Venezuela Crypto Mining: How Crypto Mining Is Thriving Amid Economic Crisis

When the Venezuelan bolívar collapsed, people didn’t wait for help—they turned to Venezuela crypto mining, the practice of using computing power to validate Bitcoin transactions and earn rewards as a lifeline in a failing economy. Also known as crypto mining under hyperinflation, it became one of the few ways ordinary people could convert electricity into real value. With monthly inflation hitting over 1,000,000% at its peak, wages vanished before payday. But Bitcoin? It didn’t care about government policies. Miners started running rigs in basements, garages, and even rooftops, using cheap or subsidized power to generate income in dollars—literally mining their way out of poverty.

What makes Venezuela’s case unique isn’t just the scale—it’s the necessity. Unlike mining in places like the U.S. or Kazakhstan, where it’s a business decision, in Venezuela, it’s a survival tactic. Families pool money to buy used ASIC miners from China, often shipped through third countries to avoid customs blocks. They connect them to government-subsidized electricity, which costs pennies compared to global rates. Some miners earn enough to buy food, medicine, or send remittances to relatives abroad. This isn’t speculative investing—it’s barter in the digital age. And it’s not just Bitcoin. Many also mine Ethereum Classic, Monero, and other coins that can be easily converted into cash through peer-to-peer platforms like LocalBitcoins or Paxful.

The government didn’t stop it—they tried to control it. In 2018, Venezuela launched its own state-backed cryptocurrency, the Petro, hoping to bypass U.S. sanctions. But no one trusted it. Meanwhile, miners kept running their rigs quietly, ignoring the Petro and sticking with Bitcoin. The state eventually gave up trying to ban mining outright. Instead, it began taxing electricity used for mining, then later offered special power rates to licensed miners. But most miners stayed underground, avoiding bureaucracy and risk. What emerged wasn’t a national crypto project—it was a grassroots network of resilience.

Today, Venezuela has one of the highest rates of crypto adoption in Latin America. Over 15% of adults use crypto regularly, according to Chainalysis. And while global mining has shifted to places with cheap renewables and strict regulations, Venezuela’s story remains a raw, real-world example of how decentralized tech can empower people when traditional systems fail. The rigs may be old, the cables frayed, and the power outages frequent—but the Bitcoin keeps coming in. This isn’t tech innovation for its own sake. It’s people using what’s available to rebuild their lives, one hash rate at a time.

Below, you’ll find real stories, technical breakdowns, and hard truths about what’s happening on the ground in Venezuela—how miners survive, what hardware they use, where they sell their coins, and why this isn’t just a footnote in crypto history. It’s a blueprint for economic resistance.

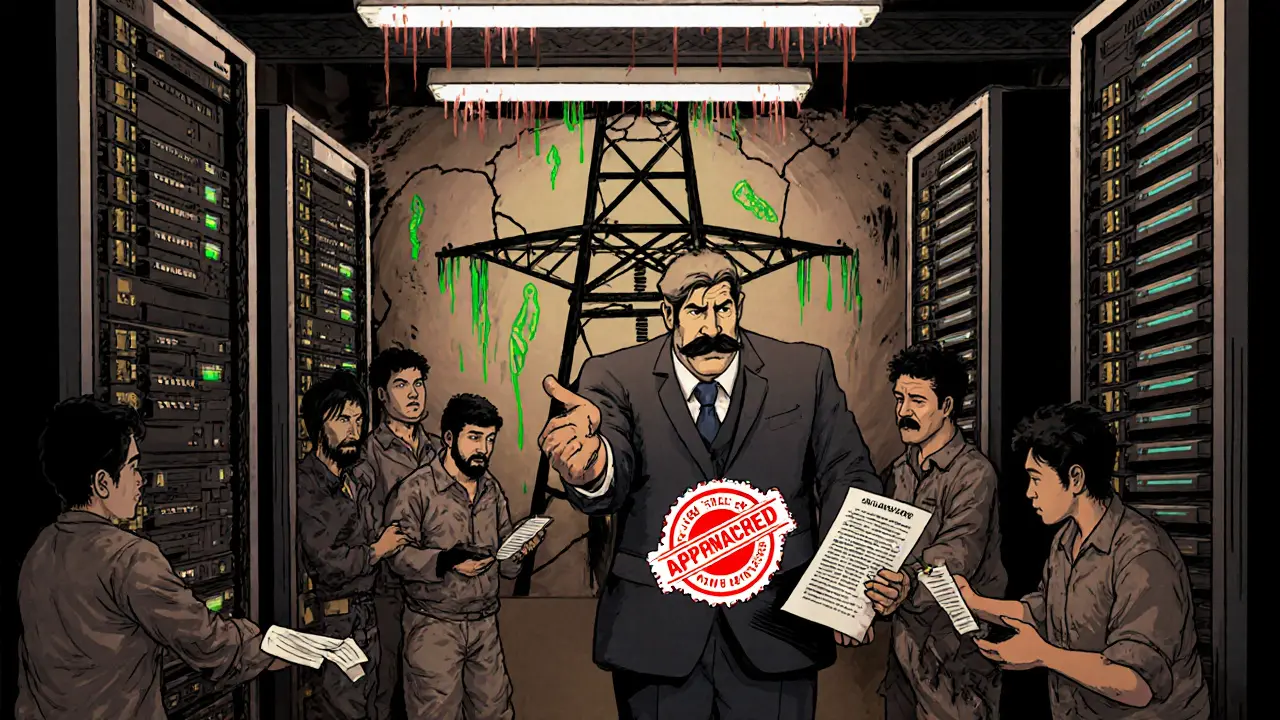

State Control of Crypto Mining in Venezuela: How the Government Manages and Limits Digital Mining

- 6 Comments

- Feb, 24 2025

Venezuela's state-controlled crypto mining system uses cheap electricity and strict regulations to manage digital mining - but corruption, power outages, and public distrust have made it chaotic. Despite bans and bureaucracy, mining continues underground.