Iraq Dinar Value Calculator

Calculate Your Savings Impact

Iraq's currency has lost over 23% of its value since 2020. This calculator shows how much your dinar savings are worth today compared to the previous exchange rate.

Old Exchange Rate (2020): 1,182 IQD = 1 USD

Current Exchange Rate (2025): 1,450 IQD = 1 USD

Current USD Value: $0.00

Value if Rate Was Still 1,182: $0.00

Value Lost Since 2020: $0.00

Percentage Loss: 0%

Stablecoin Equivalent: $0.00

Important: This calculator shows the theoretical impact of currency devaluation on your savings. In Iraq, the Central Bank's ban on cryptocurrency means you have no legal way to protect your savings from inflation through digital assets. If you're considering informal crypto trading to preserve value, remember that while owning crypto isn't illegal, using payment systems to trade carries significant risk of money laundering investigations.

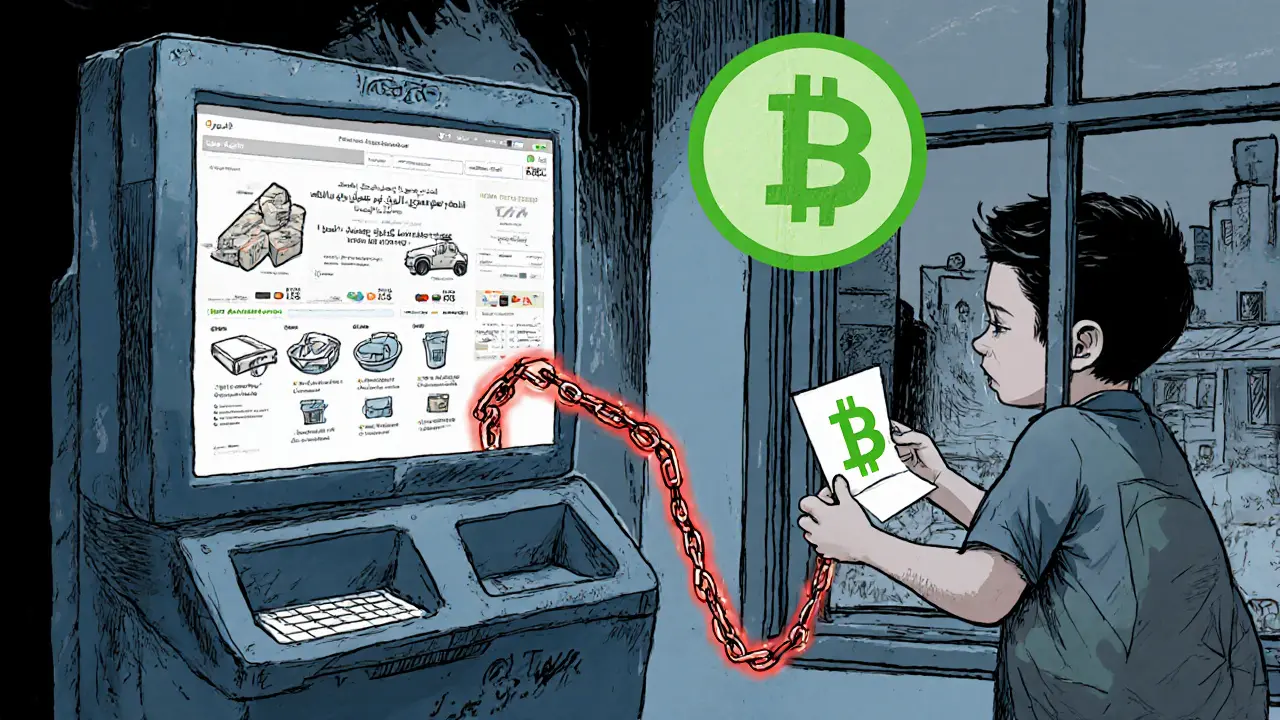

As of 2025, the Central Bank of Iraq maintains one of the strictest cryptocurrency bans in the world. Not only is it illegal for banks and payment providers to touch Bitcoin or any other digital asset - it’s also forbidden to use credit cards, e-wallets, or online payment platforms to buy, sell, or trade crypto. This isn’t a gray area. It’s a full stop. And yet, despite this, people in Iraq are still trading crypto - quietly, secretly, and at risk.

Why Did Iraq Ban Cryptocurrency?

The Central Bank of Iraq first cracked down on crypto in 2017. Back then, Bitcoin was still a fringe curiosity. But the CBI saw trouble coming. They worried about money laundering, fraud, and the loss of control over Iraq’s shaky financial system. Their main concern? That digital currencies could bypass state oversight entirely. In 2021, they made it official with Circular No. (125/5/9). This document didn’t just discourage crypto - it outlawed it for every licensed financial institution in the country. Banks, exchange offices, mobile wallet providers - all were ordered to cut ties with digital assets. The circular made it clear: crypto has no legal status in Iraq. You can’t use it to pay for goods. You can’t settle debts with it. And if you try, the law won’t protect you. The 2022 update tied Iraq’s rules to global anti-money laundering standards from the Financial Action Task Force (FATF). That meant banks had to install new monitoring tools, review internal policies, and report anything suspicious. But here’s the twist: while institutions got stricter rules, individuals? Nothing changed. There’s no law saying it’s illegal for you to own Bitcoin. But if you use it, you could be pulled into an AML investigation - and that’s dangerous.How Is This Different From Other Countries?

