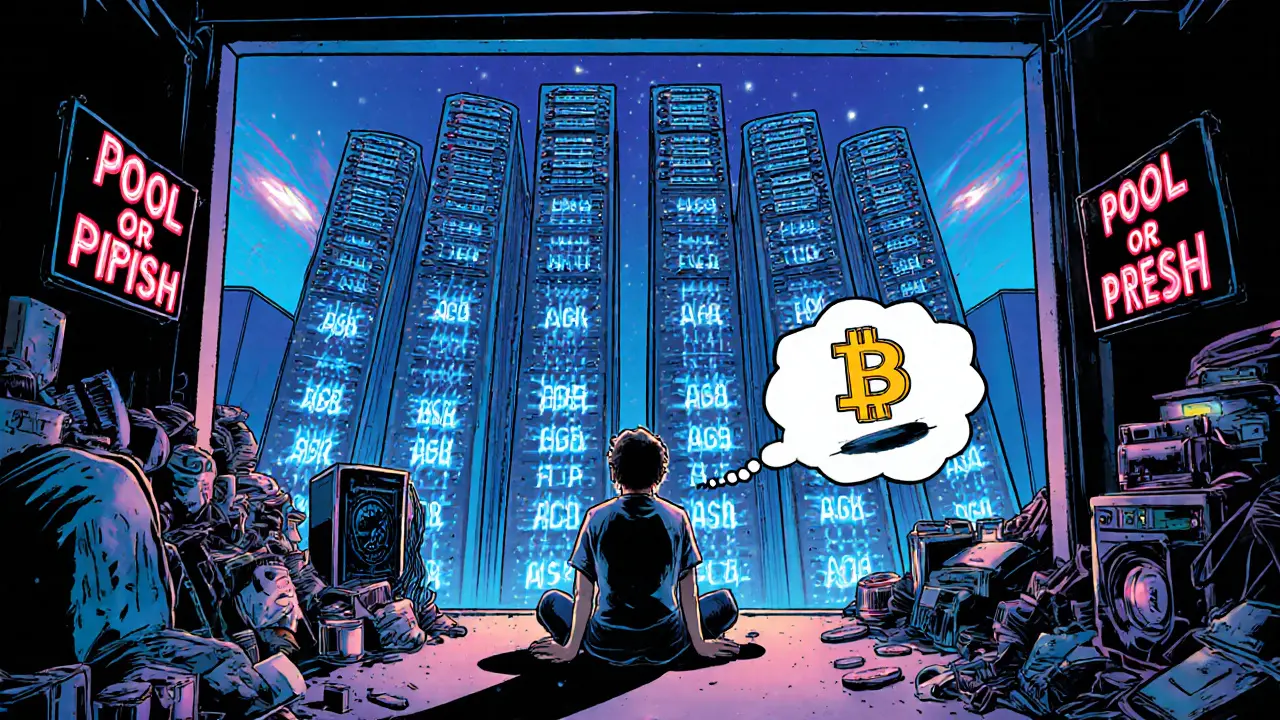

Mining Pool Industry: How Crypto Mining Pools Work and Why They Matter

When you mine cryptocurrency, you’re competing against thousands of others to solve complex math problems. Alone, your chances of earning a reward are tiny. That’s where the mining pool industry, a network of coordinated miners who combine computing power to increase success rates and share rewards comes in. It’s not just a workaround—it’s the backbone of Bitcoin and other proof-of-work blockchains. Without mining pools, most people couldn’t mine profitably at all.

The hash rate, the total computational power used to secure a blockchain network is what keeps networks like Bitcoin safe. But no single miner can match the power of a big pool. Today, just a few pools control over 70% of Bitcoin’s hash rate. These aren’t just groups of hobbyists—they’re professional operations using custom hardware, low-cost electricity, and automated software. The mining hardware, specialized machines designed to solve cryptographic puzzles faster than regular computers used in these pools costs thousands of dollars and runs nonstop. Even if you can’t afford your own rig, joining a pool lets you contribute a small amount of power and still get paid.

Not all pools are the same. Some pay out daily, others weekly. Some charge fees, others don’t. Some are open to anyone, while others require minimum hash rates. And while pools make mining accessible, they also concentrate power. A few large pools could theoretically control the network—a risk the crypto world tries to manage through decentralization incentives. The Bitcoin mining, the process of validating transactions and adding them to the blockchain using proof-of-work system was built to be democratic, but the reality is shaped by economics, not ideals.

What you’ll find here isn’t just theory. These posts dig into real cases: how Venezuela’s state-run mining system tries—and fails—to control the industry, how exchange inflows hint at miners selling their rewards, and why some crypto projects are outright dead while others still rely on mining to survive. You’ll see how regulation, power shortages, and scams shape the landscape. Whether you’re curious about joining a pool, worried about centralization, or just trying to understand why mining still matters in 2025, this collection gives you the facts without the fluff.

Future of Mining Pool Industry: How Bitcoin Pools Are Evolving in 2025 and Beyond

- 9 Comments

- Oct, 2 2025

In 2025, mining pools are the only way to profitably mine Bitcoin. Discover how Neopool, ViaBTC, and F2Pool are leading the industry with smarter tech, lower fees, and new features like staking and AI-driven optimization.