Venezuela Mining Profitability Calculator

Calculate Your Mining Potential

Based on Venezuela's electricity costs ($0.03/kWh) and government regulations. Minimum 500kW required

How Venezuela Took Control of Crypto Mining

When Venezuela launched its state-run crypto mining system, it wasn’t just about making money from Bitcoin. It was a desperate move to survive an economic collapse. With hyperinflation eating away at salaries and savings, ordinary Venezuelans turned to cryptocurrencies like Bitcoin and USDT to buy food, pay rent, and send money home. The government saw an opportunity: use the country’s cheap electricity to mine crypto, collect a cut, and keep control over the entire process.

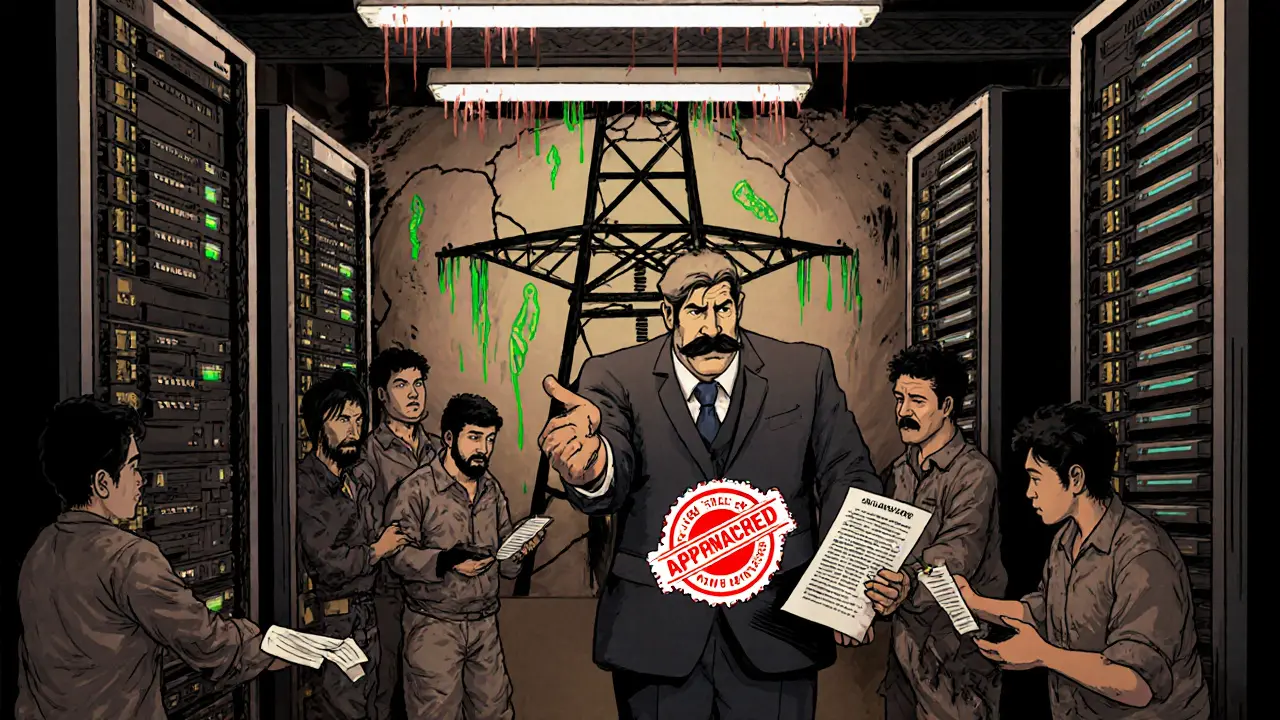

By 2019, the regime created SUNACRIP - the National Superintendence of Cryptocurrencies - to oversee everything. All mining had to go through it. No exceptions. Miners needed licenses. They had to register their equipment. They had to connect to the state’s National Mining Pool (NMP), which distributed rewards and tracked every hash. It wasn’t just regulation. It was nationalization.

The Rules: What Miners Had to Do

If you wanted to mine legally in Venezuela after 2020, you had to jump through a series of bureaucratic hoops. First, you had to prove you had access to at least 500 kilowatts of electricity - not easy when the grid collapses for 40 to 60 hours a month. Then, you had to submit your ASIC miners’ serial numbers, your ID, and your power contract to SUNACRIP. Approval took three to four months.

