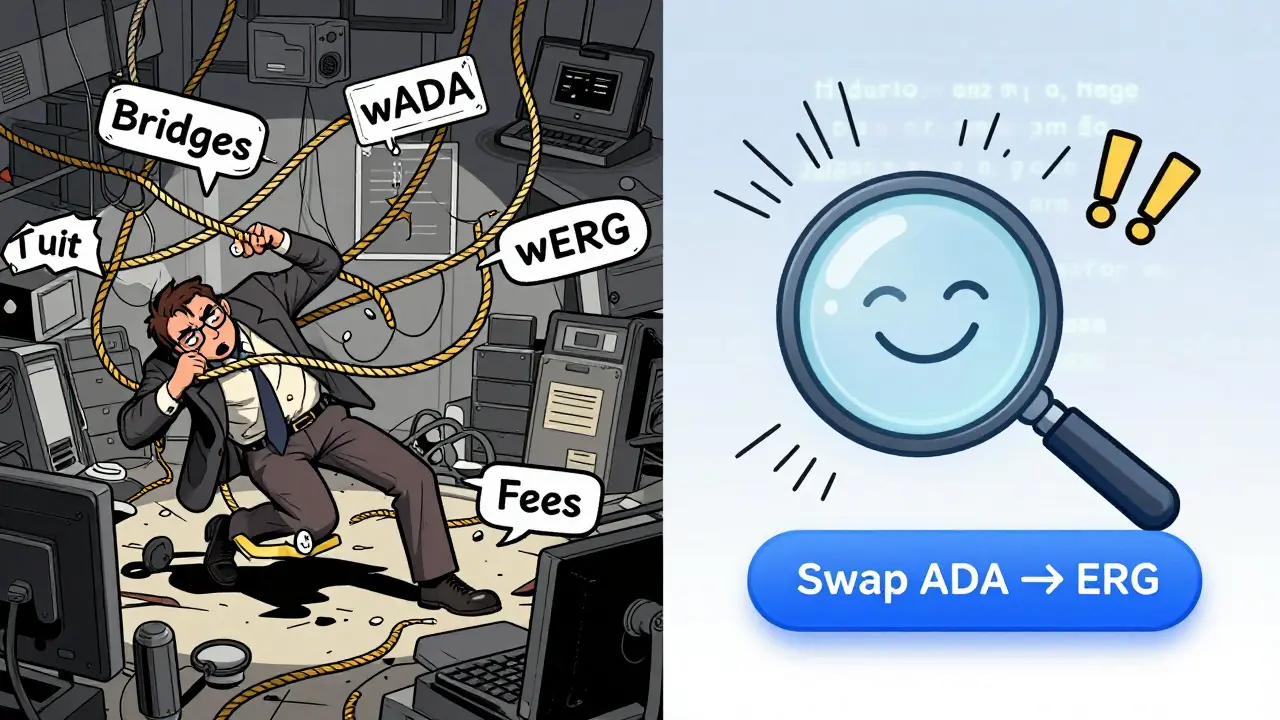

Most crypto exchanges make you wrap your assets before swapping them. You send ADA to a bridge, it turns into wADA, then you trade wADA for ETH, and finally unwrap it back. It’s slow. It’s costly. And it’s not really your asset anymore. Spectrum Finance changes that. It lets you swap native ADA directly for native ERG - no wrapping, no middlemen, no extra steps. If you’re tired of the complexity of cross-chain trading, this exchange might be the quiet revolution you’ve been waiting for.

What Is Spectrum Finance?

Spectrum Finance is a decentralized exchange built on top of the Spectrum Network, a cross-chain messaging protocol launched in 2022. Unlike centralized exchanges like Binance or Coinbase, it doesn’t hold your funds. You trade directly from your wallet. And unlike other DEXs like Uniswap or PancakeSwap, it doesn’t force you to convert your coins into wrapped versions. It swaps native assets - real ADA, real ERG, real ETH - across chains in one step. It’s not a general-purpose exchange. It doesn’t support Bitcoin, Solana, or Polygon. Right now, it’s focused on two blockchains: Cardano and Ergo. That’s by design. The team built it to solve a real problem in those ecosystems: liquidity fragmentation. Cardano has hundreds of tokens, Ergo has dozens, and until now, moving between them meant using bridges that added risk, delay, and fees. Spectrum Finance cuts that out. The platform runs on Layer 1 smart contracts using ErgoScript - the same language that powers Ergo’s decentralized apps. This means transactions are settled directly on-chain, without relying on third-party relayers or sidechains. The entire system is open-source, audited, and non-custodial. Your keys. Your coins. Your trade.How It Works: No Wrapping, No Guesswork

Here’s the simplest way to understand it: imagine you own 100 ADA and want 0.5 ERG. On most platforms, you’d need to:- Send ADA to a bridge

- Wait 10-30 minutes for it to be locked and minted as wADA

- Trade wADA for wERG on a DEX

- Send wERG to another bridge

- Wait again for ERG to be unlocked

- Connect your Cardano wallet (Nami, Eternl)

- Select ADA → ERG

- Confirm the trade

- Wait under 15 minutes

Supported Assets and Trading Pairs

As of late 2025, Spectrum Finance supports exactly seven native tokens across two chains:- Cardano (ADA) network: ADA, FDUSD, LQTY, PAB, TKN, TUSD, WISH

- Ergo (ERG) network: ERG, TKN, PAB, LQTY, FDUSD, TUSD, WISH

The SPF Token: Governance and Incentives

Spectrum Finance has its own token: SPF. It’s not a revenue-sharing token. It’s not a speculative asset. It’s a utility token with three clear roles:- Governance: SPF holders can vote on protocol upgrades, fee structures, and new chain integrations.