Most countries either regulate crypto or ignore it. Iraq does neither - it bans it. Only about ten countries in the world have a total ban like this. China restricts exchanges and mining but allows private ownership. The U.S. taxes it. The U.K. regulates it. Iraq? It says it doesn’t exist. What makes Iraq’s ban even more extreme is how far it reaches. Many nations only block financial institutions. Iraq blocks the tools people use to access crypto. If you try to buy Bitcoin using your mobile wallet or a prepaid card, you’re violating CBI rules. That’s not just about banks - it’s about cutting off the entire pipeline from the ground up. And unlike places like Nigeria or Vietnam, where crypto use exploded because of currency instability, Iraq’s ban has been reinforced by religious authorities. In 2018, the Supreme Fatwa Authority in Kurdistan ruled against OneCoin - a notorious scam - calling it haram. That wasn’t just about fraud. It was a cultural signal: crypto is dangerous, untrustworthy, and against Islamic financial principles. That kind of messaging sticks.The Cash Crisis Behind the Ban

Iraq’s crypto ban isn’t just about fear of technology. It’s about survival. The Iraqi dinar has been under pressure for years. In 2020, the government devalued the currency from 1,182 to 1,450 dinars per U.S. dollar. Prices for food, fuel, and medicine shot up overnight. People lost savings. The banking system barely functioned. Today, only 8.8% of the money printed in Iraq is actually deposited in banks. The rest? It’s sitting in homes, under mattresses, or being smuggled across borders. The CBI doesn’t have enough cash to cover monthly spending needs - which hover between 18 and 20 trillion dinars. Printing more money just makes inflation worse. So they’re stuck. And crypto? It looked like a threat to their last remaining control point: the flow of money. By banning crypto, they hoped to stop people from escaping the broken system. If you can’t use Bitcoin to buy dollars or send money abroad, then you’re forced to use the dinar - even if it’s losing value.

The Hidden Reality: People Are Still Using Crypto

Here’s the contradiction: Iraq bans crypto, but people still trade it. You won’t find Bitcoin ATMs in Baghdad. You won’t see crypto ads on TV. But you’ll find WhatsApp groups where traders swap QR codes for USDT. You’ll hear about friends who use P2P platforms like LocalBitcoins or Paxful to buy Bitcoin with cash. Some even use informal hawala networks to move value across borders without touching a bank. Enforcement? Almost nonexistent. The CBI doesn’t have the tools to track individual crypto wallets. There’s no law that says owning Bitcoin is a crime. So people operate in the shadows - not because they’re criminals, but because they need to protect their money from inflation and corruption. This isn’t rebellion. It’s adaptation. When your currency is collapsing and your bank won’t let you access your own savings, you find a way. Crypto isn’t a luxury here - it’s a lifeline.The State Is Building Its Own Digital Currency

While banning private crypto, the Central Bank of Iraq is quietly building its own digital currency - a Central Bank Digital Currency (CBDC). In March 2025, Mazhar Mohammed Saleh, financial advisor to the Prime Minister, confirmed the CBI is in the research phase. The goal? Replace paper money with a government-controlled digital version. Why? The CBI says it wants to reduce printing costs, track spending, fight money laundering, and improve financial inclusion. But the real reason is control. A CBDC means every transaction - every dollar you spend, every transfer you make - can be logged, monitored, and frozen by the state. That’s not innovation. That’s surveillance. Human rights groups are warning that Iraq’s CBDC could become a tool of oppression. The country already has low scores for civil liberties. Criticizing the government online can get you arrested. Your salary can be docked. Your phone can be hacked. Now imagine if the government can see every purchase you make - whether you bought medicine, paid for a protest, or sent money to a relative in another city. The CBDC doesn’t solve Iraq’s liquidity crisis. It just gives the state a new way to watch you while you suffer through it.

What This Means for You

If you’re in Iraq: don’t trust banks with crypto. Don’t use your debit card to buy Bitcoin. Even if you think you’re safe, you’re playing with fire. You could be flagged for money laundering, even if you didn’t break any laws. If you’re outside Iraq: understand that the country’s crypto ban isn’t about technology. It’s about power. The CBI doesn’t fear Bitcoin - it fears losing control over its economy and its people. And if you’re wondering whether Iraq will ever change its stance? Don’t hold your breath. The government isn’t looking for innovation. It’s looking for stability - even if that stability means locking people out of the global financial system.What’s Next?

