COSTon Price Comparison Tool

Compare current COSTon token prices across platforms to see significant price discrepancies and liquidity issues.

Current Price Analysis

Based on real data from the article: prices vary significantly due to low liquidity and inconsistent market data.

Price Comparison Results

There’s no such thing as a "Costco crypto coin"-not in the way Bitcoin or Ethereum are crypto coins. But if you’ve heard people talking about COSTon, you’re not imagining things. It’s a real asset, but it’s not a cryptocurrency in the traditional sense. COSTon is a tokenized version of Costco Wholesale Corporation stock, created by Ondo Finance. It lets you own a digital slice of Costco without buying shares on the stock market. Sounds simple? It’s not. And that’s the problem.

What Exactly Is COSTon?

COSTon is an ERC-20 token on the Ethereum blockchain. That means it’s built like a typical crypto token-you can store it in a wallet, send it to others, and trade it on some decentralized exchanges. But here’s the twist: its value isn’t based on hype, speculation, or community votes. It’s tied directly to the price of Costco stock (COST) on the NASDAQ. Every time Costco’s stock goes up or down, COSTon moves with it-minus fees, delays, and the occasional glitch.

Unlike buying stock through Fidelity or Robinhood, COSTon lets you trade 24/7. No market hours. No broker fees. You can own a fraction of a share, even if you only have $20. And because it’s on Ethereum, you can theoretically use it in DeFi apps-lend it, stake it, or use it as collateral. But in practice? That’s mostly theoretical right now.

How Does Ondo Finance Make This Work?

Ondo Finance doesn’t just slap a blockchain label on Costco stock. They hold the real shares in a trust. Every COSTon token is backed by actual Costco shares held in a legal structure that complies (or tries to comply) with U.S. securities laws. When you buy COSTon, you’re not buying a promise-you’re buying a digital receipt for a piece of real stock. Dividends from Costco are automatically reinvested into more shares, which then get converted into more tokens. That’s the "automatic reinvestment" feature people talk about.

But here’s where it gets messy: Ondo doesn’t control the price. The market does. And because there are so few people trading COSTon, the price jumps around like a rubber band.

The Numbers Don’t Add Up

Look at the data. As of September 2025, different platforms report wildly different numbers:

- Phantom says there are only 0.5197 COSTon tokens in existence.

- RWA.xyz says there are over 1,170 tokens.

- Crypto.com lists the price at $916.72 one moment, $917.98 the next.

- Coinbase’s converter says it’s worth $971.58.

That’s not just minor variation. That’s chaos. If you’re trying to figure out what COSTon is actually worth, you’re stuck guessing. The market cap? Around $489 on one site. Over $1 million on another. The Net Asset Value (NAV)-the real value tied to Costco stock-was around $926 per token. But even that number changed by almost 2% in 30 days.

And the trading volume? Pathetic. One listing shows $4,411 traded in 24 hours. Another shows $21,481. That’s less than what a single whale might move in Bitcoin in five minutes. There are only 28 known holders. Only 14 active wallet addresses in the past month. Fifty-seven total transfers. $3,327 in monthly volume. This isn’t a liquid market. It’s a sandbox.

Why Does This Even Exist?

Tokenized stocks like COSTon are part of a bigger trend called Real World Assets (RWA). The idea is simple: bring traditional investments-stocks, bonds, real estate-onto blockchains so they can be traded faster, cheaper, and globally. Ondo isn’t alone. Synthetix, Mirror Protocol, and others offer similar products. But Ondo is one of the few trying to do it legally, with proper custody and compliance.

For institutions, this is exciting. Hedge funds and asset managers want exposure to assets like Costco without dealing with legacy banking systems. For crypto natives, it’s a way to get stock exposure without leaving the DeFi ecosystem. But for most people? It’s overkill.

What Are the Real Risks?

Let’s cut through the noise. Here’s what actually matters if you’re thinking about buying COSTon:

- Regulatory risk: The SEC hasn’t said whether tokenized stocks are legal. They could shut this down tomorrow. Ondo claims compliance, but no one outside their legal team really knows.

- Liquidity risk: You might not be able to sell when you want to. With only 28 holders and almost no trading volume, finding a buyer is a gamble.

- Counterparty risk: You’re trusting Ondo to hold the real Costco shares. If they mess up, get hacked, or disappear, your tokens could become worthless.

- Price confusion: Different exchanges show different prices. Which one do you trust? The one with $4,000 in volume? Or the one with $20,000? There’s no clear answer.

- Complexity: You need a wallet, Ethereum, knowledge of ERC-20 tokens, and access to platforms like Ondo Global Markets or decentralized exchanges. It’s not plug-and-play.