Once approved, you were forced into the National Mining Pool (NMP). This wasn’t just a software platform. It was the government’s way of controlling who got paid and how much. Miners reported delays in payouts, system crashes, and even rewards being redirected to other accounts. One miner in Maracaibo told reporters his rig was running fine, but he hadn’t received a single Bitcoin in six weeks. When he called SUNACRIP, they said his equipment hadn’t been "verified." He never got it resolved.

There were also strict anti-money laundering rules. Every transaction had to be logged. Every wallet had to be registered. Miners couldn’t just send their Bitcoin to a private exchange. They had to use government-approved platforms, which often charged high fees and had long withdrawal delays.

The Energy Problem

Venezuela has one of the cheapest power rates in the world - around $0.03 per kilowatt-hour. That’s less than half the global average. For crypto miners, that’s a dream. But the country’s power grid is a nightmare.

Even licensed mining centers, which were supposed to be energy-efficient hubs, used up about 10% of the nation’s total electricity in 2025. That’s a lot when millions of people go days without lights. The government responded with crackdowns. In 2023, after a corruption probe tied to oil and energy officials, SUNACRIP shut down over 300 mining operations overnight. No warning. No appeals. Just power cuts.

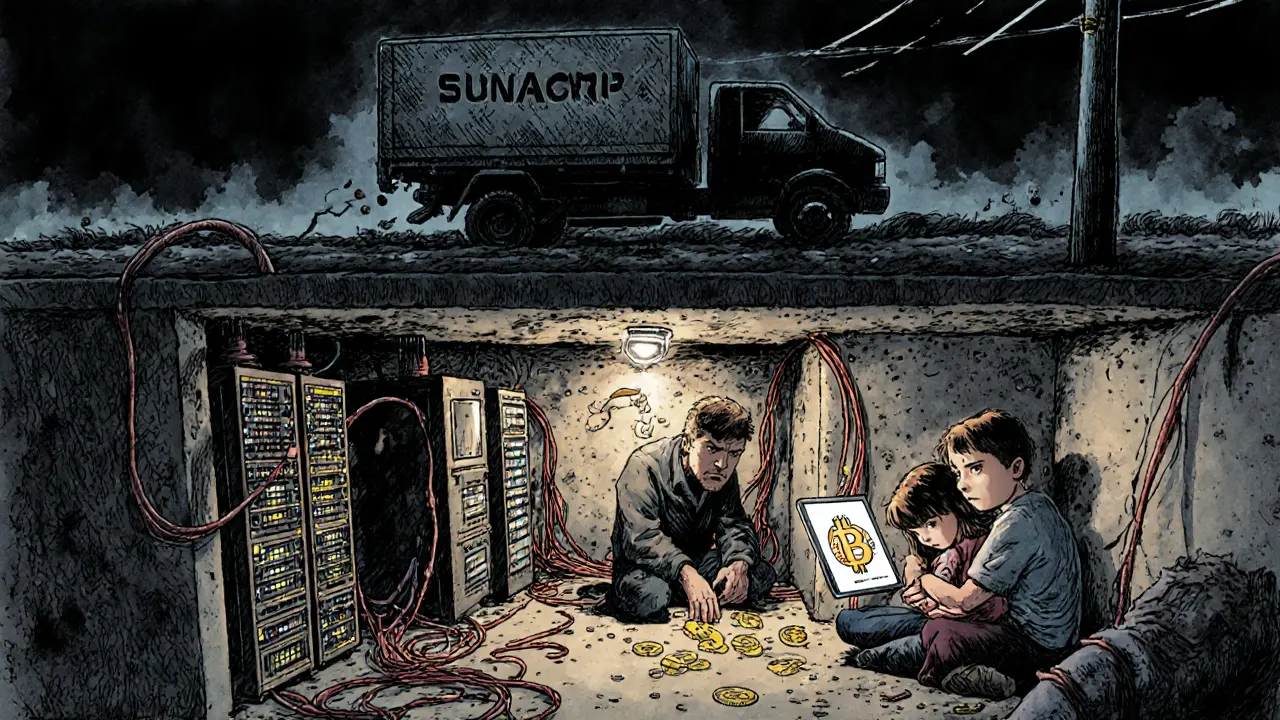

Many miners had to buy diesel generators to keep running. That added 25% to their costs. Some gave up. Others moved underground - literally. Reports surfaced of miners operating in basements, warehouses, and even abandoned subway tunnels, using stolen grid power. The state didn’t stop them. It just didn’t license them.

