Regulatory Impact Estimator

How Regulations Affect Trading Volume

Based on 2025 data, this tool estimates volume changes based on your jurisdiction and exchange compliance status.

Enter your jurisdiction and compliance status to see estimated volume impact.

Trading volume in crypto markets has been falling hard since early 2025 - and it’s not because prices are down. Bitcoin hit a new all-time high above $110,000 in May. Ethereum broke $4,000. Altcoins were flying. But something strange happened: trading volume crashed. On major exchanges, spot trading volume dropped 27.7% quarter-over-quarter. That’s not a correction. That’s a collapse - and it’s directly tied to new government rules.

What’s Really Causing the Drop?

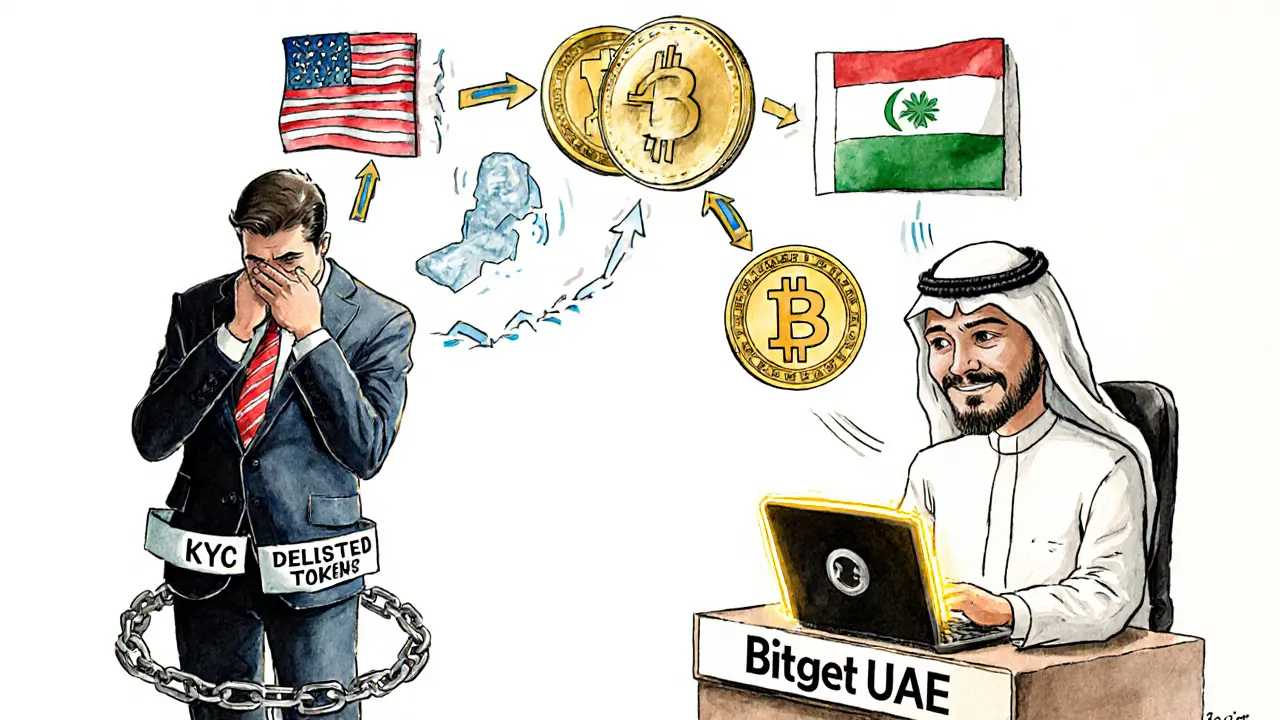

It’s not fear. It’s not a bear market. It’s regulation. In 2023, crypto exchanges could operate with loose rules. You could trade anything, anywhere, with minimal ID checks. By 2025, that’s over. The U.S. passed the GENIUS Act, requiring stablecoins to be 1:1 backed by U.S. dollars and registered with federal regulators. The EU rolled out MiCA, forcing exchanges to get licenses or shut down. India tightened tax reporting. Japan raised capital requirements. Suddenly, exchanges had to choose: comply or lose access to millions of users. The result? Massive volume drops. Crypto.com, once the second-largest exchange globally, saw its quarterly trading volume plunge 61.4%. It went from $560 billion in Q1 to just $216 billion in Q2. Why? Because it chose to follow U.S. rules instead of moving offshore. Other exchanges like MEXC and Bitget grew because they relocated to places like the UAE or Singapore - where rules were clearer or lighter.It’s Not Just One Country - It’s a Global Patchwork

Regulations aren’t uniform. That’s the problem. In Switzerland and Japan, where rules are clear and predictable, volume declines were mild - around 7-8%. Traders knew what was allowed. They could plan. In the U.S., India, and parts of Europe, where rules changed fast or were ambiguous, volume dropped 20-25%. Some exchanges froze trading on entire token categories overnight. One user on Reddit said their portfolio lost 37% of its tradable assets because their exchange delisted coins that didn’t meet new U.S. compliance standards. Even stablecoins - the backbone of crypto trading - got caught in the crossfire. USDT and USDC still moved over $1 trillion a month. But smaller stablecoins like EURC, created under the EU’s MiCA rules, exploded from $47 million to $7.5 billion monthly in just a year. Why? Because institutions finally trusted them. They knew they were legal. That’s the difference: regulation doesn’t kill volume - bad regulation does.Price Up, Volume Down - The Market Is Broken

