Bitcoin Flow: Understanding Crypto Movement, Mining Pools, and Market Trends

When we talk about Bitcoin flow, the movement of Bitcoin across wallets, exchanges, and mining networks over time. Also known as Bitcoin transaction velocity, it reveals who’s buying, who’s selling, and where large amounts are moving—often before prices change. This isn’t just numbers on a screen. Bitcoin flow tells you if big players are accumulating, if miners are cashing out, or if exchanges are seeing unusual deposits—key clues for anyone trying to read the market.

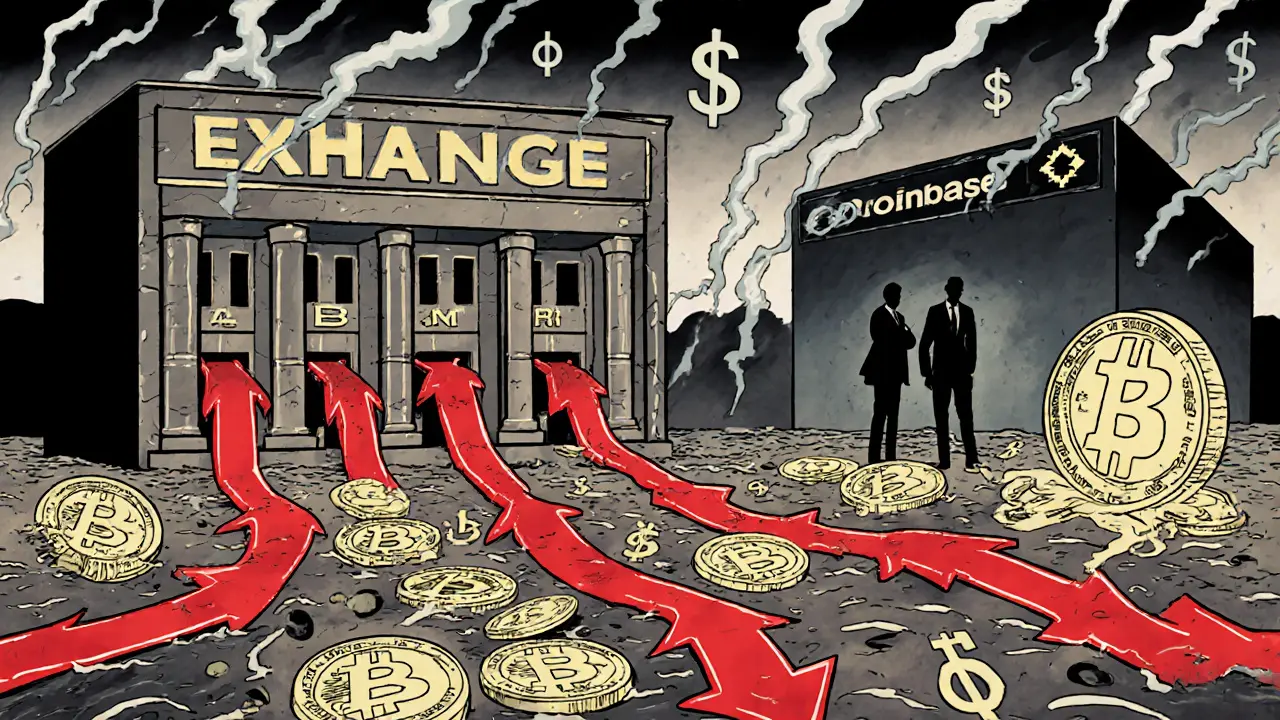

Behind every Bitcoin flow is the mining pool, a group of miners who combine computing power to earn Bitcoin rewards more consistently. Also known as crypto mining collective, it’s the engine that keeps Bitcoin running. Pools like ViaBTC and F2Pool don’t just mine—they influence flow by selling mined Bitcoin to cover costs. When a major pool starts dumping coins, it shows up in flow data as a spike on exchanges. And with institutional adoption surging in 2025, big funds now track these patterns to time their entries. Bitcoin flow doesn’t lie. If you see large amounts moving from cold storage to Binance or Coinbase, something’s coming. Meanwhile, institutional adoption, when corporations, hedge funds, and banks start holding Bitcoin as part of their treasury strategy. Also known as corporate Bitcoin holdings, it’s reshaping how Bitcoin moves. Companies like MicroStrategy and Tesla don’t buy a few coins—they buy thousands at a time, creating long-term flow shifts that retail traders can’t match. These aren’t random transactions. They’re strategic moves that ripple through the network.

Bitcoin flow also connects to what’s happening in Nigeria, where millions use Bitcoin to bypass broken banks, or in Venezuela, where state-run mining tries—and fails—to control the flow. It’s why tax loss harvesting works: you can time your sales based on flow trends. It’s why exchanges like Bitfinex and HashKey are so valuable—they’re the gateways where Bitcoin enters and exits the real economy. And it’s why you need to know the difference between a legitimate mining pool and a shady exchange like BitxEX that pretends to be a real player.

What you’ll find below isn’t just news. It’s a map. You’ll see how Bitcoin flow drives everything—from airdrop scams that ride hype waves to the quiet rise of regulated platforms like HashKey. You’ll learn why some tokens vanish overnight while Bitcoin keeps moving. You’ll understand why mining pools are more important than ever, and how institutional buyers are quietly rewriting the rules. This isn’t theory. It’s what’s happening right now, in real time, on the blockchain.

Exchange Inflow and Outflow Metrics: What They Really Tell You About Crypto Markets

- 10 Comments

- Oct, 16 2025

Exchange inflow and outflow metrics reveal whether crypto holders are preparing to sell or hold long-term. Learn how these on-chain signals predict market moves and what institutions are watching.