The Paralysis of SUNACRIP

Here’s the biggest problem: SUNACRIP stopped working.

In March 2023, its leadership was arrested in a corruption case involving fake mining licenses and bribes from oil companies. The agency shut down. For over a year, no new licenses were issued. Existing miners couldn’t renew. The website went dark. The phone lines rang unanswered.

It was reorganized in March 2024, with private companies like CAVEMCRIP brought in to help manage compliance. But trust was gone. Miners didn’t believe the new system would be any fairer. And the government still didn’t fix the core issue: the lack of real oversight.

Today, Venezuela’s crypto mining scene is split. There’s the official side - a handful of state-approved centers, mostly run by government allies, quietly mining with subsidized power. And then there’s the rest - thousands of underground miners, freelancers, and crypto-savvy families running rigs in their living rooms. Neither side is fully legal. Neither side is fully stopped.

Why People Still Mine - Even When It’s Risky

Despite the risks, crypto mining in Venezuela hasn’t died. Why?

Because for many, it’s the only way to earn real value. With inflation hitting 200% in 2024, the bolívar is nearly worthless. Bitcoin and stablecoins? They hold their worth. A miner who earns 0.1 Bitcoin a month can buy groceries for a family for weeks. That’s more than a teacher’s salary.

Even without SUNACRIP, people keep mining. They use decentralized pools. They trade on peer-to-peer apps like Paxful and LocalBitcoins. They convert crypto into gift cards, phones, or even US dollars through informal networks. The government can control the official pipeline - but it can’t control the people’s need to survive.

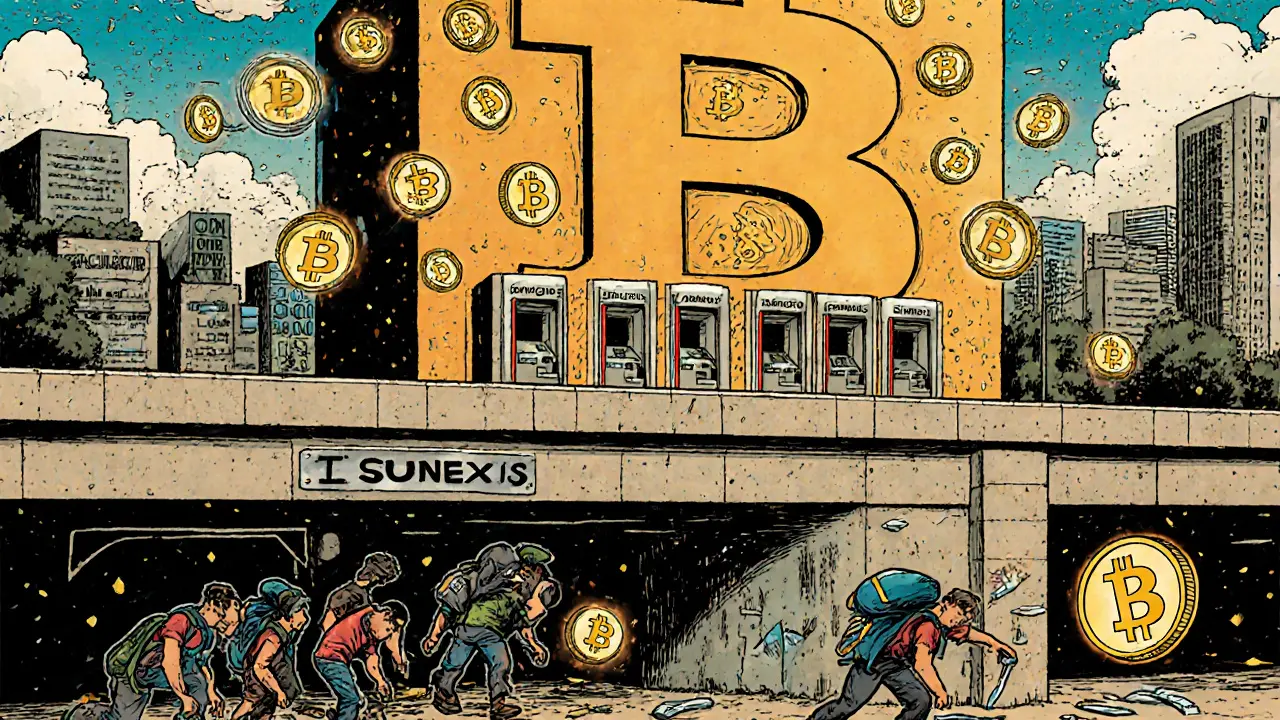

The Future: Banks Will Soon Handle Bitcoin

In December 2025, Venezuela plans to let its banks offer Bitcoin and stablecoin services directly to customers. The Conexus initiative - already handling 40% of the country’s digital payments - is building a blockchain-based interbank network. This isn’t just about mining anymore. It’s about integrating crypto into the financial system.

