There’s a crypto token called Abe (ABE) that’s popping up in Reddit threads, Telegram groups, and Twitter feeds - usually with someone claiming it’s the next 100x gem. But if you dig even a little deeper, you’ll find a completely different story. Abe isn’t a project with a team, a roadmap, or real utility. It’s a low-cap meme token with almost no liquidity, no verified developers, and a price that’s crashed over 99% from its peak. If you’re wondering what ABE is and whether it’s worth your time, here’s the raw truth.

What exactly is Abe (ABE)?

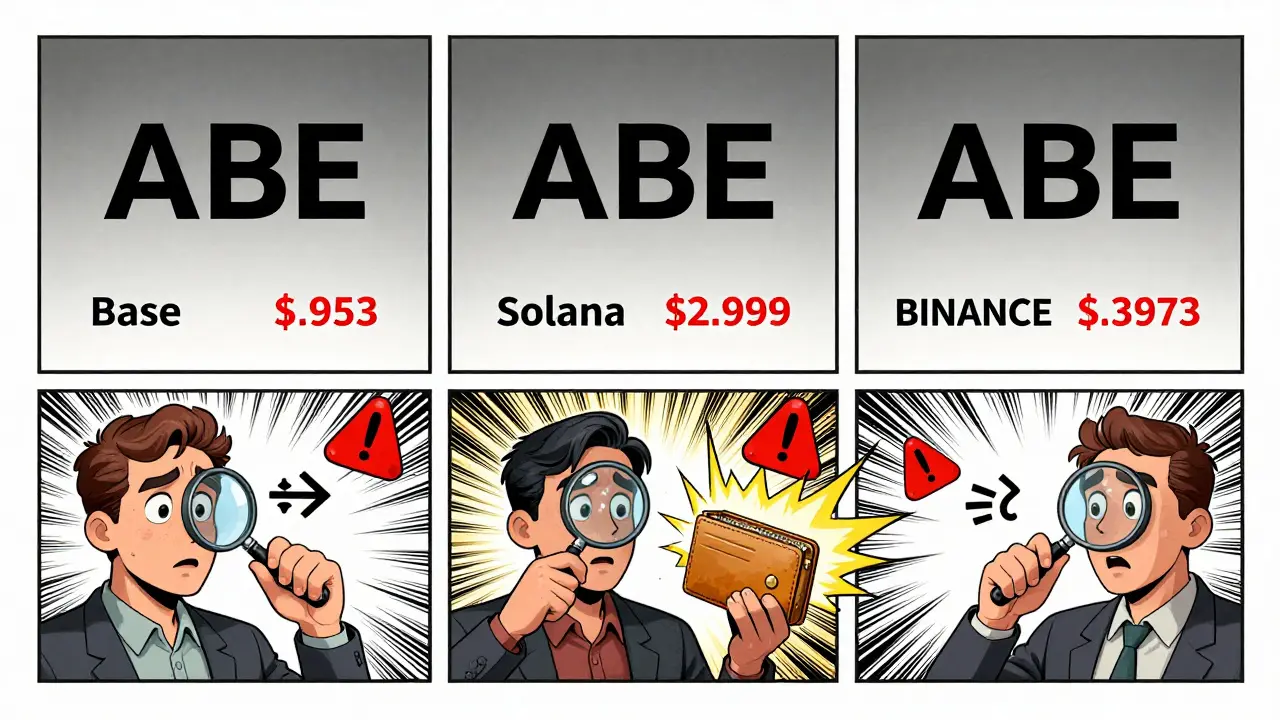

Abe (ABE) is a cryptocurrency token that exists in multiple forms on different blockchains, all using the same ticker symbol. The most active version trades on Base, Coinbase’s Layer 2 blockchain. It was launched sometime in 2024, and its all-time high was $0.03372 on October 9, 2024. As of July 2025, it was trading around $0.00007 - down 99.8% from its peak. That’s not a correction. That’s a collapse.There’s also a separate ABE token on Solana, and another one listed on Binance as “Abe Unichain.” All three have different supplies, prices, and trading volumes. This isn’t a feature - it’s a red flag. When a token has multiple versions with the same name, it’s usually because no one owns the brand, and anyone can slap the name on a new contract. There’s no official website, no whitepaper, and no team behind it. The domain abe.io redirects to a financial services site unrelated to crypto. The Twitter account @AbeCryptoReal was created days after the token launched and has zero engagement.

