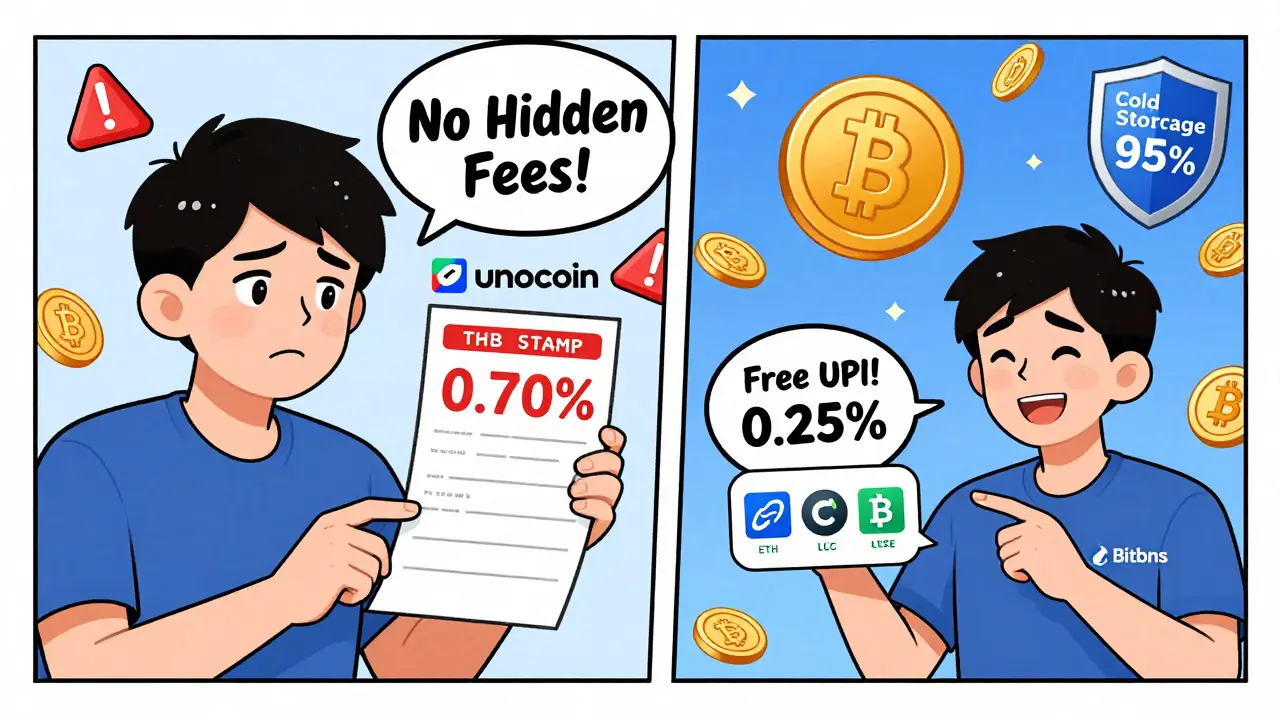

Trading fees are flat at 0.25% for both makers and takers. That’s the industry standard, but here’s the catch: most Indian exchanges charge more. Unocoin, for example, charges 0.70%. That’s nearly three times more. Over time, that adds up.

Withdrawal fees? Most coins are free. No hidden charges on ETH, LTC, or XRP withdrawals. Even Bitcoin withdrawals cost just 0.0005 BTC-about 40% lower than the global average. That’s rare. Most exchanges charge more, even if they claim to be “low fee.”

There’s also a volume rebate. If you trade more than ₹400,000 in a day, you get a fee rebate. It’s not a huge discount, but for active traders, it helps. And deposits? UPI is free and instant. NEFT, RTGS, IMPS-all supported with no extra cost. No other Indian exchange matches this level of local payment integration.

Security: Mixed Signals

Bitbns claims to use cold storage for 95% of funds and hot wallets for quick access. That’s standard. It also offers two-factor authentication (2FA). No major hacks reported since launch in 2017. That’s impressive.

But here’s the problem: Traders Union gave it a security score of 4.75 out of 10. That’s low. Why? Because it’s not regulated by SEBI or any Indian financial authority. It’s only registered with FIU-India, which is a basic anti-money laundering requirement-not actual financial oversight. Compare that to Kraken or Coinbase, which are regulated in the U.S. and EU. Bitbns doesn’t have investor protection funds. If something goes wrong, you’re on your own.

It doesn’t use facial recognition or advanced biometrics. No insurance fund. No third-party audit reports published publicly. For a platform handling millions in daily trades, that’s a red flag.

