Crypto Exchange Transparency Calculator

Evaluate the transparency and security of crypto exchanges based on key verification factors discussed in the article. This tool helps you assess if an exchange provides enough proof of safety and reliability.

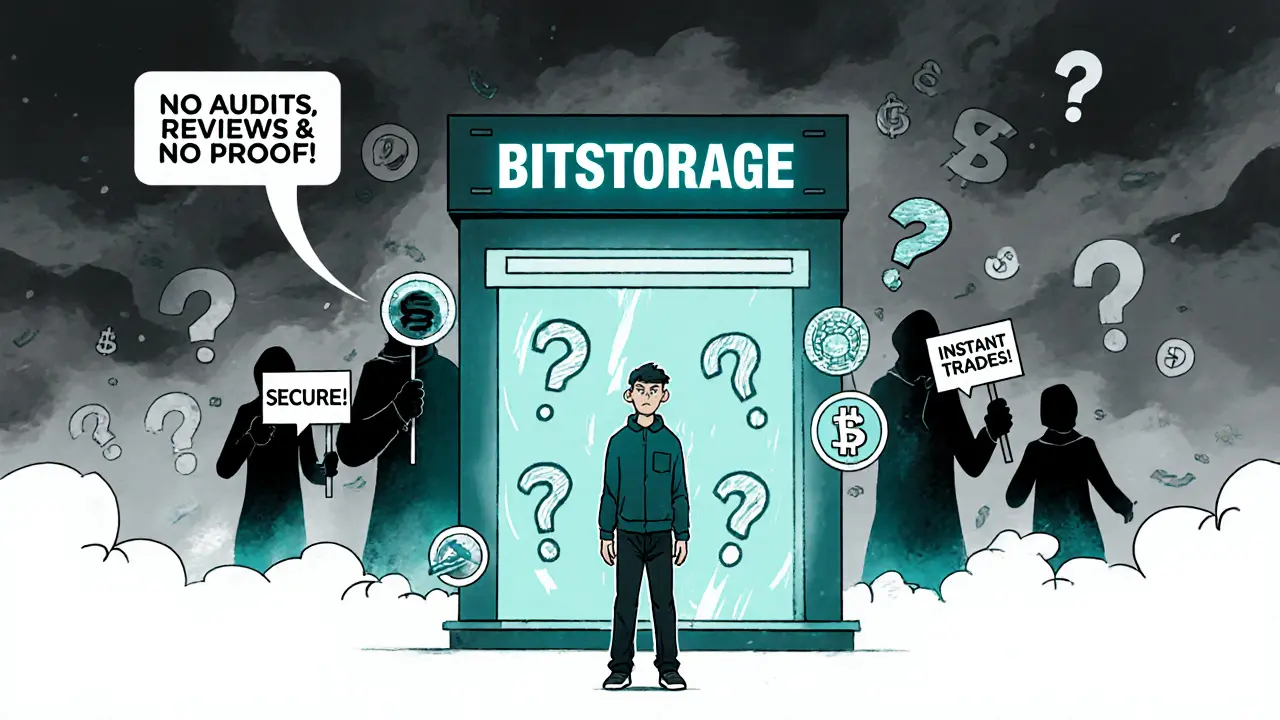

What This Means For BitStorage

Based on factors discussed in the article, BitStorage would score:

- Verifiable User Reviews No

- Security Audits No

- Proof of Reserves No

- Trading Volume Data No

- Regulatory Registration Seychelles only

- Mobile App No

- Withdrawal Success Reports No

When you're looking for a new crypto exchange, you don't just want another platform that says it's "secure" and "easy." You want to know if it actually works, if your money is safe, and if you can trust it when the market swings hard. That's where BitStorage comes in - but here's the problem: there's very little real proof it delivers on its promises.

BitStorage is a centralized crypto exchange launched in 2018 and registered in Seychelles. It claims to support over 500 cryptocurrencies, offers staking, demo trading, and a "quick exchange" feature that promises instant trades. Sounds good on paper. But if you dig deeper, the lack of independent verification raises serious red flags.