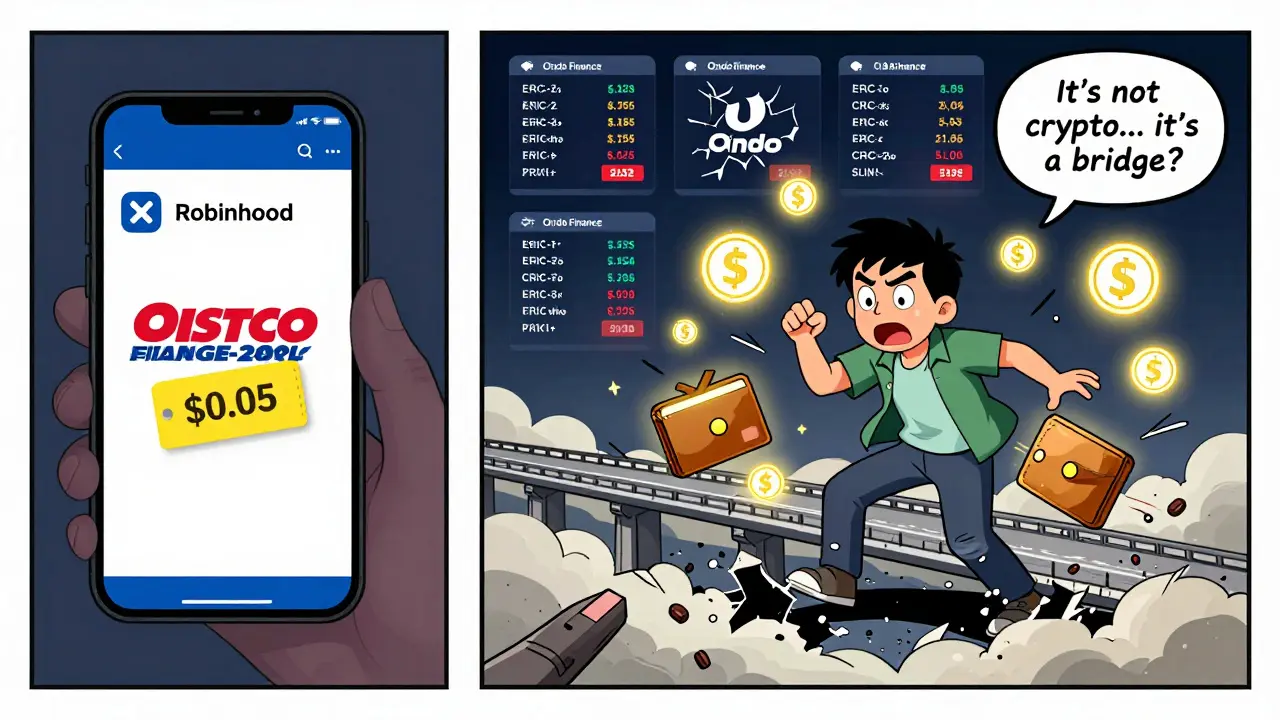

Compare that to buying Costco stock directly: you use Robinhood, Fidelity, or Charles Schwab. You pay a few cents in fees. You know exactly what you own. You can sell anytime during market hours. And you’re protected by the SEC.

Who Is This For?

Not you, probably. Unless you’re:

- A crypto investor who already holds a lot of Ethereum and wants to dabble in stocks without leaving DeFi.

- An institutional player testing the waters of tokenized securities.

- A researcher or speculator betting on the future of RWA.

If you’re just trying to invest in Costco because you like the bulk snacks and cheap rotisserie chickens? Buy the stock. It’s cheaper, safer, and easier.

If you’re drawn to COSTon because you think it’s the "next big crypto"? You’re misunderstanding the whole point. It’s not supposed to be a speculative asset. It’s supposed to be a bridge. And right now, that bridge is barely wide enough for a bicycle.

Where Can You Buy It?

Good luck. COSTon is listed on a handful of platforms:

- Crypto.com - Has two different listings with conflicting prices and volumes.

- Coinbase - Only available as a converter, not a tradeable asset.

- Ondo Global Markets - The official platform, but requires KYC and isn’t user-friendly.

- Decentralized exchanges - Like Uniswap, but liquidity is near zero.

You won’t find it on Binance, Kraken, or Gemini. You won’t see it in your Robinhood app. You can’t just tap a button and buy it like you would Dogecoin. You need to navigate a fragmented, confusing ecosystem just to get started.

The Bigger Picture

Tokenized stocks like COSTon are a glimpse into the future. Imagine owning a share of Apple, Tesla, or Coca-Cola as a token you can send to a friend in Nigeria, use as collateral for a loan in DeFi, or trade at 3 a.m. That’s the vision.

