Base Chain Slippage Calculator

How Slippage Affects Your Trades

Slippage is the difference between the expected price of a trade and the actual execution price. On Base Chain, this can range from 0.4% to 1.2% depending on liquidity and token volatility. The article mentions that new tokens often have higher slippage.

Warning: Setting slippage too low (below 1-2%) can cause trades to fail for volatile memecoins. Setting it too high exposes you to price manipulation. For Base Chain tokens, 1-2% is recommended.

When you're trading new tokens on the Base blockchain, you need a DEX that moves fast and costs next to nothing. That’s where LaserSwap comes in. It’s not Binance. It’s not Uniswap. It’s something smaller, faster, and built just for Base users who want early access to memecoins and emerging projects. But is it safe? Is it worth your time? Let’s cut through the noise.

What Exactly Is LaserSwap?

LaserSwap is a decentralized exchange (DEX) running entirely on the Base network - Coinbase’s Layer 2 blockchain built on Ethereum. Unlike centralized exchanges where you hand over your keys, LaserSwap lets you trade directly from your wallet. No deposit. No KYC. Just connect MetaMask or Coinbase Wallet, approve a token, and swap.

It launched in 2024 and quickly became a go-to for traders hunting for new Base-native tokens before they hit bigger platforms. Think of it like a hidden alleyway in a busy market - not the main store, but where the best deals show up first.

It uses an Automated Market Maker (AMM) model, meaning trades happen through liquidity pools instead of order books. Every swap costs 0.3% in fees - 0.25% goes to liquidity providers, 0.05% to the protocol. That’s standard for DEXs. But here’s the kicker: gas fees on Base average just $0.01-$0.05 per trade. On Ethereum mainnet, you’d pay $1.50-$3.00 for the same swap. That’s why Base traders stick with LaserSwap.

How It Works: Simple, But Not for Beginners

Using LaserSwap isn’t hard - if you’ve used a DEX before. If you haven’t, you’re in for a learning curve.

Here’s the step-by-step:

- Get a Web3 wallet (MetaMask, Coinbase Wallet, or Rabby).

- Buy some Base-native ETH (ETH on Base, not Ethereum mainnet). You need this to pay gas.

- Go to laserswap.io and connect your wallet.

- Click ‘Swap’ - pick the token you want to trade and the one you want to get.

- Set your slippage tolerance (recommended: 1-2% for new tokens).

- Confirm the transaction in your wallet.