If it works, Venezuelans could soon deposit Bitcoin into their bank accounts, pay bills with USDT, or send remittances without crossing borders. It’s a radical shift. But it’s also a sign the government knows it can’t stop crypto. So it’s trying to control it - not by banning it, but by owning it.

Still, the same problems remain. Will the banks be secure? Will the system be transparent? Will the government stop stealing from it? No one knows. What’s clear is this: crypto in Venezuela isn’t going away. It’s evolving. And whether it’s state-run or underground, it’s now part of daily life.

What This Means for the Rest of the World

Venezuela’s experiment is a warning - and a blueprint. It shows how a failing state can try to weaponize crypto for survival. It also shows how quickly regulation can collapse when corruption takes root. Other countries watching Venezuela’s model - especially those with cheap power and weak institutions - might be tempted to copy it.

But Venezuela’s story proves one thing: you can’t force people to use a broken system. When the state controls the mining, but not the trust, people find a way around it. The real power isn’t in the hardware. It’s in the people who use it.

SHASHI SHEKHAR

November 27, 2025 AT 16:28Man, Venezuela’s crypto saga is wild 🤯 I’ve seen power outages in Delhi, but 60 hours a month? That’s next-level chaos. And yet people are still mining in basements and subway tunnels? 🤯 The fact that they’re using stolen grid power just to buy rice and beans… it’s not crypto, it’s survival mode. SUNACRIP was supposed to be the solution but turned into a bureaucratic ghost town. I bet half those ‘licensed’ miners are just frontmen for military buddies. Still, props to the folks running rigs in their living rooms - they’re the real crypto pioneers. 💪🌍

Vaibhav Jaiswal

November 29, 2025 AT 12:39Okay but imagine this - you’re sitting in a dark apartment, fan buzzing, your ASIC rig humming like a dragon… and then the lights go out AGAIN. You grab your diesel generator, cough through the fumes, and keep mining because your kid needs formula. That’s not capitalism. That’s not even communism. That’s just… human. 🥲 Venezuela didn’t invent crypto mining - it invented crypto *resilience*. The government can shut down servers, but they can’t shut down a mother’s will to feed her child. And honestly? That’s the most powerful blockchain of all.

Abby cant tell ya

November 29, 2025 AT 23:51Ugh. So the state is basically a corrupt middleman who takes 30% and then vanishes? Classic. And people still fall for this? 😒 I mean, if you’re gonna risk jail and blackouts just to mine Bitcoin, why not just sell your kidneys? At least you’d get paid upfront. This isn’t innovation - it’s desperation dressed up as tech. #FirstWorldProblems

Vijay Kumar

November 30, 2025 AT 11:02They didn’t control crypto. They just made it slower, costlier, and more dangerous. The state can’t own the network. Only the people can.

Vance Ashby

November 30, 2025 AT 14:57Wait, so the government created a mining pool… then collapsed due to corruption… then outsourced to a private company called CAVEMCRIP? 😂 That’s like hiring a guy named ‘CryptoBob’ to fix your IRS forms. And now banks are gonna handle Bitcoin? LMAO. If the banks in Venezuela are as reliable as the power grid, I’d rather hold my crypto in a shoebox under my bed. Also, 0.1 BTC/month = groceries? That’s wild. In the US, that’s a nice dinner and a Netflix subscription. In Venezuela? That’s a whole damn life. 🤯

Eddy Lust

December 1, 2025 AT 18:10It’s funny how the more the state tries to cage crypto, the more it slips through the cracks like smoke. They built SUNACRIP to control the flow - but the real flow was never in the machines. It was in the people. The mom mining in her kitchen. The kid trading USDT for rice on Paxful. The guy in the subway tunnel with a generator and a prayer. The government can shut down servers, freeze accounts, arrest officials… but they can’t arrest hunger. They can’t jail hope. And that’s why this isn’t a story about regulation. It’s about survival. Crypto didn’t save Venezuela. The people did. And they didn’t need a license to do it. 💛