When China shut down Bitcoin mining in 2021, the entire global crypto landscape shifted overnight. Over 75% of the world’s Bitcoin mining power was concentrated in China just a year earlier. Then, in a matter of months, it vanished. Not because the machines broke. Not because miners gave up. But because they packed up and left.

Why China Banned Crypto Mining

China didn’t just discourage mining-it made it illegal. In 2021, the central government moved beyond targeting crypto trading and went straight for the source: the machines. Provincial bans started in Inner Mongolia, where coal-powered mines were eating up too much electricity. Then came the nationwide order: no more Bitcoin mining. The message was clear-energy-intensive industries were a threat to China’s carbon neutrality goals. And mining rigs, running 24/7, were seen as wasteful and uncontrolled. Unlike other countries that taxed or regulated mining, China simply turned off the power. Miners got weeks, sometimes days, to shut down. Thousands of farms, some with tens of thousands of ASIC machines, had to move fast. There was no time to build new data centers or negotiate long-term power deals. They needed a place with cheap electricity, reliable grids, and no legal risk. And they found it.Kazakhstan: The First Safe Harbor

Kazakhstan didn’t plan to become the world’s second-largest Bitcoin mining hub. It just happened. With vast coal reserves and underused power infrastructure, the country had the energy to spare. When Chinese miners started crossing the border with shipping containers full of rigs, Kazakhstan didn’t ask questions. It welcomed them. Between 2019 and 2021, Kazakhstan’s share of global Bitcoin mining jumped from 1.4% to over 18%. By October 2021, it briefly overtook China in total hashrate. The country’s power grid, already stretched thin from industrial use, suddenly had to handle a new kind of demand. Power outages followed. Some local residents complained about rolling blackouts. But the government saw opportunity. Mining brought tax revenue, foreign investment, and a reason to upgrade transmission lines. Still, the reliance on coal raised red flags. Environmental groups warned that the exodus didn’t reduce emissions-it just moved them. A mining farm in Kazakhstan using coal power might have the same carbon footprint as one in Inner Mongolia. The decentralization of Bitcoin didn’t make it greener. It just spread the pollution.Texas: The Renewable Alternative

