Bitcoin Nigeria: What You Need to Know About Crypto, Regulations, and Local Exchanges

When people talk about Bitcoin Nigeria, the widespread use of Bitcoin as a peer-to-peer currency in Nigeria despite government restrictions. Also known as Nigerian crypto adoption, it's not just about speculation—it's about survival, remittances, and bypassing a broken banking system. Over 30% of Nigerian adults have used crypto, according to Chainalysis, not because they’re chasing moon shots, but because they need a way to send money home, protect savings from inflation, or pay for services without bank delays.

That’s why SEC Nigeria, the Securities and Exchange Commission of Nigeria, which now regulates all digital asset platforms. Also known as Nigerian crypto regulator, it’s the gatekeeper for who can operate legally. Only two exchanges—Quidax and Busha—are officially licensed. Every other platform, even big names like Bybit or KuCoin, is technically illegal. Using them isn’t just risky—it can get your account frozen or your funds seized. The government isn’t against crypto; it’s against uncontrolled crypto. That’s why they pushed for licensing: to track users, prevent fraud, and stop money laundering.

And yes, crypto airdrop Nigeria, free token offers targeting Nigerian users, often tied to unregulated platforms. Also known as Nigerian crypto giveaways, they’re everywhere—but most are traps. You’ll see ads promising $10 in free tokens if you share a post or sign up with your phone number. But if the project has no team, no whitepaper, and no exchange listing, it’s not a gift—it’s a data harvest or a rug pull. Nigerian users are targeted because of high mobile penetration and trust in social media influencers. Don’t fall for it. Check the SEC’s approved list before you touch anything.

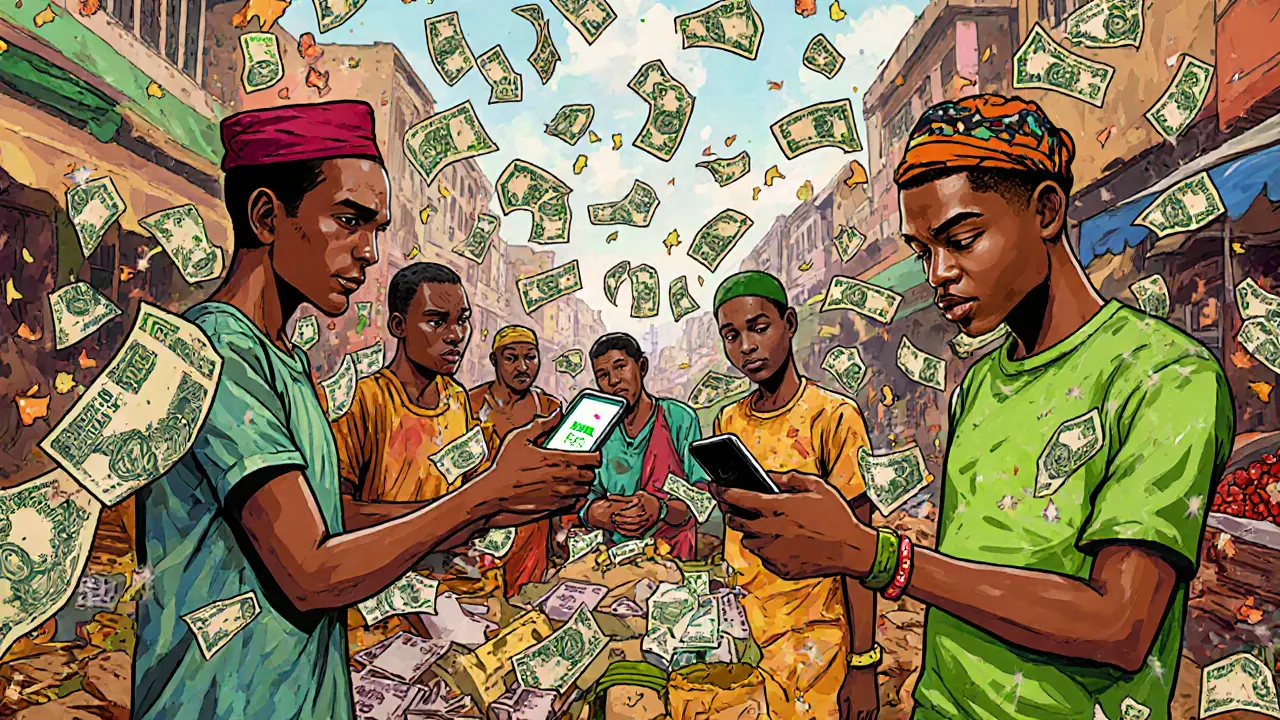

Bitcoin in Nigeria isn’t about mining or DeFi yields. It’s about sending money to family in rural areas, buying groceries when the naira drops, or paying freelancers without waiting days for bank transfers. That’s why P2P trading is huge—local sellers and buyers meet on platforms like Paxful or LocalBitcoins, trading cash for BTC in person or via bank transfer. It’s messy, it’s informal, but it works. And that’s why the government can’t shut it down completely.

What you’ll find below isn’t just news—it’s a map. We’ve gathered every real, verified, and relevant update about how Bitcoin and crypto actually function in Nigeria right now. From exchange reviews that warn you before you lose cash, to airdrop scams that look too good to be true (and are), to the legal gray zones you need to avoid. No fluff. No hype. Just what matters if you’re trading, sending, or saving with crypto in Nigeria.

Crypto Adoption in Nigeria: How Economic Pressure Is Driving Mass Adoption Despite Restrictions

- 5 Comments

- Jan, 8 2025

Nigeria leads global crypto adoption as millions use Bitcoin and stablecoins to survive inflation, bypass banking restrictions, and send remittances. With $59B in transactions and 22 million users, crypto is no longer optional-it’s essential.