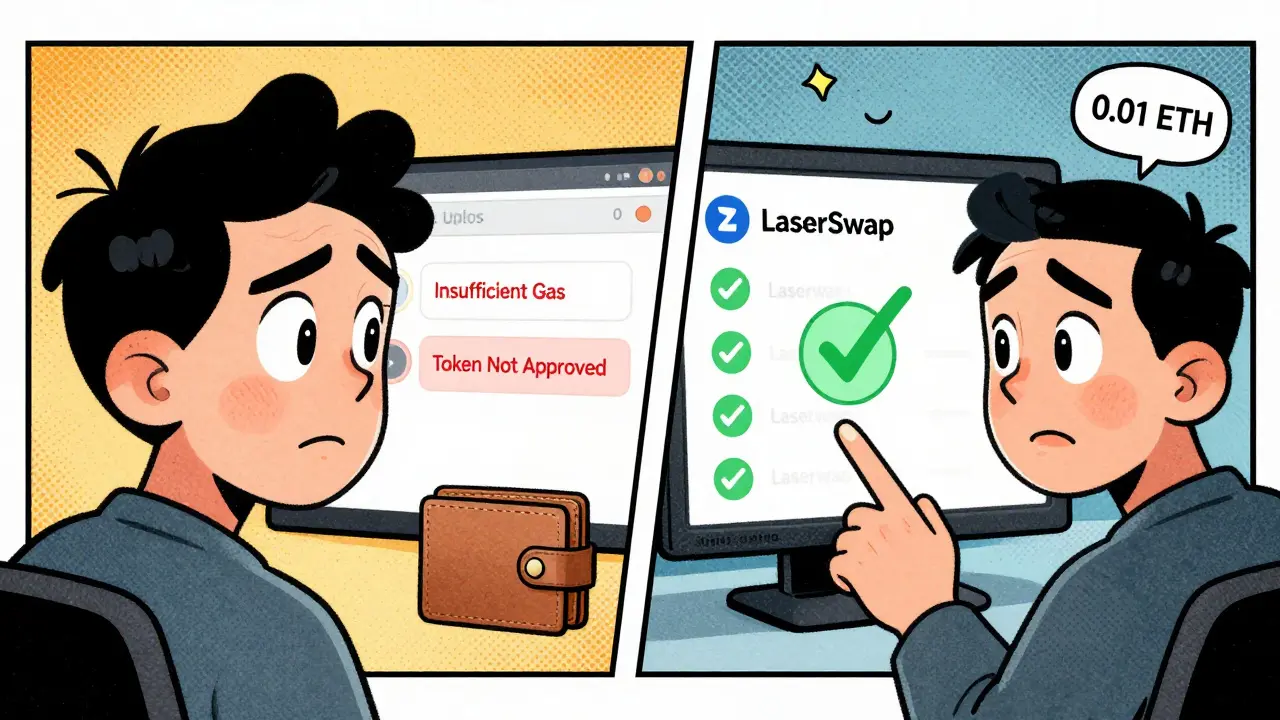

That’s it. But here’s where people get stuck:

- **Insufficient gas**: 22% of failed transactions are because users didn’t have enough Base ETH for fees.

- **Token approval errors**: 17% of support tickets are about not approving token spending first.

- **Slippage surprises**: New traders set 0.1% slippage for a memecoin and get rekt when the price jumps 5% during the swap.

Most users report it takes 2-3 hours to complete their first successful trade. There’s no 24/7 customer support. If you run into trouble, you’re on Discord. Response time? Around 4.7 hours on average.

Liquidity and Trading Volume: Niche, Not Massive

LaserSwap isn’t competing with Uniswap. It’s not even trying. As of November 2025, Uniswap handles $1.2 billion in daily volume. LaserSwap? $8.7 million.

That sounds tiny - and it is. But here’s the real story: LaserSwap dominates in one area - early-stage Base tokens. It was one of the first places to list Bonk Live (BONK) and other memecoins before they exploded. If you want to get in on a new project before it hits Coinbase or Binance, LaserSwap is often your only option.

But if you’re trading stablecoins like USDC or USDT? Bad idea. Slippage averages 1.2% on $10,000 trades. On Uniswap, it’s 0.4%. That’s a $120 loss vs. $40 on the same trade. Not worth it.

Token selection? Around 1,200 pairs. Uniswap has over 15,000. You won’t find major altcoins like SOL or ADA here. LaserSwap is focused on Base ecosystem tokens - the ones with low market caps and high volatility.

Security: Audited, But Not Bulletproof

LaserSwap’s smart contracts were audited by BlockSec in March 2025. That’s a good sign. But here’s the catch: no public audit report. No detailed findings. No list of fixed vulnerabilities. Just a one-line statement on GitHub.

Compare that to Curve Finance, which underwent four separate audits from OpenZeppelin, Trail of Bits, and others. LaserSwap’s audit is basic. It passed. That’s it.

GitHub shows 127 open issues as of November 2025. 43 are labeled critical. One major front-running bug was patched in August 2025 - the kind that lets bots steal trades before yours go through. That’s not rare in DEXs, but it’s still risky.

And while CryptoScamDB has no recorded scams targeting LaserSwap users, that doesn’t mean it’s safe. Scams on DEXs usually come from fake tokens, not the platform itself. If you trade a token called “BONK” that’s not the real one? You lose money. LaserSwap can’t stop you from doing that.

Compared to the Competition

Here’s how LaserSwap stacks up against its closest rivals:

| Feature | LaserSwap | Aerodrome Finance | BaseSwap | Uniswap V3 (on Base) |

|---|---|---|---|---|

| 24h Trading Volume | $8.7M | $126M | $41M | $280M |

| Market Share on Base | 4.3% | 62.1% | 18.7% | 13.9% |

| Token Pairs | ~1,200 | ~8,500 | ~6,200 | ~15,000 |

| Slippage (10k trade) | 1.2% | 0.6% | 0.8% | 0.4% |

| Fiat On-Ramp | No | No | No | No |

| Advanced Order Types | No | Yes | Yes | Yes |

| Customer Support | Discord only | Discord + email | Discord only | Discord only |

| Future Upgrade | v2 with concentrated liquidity (Q1 2026) | Already live | Under development | Live |

Aerodrome Finance is the king of Base DEXs. It has more volume, better liquidity, and advanced tools. BaseSwap is a close second. LaserSwap? It’s the underdog. It’s slower to update. It has less liquidity. But it’s the one that took chances on early tokens. If you’re chasing alpha, that matters.

Who Is LaserSwap For?

LaserSwap isn’t for everyone. Here’s who it works for:

- Base ecosystem traders: You’re already using Base. You want to trade new tokens before they go big.

