Nigeria Crypto Exchange License Checker

Check if Your Exchange is Licensed

Verify if a crypto exchange is legally operating in Nigeria according to SEC regulations as of 2025.

Important: As of August 2025, only Quidax and Busha have full SEC licensing. All other exchanges are unlicensed and carry significant risks including frozen accounts and lost funds.

If you're a Nigerian using crypto in 2025, your biggest risk isn't price drops or scams-it's regulatory crackdowns. The Nigerian government isn't banning crypto. It's cleaning house. And if you're still using unlicensed exchanges, you're playing with fire. Your bank account could freeze. Your funds could vanish. And getting them back? That’s a months-long nightmare.

Why This Matters Right Now

In February 2021, the Central Bank of Nigeria (CBN) told banks to cut off crypto exchanges. That caused chaos. People turned to peer-to-peer (P2P) trading. Volume exploded. Nigeria became the second-largest Bitcoin trading market in the world. Then, in December 2023, the CBN reversed course. They said banks could work with crypto firms-if those firms got licensed. That was the first sign things were changing. By March 2025, the Investments and Securities Act (ISA 2025) kicked in. This law made it clear: no license, no business. The Securities and Exchange Commission (SEC) now has full power to freeze assets, shut down operations, and seize property from any exchange operating without approval. The message is simple: if your exchange isn’t on the SEC’s official list, it’s illegal. And if you trade on it, you’re at risk.Exchanges You Must Avoid

As of August 2025, only two exchanges have full SEC licensing: Quidax and Busha. That’s it. Every other platform-even the big global names-is operating illegally in Nigeria. That includes:- Bybit