- Fee discounts: Paying trading fees in SPF reduces them by up to 30%.

- Cross-chain validation: SPF tokens are staked by validators who help secure the cross-chain messaging layer. If you’re running a validator node, you need SPF.

Why Spectrum Finance Stands Out

Most cross-chain DEXs - like THORSwap, Chainflip, or Multichain - use wrapped tokens. They lock your asset on Chain A, mint a fake version on Chain B, and hope the bridge doesn’t get hacked. There have been over $2 billion in bridge exploits since 2020. Spectrum Finance avoids that entirely. It doesn’t need to lock your ADA. It doesn’t need to mint anything. It just coordinates the movement of native assets using cryptographic proofs. That’s why it’s called a “trustless” cross-chain exchange. You’re not trusting a bridge. You’re trusting math. It’s also cheaper. Average swap fees on Spectrum Finance are around 0.8%, which includes both chain gas and protocol fees. Compare that to THORSwap, where you might pay 0.5% for the swap + 1.5% in bridge fees + 0.3% in network gas. That’s 2.3% total. Spectrum Finance cuts that in half.Limitations and Risks

But this isn’t perfect. And you should know the downsides before you use it. 1. Limited chain support. Only Cardano and Ergo. If you want to swap Bitcoin for Solana, you’re out of luck. This isn’t a universal DEX. It’s a specialist tool. 2. Low liquidity on some pairs. ADA/ERG has decent volume. ADA/WISH? Not so much. Users on Reddit have reported slippage over 5% on low-volume pairs. Always check the depth chart before trading. 3. Steep learning curve. You need a Cardano wallet and an Ergo wallet. You need to understand how to send assets between them. You need to know what impermanent loss means in a cross-chain AMM. This isn’t for beginners. If you’ve never used a non-custodial wallet, spend a few hours learning first. 4. No mobile app. You can’t trade on the go. You need a desktop browser and compatible wallets. No iOS or Android apps exist yet. 5. Regulatory gray zone. The SEC hasn’t targeted Spectrum Finance. But it’s watching. Cross-chain DEXs with governance tokens are under scrutiny. SPF could be classified as a security in some jurisdictions. Use at your own risk.Who Is This For?

Spectrum Finance isn’t for everyone. But it’s perfect for:- Cardano holders who want to access Ergo DeFi without wrapping

- Ergo users who need ADA for staking or liquidity mining

- Developers building cross-chain apps who need a trustless bridge

- Traders who hate wrapped tokens and want native asset swaps

How to Get Started

Here’s a quick step-by-step:- Install a Cardano wallet: Nami or Eternl (Chrome extension)

- Install an Ergo wallet: Yoroi or Nautilus (Chrome extension)

- Buy ADA and ERG on a centralized exchange like Kraken or Binance

- Send ADA to your Cardano wallet. Send ERG to your Ergo wallet.

- Go to spectrum.fi and connect both wallets.

- Select your pair (e.g., ADA → ERG), enter the amount, review the rate, and confirm.

- Wait 10-15 minutes. Your ERG arrives in your Ergo wallet.

Future Roadmap

The team is working on three big updates:- Mobile wallet integration - expected Q2 2025

- Integration with Algorand and Polygon - in testing phase

- Enhanced liquidity mining - higher rewards for LPs on low-volume pairs

Final Verdict

Spectrum Finance isn’t the biggest or flashiest crypto exchange. But it’s one of the most technically elegant. It solves a real problem - cross-chain asset friction - with minimal compromise. No wrapping. No custodians. No middlemen. If you’re deep in the Cardano or Ergo ecosystems, it’s worth your time. The fees are low, the security is strong, and the concept is sound. But if you’re new to crypto, or you want to trade Bitcoin, Ethereum, or Solana - this isn’t your platform. It’s not for everyone. But for the right users? It’s exactly what the DeFi world needs.Does Spectrum Finance support Bitcoin or Ethereum?

No. Spectrum Finance currently only supports native assets from Cardano and Ergo. You cannot swap Bitcoin, Ethereum, Solana, or any other blockchain’s native tokens directly. The platform is intentionally focused on bridging these two ecosystems, with future plans to add Algorand and Polygon.

Is Spectrum Finance safe to use?

Yes, if you understand the risks. Spectrum Finance is non-custodial, open-source, and doesn’t use wrapped tokens - which removes major attack vectors found in bridges. However, cross-chain protocols are complex. Smart contract bugs, low liquidity, or user error (like sending to the wrong wallet) can result in lost funds. Always test with small amounts first.

