SBUXon Value Calculator

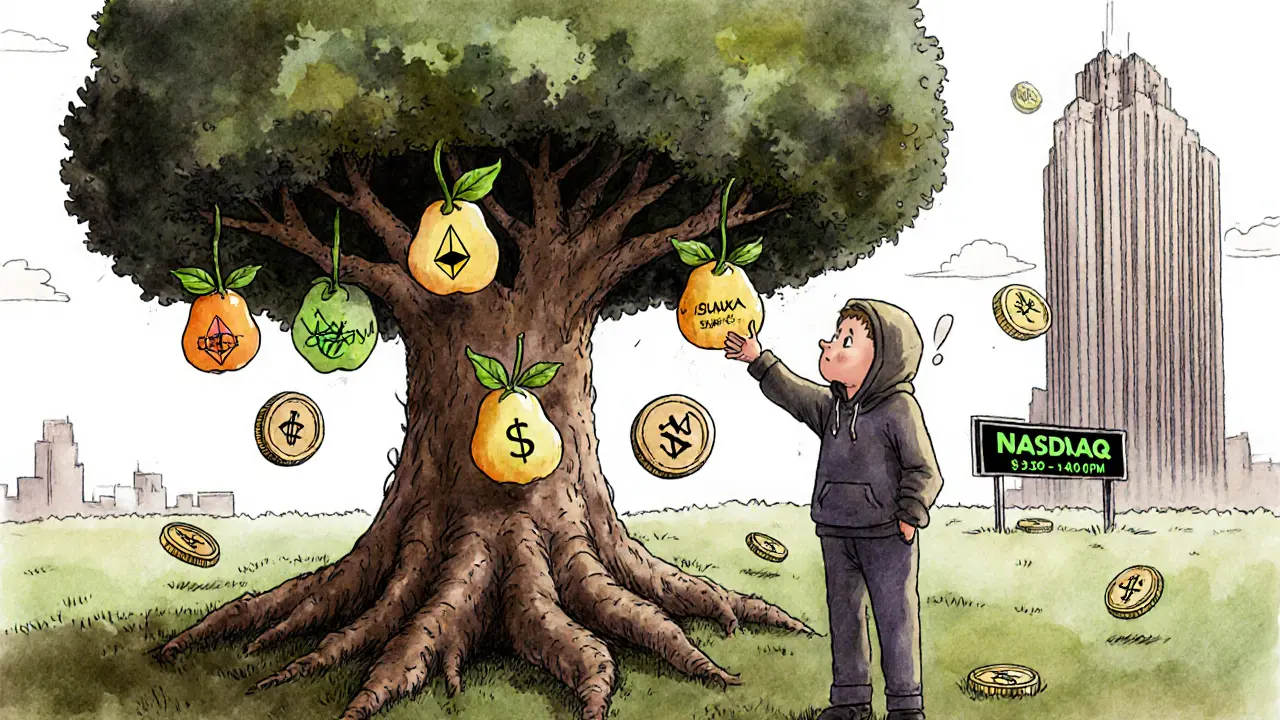

There’s a new kind of digital asset floating around crypto circles that looks like Starbucks stock-but it’s not. It’s called SBUXon, and it’s not a cryptocurrency in the traditional sense. It’s a blockchain-based token that mirrors the value of Starbucks Corporation (SBUX) shares traded on the Nasdaq. If you’ve seen headlines claiming you can "buy Starbucks as a crypto coin," you’re not alone. But here’s the truth: you’re not buying Starbucks stock. You’re buying a digital promise that tracks it.

What Exactly Is SBUXon?

SBUXon is a token issued by Ondo Finance, a financial technology firm founded in 2021 that specializes in tokenizing traditional assets like stocks and bonds. Launched in September 2023, SBUXon is designed to give crypto investors exposure to Starbucks’ stock price without needing a brokerage account. Each SBUXon token is meant to represent the economic value of one share of Starbucks (SBUX) stock.

It’s built on Ethereum as an ERC-20 token with the contract address 0xf15fbc1349ab99abad63db3f9a510bf413be3bef. There’s also a version on BNB Chain, but the Ethereum version is the main one. Unlike Bitcoin or Ethereum, SBUXon doesn’t have its own network. It’s a digital representation of something that already exists in the real world.

What makes it different from buying SBUX stock directly? For starters, you can trade it 24/7. The Nasdaq only operates from 9:30 a.m. to 4:00 p.m. Eastern time. SBUXon trades whenever crypto markets are open. You can also buy fractions of a token-down to 0.000000001 SBUXon-so you don’t need $87 to get started. That’s appealing if you want to dip your toes into high-priced stocks without committing a lot of cash.

