Cypriot Crypto Exchange Checker

Check Licensed Exchanges

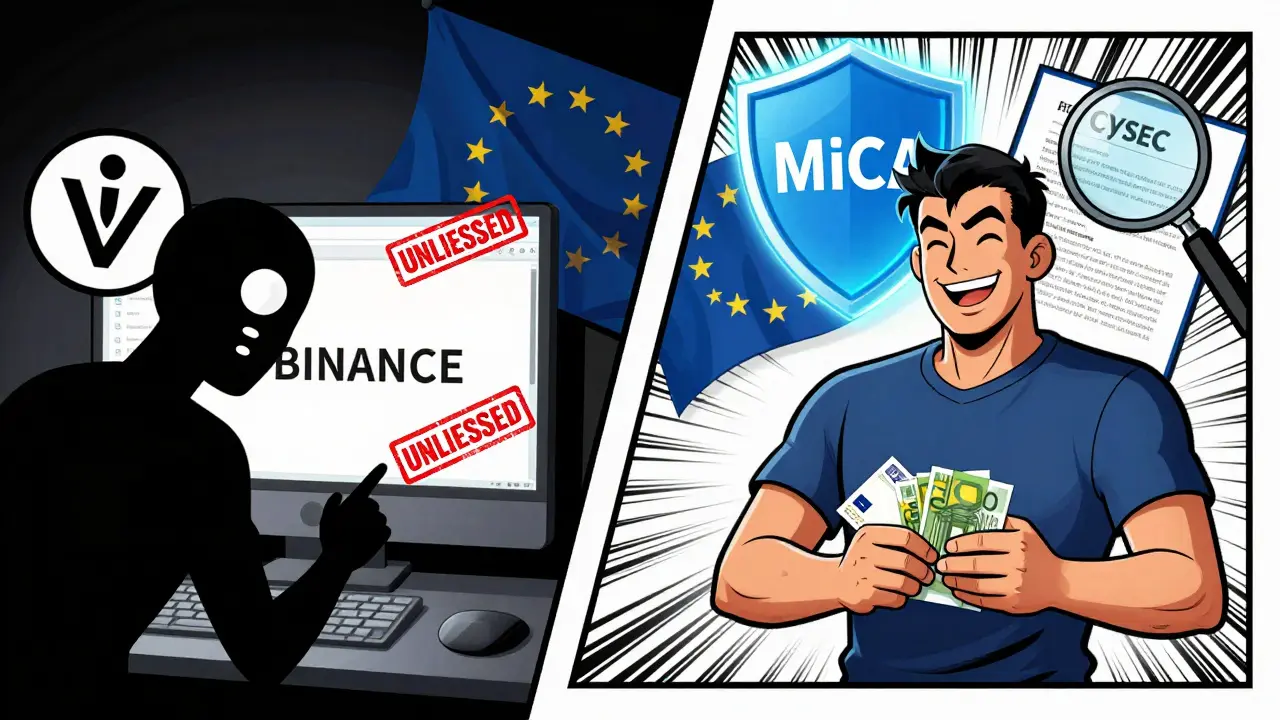

Verify if a crypto exchange is licensed by CySEC for use in Cyprus under EU MiCA regulation

Licensed Exchanges in Cyprus

All regulated platforms must be listed on the CySEC CASP Register

⚠️ Warning: Unlicensed exchanges don't follow EU AML rules and aren't protected by CySEC

When you live in Cyprus and want to buy Bitcoin, trade Ethereum, or hold stablecoins, you don’t need to hunt for shady platforms or use VPNs. The system is built in - legal, clear, and regulated. Cypriots access cryptocurrency exchanges through licensed providers that follow strict EU rules, not loopholes. There’s no guesswork. If you’re in Cyprus, you’re covered by the same crypto rules as someone in Germany or France - and that’s actually a good thing.

Regulation Isn’t a Barrier, It’s the Pathway

Many people think regulation means restrictions. In Cyprus, it means safety. The Cyprus Securities and Exchange Commission (CySEC) is the gatekeeper. Since 2024, all crypto exchanges serving Cypriots must be licensed under the EU’s Markets in Crypto-Assets (MiCA) regulation. This isn’t optional. It’s law. And because Cyprus is part of the EU, any platform licensed in Cyprus can operate across the entire bloc. That means Cypriots have access to dozens of EU-wide exchanges that meet the same high standards.Before MiCA, some local firms tried to operate under Cyprus’s old national rules. Now, CySEC has stopped accepting new applications under those outdated laws. All new and existing crypto service providers had to switch to MiCA compliance by December 30, 2024. If a platform isn’t on CySEC’s official CASP register, it’s not legal to serve Cypriots - and using it puts you at risk.

What You Need to Do to Get Started

Getting started is straightforward. You don’t need special tools or tricks. Just follow these steps:- Go to the CySEC CASP Register and find a licensed provider.

- Choose a platform that offers the coins you want - Bitcoin, Ethereum, Solana, or stablecoins like USDT.