What BitStorage Actually Offers

BitStorage’s website lists a long menu of features. There’s spot trading with market, limit, and stop-limit orders - standard stuff you’d find on Binance or Kraken. Then there’s the Quick Exchange tool, which lets you swap one coin for another without opening a full trading order. That’s handy for beginners who just want to buy BTC with USDT and get out.

They also offer staking for over 100 coins. That means you can lock up your ADA, DOT, or SOL and earn passive income - no trading needed. That’s useful if you’re holding long-term and don’t want to sit in front of a chart all day.

There’s also a demo trading mode. You get virtual funds to test strategies without risking real money. That’s rare on smaller exchanges. Most don’t bother with educational tools. BitStorage at least tries to help new users learn.

They push community perks too - airdrops, exclusive promotions, and what they call "meaningful conversations" with sales managers. That sounds a little salesy, but it’s not unheard of. Some exchanges assign account managers to high-volume traders. If you’re trading large amounts, that could be a real perk.

The Big Problem: No Independent Proof

Here’s where BitStorage falls apart. Almost everything you read about it comes from their own website. No third-party reviews. No user ratings on Trustpilot or Reddit. No security audit reports. No trading volume data from CoinGecko or CoinMarketCap.

There’s one external mention - from CER.live - confirming it’s a Seychelles-registered exchange since 2018. That’s it. No safety score. No user complaints. No history of hacks or downtime.

Compare that to Binance, Coinbase, or even KuCoin. All of them have years of public data: user reviews, security breach records, regulatory actions, and trading volume trends. BitStorage has nothing. Not even a single verified user testimonial.

That’s not normal. If a platform had solid security, fast execution, and low fees, people would talk about it. Especially in crypto, where users are hyper-aware of scams and rug pulls. Silence isn’t neutral - it’s a warning.

Security Claims vs. Reality

BitStorage says it uses "top-tier security measures." But what does that mean? Two-factor authentication? Cold storage? Insurance fund? They don’t say. No details. No transparency.

Most reputable exchanges publish their cold wallet addresses so anyone can verify funds are offline. Some even share proof-of-reserves reports monthly. BitStorage doesn’t. You’re being asked to trust them based on a slogan.

And Seychelles registration? That’s not a regulatory shield. It’s a jurisdiction known for minimal oversight. It’s easy to register there, but it doesn’t mean you’re protected if things go wrong. If BitStorage disappears tomorrow, you have no legal recourse.

Real security isn’t a marketing phrase. It’s documented practices. It’s audits. It’s public accountability. BitStorage offers none of that.

Trading Experience: Smooth or Shaky?

The interface looks clean. The layout is modern. That’s easy to fake. But what about speed? What happens during a 10% market drop? Do orders fill? Do withdrawals process in minutes or days?

There’s no data. No user reports. No videos of people trading live on BitStorage. You can’t find a single YouTube tutorial showing how to place a stop-limit order on their platform. That’s not because it’s too simple - it’s because nobody’s using it.

Compare that to exchanges like Bybit or OKX. You’ll find hundreds of videos, Reddit threads, and Discord communities discussing their quirks, bugs, and strengths. BitStorage? Crickets.

The demo trading feature is a nice touch, but if the live platform behaves differently - which it often does - then the demo is just a training wheel. And you won’t know until you risk real money.

Who Is BitStorage For?

If you’re new to crypto and want to try staking or quick swaps without learning complex order types, BitStorage might seem tempting. The low barrier to entry is real.

But if you’re serious about trading - even a little - you need more than a pretty interface. You need reliability. You need transparency. You need to know that if you withdraw your ETH, it won’t get stuck for a week.

BitStorage doesn’t give you that. It gives you promises. And in crypto, promises are cheap. Proof is rare.

