A7A5 Stablecoin: What It Is, Why It Matters, and What You Need to Know

When you hear A7A5 stablecoin, a digital currency designed to maintain a stable value by being pegged to a fiat asset like the US dollar. Also known as USD-backed token, it's built to reduce the wild price swings common in Bitcoin or Dogecoin, making it useful for everyday crypto transactions, savings, and trading. Unlike volatile coins, A7A5 doesn’t aim to make you rich overnight—it aims to keep your money safe while you move it between exchanges, apps, or wallets.

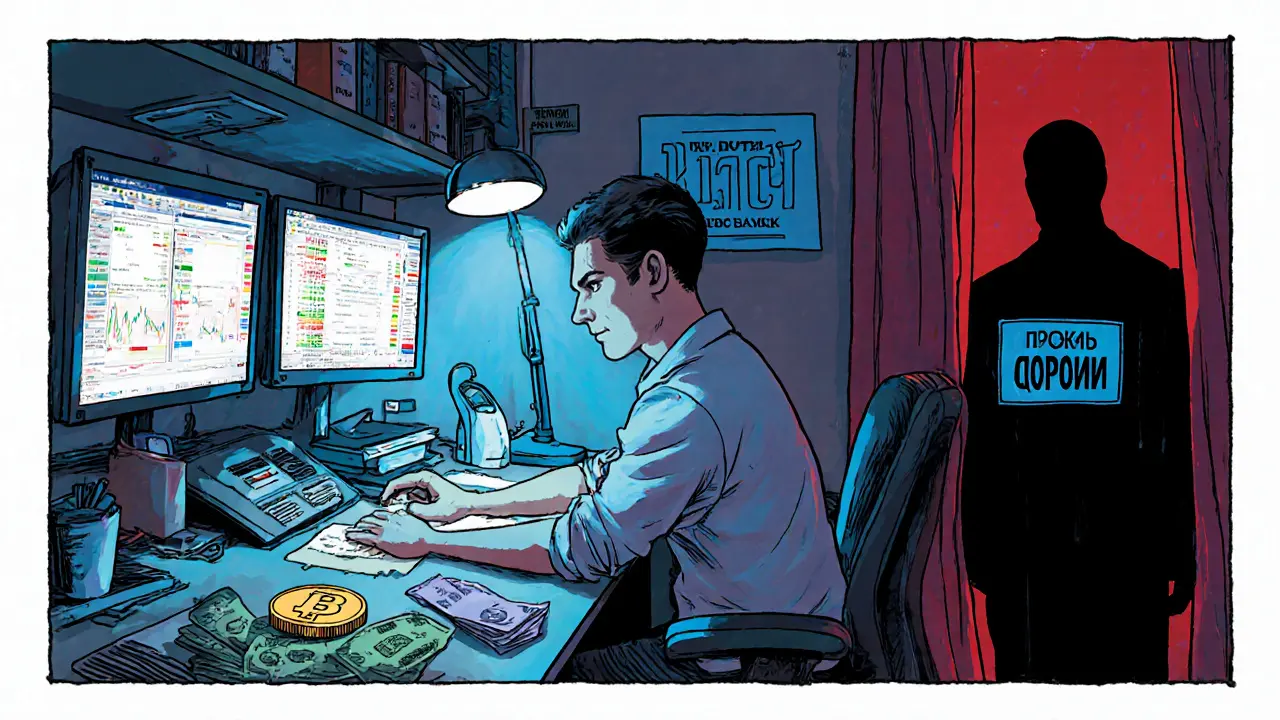

Stablecoins like A7A5 are the backbone of crypto trading. Most traders use them to avoid selling into fiat during market drops. You swap Bitcoin for A7A5, hold it steady, then buy back when prices drop. It’s like keeping cash in your wallet while you wait for the right time to shop. Other stablecoins you’ve probably heard of—USDC, USDT, and even CAD Coin (CADC)—work the same way. But A7A5 stands out because it’s not tied to a big company or bank. It’s designed for users who want transparency, low fees, and no middlemen.

What makes a stablecoin trustworthy? Three things: reserves, audits, and liquidity. If A7A5 claims it’s backed 1:1 by USD, you need proof—regular audits, public wallet addresses, and real-time reserve checks. Without these, it’s just a number on a screen. That’s why many users avoid new stablecoins with no track record. The posts below cover real cases where stablecoins failed, got hacked, or vanished overnight. You’ll also find guides on how to check if a stablecoin like A7A5 is legit before you use it.

Stablecoins aren’t just for traders. In countries like Nigeria and Venezuela, people use them to protect savings from inflation and bypass broken banking systems. A7A5 could be part of that movement—if it’s reliable. But not all stablecoins are created equal. Some are backed by risky assets. Others have no reserve at all. The posts here cut through the noise. You’ll see how exchange inflows and outflows signal whether traders are moving into or out of stablecoins. You’ll learn why some stablecoins like CADC are regulated and safe, while others are ghost tokens with no future. And you’ll find out how to spot a fake stablecoin before you deposit your money.

Whether you’re holding A7A5, comparing it to other stablecoins, or just trying to understand why they matter, the articles below give you real, no-fluff answers. No hype. No promises. Just what’s working, what’s broken, and what to watch out for in 2025.

Crypto Exchanges That Accept Russian Citizens in 2025

- 9 Comments

- Oct, 14 2025

In 2025, Russian citizens use offshore exchanges like Bybit, Gate.io, and KuCoin to trade crypto, while avoiding government restrictions. A7A5 stablecoin and peer-to-peer platforms have become essential tools for bypassing sanctions and banking limits.