- Sign up with your government-issued ID and proof of address.

- Complete the KYC process. For transactions over €1,000, you’ll need to verify your identity. That’s standard across the EU.

- Deposit funds via bank transfer, SEPA, or a supported payment method.

- Start trading or holding your crypto.

Some platforms let you use your Cyprus ID card. Others ask for a passport. But you won’t be asked for anything unusual. No fake documents. No offshore bank accounts. Just your real ID and a clear paper trail.

What Payment Methods Work Best?

Cypriots mostly use SEPA bank transfers. It’s fast, cheap, and trusted. Most licensed exchanges support SEPA deposits and withdrawals. Some also accept debit or credit cards, but those often come with higher fees. You’ll rarely see crypto-to-crypto on-ramps like peer-to-peer (P2P) platforms promoted by licensed providers - they’re too risky under MiCA’s AML rules.Local banks in Cyprus don’t block crypto transactions. The Central Bank of Cyprus has never banned them. In fact, they’ve made it clear: crypto isn’t legal tender, but using it through regulated channels is perfectly fine. Your bank won’t freeze your account if you deposit euros into a CySEC-licensed exchange. That’s a big difference from countries where banks shut down crypto-related accounts.

Taxation: No Capital Gains, No Headaches

One of the biggest reasons Cypriots are active in crypto is taxes. As of 2025, Cyprus does not tax capital gains from selling or exchanging cryptocurrencies. That’s the same rule that applies to stocks, real estate, and other investments. If you buy Bitcoin at €20,000 and sell it at €30,000, you keep the full €10,000 profit. No government cut.This isn’t a loophole. It’s official policy. The Cyprus Income Tax Law doesn’t classify crypto as a taxable asset unless it’s used in business or generates regular income (like staking rewards). Even then, the rules are clear and predictable. Compare that to countries where crypto gains are taxed at 30% or more - Cyprus is a quiet advantage.

Who’s Running the Exchanges Cypriots Use?

You won’t find local Cypriot-only exchanges like “CryptoCyprus.com.” That’s not how MiCA works. Instead, Cypriots use well-known EU-licensed platforms. These include:- Bitstamp - Licensed in Luxembourg, widely used in Cyprus.

- Kraken - Registered with CySEC under MiCA, offers EUR deposits.

- Bybit - Licensed in Cyprus since 2024, supports SEPA.

- OKX - Holds a CySEC CASP license for EU clients.

- Coinbase - Operates under MiCA through its EU entity.

These aren’t random picks. They’re all on CySEC’s public register. You can verify each one. No need to trust forum rumors. If a platform says it’s licensed for Cyprus, check the register. If it’s not there, it’s not legal.

What About Privacy? Can You Stay Anonymous?

No. And that’s by design. MiCA requires full identity verification for anyone trading over €1,000. That means your name, address, ID, and transaction history are recorded. You can’t bypass this. Even if you try to use a non-licensed platform, you’re breaking the law - and exposing yourself to fraud, scams, or frozen funds.Some users think anonymity means freedom. In Cyprus, it means danger. The Unit for Combating Money Laundering (MOKAS) monitors all suspicious activity. If a licensed exchange flags your account for unusual behavior, MOKAS can investigate. That’s not surveillance - it’s protection. It stops criminals from using Cyprus as a crypto hub for illegal activity.

What If You’re Not in Cyprus Anymore?

If you move to another EU country, your CySEC-licensed account stays valid. MiCA lets you keep using the same platform anywhere in the EU. If you move outside the EU, you’ll need to check the rules of your new country. But within the bloc, your access doesn’t change. That’s the power of EU-wide regulation.What’s Next for Cyprus and Crypto?

CySEC’s Innovation Hub is actively working with crypto firms to shape future rules. That means Cyprus isn’t just following EU laws - it’s helping shape them. Expect more support for tokenized assets, DeFi integrations, and blockchain-based identity tools in the coming years. But the core rule won’t change: if you want to access crypto in Cyprus, you do it through licensed, regulated platforms.There’s no underground scene. No need to find unregulated apps. The system is open, transparent, and designed for everyday users. You don’t need to be a tech expert. You just need to know where to look - and that’s the CySEC register.

How to Stay Safe

Here’s what to do every time you use a crypto exchange in Cyprus:- Always verify the platform is on the official CySEC CASP Register.

- Never send funds to a platform that doesn’t offer KYC or claims to be “anonymous.”

- Use only SEPA or direct bank transfers - avoid third-party payment processors.

- Enable two-factor authentication on your account.

- Keep records of all transactions for tax purposes, even if no tax is due.

Most Cypriots who use crypto do it safely because they stick to the rules. They don’t chase promises of high returns from unlicensed apps. They don’t risk their savings on platforms that vanish overnight. They use the system that works - and it works well.

Can Cypriots use Binance?

No. Binance is not licensed under MiCA in Cyprus and is not on CySEC’s CASP register. While Binance used to serve Cypriots before 2024, it stopped offering services to EU residents after failing to obtain a MiCA license. Cypriots should avoid Binance and use only platforms listed on the official CySEC register.