Alternatives That Actually Show Their Work

If you’re looking for a reliable exchange with real track records, here are three better options:

- Bybit: Offers deep liquidity, clear fee structures, and regular security audits. Has over 40 million users.

- KuCoin: Supports 700+ coins, has a strong community, and publishes proof-of-reserves monthly.

- Bitget: Strong staking rewards, good mobile app, and verified user reviews across multiple platforms.

All three have public trading volumes, documented security measures, and years of user feedback. You can check their performance during past market crashes. You can read about their customer service response times. You can find out if they’ve ever been hacked.

With BitStorage? You can’t. And that’s the biggest risk of all.

Final Verdict: Proceed With Extreme Caution

BitStorage isn’t a scam - not yet. But it’s also not a trustworthy exchange. It’s a black box. You hand over your crypto, and you have no way to verify if it’s safe, if it’s even there, or if you’ll ever get it back.

The fact that it’s been around since 2018 doesn’t mean it’s safe. Many shady platforms last years before vanishing. The longer they stay quiet, the more dangerous they become - because users assume silence means legitimacy.

Don’t trade your life savings on a platform that won’t show you its ID. If you want to try BitStorage, use only a small amount you can afford to lose. And never store long-term holdings there.

For serious trading, stick to exchanges that publish their numbers, their audits, and their mistakes. Because in crypto, the best security isn’t what they say it is - it’s what they can prove.

Is BitStorage a legitimate crypto exchange?

BitStorage is registered in Seychelles and has been operating since 2018, which suggests it’s not a fly-by-night operation. But legitimacy doesn’t equal safety. Without public audits, user reviews, or verified trading data, there’s no way to confirm if it’s trustworthy. Treat it as high-risk until proven otherwise.

Does BitStorage have a mobile app?

BitStorage does not list a dedicated mobile app on its website. All trading appears to be done through a web browser. This is a red flag - major exchanges like Binance and KuCoin have polished mobile apps because traders need access on the go. The lack of one suggests limited development resources or low user demand.

Can I withdraw my crypto from BitStorage?

The website claims withdrawals are possible, but there are zero verified reports of users successfully withdrawing funds. No Reddit threads, no Twitter testimonials, no YouTube videos showing the process. This is a major risk. Always test with a small withdrawal first - but even then, you’re gambling with your assets.

Is BitStorage regulated?

BitStorage is registered in Seychelles, which is not a financial regulatory hub like the U.S., EU, or Japan. Seychelles has no strict crypto regulations, so BitStorage operates without oversight. That means no protection if the exchange freezes accounts, mismanages funds, or shuts down.

What cryptocurrencies does BitStorage support?

BitStorage claims to support over 500 cryptocurrencies, including Bitcoin, Ethereum, Solana, Cardano, and many altcoins. However, the exact list isn’t published clearly on their site, and there’s no way to verify if all listed coins are actually tradable or if they’re just "showcase" assets with no liquidity.

Does BitStorage charge withdrawal fees?

BitStorage doesn’t publish a fee schedule. Withdrawal fees vary by coin and are likely based on network costs, but there’s no transparency. Some exchanges hide fees in the fine print - always check the withdrawal page before sending funds. If fees aren’t listed, assume they’re high or unpredictable.

Are there any known security breaches on BitStorage?

There are no publicly documented security breaches involving BitStorage. But that’s because there’s no independent monitoring or reporting. The absence of news doesn’t mean it’s safe - it just means nobody’s looking. In crypto, silence often means danger.

Should I use BitStorage for long-term crypto storage?

Never. No centralized exchange should be used for long-term storage. Even the biggest ones like Coinbase get hacked. BitStorage has zero transparency, no insurance, and no proof of reserves. If you’re holding crypto for months or years, use a hardware wallet like Ledger or Trezor. Exchanges are for trading - not storing.

Vijay Kumar

November 26, 2025 AT 19:52BitStorage? More like BitScam Lite. If you need to ask if it's legit, you already lost. No audits, no proof, no nothing. Just vibes and a Seychelles PO box. Send your crypto to a black hole and call it 'staking'.