Customer Support: Surprisingly Good

Here’s where Bitbns shines. Customer support runs 24/7 through Telegram. Response times? Around five minutes, according to hundreds of user reports. That’s faster than most banks. Unocoin’s support is limited to business hours and takes hours to reply. Bitbns doesn’t just answer-you get clear, helpful replies.

They even have a dedicated support channel for high-volume traders. If you’re moving large amounts, you can get direct access. That kind of service is rare in crypto exchanges, especially in emerging markets.

Payment Methods: Built for India

Bitbns understands Indian users. You can deposit via UPI-no fees, instant. That’s huge. No other exchange in India offers that speed and convenience. RTGS and NEFT are also supported for larger transfers. IMPS works for quick, small deposits.

But here’s the downside: no credit card deposits. No PayPal. No international wire options beyond bank transfers. If you’re outside India, you’re stuck. Even for UAE users, deposits go through USDT P2P, not direct AED. That’s clunky.

International traders? You’re better off with Binance or Kraken. But if you live in India and want to deposit rupees quickly? Bitbns wins.

Extra Features: More Than Just Trading

Bitbns doesn’t stop at buying and selling. You can buy crypto gift vouchers to send to friends. They sell hardware wallets (₹14,999), which is useful if you’re holding large amounts long-term. They’ve partnered with Binocs and Koinx for tax reporting-critical for Indian users who need to file crypto gains under Income Tax rules.

There’s also a crypto fixed deposit feature. Lock up your BTC, ETH, or USDT and earn interest. Rates vary but can hit 6-8% annually. Not as high as some DeFi protocols, but it’s safe, regulated by the exchange, and pays out in crypto. No slashing risk. No smart contract bugs.

They’ve run Bitcoin flash sales where new users got free coins just for signing up. Not a gimmick-it’s real. And they’re planning to launch options trading soon. That’s a sign they’re investing in advanced tools.

Who Is Bitbns For?

Bitbns is perfect for Indian traders who want:

- Low fees and free withdrawals

- Fast UPI deposits and INR trading

- Access to 600+ altcoins

- 24/7 support that actually responds

- Simple tools like fixed deposits and tax reporting help

It’s not for:

- International users (no credit cards, limited deposit options)

- Those who need government-backed regulation or insurance funds

- Advanced traders who need derivatives, API trading, or institutional tools

If you’re in India and you’re serious about crypto, Bitbns is one of the top three choices-alongside WazirX and CoinSwitch Kuber. It’s not perfect, but it’s reliable, fast, and built for your needs.

Final Verdict

Bitbns is the most user-friendly exchange for Indian crypto traders. It’s not the safest in the world, but it’s the most practical. The fees are low, the support is fast, and the payment system is unmatched in India. The lack of regulation and investor protection is a real risk, but for retail users who aren’t holding millions, it’s a trade-off most are willing to make.

If you’re starting out or already trading regularly in rupees, Bitbns should be on your shortlist. Just don’t leave your life savings on it. Use cold wallets for long-term holds. Keep your trading funds on Bitbns. Use the UPI deposits. Trade the altcoins you want. And take advantage of the free withdrawals and tax tools.

It’s not the future of crypto. But for now, in India, it’s one of the best ways to get there.

Is Bitbns safe to use in India?

Bitbns has never been hacked since its launch in 2017 and uses cold storage for most funds. It offers 2FA and is registered with FIU-India, which means it follows basic anti-money laundering rules. But it’s not regulated by SEBI or any financial authority, and it has no investor protection fund. Security ratings from third parties are low. It’s safe enough for retail trading, but don’t store large amounts long-term on the exchange.

What are the trading fees on Bitbns?

Bitbns charges a flat 0.25% fee for both makers and takers on all trades. That’s the same as Binance and Kraken. For Bitcoin withdrawals, it’s 0.0005 BTC-lower than the global average. Most other cryptocurrencies have zero withdrawal fees. If you trade over ₹400,000 per day, you qualify for a rebate.

Can I deposit INR on Bitbns?

Yes. Bitbns supports UPI (free and instant), NEFT, RTGS, and IMPS for INR deposits. UPI is the fastest and most popular option. You can deposit any amount, and the funds reflect in seconds. No other Indian exchange offers this level of speed and convenience.

Does Bitbns have a mobile app?

Yes. The Bitbns mobile app is available on iOS and Android. Users rate it highly for its clean interface, fast order execution, and real-time price alerts. It supports all major features including spot trading, margin trading, and fixed deposits. Many users say it’s easier to use than the web version.