But right now? We’re in the early 1990s of the internet. The tech exists. The infrastructure is shaky. Most people don’t need it. And regulators are watching closely.

COSTon isn’t a get-rich-quick crypto coin. It’s a proof of concept. A tiny, fragile experiment. And right now, it’s more interesting as a case study than as an investment.

Should You Buy COSTon?

Only if you understand the risks and are okay with losing your entire investment. If you’re curious, put in $10. See how it works. Don’t expect returns. Don’t expect liquidity. Don’t expect clarity.

For everyone else? Stick to the real stock. Costco’s business is solid. Its stock has performed well for decades. You don’t need a blockchain to benefit from that.

The future of finance might be tokenized. But the present? It’s still messy, slow, and full of traps. COSTon isn’t the future-it’s a warning sign wrapped in a blockchain.

nicholas forbes

December 4, 2025 AT 23:28COSTon is just a fancy way to say 'I want to trade stocks like I trade meme coins.' The fact that there are only 28 holders and $3k in monthly volume says everything. If this were real adoption, we’d see thousands of wallets moving it daily. Instead, it’s a ghost town with a blockchain label.

Regina Jestrow

December 6, 2025 AT 21:33I read this whole thing twice because I was so confused. Like… if I buy COSTon, am I technically owning Costco stock? Or am I owning a token that represents a claim on stock that someone else holds? And if Ondo goes under, do I get my money back? Or just a bunch of digital receipts that no one accepts? My brain hurts.

Martin Hansen

December 8, 2025 AT 18:49Wow. So you’re telling me some guy with a website and a legal disclaimer is letting me ‘invest’ in Costco through a crypto token that’s barely traded? And you think this is ‘the future’? Please. This isn’t innovation-it’s financial cosplay. Real investors don’t need to use Uniswap to buy a company that’s been in the S&P 500 for 20 years. This is just crypto bros trying to make dividend-paying blue chips look like they’re ‘decentralized.’ Pathetic.

Joe West

December 9, 2025 AT 01:02For anyone considering COSTon: treat it like a $10 experiment, not an investment. If you’re curious about tokenized assets, go ahead and throw a few bucks in-but don’t expect liquidity, clarity, or returns. The NAV is close to the real stock price, which is good, but the spreads are insane on some DEXs. One platform shows $916, another $971-same asset, same underlying stock. That’s not market inefficiency, that’s a scam waiting to happen. Stick to Robinhood unless you’re a DeFi degens who enjoys debugging wallet transactions at 2 a.m.

Also, if you’re using this to ‘get exposure’ to stocks without leaving crypto, you’re missing the point. You’re not gaining anything except complexity and risk. The dividends are auto-reinvested? Cool. But you could’ve done that on Fidelity for free. This is like buying a Tesla with a USB charger instead of a wall connector because ‘it’s more decentralized.’

Richard T

December 9, 2025 AT 12:12Just to clarify something for newcomers: COSTon isn’t a crypto coin. It’s a security token. That means it’s regulated under securities law, not as a currency. That’s why it’s on Ondo’s platform and not Binance. The reason trading volume is so low is because most retail traders don’t even know it exists-and those who do are either too scared or too confused to trade it. The real story here isn’t the token-it’s the fact that institutions are quietly testing this infrastructure. Hedge funds are buying these tokens in bulk behind the scenes. They’re not doing it for the ‘crypto’ vibe. They’re doing it because they want to move assets faster across borders without going through custodians. This is the quiet revolution. You just can’t see it yet because it’s not on Reddit.

So yes, it’s messy. Yes, it’s illiquid. But if you think this is just a gimmick, you’re not looking far enough ahead.

jonathan dunlow

December 11, 2025 AT 07:56Let me tell you something-this whole thing is a beautiful mess, and I love it. Think about it: for the first time in history, you can own a slice of Costco stock and send it to your cousin in Manila as a birthday gift. No bank. No wire transfer. No waiting 3 days. Just a wallet, a private key, and a blockchain. Yeah, the volume is trash. Yeah, the prices are all over the place. Yeah, the SEC might shut it down tomorrow. But guess what? So was the internet in 1995. So was email. So was online banking. People laughed at those too. This isn’t about making money today. It’s about building the plumbing for tomorrow’s financial system. And if you’re not even willing to put $10 into this experiment, you’re not just missing out-you’re choosing to stay in the 1980s while the world moves forward. The real risk isn’t losing your $10. The real risk is waking up in 2030 and realizing you could’ve been part of this, but you were too scared to click ‘buy’ because it didn’t look like a Robinhood stock ticker. Don’t be that guy.