How Does It Work?

Ondo Finance doesn’t just drop tokens into the wild. There’s a legal structure behind it. SBUXon is issued under a Reg S exemption, a U.S. Securities and Exchange Commission (SEC) rule that allows private offerings to non-U.S. investors without full registration. The legal entity behind the token is registered in the British Virgin Islands, not the U.S. That means U.S. residents can technically hold it, but they can’t buy it directly from Ondo. Most buyers get it through exchanges like Ondo Global Markets or other crypto platforms that support it.

To get SBUXon, you need to:

- Complete KYC (Know Your Customer) verification through Ondo’s platform

- Transfer funds to a supported exchange

- Use a crypto wallet compatible with Ethereum (like MetaMask)

- Pay Ethereum gas fees-around $1.27 per transaction as of late 2023

It’s not plug-and-play. If you’re used to buying stocks through Robinhood or Fidelity, this process feels like learning a new language. Ondo’s own onboarding guide takes about 45 minutes to get through, according to user testing by DeFi Safety. That’s a big barrier for casual investors.

Price and Performance: Is It Tracking Starbucks Stock?

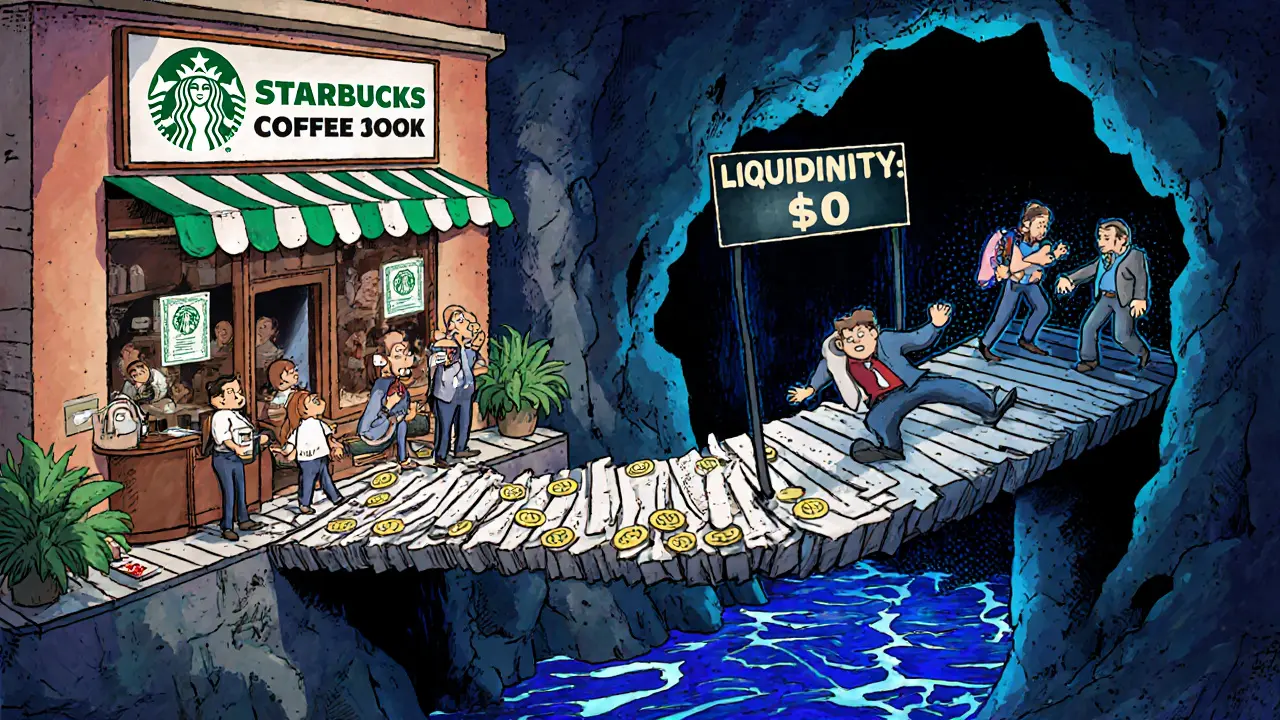

SBUXon is supposed to mirror the price of Starbucks stock. But in practice, it doesn’t always. As of November 25, 2023, Starbucks (SBUX) was trading at $87.25 on Nasdaq. SBUXon was hovering between $83.70 and $86.10 across platforms. That’s a 1.5% to 4% gap. Why? Because there’s almost no trading activity.