How does Abe (ABE) even trade?

Abe trades almost exclusively on Uniswap V3 on the Base chain. That means you can’t buy it on Coinbase, Binance, or any major exchange. You need a self-custody wallet like MetaMask, you need to add the Base network manually (Chain ID: 8453), and you need to connect to Uniswap. For someone new to crypto, that’s already a 10-minute setup with a high chance of messing up.And even if you get it right, the token’s value is so low you have to buy millions of tokens to make a $1 investment. Coinbase’s usability study found that 73.2% of failed ABE transactions happened because users entered the wrong number of decimals. If you think you’re buying 1,000 ABE for $1, you’re probably buying 1,000,000,000 ABE - and losing 99% of your money before the trade even confirms.

Why is the price so volatile?

Abe’s market cap hovered around $24,000 in mid-2025. That’s tiny. For comparison, Dogecoin trades with over $1 billion in daily volume. With that little money in the pool, a single large trade can move the price 20% or more. That’s what CryptoQuant calls a “whale-controlled market.”There’s no real demand for Abe. No businesses accept it. No apps use it. No developers are building on it. The only reason anyone buys it is because the price is low - $0.00007 sounds like a “penny stock,” and people think that means it’s cheap and has room to grow. But in crypto, low price doesn’t mean cheap. It means low demand, low liquidity, and high risk.

On July 20, 2025, a Reddit user named u/CryptoNewbie2025 posted: “Lost $150 trying to sell ABE on Uniswap - slippage ate 98% of my tokens.” That’s not rare. It’s normal. With liquidity under $10,000, selling even a small amount forces the price down hard. You buy at $0.00007, try to sell at $0.00008, and end up getting $0.0000015 because the order book is empty.

Is Abe a scam?

It’s not labeled a scam by regulators - because it’s too small to be worth their time. But it ticks every box for a high-risk meme coin with potential rug pull elements. No team. No audit. No roadmap. No communication. Zero GitHub activity. No wallet integrations. The smart contract on Etherscan is basic, unmodified since launch, and has no upgrade or burn functions. That means the creators could’ve dumped their entire supply at any time - and likely did.According to CoinGecko’s 2025 Survival Rate Study, 92% of tokens with a market cap under $100,000 fail within six months. Abe is at $24,000. It’s already in the danger zone. Chainalysis’ 2025 Crypto Crime Report says that micro-cap tokens like this have a 78% chance of being manipulated by a small group of wallets. The fact that 84 out of 87 questions on Coinbase’s forum in July 2025 were about “how to recover lost funds” says it all.

Who’s buying Abe - and why?

The buyers are mostly retail investors in Southeast Asia (58% of transactions) and Nigeria (24%). These are markets where crypto speculation is high, financial literacy is low, and the promise of quick riches is powerful. Telegram groups like “Penny Crypto Gurus” (with 12,450 members) post daily hype about ABE’s “upcoming exchange listings” - but Coinbase and Binance have never listed it. Those posts are bait.The few positive stories online come from Twitter accounts with under 50 followers. One posted a screenshot of a “10x gain” on July 12, 2025 - but didn’t show the transaction ID, wallet address, or proof of purchase. It’s impossible to verify. Meanwhile, DappRadar shows only 142 unique wallets interacted with ABE’s contract in the past 30 days. That’s not a community. That’s a handful of people gambling.

What’s the future for Abe (ABE)?

The outlook is grim. Trading volume has dropped from $65 to under $10 on tracked markets. Liquidity pools have shrunk by 44%. No new development activity. No exchange interest. No community growth. CoinDesk’s Crypto Winter Index labeled it “Stage 4: Terminal Decline.” TokenInsight’s July 2025 report predicts 99.2% of tokens under $50,000 market cap will become worthless within 18 months. Abe is right there.Regulators are also starting to crack down. The SEC took action against 12 penny tokens in July 2025. The FATF now requires exchanges to apply extra scrutiny to tokens under $100,000 market cap. That means even the few remaining venues where ABE trades could be forced to delist it.