Normally, when Bitcoin surges, traders rush in. Volume spikes. That’s how markets work. In Q2 2025, Bitcoin rose 30%. Volume fell 27.7%. That’s never happened before. It means people aren’t trading. They’re holding. Why? Because they can’t. Exchanges have restricted access. Withdrawals are delayed. New coins are banned. Even if you believe the price will go higher, you can’t act on it. This isn’t speculation. CoinGecko’s data shows it. Bitwise’s report confirms it. Even JPMorgan admitted the disconnect is “unprecedented.” The market is still alive - but it’s fragmented. Traders in the U.S. can’t access the same coins as traders in Dubai. Liquidity is broken.

Who’s Winning? Who’s Losing?

The winners aren’t the big names. They’re the quiet ones. Exchanges that moved to clear regulatory zones - like Bitget in the UAE, MEXC in Singapore, and OKX in the Caymans - grew. They didn’t fight the rules. They adapted. They got licensed. They built compliant products. Their volume went up. The losers? Exchanges that stayed put and tried to ride out the storm. Crypto.com. Binance (which lost U.S. users after exiting the market). Kraken, which spent $100 million on legal fees just to stay in the U.S. Institutional investors are shifting too. They’re pouring $5.95 billion into crypto ETFs in a single week. Why? Because ETFs are regulated. They’re safe. They don’t require you to touch a crypto exchange. You buy through Fidelity or BlackRock. You don’t need to worry about token delistings or KYC delays.What’s Happening to Real People?

Behind the numbers are real users. On Trustpilot, average ratings for major exchanges dropped from 4.3 to 2.5 stars in Q1 2025. Why? Users complained about:- Sudden delistings of coins they owned

- Extended verification processes (some took 3+ weeks)

- Withdrawal limits imposed without warning

- Accounts frozen over minor compliance flags

Casey Meehan

November 29, 2025 AT 03:54Tom MacDermott

November 29, 2025 AT 08:52Martin Doyle

November 30, 2025 AT 23:08Susan Dugan

December 2, 2025 AT 06:23SARE Homes

December 2, 2025 AT 23:41Grace Zelda

December 3, 2025 AT 16:24Sam Daily

December 5, 2025 AT 07:44Kristi Malicsi

December 7, 2025 AT 02:07