Do I need two wallets to use Spectrum Finance?

Yes. You need a Cardano wallet (like Nami or Eternl) and an Ergo wallet (like Yoroi or Nautilus). The platform connects both simultaneously to execute swaps. You cannot use a single wallet. This is by design - it ensures you retain full control over your assets on each chain.

What are the fees on Spectrum Finance?

Trading fees are typically around 0.8%, which includes both the protocol fee and blockchain gas costs. Paying with the SPF token reduces this fee by up to 30%. There are no hidden fees, and no withdrawal fees. However, you’ll need to have small amounts of ADA and ERG on hand to cover network transaction fees.

Can I earn rewards on Spectrum Finance?

Yes. You can provide liquidity to trading pairs and earn a share of trading fees. The platform also plans to launch enhanced liquidity mining incentives in 2025, offering additional SPF token rewards for users who add liquidity to low-volume pairs. These rewards are distributed automatically and can be claimed anytime.

Is there a mobile app for Spectrum Finance?

No, there is no official mobile app as of December 2025. You must use a desktop browser with compatible wallet extensions like Nami, Eternl, Yoroi, or Nautilus. Mobile support is planned for Q2 2025, but no release date has been confirmed yet.

What happens if the Spectrum Network goes down?

Your funds are never held by Spectrum Finance. They stay in your own wallets. If the network temporarily fails, you can still access your ADA and ERG directly on their respective blockchains. You just won’t be able to perform cross-chain swaps until the network is back online. The protocol is designed so that downtime doesn’t risk your assets.

Sammy Tam

December 16, 2025 AT 02:19Man, I’ve been waiting for this for years. Wrapping assets always felt like handing your keys to a stranger and hoping they don’t steal your car. Spectrum just cuts the middleman out - no more wADA, no more waiting 20 minutes for a bridge to confirm. I swapped 50 ADA for ERG last week and it was smoother than a jazz solo. The 0.8% fee? Chump change compared to what I used to pay on THORSwap. This is what DeFi was supposed to be.

Also, love that they’re not throwing every memecoin under the sun on here. It’s clean. Focused. Like a Swiss watch made of blockchain.

Kayla Murphy

December 17, 2025 AT 12:59OMG I tried this yesterday and it actually worked?! I was scared to death because I’ve lost money on bridges before, but this felt so intuitive. Connected Nami and Nautilus in like 2 minutes, clicked ADA→ERG, and boom - 12 minutes later my ERG popped up. No drama. No panic. Just pure, quiet tech magic. I’m telling all my Cardano friends about this. We need more tools like this, not more wrapped garbage.

Also, SPF token is actually useful? Wild. I thought all governance tokens were just pump-and-dump bait. This one feels different.

Dionne Wilkinson

December 18, 2025 AT 10:54I don’t trade much, but I read this whole thing because I care about how tech affects people. What’s beautiful here is that it doesn’t ask you to trust a company or a bridge - it asks you to trust math. And math doesn’t lie. It doesn’t get greedy. It doesn’t vanish during a market crash.

I think this is a quiet revolution. Not flashy, not viral, not full of influencers shouting ‘TO THE MOON.’ Just two blockchains talking to each other like neighbors sharing tools. No drama. No hype. Just utility.

Also, the fact that they didn’t add Bitcoin or Solana? That’s not a limitation. That’s wisdom. Sometimes less is more. Especially when you’re building something that’s supposed to last.

Kelsey Stephens

December 19, 2025 AT 19:43Just wanted to say thank you for writing this so clearly. I’m new to crypto and was drowning in jargon until I read this. The part about needing two wallets? I thought I’d need five. The step-by-step guide saved me from a disaster. I tested with 5 ADA and it worked perfectly.

I’m not a trader, but I appreciate tools that respect your autonomy. This feels like the opposite of centralized exchanges - no surveillance, no KYC, no ‘we’ll help you.’ Just you and your keys. That’s rare.

Also, if you’re nervous, start small. I did. And now I’m hooked. Not on trading - on the idea that tech can be simple and honest.

Tom Joyner

December 20, 2025 AT 00:23Admittedly, this is the first cross-chain DEX that doesn’t make me cringe. Most of these projects are just DeFi bros slapping ‘trustless’ on a bridge that’s basically a glorified escrow. Spectrum’s approach is… surprisingly elegant. No wrapped tokens? Using ErgoScript on-chain? No sidechains? That’s not just innovation - that’s competence.

Of course, the liquidity is laughably thin on all but ADA/ERG, and the lack of a mobile app screams ‘niche beta.’ But I’ll give them credit: they didn’t try to be everything. They solved one problem, cleanly, with minimal attack surface. Most teams wouldn’t have the discipline to do that.

SPF at $0.0043? Probably undervalued. If they integrate Algorand and cut swap times to 10 minutes, this could become the backbone of mid-tier DeFi. Not because it’s loud - but because it’s quiet. And quiet things last longer.