Ondo Finance: What It Is, How It Works, and What You Need to Know

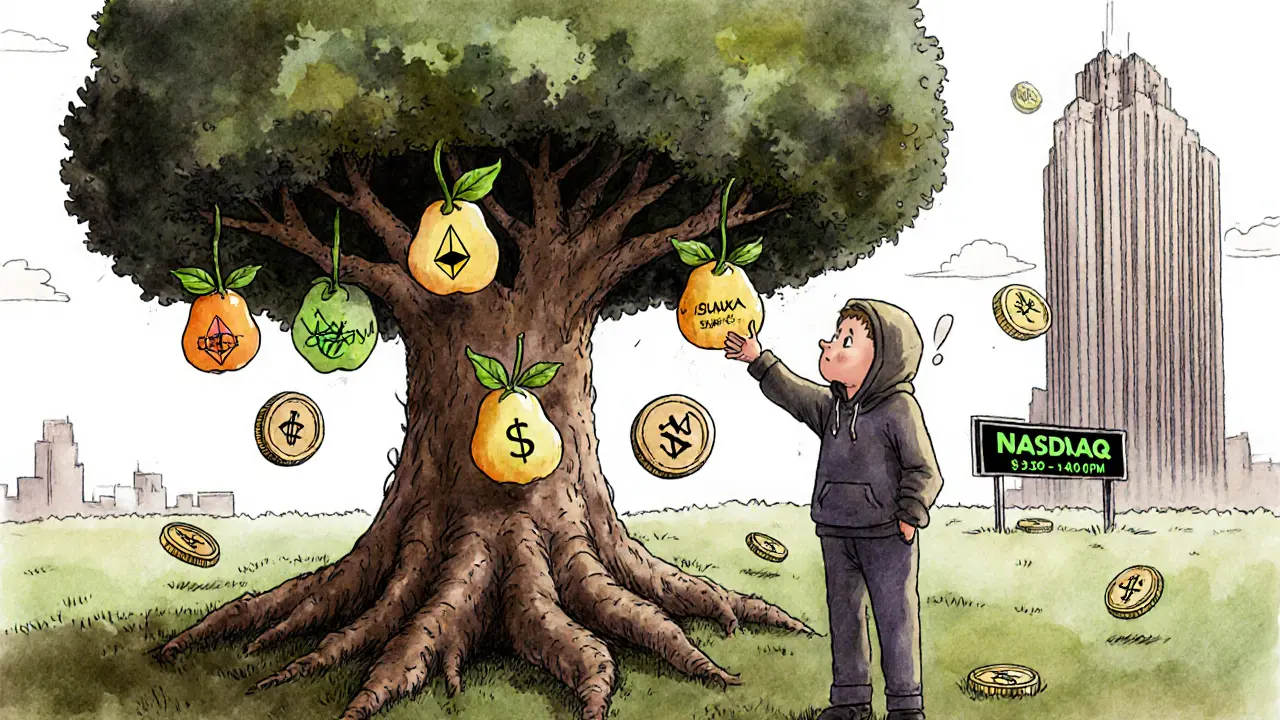

When you hear Ondo Finance, a decentralized finance platform that brings institutional yield strategies to everyday crypto users. It’s not another meme coin or speculative token—it’s a serious infrastructure project built to connect Wall Street-style returns with blockchain accessibility. Ondo Finance lets you earn yield from real-world assets like U.S. Treasuries, all without needing a brokerage account or minimum investment of $1 million. That’s the core idea: making what was once only for hedge funds available to anyone with a wallet.

Ondo Finance doesn’t just create tokens—it bridges two worlds. On one side, there’s the $25 trillion U.S. government bond market. On the other, there’s crypto’s 24/7, borderless infrastructure. Their main product, ONDO, the native token that governs access to yield-bearing assets and powers the platform’s treasury operations, acts as a key to unlock these yields. You don’t buy ONDO to gamble on price swings—you hold it to access real, predictable income streams backed by actual financial instruments. And it’s not just about bonds. Ondo also offers USDY, a regulated, fully collateralized stablecoin pegged to the U.S. dollar and issued in partnership with a licensed financial institution, which is used inside their ecosystem to reduce volatility while earning yield.

What makes Ondo different from other DeFi protocols? It doesn’t rely on risky liquidity pools or volatile crypto collateral. Instead, it partners with licensed entities to tokenize real-world assets and bring them on-chain. That means less risk, more transparency, and compliance with financial regulations. You’re not lending to strangers—you’re earning interest from U.S. government debt, just like a bank or pension fund would. And because it’s built on Ethereum and Polygon, you still get the speed and control of crypto.

There’s no hype around Ondo Finance. No influencers pushing it. No fake airdrops. Just clear documentation, audited contracts, and institutional backing. That’s why you see funds like Coinbase Ventures and Polychain Capital investing in it. It’s not trying to replace banks—it’s giving people better access to what banks already use.

Below, you’ll find deep dives into how Ondo Finance actually works, what ONDO and USDY are used for, how they compare to other yield protocols, and whether this is the real deal—or just another crypto buzzword. If you’re tired of chasing 1000% returns that vanish overnight, and you want to understand how real yield works in crypto, you’re in the right place.

What Is Costco Tokenized Stock (Ondo) (COSTon) Crypto Coin?

- 6 Comments

- Jun, 14 2025

COSTon is a tokenized version of Costco stock built by Ondo Finance on Ethereum. It lets you trade Costco shares on blockchain, but with extreme liquidity issues, regulatory uncertainty, and price inconsistencies, it's not a practical investment for most people.

What Is Starbucks Tokenized Stock (Ondo) (SBUXon)? The Real Story Behind the Crypto-Like Stock Token

- 8 Comments

- Dec, 4 2024

SBUXon is a blockchain token by Ondo Finance that tracks Starbucks stock price but isn't actual stock. It offers 24/7 trading and fractional ownership but suffers from zero liquidity, regulatory risk, and minimal adoption.