- Memecoin hunters: You’re okay with high risk for a shot at 10x returns.

- Low-fee seekers: You hate paying $3 in gas every time you swap.

Here’s who should avoid it:

- Beginners: If you don’t know what slippage or impermanent loss means, you’ll lose money.

- Stablecoin traders: Use a centralized exchange. The spreads are tighter.

- Institutional users: No KYC, no support, no audit transparency - not suitable.

- Those needing 24/7 help: Discord is not a call center.

The Future: Can LaserSwap Survive?

12 Base DEXs shut down or merged in 2025. The market is consolidating fast. Messari predicts only 3-4 specialized DEXs will survive per Layer 2 by 2027.

LaserSwap’s survival depends on one thing: staying relevant in the Base ecosystem. Its planned v2 upgrade in Q1 2026 - bringing concentrated liquidity like Uniswap V3 - could be a game-changer. Right now, it’s just another DEX. With v2, it might become the go-to for high-risk, high-reward trades.

But there’s a bigger threat: Coinbase. They’re rolling out their own Base-native exchange with institutional-grade tools. If they start listing early tokens, LaserSwap’s edge vanishes.

Right now, LaserSwap is a tool for a specific job. Not the best tool. Not the safest. But for its niche? It’s still the only one that moves fast enough to catch the next memecoin.

Tax and Compliance: What You Need to Know

Every swap on LaserSwap is a taxable event in the U.S. and many other countries. Crypto Tax Calculator released a dedicated guide in October 2025 for tracking LaserSwap transactions. It’s one of the few tax tools that recognizes LaserSwap as a valid exchange.

You’ll need to export your transaction history from your wallet and import it into a tax tool like Koinly or CoinTracker. Don’t rely on LaserSwap for records - it doesn’t provide them. Every trade, every liquidity deposit, every withdrawal must be tracked manually.

There’s no KYC. That means no 1099 forms. But the IRS doesn’t care. You’re still responsible for reporting.

Final Verdict: Should You Use LaserSwap?

Yes - if you’re a Base user hunting for early tokens and you understand the risks.

No - if you want safety, support, or stablecoin trading.

LaserSwap isn’t a replacement for Coinbase or Uniswap. It’s a specialized tool. Like a chainsaw vs. a screwdriver. You wouldn’t use a chainsaw to hang a picture. And you shouldn’t use LaserSwap to trade USDC.

But if you’re chasing the next big memecoin on Base? It’s still one of the fastest, cheapest, and most responsive options out there. Just don’t throw money at it blindly. Know your slippage. Know your tokens. And never invest more than you can afford to lose.

Is LaserSwap safe to use?

LaserSwap’s smart contracts were audited by BlockSec, but no public report details what was found. There are 43 critical issues open on GitHub, including a patched front-running vulnerability. The platform is non-custodial, so your funds aren’t held by them - but you’re still vulnerable to scams, fake tokens, and high slippage. Use it only if you understand DeFi risks.

Does LaserSwap have fiat on-ramps?

No. LaserSwap is a pure DEX. You must buy Base ETH or other tokens on a centralized exchange like Coinbase or Binance first, then transfer them to your wallet before trading on LaserSwap.

What’s the trading volume on LaserSwap?

As of November 2025, LaserSwap handles around $8.7 million in daily trading volume. That’s tiny compared to Uniswap ($1.2B) or even Aerodrome Finance ($126M) on Base. It’s a niche player focused on early-stage tokens, not mainstream trading.

How do I get started with LaserSwap?

Connect a Web3 wallet like MetaMask or Coinbase Wallet, make sure you have Base ETH for gas fees, visit laserswap.io, approve the token you want to trade, set your slippage (1-2% for new tokens), and confirm the swap. First-time users should expect 2-3 hours to learn the process.

Is LaserSwap better than Uniswap on Base?

For most users, no. Uniswap V3 on Base has 15x more volume, tighter slippage, and more liquidity. But LaserSwap sometimes lists new tokens before Uniswap does. If you want early access to obscure Base tokens, LaserSwap has the edge. For everything else, Uniswap is safer and more reliable.

Can I earn rewards on LaserSwap?

Yes. You can provide liquidity to token pairs and earn 0.25% of every trade in that pool. But you’re exposed to impermanent loss - especially with volatile tokens. Most users lose money on pools without understanding how AMMs work. Only provide liquidity if you know what you’re doing.

What’s the biggest risk of using LaserSwap?