- KuCoin

- Binance P2P

- Gate.io

- OKX

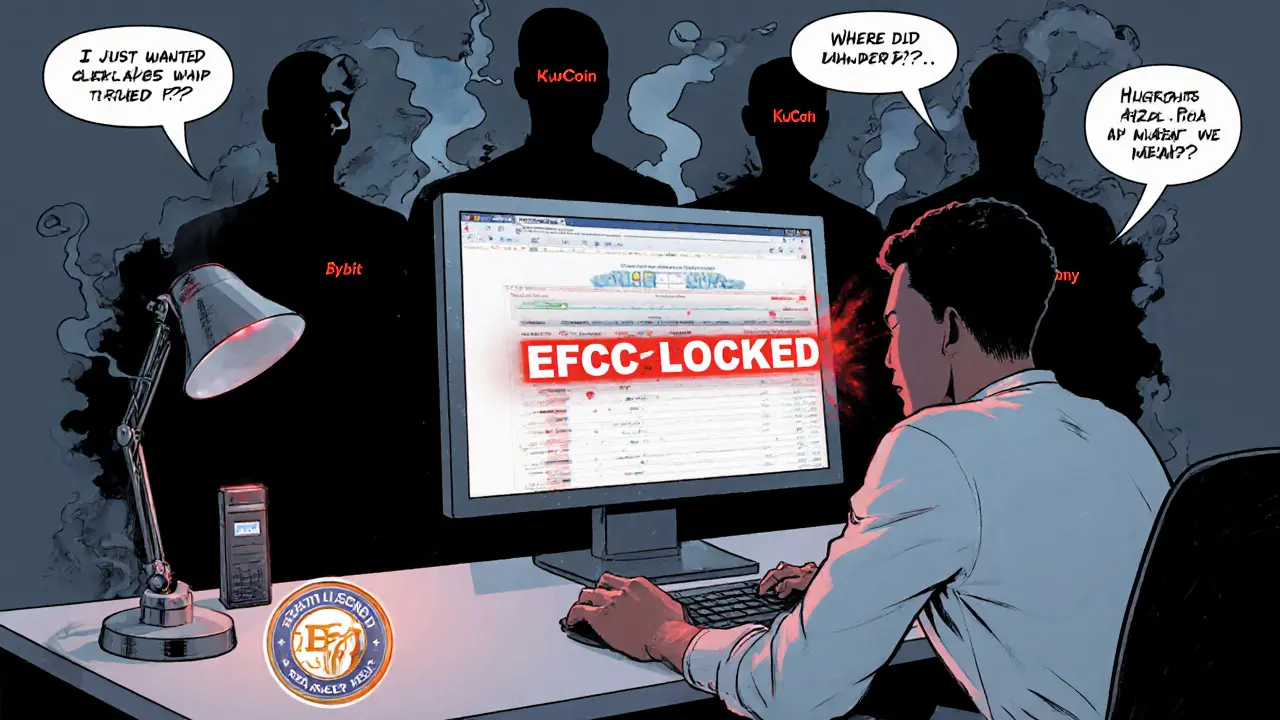

What Happens When You Use an Unlicensed Exchange

It’s not just about losing money. It’s about losing control. When you deposit Naira into an unlicensed exchange, you’re not depositing into a Nigerian company. You’re sending money to an offshore shell company-probably in Seychelles or Malta. When the EFCC freezes your account, they don’t know who to contact. There’s no local office. No customer service line. No legal recourse. Real stories prove this:- On Reddit, user u/LagosTrader89 lost ₦2.4 million after EFCC froze their account for trading on KuCoin. It took 47 days and 12 visits to recover just 63%.

- A Nairaland thread titled “My ₦5m frozen by EFCC for Bybit trading” had over 1,200 replies. 78% of users said recovery took more than 30 days. 41% never got their full money back.

What Makes a Licensed Exchange Safe

Quidax and Busha aren’t just licensed. They’re built to meet Nigeria’s strict rules. Here’s what they do that others don’t:- SEC-mandated insurance: Up to ₦50 million per user account if something goes wrong.

- Naira integration: Deposit and withdraw Naira directly. No P2P middlemen.

- Biometric KYC: You must verify your identity using your National Identification Number (NIN). No bypassing this.

- Real-time monitoring: Suspicious transactions are flagged in under half a second.

- Local legal entity: Quidax is “Quidax Technologies Limited” (RC1782456). Busha is “Busha Fintech Limited” (RC1834562). You can check both in the Corporate Affairs Commission (CAC) registry.

The Cost of “Cheaper Fees”

Unlicensed exchanges often boast lower trading fees-sometimes 0.15% vs. 0.25% on licensed platforms. That sounds good, right? But here’s the catch: that 0.1% savings is meaningless if your account gets frozen and you lose access to your funds for months. Reddit threads from r/NigeriaInvest and r/CryptoNaija show users on unlicensed platforms reported 87% more account freezing incidents between January and September 2024. That’s not a small risk. That’s a deal-breaker. And when you use P2P trading on unlicensed platforms-which 92% of Nigerian crypto volume still relies on-you’re bypassing all protections. No KYC. No monitoring. No recourse. That’s why 78% of EFCC’s flagged transactions in Q3 2024 came from unverified P2P trades.How to Check if an Exchange Is Safe

Don’t guess. Don’t rely on YouTube videos or Telegram groups. Do this:- Go to sec.gov.ng/crypto-exchanges. This is the SEC’s official, weekly-updated list. Only Quidax and Busha are on it as of August 2025.

- Check the CAC registry. Search for the exchange’s legal name. If it doesn’t exist as a Nigerian company, walk away.

- Look for the “CBN Verified” badge on their Nigerian website. Test it by texting “VERIFY [name]” to 20255.

- Make sure the KYC process asks for your NIN. If it doesn’t, it’s not compliant.

What About Decentralized Exchanges (DEXs)?

Some people are switching to Uniswap, PancakeSwap, or other DEXs to avoid regulation. That’s a trap. DEXs have no customer support. No dispute process. No insurance. No legal entity. If you send crypto to the wrong address? Gone forever. If you get hacked? No one helps. The Nigerian Cybersecurity Experts Forum reported a 34% spike in DEX usage since ISA 2025. But they also warned: “These platforms offer zero protection. They’re not safer-they’re riskier.”What’s Next for Nigeria’s Crypto Market

The SEC is ramping up enforcement. By September 2025, automated systems will freeze assets from unlicensed exchanges within 15 minutes of detection. The EFCC’s crypto unit has grown from 15 to 47 agents. Their goal? Shut down every unlicensed platform by Q4 2025. Market analysts predict 98% of Nigerian crypto users will be on licensed platforms by Q2 2026. The shift is real. The rules are clear. The risks are high.Final Advice

If you’re still using Bybit, KuCoin, Binance P2P, or any other unlicensed exchange in 2025, you’re not being clever. You’re being vulnerable. Your money isn’t safe just because it’s digital. It’s safe because the system protecting it is legal, accountable, and regulated. Switch to Quidax or Busha. Use their Naira integration. Enable full KYC. Keep your funds where the law protects them. The crypto boom in Nigeria isn’t over. It’s just getting serious. And if you want to keep your money, you play by the rules.Can I still use Binance in Nigeria?