The CBI’s CBDC is likely to launch in phases over the next two to three years. First, it’ll be tested with government employees and public sector payments. Then, it’ll expand to pensioners, then to general banking. Meanwhile, informal crypto trading will keep growing - not because people want to break the law, but because they have no other choice. The real question isn’t whether Iraq will lift its ban. It’s whether the world will let a country with such poor human rights records control the digital money of its citizens.Is it illegal to own Bitcoin in Iraq?

No, there is no law that makes owning Bitcoin or any other cryptocurrency illegal for individuals in Iraq. However, using banks, payment apps, or financial services to buy, sell, or trade crypto is strictly banned. While possession isn’t criminalized, any transaction involving regulated institutions could trigger an anti-money laundering investigation.

Can I use a crypto exchange in Iraq?

No. All licensed financial institutions in Iraq - including banks, payment processors, and e-wallet providers - are prohibited from offering crypto services. Any exchange operating in Iraq is doing so illegally and without oversight. Using them puts you at risk of financial penalties or being caught in an AML probe.

Why is Iraq pushing a Central Bank Digital Currency (CBDC)?

Iraq’s government wants to replace cash with a digital version it fully controls. The stated goals are reducing printing costs, tracking spending, and fighting corruption. But experts warn the real motive is surveillance. A CBDC lets the state monitor every transaction, which could be used to punish dissent, freeze accounts, and suppress financial freedom - especially in a country with weak civil liberties.

Is crypto trading common in Iraq despite the ban?

Yes. Despite the ban, informal crypto trading is widespread. People use P2P platforms, WhatsApp groups, and cash-based deals to buy Bitcoin and USDT. Enforcement against individuals is rare, but the lack of legal protection means users have no recourse if they’re scammed or lose funds. This underground market exists because people need to protect their savings from inflation and a broken banking system.

How does Iraq’s crypto ban compare to other countries?

Iraq is among only ten countries with a total crypto ban. Unlike China, which restricts exchanges but allows private ownership, Iraq blocks all institutional access and targets consumer tools like payment cards and e-wallets. It’s stricter than most, even in the Middle East. Neighboring countries like Saudi Arabia and the UAE have regulatory frameworks - Iraq has a wall.

Could Iraq change its crypto policy in the future?

Unlikely in the near term. The Central Bank of Iraq is focused on launching its own CBDC, not regulating private crypto. The government sees digital assets as a threat to control, not an opportunity. Without major political or economic shifts - like a new constitution or a surge in public pressure - the ban will remain. The future of money in Iraq will be state-controlled, not decentralized.

Rachel Thomas

November 27, 2025 AT 13:50This is wild-Iraq bans crypto but people still trade it like it’s 2014? LOL. I mean, if your money’s falling apart, why not just grab Bitcoin? The government’s acting like a toddler hiding the cookies while everyone’s starving.

Sierra Myers

November 28, 2025 AT 02:09Actually, it’s not that surprising. Look at Nigeria and Venezuela-when your currency’s trash, crypto becomes the only real bank. The CBI’s just scared because they can’t control it. And now they’re building their own digital currency? Classic move. Surveillance disguised as progress.

Tina Detelj

November 28, 2025 AT 04:12Ohhh, this is the tragedy of modern sovereignty in action! A nation so desperate to cling to control that it suffocates its own people’s survival instincts! 🌪️ The Central Bank isn’t protecting the economy-it’s guarding a crumbling castle while the citizens build bridges out of blockchain and WhatsApp QR codes! The CBDC? A digital leash with a fancy logo! It’s not innovation-it’s authoritarianism in beta! And let’s be real: when your only hope is a decentralized ledger because your banks are bankrupt and your dinar’s a joke… that’s not rebellion. That’s evolution. Forced. Beautiful. Terrifying. And utterly human.

Wilma Inmenzo

November 29, 2025 AT 19:03CBDC?? OF COURSE IT’S A TRACKING DEVICE!! They’re gonna use it to freeze your account if you buy medicine for your sick kid!! And don’t you DARE think this isn’t tied to the CIA or the IMF or the Illuminati!! They’ve been planning this since 2017!! The ‘haram’ fatwa? A distraction!! The real goal? To make every Iraqi a digital slave with a spending cap!! You think they don’t know your every click?? THEY DO!! THEY’RE WATCHING RIGHT NOW!!

Tony spart

November 30, 2025 AT 18:14USA would never let some third world country tell us what to do with money. Iraq’s a mess because they let Islam and corruption run things. Crypto’s for smart people, not peasants who can’t even keep their own currency stable. If you can’t handle your money, don’t blame the tech. Fix your government. And stop crying about it.

Abby cant tell ya

December 1, 2025 AT 05:41Wow. Just… wow. People are risking everything for Bitcoin while the government’s building a surveillance state? And you call that ‘adaptation’? No. That’s desperation dressed up like a tech trend. You’re not a revolutionary-you’re a sucker. And the CBI? They’re not evil. They’re just trying to stop you from ruining yourself. Wake up. Crypto isn’t freedom. It’s a trap.