The biggest risk isn’t the platform - it’s the tokens. Many tokens listed on LaserSwap are scams, pump-and-dumps, or have no real utility. Without research, you can easily lose your entire investment. Also, the lack of customer support means if something goes wrong, you’re on your own.

Joe West

December 5, 2025 AT 10:03LaserSwap is legit for Base memecoins, but don't go in blind. I've seen people lose their entire bag because they didn't check token contracts. Always verify the address on Etherscan before you swap. And keep your slippage at 1.5% max unless you're gambling on a 1000% pump.

Martin Hansen

December 6, 2025 AT 13:28Wow. Someone actually wrote a 2000-word essay on a DEX that handles less than 1% of Aerodrome’s volume? How quaint. If you’re still using LaserSwap in 2025, you’re either a masochist or you haven’t checked the charts in a week. The real alpha is on Aerodrome’s concentrated liquidity pools - not some ghost town with 43 critical GitHub issues. This isn’t a review, it’s a eulogy for a dying niche.

Mariam Almatrook

December 6, 2025 AT 22:13It is, with profound regret, incumbent upon the modern trader to recognize that the proliferation of decentralized exchanges-particularly those predicated upon ephemeral liquidity and opaque audits-constitutes not innovation, but a systemic erosion of financial prudence. One cannot, in good conscience, endorse a platform whose very architecture encourages speculative ruin under the guise of ‘early access.’ The absence of KYC is not freedom; it is an abdication of responsibility. I implore you: trade with discernment, not desperation.

Chris Mitchell

December 7, 2025 AT 01:12Use it for early tokens. Avoid it for everything else. That’s it.

Slippage kills more wallets than hacks.

rita linda

December 7, 2025 AT 05:00Base Chain is the only Layer 2 that actually respects the original Ethereum ethos-decentralized, permissionless, anti-corporate. LaserSwap embodies that spirit. Meanwhile, Aerodrome and Uniswap have become nothing but profit-hungry institutional fronts with their concentrated liquidity and fee-grabbing mechanisms. If you’re not using LaserSwap, you’re not fighting the system-you’re just another cog in the centralized machine. The audit isn’t perfect? Good. That means they’re still independent.

Regina Jestrow

December 7, 2025 AT 21:49I spent three hours trying to swap my first token on LaserSwap and nearly gave up. The interface feels like it was built in 2021. Then I got it right-did a $50 trade on a new token called 'DogeZilla' and it went up 800% in 4 hours. Now I’m hooked. But oh my god, the panic when the wallet says ‘insufficient gas’? I thought I lost everything. If you’re new, watch a YouTube tutorial first. Don’t trust the ‘simple’ label.

jonathan dunlow

December 8, 2025 AT 06:42Look, I get it-you’re excited about the next memecoin. I was there too. But here’s the thing: LaserSwap isn’t just a tool, it’s a mindset. You’ve got to treat it like a high-stakes poker game where the dealer doesn’t care if you win or lose. Learn the slippage rules. Learn how to read liquidity pools. Learn to spot fake tokens by the contract length and the dev wallet activity. And please, for the love of crypto, don’t put your rent money in. I’ve seen too many people cry over their losses. You don’t need to be the smartest trader. You just need to be the most patient one. Take notes. Track every trade. Use Koinly. And when you finally hit that 10x? You’ll thank yourself for not rushing.

nicholas forbes

December 8, 2025 AT 14:54Some of you are acting like LaserSwap is the end-all-be-all. It’s not. It’s a tool. Like a hammer. Use it for nails, not for opening cans. And if you’re mad about the lack of support? Then stop complaining and build something better. Or just use Aerodrome. Nobody’s forcing you to gamble on a DEX with 43 open critical issues. But if you’re going to use it? At least read the GitHub. Don’t be the guy who blames the platform after he approves a token from a scammer’s address.

Richard T

December 9, 2025 AT 10:16Just a quick note: if you're using LaserSwap, make sure you’re on laserswap.io and not laserswap.net or laserswap.xyz. There are at least three phishing clones floating around. I lost $200 to one last month. Always double-check the URL, even if it looks right. Also, never click ‘approve unlimited’ unless you really trust the token. Use a 1000 ETH cap instead. Small habits save big money.

Lawal Ayomide

December 11, 2025 AT 05:27Why are y’all still talking about this? LaserSwap is dead. Aerodrome took over Base months ago. The only reason this post exists is because someone’s still holding BONK Live and hoping for a miracle. Wake up. The future is on Arbitrum and zkSync. Base is the new Polygon-cool for a while, now just a graveyard for lost wallets.