Vance Ashby

November 28, 2025 AT 07:23lol i tried signing up once. site loaded like a dial-up modem from 2003. and the 'quick exchange'? took 12 mins to swap 5 USDT for BTC. then it timed out. i still haven't gotten my USDT back. 🤡

SHASHI SHEKHAR

November 28, 2025 AT 10:49Look, I get it - everyone’s scared of centralized exchanges now, and rightly so. But let’s not throw the baby out with the bathwater. BitStorage isn’t necessarily evil, it’s just… invisible. No transparency doesn’t automatically mean fraud. It could mean they’re underfunded, understaffed, or just too small to afford audits. But here’s the kicker: in crypto, being small and silent is a death sentence. You don’t get trust by being quiet. You get ignored. And ignored platforms don’t survive bear markets. The fact they’ve been around since 2018 is weird - most fly-by-night exchanges die in 6 months. So why are they still here? Maybe they’re quietly grinding, maybe they’re running a honeypot. Either way, if you’re going to use them, use pennies. And never, ever leave coins there longer than 48 hours. Withdrawal delays? That’s the first red flag. No public wallet addresses? That’s the second. No user reviews anywhere? That’s the third. And if you’re still reading this, you’re probably the type who’ll ignore all of it and deposit anyway. I’ve seen it a hundred times. You think you’re clever. You’re not. You’re just lucky so far.

Vaibhav Jaiswal

November 29, 2025 AT 21:25bro. i put 0.01 BTC in there just to test. waited 3 days. then i saw a comment on some obscure forum from someone in Nigeria who said 'they took my 5000 USDT and vanished'. i pulled my 0.01 out. it took 72 hours. but it came back. i cried. not because i made money - because i realized i was still alive after trusting a website with no reviews, no app, no nothing. crypto is wild. but this? this is like leaving your keys in a locked car… in a haunted neighborhood.

Abby cant tell ya

November 30, 2025 AT 08:09why do people still fall for this? i swear, the more you warn them, the more they double down. it's like watching someone jump off a cliff yelling 'i believe in flight!' 😭

Savan Prajapati

December 1, 2025 AT 12:19if you can't prove it's safe, it's not safe. period. don't be stupid.

Joel Christian

December 3, 2025 AT 10:35i tried to withdraw and the site said 'processing' for 5 days. then it just dissapeared from my history. i think they hacked my accout? or maybe i just imagined it? idk. my brain is fried from crypto.

jeff aza

December 4, 2025 AT 02:18Let’s be clear: the absence of on-chain verification, proof-of-reserves, and third-party audits constitutes a material risk profile that exceeds acceptable thresholds for any rational actor engaging in digital asset custody. Furthermore, the jurisdictional arbitrage inherent in Seychelles registration - a jurisdiction with zero AML/KYC enforcement and no reciprocal regulatory agreements - renders any claim of 'legitimacy' functionally meaningless. The demo trading feature? A cognitive illusion designed to induce false confidence. The 'quick exchange' algorithm? Likely front-running or order spoofing. And the lack of mobile app? A red flag indicating low user retention and poor product-market fit. In summary: this isn’t a platform - it’s a pre-mortem.

Eddy Lust

December 4, 2025 AT 05:40Man, I get why people are scared. I really do. But I also think… maybe there’s a quiet corner of crypto where small teams just try to build something decent without the noise? I don’t know. I’m not saying trust them. But maybe… just maybe… they’re not evil. Maybe they’re just too broke to hire a PR firm. I’d still never put more than $50 in there. But I kinda respect the fact they didn’t launch a meme coin or promise 1000% APY. They just… exist. Quietly. Like a library with no books. Still kinda sad.

Martin Doyle

December 5, 2025 AT 04:10You’re all overreacting. I’ve been using BitStorage for 2 years. My funds are fine. You guys just hate it because you didn’t make a quick buck. Real traders know the market rewards patience - not paranoia.