Tokenized Equities: What They Are and Why They Matter in Crypto

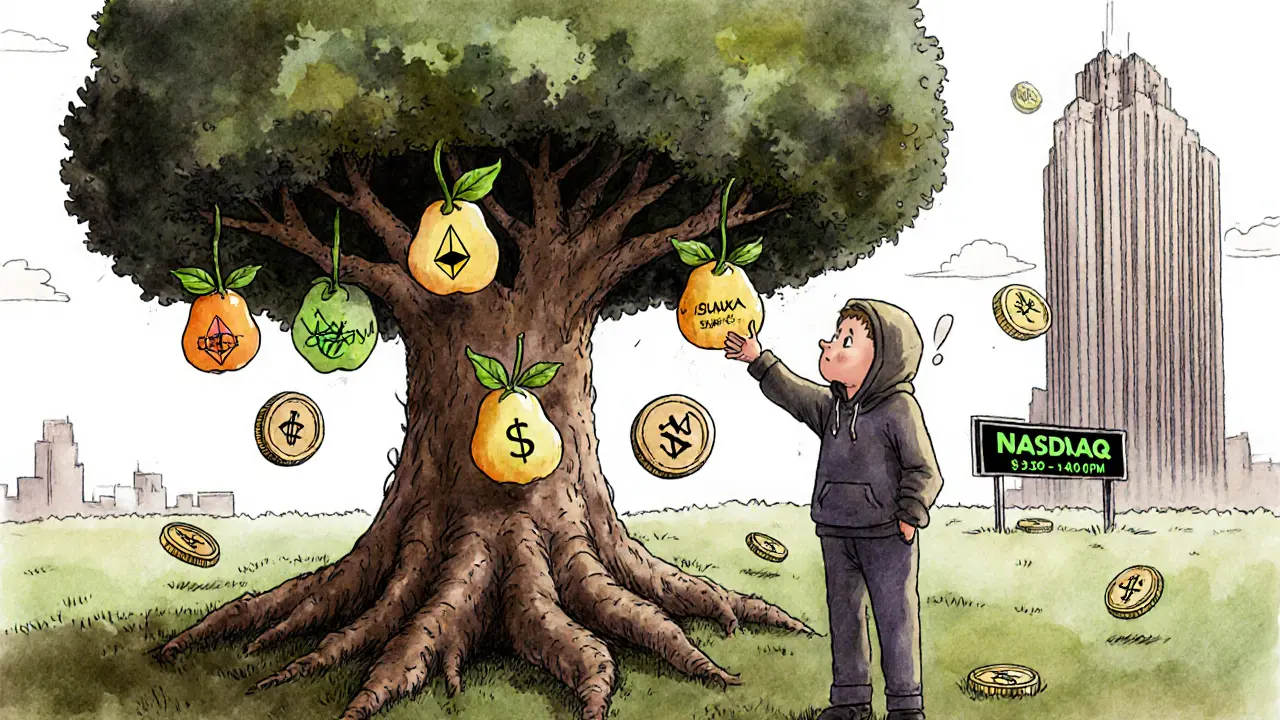

When you buy a share of Apple or Tesla, you own a tiny piece of that company. Tokenized equities, digital versions of traditional stocks built on blockchain networks. Also known as security tokens, they let you hold ownership in real companies using crypto wallets instead of brokerage accounts. Unlike meme coins or speculative tokens, tokenized equities are backed by actual assets—like shares in a public or private company—and often follow securities laws. This isn’t just crypto hype; it’s finance being rebuilt from the ground up.

These digital shares aren’t just copies of paper stocks. They’re programmed to do things regular shares can’t. Imagine getting dividends automatically paid in stablecoins, or selling part of your Apple holding without waiting for market hours. That’s what blockchain stocks, tokenized equities traded on decentralized platforms make possible. They also open doors for people who can’t access traditional markets—like those in countries with strict capital controls or limited banking options. In Nigeria, where crypto adoption is driven by economic need, tokenized equities could let someone buy a slice of a U.S. tech giant without needing a U.S. bank account. And in places like Venezuela, where inflation eats away savings, owning tokenized shares in stable companies becomes a lifeline.

But it’s not all smooth sailing. Digital securities, the legal framework behind tokenized equities still face regulatory gray zones. The SEC in the U.S., for example, treats many of them as securities, meaning issuers must comply with strict rules. That’s why most real tokenized equity projects are tied to licensed platforms, not random crypto exchanges. You won’t find them on shady platforms like BitxEX or DubiEx—because those platforms don’t have the compliance infrastructure. Instead, look to regulated players like HashKey Exchange or platforms built for institutional use. The technology is ready. The legal systems are catching up.

What you’ll find below isn’t a list of tokenized equity projects—there aren’t many legitimate ones yet. But you’ll see posts about related topics: how exchange inflows signal investor behavior, how crypto regulations shape what’s allowed, and how platforms like Bitfinex or Tinyman handle asset-backed tokens. You’ll also find warnings about fake tokens and dead projects that pretend to be something they’re not. This isn’t about chasing quick gains. It’s about understanding how real ownership is moving from paper to blockchain—and why you need to know the difference before you invest.

What Is Starbucks Tokenized Stock (Ondo) (SBUXon)? The Real Story Behind the Crypto-Like Stock Token

- 8 Comments

- Dec, 4 2024

SBUXon is a blockchain token by Ondo Finance that tracks Starbucks stock price but isn't actual stock. It offers 24/7 trading and fractional ownership but suffers from zero liquidity, regulatory risk, and minimal adoption.