According to CoinMarketCap, the 24-hour trading volume for SBUXon was $0. Phemex reported $41,000-tiny compared to the $308 million average daily volume for actual SBUX shares on Nasdaq. That lack of liquidity means the price can drift. There’s no big market forcing it to stay in line. If someone buys 100 SBUXon tokens in a quiet market, the price can jump. If they sell, it can crash. That’s not how real stock markets work.

It hit an all-time high of $89.39 in early September 2023-just a few days after launch-and then dropped to $78.03 by early November. That’s a 12.7% swing in under two months. For comparison, SBUX stock moved less than 5% in the same period. This volatility isn’t from Starbucks’ earnings or coffee sales. It’s from crypto market sentiment and thin trading.

Who Owns It?

As of November 2023, there were only 34 unique wallet addresses holding SBUXon across Ethereum and BNB Chain. That’s it. Thirty-four people or entities own the entire circulating supply of 19,561.51 tokens. Compare that to Starbucks’ 1.8 million shareholders. This isn’t a mass-market product. It’s a niche tool for a small group of crypto-savvy investors.

Some of those holders are likely arbitrage traders trying to exploit price differences between SBUXon and SBUX. But with almost no volume, even that’s nearly impossible. One Reddit user summed it up: "SBUXon’s price divergence from actual SBUX makes arbitrage opportunities, but the $0 volume means you can’t execute trades."

There’s no Trustpilot reviews, no public user base, and no clear retail adoption. This isn’t something grandma is buying for her retirement fund. It’s a speculative instrument for people who already understand DeFi, wallets, and blockchain.

How Is It Different From Other Tokenized Stocks?

Ondo isn’t the first to try this. Mirror Protocol launched mSBUX in 2021. It collapsed during the 2022 crypto winter. SwissBorg tried tokenized stocks too-and shut it down in 2022. So why is Ondo still around?

Because they’re focused on compliance. Most past projects ignored regulators. Ondo built its model around Reg S, which gives it a legal cushion-even if it’s not perfect. David Lester, CEO of Tokensoft, called Ondo’s approach "the most viable path for tokenized equities in the current SEC enforcement environment." But even he admitted the liquidity problem is a dealbreaker.

Compared to competitors, SBUXon has better legal footing. But it’s still not a substitute for owning real stock. You don’t get voting rights. You don’t get direct dividend payments-you get dividend reinvestment rights, meaning Ondo buys more SBUX stock on your behalf and issues you more tokens. It’s indirect. And it’s slow.

Is It Safe? What Are the Risks?

There are three big risks:

- Regulatory risk: The SEC hasn’t approved tokenized stocks. SEC Commissioner Hester Peirce said in November 2023 that "tokenized stocks operating under Reg S exemptions still face significant regulatory uncertainty." SEC Director John Coates went further, calling them "unregistered securities offerings." That means the SEC could shut SBUXon down tomorrow. There’s no guarantee it’ll survive.

- Liquidity risk: With $0 daily volume, you might not be able to sell when you want to. If you need cash fast, you’re stuck. There’s no market to exit into.

- Counterparty risk: You’re trusting Ondo Finance to hold the real Starbucks shares, manage dividends, and issue tokens correctly. If Ondo fails, gets hacked, or disappears, your SBUXon tokens could become worthless.

And here’s the kicker: SBUXon is worth less than $1.7 million in total market cap. Starbucks’ entire company is worth over $100 billion. This token is a speck of dust on a giant’s shoulder.

Why Does This Even Exist?

It’s not about replacing traditional stock markets. It’s about giving crypto-native investors a way to participate in traditional finance without leaving their crypto ecosystem. For people who already hold ETH, USDC, or BTC, SBUXon lets them add equity exposure without opening a brokerage account. It’s a bridge-but a very wobbly one.

Some see it as a stepping stone. Ondo has started integrating SBUXon into DeFi protocols. For example, it’s now accepted as collateral on Aave’s GHO stablecoin. But as of late November 2023, only $12,345 worth of SBUXon was locked in as collateral. That’s less than 0.1% of its total supply.

J.P. Morgan’s November 2023 report predicted mainstream adoption of tokenized stocks could take 5 to 7 years. Until then, it’s a playground for a few hundred tech-savvy investors-not a replacement for Wall Street.

Should You Buy SBUXon?

If you’re looking for a safe, liquid way to invest in Starbucks? Don’t. Buy SBUX stock directly. It’s cheaper, more transparent, and legally protected.