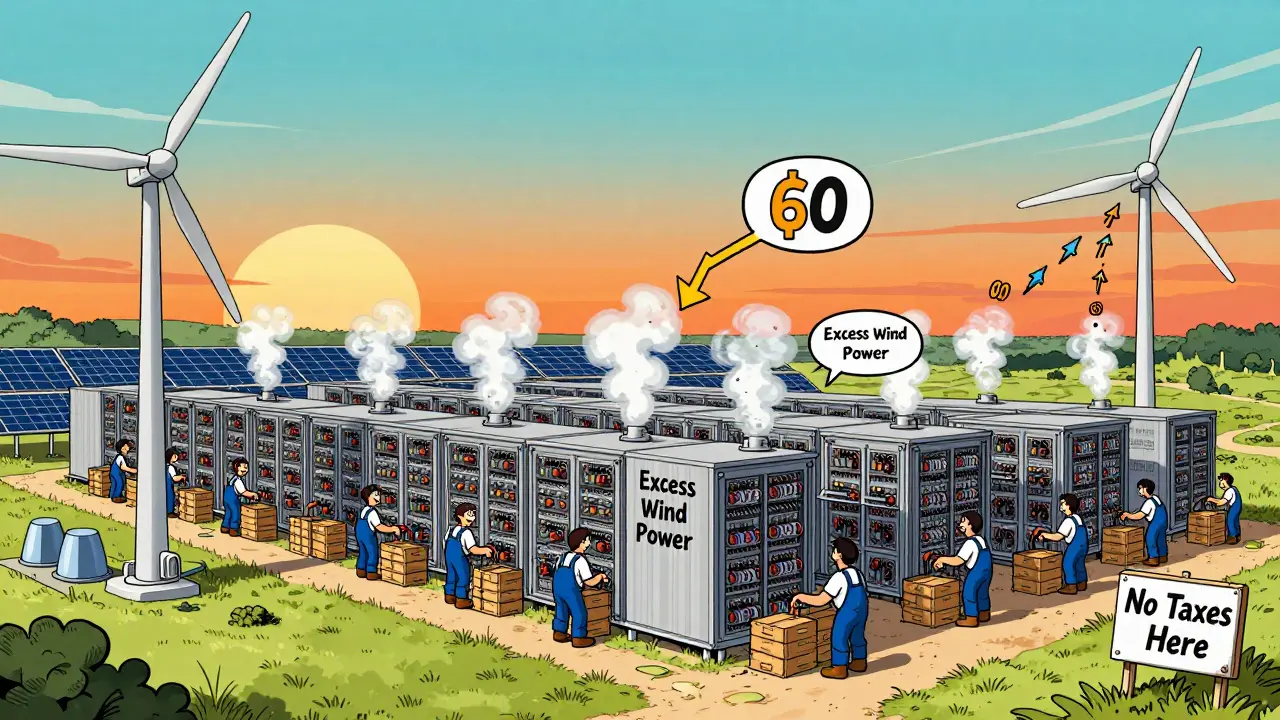

While Kazakhstan took the bulk of the hardware, Texas took the spotlight. Why? Because it offered something Kazakhstan couldn’t: access to clean energy. Texas has a deregulated power market. That means miners can buy electricity directly from generators, often at night when demand is low and prices drop. Wind farms in West Texas produce more power than the state can use during peak wind hours. Instead of wasting it, grid operators pay miners to use the excess. Miners plug in, run their rigs, and shut down when the grid needs the power back. It’s called demand response-and it’s turning Bitcoin mining into a grid stabilizer. By 2025, Texas hosts about half of all Bitcoin mining in the U.S.-roughly 2.6 gigawatts of power. That’s more than the entire country of Germany uses for mining. Companies like Riot Platforms, Marathon Digital, and CleanSpark built massive campuses in places like Fort Worth, Abilene, and Rockdale. Some are powered by 80% renewable energy. Others use stranded natural gas that would’ve been flared off. The state doesn’t tax mining. It doesn’t regulate it. It just lets the market decide. The result? Texas has seen new transmission lines built, power plant upgrades funded, and local jobs created. Miners aren’t just energy consumers-they’re infrastructure partners.

Other Key Destinations

Not every miner went to Kazakhstan or Texas. Some headed to Russia, where energy is cheap and the government has stayed quiet on mining. Others moved to Iran, where subsidized electricity and U.S. sanctions made mining a way to bypass financial restrictions. Canada saw a small influx, especially in Quebec, where hydropower is abundant and clean. Georgia and Malaysia also picked up a few operations, though neither came close to matching the scale of Kazakhstan or Texas. One surprising winner? Paraguay. With massive hydroelectric dams and low electricity rates, it attracted miners looking for stable, renewable power. One farm in Ciudad del Este now runs on 100% hydropower, with no emissions and no regulatory interference. The pattern was simple: miners went where electricity was cheap, reliable, and legal. Not where it was trendy. Not where it was popular. Where it was available.How Miners Moved So Fast

You can’t move a data center like a couch. But you can move a Bitcoin mining rig like a refrigerator. Each ASIC miner is a self-contained box-about the size of a small printer, weighing 30 to 40 pounds. They don’t need complex cooling systems. Just air, power, and internet. That’s it. Miners didn’t need to rebuild entire facilities. They just loaded the machines onto trucks, shipped them across borders, plugged them in, and turned them on. The entire relocation process took less than six months. Some farms moved in under 30 days. The machines were disconnected in Inner Mongolia, shipped to Kazakhstan, reconnected, and mining again-all before the Chinese authorities even finished their inspection rounds. This mobility is what makes Bitcoin mining unique. It’s not tied to factories, supply chains, or labor markets. It’s pure capital and electricity. If the rules change, you move. No lawsuits. No unions. No permits. Just plug and play.

Sammy Tam

December 17, 2025 AT 16:04Man, I remember when my buddy tried to run a rig in his garage in Texas. Thought he’d hit the jackpot. Ended up with a $2k electric bill and a neighbor knocking on his door asking if he was growing weed. Then he found out about demand response-now he’s basically getting paid to let his miners chill at night. Wild how the market just figured it out.