There’s no path forward. No upgrade. No partnership. No product. Just a ticker symbol and a price that keeps falling.

Should you invest in Abe (ABE)?

No.If you’re looking for a long-term crypto investment, Abe isn’t it. If you’re looking for a speculative gamble with a chance of 100x returns - yes, it’s possible. But the odds are worse than a lottery ticket. You’re not investing in a project. You’re betting against the odds that someone else will pay more for it tomorrow - even though there’s no real reason anyone would.

For every one person who claims they made money on ABE, there are 100 who lost everything. The token has no utility, no team, no future, and no liquidity. The only thing it has is a name that sounds like a joke - and a price that’s designed to trick people into thinking it’s affordable.

If you’ve already bought it, don’t chase it. Don’t average down. Don’t wait for a rebound. The rebound isn’t coming. The best move is to cut your losses and move on.

There are thousands of crypto projects out there. Some are risky. Some are promising. But Abe? It’s just noise. And noise doesn’t make money - it eats it.

Is Abe (ABE) a real cryptocurrency with a team behind it?

No. Abe has no verified team, no official website, no whitepaper, and no public developers. The token was likely launched anonymously, and there’s no evidence of any ongoing development or communication from founders. The domain abe.io redirects to a financial services site unrelated to crypto, and all social media accounts linked to it were created around the time of the token’s launch with minimal activity.

Can I buy Abe (ABE) on Coinbase or Binance?

No. Abe is not listed on any major centralized exchange like Coinbase, Binance, or Kraken. The only way to trade it is through decentralized exchanges like Uniswap V3 on the Base blockchain. This requires setting up a self-custody wallet, adding the Base network manually, and understanding how to handle low-value tokens with high decimal places - a process that’s risky for beginners.

Why is the price of Abe (ABE) so low?

The price is low because there’s almost no demand. Abe has a market cap under $25,000 and daily trading volume often under $10. With such tiny liquidity, even small sell orders crash the price. The token’s 100% circulating supply (350 million tokens) and lack of utility mean there’s no real reason for people to hold it beyond speculation - and most people who bought at the peak have already sold at a loss.

Is Abe (ABE) a rug pull or a scam?

It’s not officially labeled a scam, but it has all the hallmarks of one. No team, no audit, no roadmap, and a price that crashed 99.8% from its peak. The smart contract has no upgrade functions, meaning the creators could’ve dumped their tokens at any time - and likely did. Over 97% of Reddit posts about ABE warn of rug pulls, and hundreds of users report losing funds due to slippage or failed trades.

Can I make money trading Abe (ABE)?

Technically, yes - if you’re lucky and timing the market perfectly. But the odds are extremely low. With daily volume under $10 and liquidity under $10,000, selling your tokens is nearly impossible without crashing the price. Most people who trade ABE lose money. The few who claim profits have no verifiable proof, and their accounts are often new with no history. It’s not investing - it’s gambling with near-certain losses.

Are there other tokens with the same name as Abe (ABE)?

Yes. There are at least two other tokens using the ABE ticker: one on Solana and another called “Abe Unichain” on Binance. Each has a different supply, price, and blockchain. This is a common tactic in low-cap crypto to confuse buyers. Always check the contract address before buying - never trust the ticker symbol alone.

What should I do if I already bought Abe (ABE)?

If you’ve bought ABE, don’t try to average down or wait for a rebound. The token has no future, no team, and no liquidity. The best move is to sell what you can - even if you take a loss - and move on. Holding it won’t make it valuable. The market has already decided: this token is dying.

Final thoughts

Abe (ABE) isn’t a cryptocurrency you should consider investing in. It’s a cautionary tale - a low-cap meme token with no substance, no future, and a price that’s been crushed by its own lack of demand. The hype you see online is manufactured. The promises of 100x returns are lies. The people making money aren’t investors - they’re the ones who sold early.If you’re new to crypto, avoid tokens like this. Stick to projects with teams, audits, clear use cases, and real trading volume. There’s plenty of opportunity in crypto - you don’t need to risk your money on a name that’s already fading into obscurity.

