Starbucks Tokenized Stock: What It Is and Why It Matters

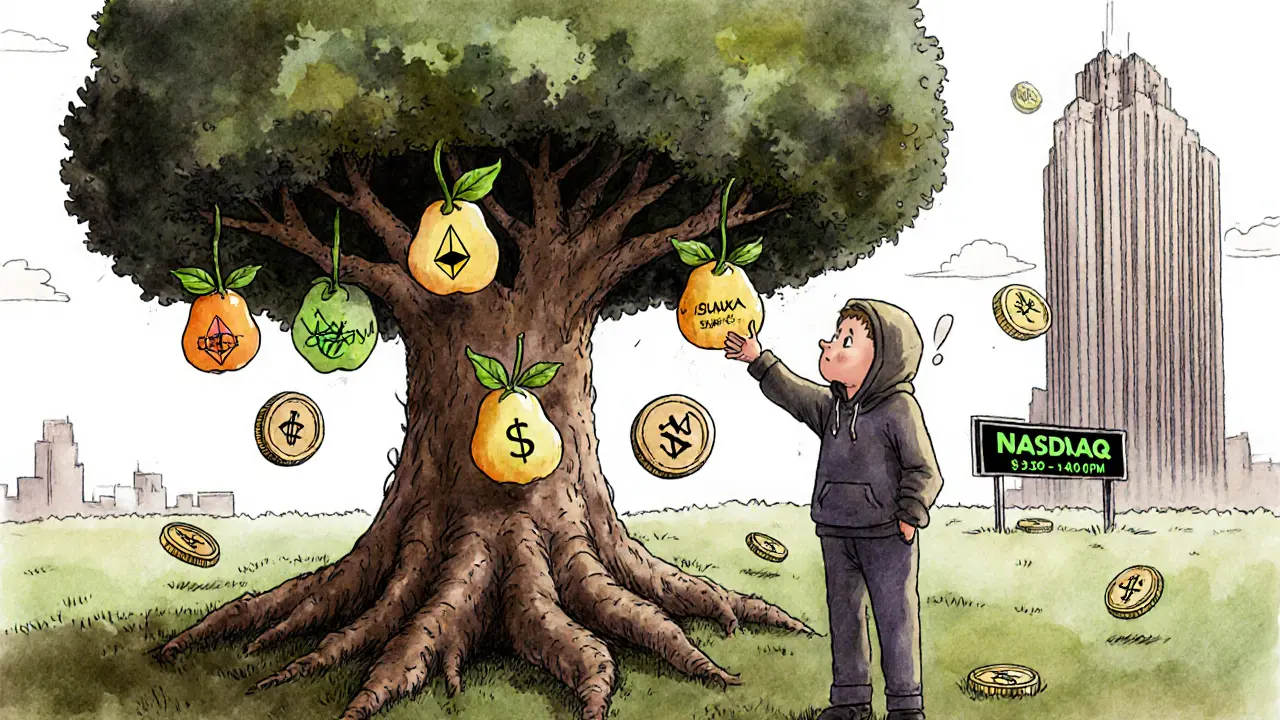

When people talk about Starbucks tokenized stock, a digital version of Starbucks shares recorded on a blockchain, allowing for faster trading and fractional ownership. It’s not something you can buy today—but the concept is part of a bigger shift in how companies think about ownership. Tokenized stocks aren’t just crypto hype. They’re real financial instruments being tested by banks, brokers, and even public companies. The idea is simple: take a traditional stock, like one share of Starbucks, and turn it into a digital token on a blockchain. That token can then be bought, sold, or split into smaller pieces—without needing a traditional broker.

This isn’t just about Starbucks. tokenized stocks, digital representations of company shares issued on blockchain networks, enabling 24/7 trading and automated compliance are being piloted by firms like BlackRock and Nasdaq. They’re designed to cut out middlemen, reduce settlement times from days to minutes, and open investing to people who can’t afford full shares. If Starbucks ever did this, you could own 0.001 of a share with a few clicks, not after saving for months. And unlike crypto tokens, these would still be tied to real company performance—dividends, earnings, board votes—all recorded on-chain.

But here’s the catch: blockchain stocks, equity securities issued and managed using distributed ledger technology, often under regulatory oversight still face big hurdles. Regulators like the SEC haven’t cleared most tokenized shares for public trading. There’s no legal framework in the U.S. that lets Starbucks swap its NYSE-listed stock for a blockchain version without breaking rules. Plus, most people don’t understand the difference between a tokenized stock and a crypto coin. One gives you partial ownership in a real business. The other? Often just speculation.

That’s why you’ll see fake claims online—"Buy Starbucks tokenized stock now!"—but no real platform offering it. Scammers love this confusion. They’ll use the name "Starbucks" to lure you into phishing sites or fake airdrops. Real tokenized equity doesn’t come with free coins or social media giveaways. It’s slow, regulated, and backed by legal paperwork.

So what’s next? If Starbucks ever moves toward tokenization, it won’t be a surprise. The company has already experimented with blockchain for loyalty programs and supply chain tracking. Moving to tokenized shares would be a natural next step—if regulators say yes. Until then, the buzz is just noise. But the underlying idea? That’s real. And it’s changing finance faster than most people realize.

Below, you’ll find a collection of posts that cut through the hype. From how tokenized assets work, to why companies like Starbucks might eventually go this route, to the scams pretending to offer them—you’ll see what’s real, what’s fake, and what you should actually be watching.

What Is Starbucks Tokenized Stock (Ondo) (SBUXon)? The Real Story Behind the Crypto-Like Stock Token

- 8 Comments

- Dec, 4 2024

SBUXon is a blockchain token by Ondo Finance that tracks Starbucks stock price but isn't actual stock. It offers 24/7 trading and fractional ownership but suffers from zero liquidity, regulatory risk, and minimal adoption.