Bitcoin mining’s not evil, it’s just… opportunistic. And honestly? Kinda brilliant. If you’ve got spare wind power rotting away, why not let some rigs turn it into digital gold? It’s like nature’s version of a garage sale.

Chevy Guy

December 19, 2025 AT 05:43they told you it was about carbon neutrality but really they just didnt want you making money without their permission

next theyll ban your toaster for using too much power

Amy Copeland

December 19, 2025 AT 08:50Oh please. Let me guess-you think Texas is some libertarian utopia where miners are saving the grid? Please. They’re just exploiting deregulation to avoid paying for infrastructure. And calling it ‘renewable’ when it’s mostly wind that’s already being curtailed? That’s not sustainability. That’s greenwashing with ASICs.

Meanwhile, Kazakhstan’s coal mines are still spewing soot like it’s 2010. This isn’t decentralization-it’s environmental arbitrage. And you’re all clapping like it’s a TED Talk.

Abby Daguindal

December 21, 2025 AT 04:48It’s fascinating how people romanticize this as ‘freedom.’ The truth? Miners are nomadic capital. They don’t care about communities, regulations, or sustainability. They care about kilowatts per dollar. And when the next country cracks down-which it will-they’ll just move again. This isn’t innovation. It’s a race to the bottom, with electricity as the prize.

And yes, I’m aware this sounds like a lecture. I’m just tired of hearing it framed as a victory.

Heather Turnbow

December 23, 2025 AT 04:10While I understand the economic incentives behind this migration, I find myself reflecting on the human cost of such rapid, unregulated expansion. Communities in Kazakhstan have experienced power shortages that impacted schools and hospitals. Meanwhile, in Texas, local governments are left to manage the environmental and infrastructural strain without adequate oversight.

Decentralization may strengthen Bitcoin’s network, but it does not absolve us of responsibility toward the places that host this activity. We must ask: who bears the burden, and who reaps the reward? The answer is rarely the same.

Jesse Messiah

December 24, 2025 AT 12:54big props to the miners who just packed up and moved like pros. no drama, no lawsuits, just got their gear on trucks and found a new home.

imagine if all industries were this adaptable. we’d have way fewer broken systems. also texas is kinda wild for letting this happen-no red tape, just power and plug. love it or hate it, its capitalism with a pulse.

Rebecca Kotnik

December 25, 2025 AT 11:04The structural implications of this migration are profound and deserve deeper consideration. The redistribution of hash power has not merely altered geographic concentration-it has redefined the relationship between energy infrastructure and digital sovereignty.

Where once a centralized state could exert control over a critical node of the global financial system, now that node is fragmented across jurisdictions with divergent regulatory philosophies. This has created a new kind of resilience, one that is not technological but institutional. The network survives not because of superior cryptography, but because it is politically uncontainable.

One might argue this is the ultimate expression of decentralization: not just in code, but in geography, governance, and energy policy. The irony is not lost that the very force that sought to suppress it-China’s authoritarian control-ultimately catalyzed its global entrenchment.

Jonny Cena

December 26, 2025 AT 18:06really cool to see how miners turned a crisis into a global upgrade. it’s like nature’s version of adaptive evolution.

and honestly? texas is kinda the MVP here. using wasted wind to power rigs instead of letting it go to waste? that’s smart. not just for profit, but for the grid. it’s not just mining-it’s energy choreography.

to everyone panicking about coal in kazakhstan-yeah, it’s not perfect. but at least now there’s competition. if one place becomes too dirty, miners will leave for cleaner options. that’s the market working.

Kayla Murphy

December 27, 2025 AT 16:34you know what’s wild? this whole thing proves that if you build something decentralized enough, you can’t kill it-you can only move it.

china thought they were shutting down a threat. instead, they turned bitcoin into a global phenomenon. now it’s stronger, smarter, and spread out like wildfire.

keep going, miners. you’re not just running rigs-you’re rewriting the rules.

Florence Maail

December 29, 2025 AT 03:26they said it was about the environment... but now texas is getting richer while the planet still burns? 😒

and don't even get me started on how the 'renewables' are just a loophole for billionaires to use wind when no one else wants it. it's not clean-it's convenient.

also... who's to say china didn't just move mining to underground labs? they're not dumb. they're just playing 4d chess. 🤔