Can I earn interest on my crypto with Bitbns?

Yes. Bitbns offers a fixed deposit feature where you can lock up BTC, ETH, USDT, and other coins to earn interest. Rates range from 6% to 8% annually, paid in the same cryptocurrency. It’s a low-risk way to earn passive income without using DeFi protocols. Withdrawals are flexible, and there’s no lock-in period for most coins.

Does Bitbns support credit card deposits?

No. Bitbns does not accept credit or debit card deposits. You can only deposit via bank transfers: UPI, NEFT, RTGS, or IMPS. This is a limitation for international users and those who prefer card payments. If you need card deposits, consider Binance or CoinSwitch Kuber.

Is Bitbns better than Unocoin?

Yes, for most users. Bitbns has lower fees (0.25% vs. 0.70%), supports over 600 coins vs. Unocoin’s limited selection (mostly Bitcoin), and offers free UPI deposits. Unocoin lacks 24/7 support and doesn’t have margin trading or fixed deposits. Bitbns is more feature-rich and better suited for active traders.

What’s the minimum deposit on Bitbns?

There’s no minimum deposit. You can deposit as little as ₹10 via UPI. The same applies to trading-you can buy fractions of Bitcoin starting at ₹100. This makes it accessible even for beginners with small budgets.

Mandy McDonald Hodge

January 3, 2026 AT 09:03OMG I just signed up for Bitbns after reading this!! UPI deposits are literally magic 🤩 I’ve been stuck on Unocoin for months and the fees are killing me. Also, 24/7 Telegram support?? I cried when I saw that. Already bought my first 0.002 BTC and it felt so easy 😭

Bruce Morrison

January 3, 2026 AT 23:17Low fees and fast deposits are great but if you’re not regulated by SEBI you’re playing Russian roulette with your money. I don’t care how clean the interface is, if the exchange gets hacked or disappears you get zero recourse. This isn’t just about convenience, it’s about trust.

Jack and Christine Smith

January 5, 2026 AT 00:34BITBNS IS THE ONLY EXCHANGE THAT ACTUALLY GETS INDIA. Like wtf why are we still comparing it to Kraken? We don’t need USD pairs or credit cards. We need UPI. We need rupees. We need to not wait 2 days for a deposit. And yeah the security score is trash but so is half the Indian banking system and nobody panics about that. Also 8% interest on USDT?? I’m locking mine in right now 💸🔥

Jackson Storm

January 6, 2026 AT 06:30For new traders in India, this is probably the best starting point. The app is super intuitive, no confusing menus, and the tax reporting integration with Koinx is a lifesaver. I used to manually track every trade in Excel until I found this. Also, the fixed deposit feature is perfect if you’re not ready for DeFi. Just don’t go all in-keep 80% in cold storage. And yeah, no credit cards is annoying but honestly? UPI is faster anyway.

Also, the 0.25% fee is a steal. I tried CoinSwitch and got hit with hidden charges on withdrawals. Bitbns is transparent. Even the Bitcoin withdrawal fee is lower than most global platforms. That’s rare.

And the support? I asked a dumb question at 2am about margin liquidation and got a reply in 3 minutes. No bots. No scripts. Real humans. That’s not luck-that’s intention.

Just remember: it’s not a bank. It’s a trading tool. Treat it like one.

Raja Oleholeh

January 7, 2026 AT 01:09India ki best exchange. Baaki sab foreign hai. UPI free? 600+ coins? 24/7 support? Sab kuch hai. SEBI ka kya matlab? Hum apna paisa khud sambhalte hain. 💪🇮🇳

Jacky Baltes

January 7, 2026 AT 21:34There’s something deeply ironic about praising a platform for being ‘built for India’ while ignoring the structural risks of operating outside formal financial oversight. Convenience and speed are seductive, but they’re not substitutes for accountability. The fact that users are willing to trade safety for speed speaks volumes about the gaps in our financial infrastructure-not about Bitbns’s brilliance.

I admire the UPI integration. I truly do. But if you build a house on sand, even the most beautiful doors won’t keep out the tide.

Willis Shane

January 8, 2026 AT 12:30While the operational efficiency of Bitbns is commendable, particularly in terms of localized payment infrastructure and responsive customer service, it remains imperative to acknowledge the absence of regulatory compliance and investor safeguards. As a fiduciary-conscious participant in digital asset markets, I cannot endorse platforms that operate without transparent third-party audits, insurance mechanisms, or adherence to recognized financial governance frameworks. The trade-off between convenience and security, while understandable, remains fundamentally untenable for any individual holding material exposure.