Is it legal to use a VPN to access non-EU exchanges?

Technically, using a VPN to access an unlicensed exchange isn’t illegal by itself - but doing so puts you at serious risk. The exchange won’t be regulated, so your funds aren’t protected. If the platform shuts down or gets hacked, you have no recourse. Cyprus law requires licensed providers to safeguard client assets. Unlicensed ones don’t. Plus, if you’re caught using an unlicensed platform for large transactions, MOKAS may investigate you for potential money laundering.

Do Cypriot banks block crypto transactions?

No. Cypriot banks, including Bank of Cyprus and Hellenic Bank, do not block transfers to CySEC-licensed crypto exchanges. The Central Bank of Cyprus has confirmed that crypto transactions through regulated platforms are permitted. However, banks may flag transfers to unlicensed or offshore platforms for review - not because crypto is banned, but because those platforms are high-risk.

Are there local Cypriot crypto exchanges?

There are no major local exchanges based only in Cyprus. Instead, Cypriots use EU-wide platforms licensed by CySEC. These include Bitstamp, Kraken, Bybit, and Coinbase. These platforms serve customers across Europe, including Cyprus, under the same MiCA rules. There’s no need for a local-only exchange because the EU system already covers Cyprus.

What happens if I trade on an unlicensed exchange?

You’re not breaking the law just by trading - but you’re putting your money at risk. Unlicensed exchanges don’t have to follow AML rules, protect your funds, or provide customer support. If the platform disappears, you lose everything. Worse, if you make large transactions, MOKAS might flag your account for investigation. It’s not worth the risk when licensed options are safe, reliable, and just as easy to use.

Accessing crypto in Cyprus isn’t about bypassing rules. It’s about using the ones that protect you. The system is simple: find a licensed exchange, verify your identity, deposit euros, and trade. No tricks. No gray areas. Just clear, legal access to the global crypto market.

Murray Dejarnette

December 5, 2025 AT 21:41This is insane. I’ve been trying to buy BTC through some sketchy P2P app for months and now I find out Cypriots just log into Kraken like it’s Starbucks? No VPNs? No drama? I’m jealous. Like, physically jealous. Why does Europe get to have it this easy?

Lawal Ayomide

December 6, 2025 AT 21:18Regulation = safety? Nah. Regulation = control. They think they’re protecting you but they’re just making you obedient. I’ve seen this in Nigeria too - they call it ‘financial inclusion’ but it’s just gatekeeping with a nice logo.

Christy Whitaker

December 7, 2025 AT 03:52So you’re telling me you just… verify your ID and trade? No hidden fees? No ‘we’re not responsible if you lose everything’ fine print? This sounds like a scam. Someone’s lying.

Sarah Locke

December 7, 2025 AT 18:11Y’all need to hear this. This is what responsible innovation looks like. No chaos. No cowboy crypto. Just clear rules, licensed platforms, and your money actually protected. This isn’t boring - this is *power*. Imagine if every country had this level of clarity. We’d be saving people from scams daily. 🙌

Philip Mirchin

December 8, 2025 AT 07:59As a guy who’s lived in 5 countries, this is the first time I’ve seen crypto regulation actually work for the user. Not against them. Not for bureaucrats - for the guy who just wants to buy ETH without getting scammed. Cyprus nailed it. Respect.

Maggie Harrison

December 9, 2025 AT 16:04NO CAPITAL GAINS TAX?? 😍 I’m crying. I just sold my SOL and paid 30% in taxes. Meanwhile, Cypriots are sipping coffee with 10k profit in their pocket. This is the crypto dream. 🌊☕️

Catherine Williams

December 11, 2025 AT 03:16So if I move to Spain next year, my Kraken account still works? No re-KYC? No switching platforms? That’s the real win here. EU-wide access is the future. This isn’t just good for Cyprus - it’s a blueprint for the whole world.

Paul McNair

December 11, 2025 AT 21:24People keep saying ‘regulation kills innovation’ - but look at this. Innovation is thriving *because* of regulation. You get security, transparency, and real consumer protection. It’s not the opposite of freedom - it’s the foundation of it.

Ann Ellsworth

December 12, 2025 AT 16:29While the MiCA framework is indeed a paradigmatic advancement in crypto-asset governance, the assertion that Cyprus is uniquely ‘open’ is somewhat reductive. One must contextualize this within the broader EU regulatory architecture - and frankly, the absence of capital gains taxation is a fiscal anomaly that may not be sustainable beyond 2027. Also, ‘SEPA’ is not a payment method - it’s a payment *infrastructure*. Please, people, precision matters.

Nancy Sunshine

December 13, 2025 AT 20:23It’s remarkable how the legal clarity in Cyprus eliminates so much of the fear and uncertainty that plagues crypto adoption elsewhere. This model should be studied by every central bank. The combination of licensing, tax neutrality, and banking cooperation is a masterclass in policy design.