No. Binance P2P is not licensed by Nigeria’s SEC as of August 2025. While Binance Global still operates as a platform, its P2P trading feature-which most Nigerians use-is unregulated and targeted by enforcement actions. The EFCC has frozen accounts linked to Binance P2P transactions. Using it puts your bank account and funds at risk.

What happens if my account gets frozen?

If your account is frozen by the EFCC for trading on an unlicensed exchange, you’ll need to visit their offices in person, provide transaction records, and prove your funds weren’t from illegal activity. Recovery can take 30 to 90 days. Many users never recover 100% of their funds. Licensed exchanges have dispute teams that resolve issues in under 4 days.

Is Quidax and Busha the only options?

As of August 2025, yes. Only Quidax and Busha have received full SEC licensing. Other exchanges are applying, but none have been approved yet. Any platform claiming to be licensed outside this list is misleading you. Always check the SEC’s official registry at sec.gov.ng/crypto-exchanges.

Can I withdraw Naira from licensed exchanges?

Yes. Quidax and Busha allow direct Naira withdrawals to your Nigerian bank account. There’s no need to use P2P traders. The process is fast, secure, and regulated. Minimum deposit is ₦1. Withdrawals are processed within 24 hours, and the SEC requires exchanges to guarantee fund availability.

Why did the CBN change its mind about crypto?

The CBN realized banning crypto pushed users into risky, unregulated P2P markets. In 2023, they shifted to a licensing model to bring crypto into the formal financial system. This allows them to track transactions, prevent money laundering, and protect consumers. Now, banks can legally support licensed exchanges-only those with SEC approval.

Martin Doyle

November 27, 2025 AT 03:23Bro, this is the most accurate take I’ve seen all year. I used Binance P2P for 2 years and got my account frozen last June. Took 58 days, 3 visits to EFCC, and a lawyer’s letter to get half my money back. No one warned me. No one cared. Now I’m on Quidax and it’s boring as hell-but my funds are safe. That’s the win.

Stop chasing 0.1% fee savings. That’s like avoiding seatbelts because the car’s interior looks nicer.

Susan Dugan

November 27, 2025 AT 13:31Y’all are acting like this is some new revelation, but the writing’s been on the wall since 2021. The CBN didn’t flip-flop-they evolved. Nigeria’s crypto scene was a wild west with zero guardrails. Now? We’re finally growing up.

Quidax and Busha? They’re not sexy. They don’t have meme coins or 100x launches. But they’ve got legal teeth. And guess what? That’s what keeps your money from vanishing into a Seychelles black hole.

Also-texting ‘VERIFY’ to 20255? That’s next-level smart. I wish the US had something like that. 🙌

SARE Homes

November 27, 2025 AT 19:35Grace Zelda

November 28, 2025 AT 16:36Okay but… why are we still treating crypto like it’s a bank? It’s not. Even licensed exchanges don’t hold your money the way a bank does. They’re just intermediaries with better compliance.

And DEXs? Yeah, they’re terrifying-but not because they’re unregulated. Because they’re *true* decentralization. No one can freeze your wallet. No one can reverse your tx. That’s not a flaw-it’s the point.

Maybe the real question isn’t ‘Which exchange is safe?’ but ‘Do I want safety… or sovereignty?’

I use Busha for Naira swaps. I use Uniswap for everything else. I accept the risks on both sides. And I don’t cry when things go sideways. I just move on.

That’s the mindset shift Nigeria needs: not just regulation… but responsibility.

Sam Daily

November 30, 2025 AT 16:00Love this breakdown. Seriously. I used to think ‘licensed’ meant ‘boring’-until I lost $800 on KuCoin and spent 6 weeks begging for help.

Now I use Busha. Their Naira deposit takes 2 minutes. Withdrawal? 14 hours max. And they actually reply to tickets-like, within 8 hours. No joke.

Also, the ‘CBN Verified’ badge? I tested it. Texted ‘VERIFY Busha’ to 20255. Got back: ‘BUSHA FINTECH LIMITED is licensed by SEC Nigeria. RC1834562. Verified.’

That’s the kind of transparency we need. Not hype. Not memes. Just facts.

PS: If you’re still using Binance P2P… I feel bad for you 😔