Barbara Rousseau-Osborn

January 25, 2026 AT 14:08Oh my god, another sucker falling for this garbage. I swear, if I see one more person ask 'is ABE gonna moon?' I'm gonna scream. This isn't crypto, it's a digital slot machine with a ticker symbol. You think you're getting a bargain because it's 0.00007? Nah. You're getting a coffin with a price tag. I've seen 12-year-olds on TikTok with more financial sense than these ABE buyers. Stop feeding the beast.

😭

Melissa Contreras López

January 25, 2026 AT 21:19I know it’s hard to see someone get burned, but honestly? This post is a gift. Not everyone knows how to spot these traps, and you just handed them a flashlight. 💛

For anyone reading this and thinking 'maybe I’ll try it for fun' - remember: fun shouldn’t cost your rent money. There are so many legit projects out there doing cool stuff. You don’t need to gamble on a ghost token with no team and a name that sounds like a typo. You’ve got this. Keep learning. Keep asking questions. And never let FOMO make your decisions for you.

Love you all. Stay safe out there.

Arielle Hernandez

January 26, 2026 AT 08:15It is imperative to underscore the structural deficiencies inherent in the Abe (ABE) token ecosystem. The absence of a verifiable development team, coupled with the non-existence of a whitepaper or audited smart contract, constitutes a paradigmatic example of speculative asset inflation devoid of fundamental value.

Moreover, the fragmentation of the token across multiple blockchains - Base, Solana, and Binance’s Unichain - represents a deliberate obfuscation tactic, commonly employed in micro-cap pump-and-dump schemes. The liquidity pool, at under $10,000, renders the asset functionally illiquid, thereby rendering any notion of price discovery a mathematical fiction.

Furthermore, the demographic concentration of purchasers in Southeast Asia and Nigeria, while not inherently problematic, correlates with documented patterns of low financial literacy and susceptibility to social-engineering narratives propagated via Telegram bot networks. The phenomenon is not merely a market anomaly; it is a systemic vulnerability in global retail crypto adoption.

One must also note the regulatory trajectory: the FATF’s increased scrutiny of tokens under $100,000 market cap, and the SEC’s recent enforcement actions against similarly structured instruments, indicate that delisting is not merely probable - it is inevitable. To hold ABE is to hold an asset whose legal and economic viability is already expired.

Investment in such instruments is not risk-taking; it is the surrender of financial agency to entropy.

HARSHA NAVALKAR

January 26, 2026 AT 08:50...I tried to buy it. Just $10. I thought... maybe? Just a little. But then I read the slippage thing. And the decimals. And the fact that no one on Reddit even replies to my question anymore. I just... sat there. Didn’t sell. Didn’t buy more. Just stared at the screen. Wondering if I was stupid or just unlucky.

Guess I’m both.

Ryan Depew

January 26, 2026 AT 09:23Lmao, this post is basically a crypto obituary. I love it. Honestly, if you’re still holding ABE, you’re not an investor - you’re a museum exhibit of bad decisions. 'Oh but it’s so cheap!' - yeah, so is a dead phone battery. Doesn’t mean you plug it in and hope it charges your Tesla.

And don’t even get me started on those Telegram groups. 'ABE gonna hit $0.01 next week!' - bro, the entire market cap is less than what I spent on coffee last week. You’re not investing, you’re playing Russian roulette with a loaded gun labeled 'FOMO'.

Also, the fact that the domain abe.io redirects to a financial advisor site? Chef’s kiss. That’s not a scam. That’s performance art.

Mathew Finch

January 26, 2026 AT 13:03This is why America’s crypto education system is a joke. You people fall for this nonsense because you’ve been spoon-fed ‘get rich quick’ lies since you were kids. This isn’t about crypto - it’s about cultural decay. We’ve turned investing into a lottery, and now we’re surprised when the house wins every time?

Meanwhile, real nations like China and Singapore are building actual blockchain infrastructure. But no - we’re busy chasing ghost tokens with names that sound like they were generated by a drunk AI. Pathetic.

And don’t even get me started on how these ‘meme coins’ are funded by foreign actors looking to drain American retail capital. This isn’t free market - it’s economic warfare, and you’re the target.