If you’re a crypto investor who wants exposure to traditional equities and understands the risks? Maybe. But only if:

- You’re okay with no liquidity

- You’re fine with regulatory uncertainty

- You’re not using money you can’t afford to lose

- You’ve done the KYC and understand the wallet setup

It’s not a get-rich-quick scheme. It’s not even a reliable investment. It’s an experiment. And like all experiments, it might fail.

What’s Next for SBUXon?

The future depends on regulators. If the SEC cracks down on Reg S exemptions, SBUXon could vanish overnight. If they create a clear framework for tokenized stocks, adoption might slowly grow. But even then, it’ll take years to match the liquidity of Nasdaq.

Right now, SBUXon is a curiosity. A digital shadow of a real company. It’s not crypto. It’s not stock. It’s something in between-and nobody’s quite sure what that means yet.

Komal Choudhary

November 26, 2025 AT 13:17Okay but why does this even exist? Like I get it’s crypto-adjacent but if I wanna invest in Starbucks I’ll just buy the stock 😅 Why am I paying gas fees and doing KYC for a token that might vanish tomorrow? This feels like someone trying to sell me a picture of a sandwich when I can just go eat the real thing.

fanny adam

November 27, 2025 AT 02:11This is a regulatory time bomb. Ondo Finance is exploiting a loophole in Reg S to distribute unregistered securities to non-U.S. investors, but the SEC is already watching. The fact that trading volume is $0 and only 34 wallets hold the entire supply proves this isn’t a market-it’s a lab experiment. If the SEC classifies this as a security offering without registration, every holder could be caught in an illegal transaction. This isn’t innovation. It’s legal gambling with your assets.

Kristi Malicsi

November 28, 2025 AT 23:46So we’re trading digital shadows of real companies now huh. Like we’re not satisfied with owning actual pieces of businesses anymore we need blockchain glitter on top. I mean if Starbucks’ stock goes up does the token magically glow brighter or do we just watch the numbers drift because no one’s actually buying or selling. It’s like owning a photo of a sunset instead of being outside watching it. The beauty is in the real thing not the pixel version.

Evelyn Gu

November 30, 2025 AT 12:19I just can’t get over how fragile this whole thing is… I mean think about it: you’re trusting a private company in the British Virgin Islands to hold real Starbucks shares, manage dividends, issue tokens correctly, and not get hacked or go bankrupt or just disappear one day… and on top of that, you’ve got zero liquidity, no regulatory clarity, and a market cap of less than two million dollars for a company worth over a hundred billion… and people are calling this the future of finance? I’m sorry but this feels less like progress and more like a house of cards built on blockchain confetti and hope.

Angel RYAN

December 1, 2025 AT 05:33It’s not perfect but it’s a step. People want to participate in traditional markets without jumping through brokerage hoops. The liquidity issue is real but it’ll improve as more platforms integrate it. Maybe not everyone needs to buy it, but it’s worth watching. The tech isn’t the problem-it’s the adoption curve. Give it time.

stephen bullard

December 2, 2025 AT 08:15Kinda reminds me of when people thought you could replace libraries with Google Books. You can access info faster but you lose the texture, the context, the human layer. SBUXon gives you price exposure but not ownership, not voice, not legacy. It’s a ghost of a stock. Maybe it’s useful for crypto natives who don’t trust banks… but it’s not a replacement. Just a parallel path. And parallel paths don’t always meet.

SHASHI SHEKHAR

December 4, 2025 AT 06:43Bro this is wild but also kinda genius 🤯 I checked the contract address and yep it’s ERC-20 on Ethereum. And the fact that you can buy 0.000000001 SBUXon? That’s accessibility for small investors 💪 And yeah volume is low but that’s because it’s new. Look at DeFi in 2020-same thing. Now it’s billions. Ondo is legit with Reg S, and they’re already in Aave as collateral. This is the future of hybrid finance. Just gotta ride the wave 🌊☕️

Vaibhav Jaiswal

December 4, 2025 AT 20:23Imagine this: you’re at a coffee shop, you pull out your phone, you buy a fraction of Starbucks stock… with crypto… while your latte cools down. That’s the vibe. It’s not about replacing Wall Street-it’s about making finance feel less like a club and more like a community. Yeah it’s messy. Yeah it’s risky. But isn’t that the whole point of crypto? To break the old rules and build something weird and new? I’m not putting my life savings in it… but I’m watching. And maybe buying one token just to say I did it. 🤷♂️