Bitcoin Mining: How It Works, Who Does It, and Why It Matters

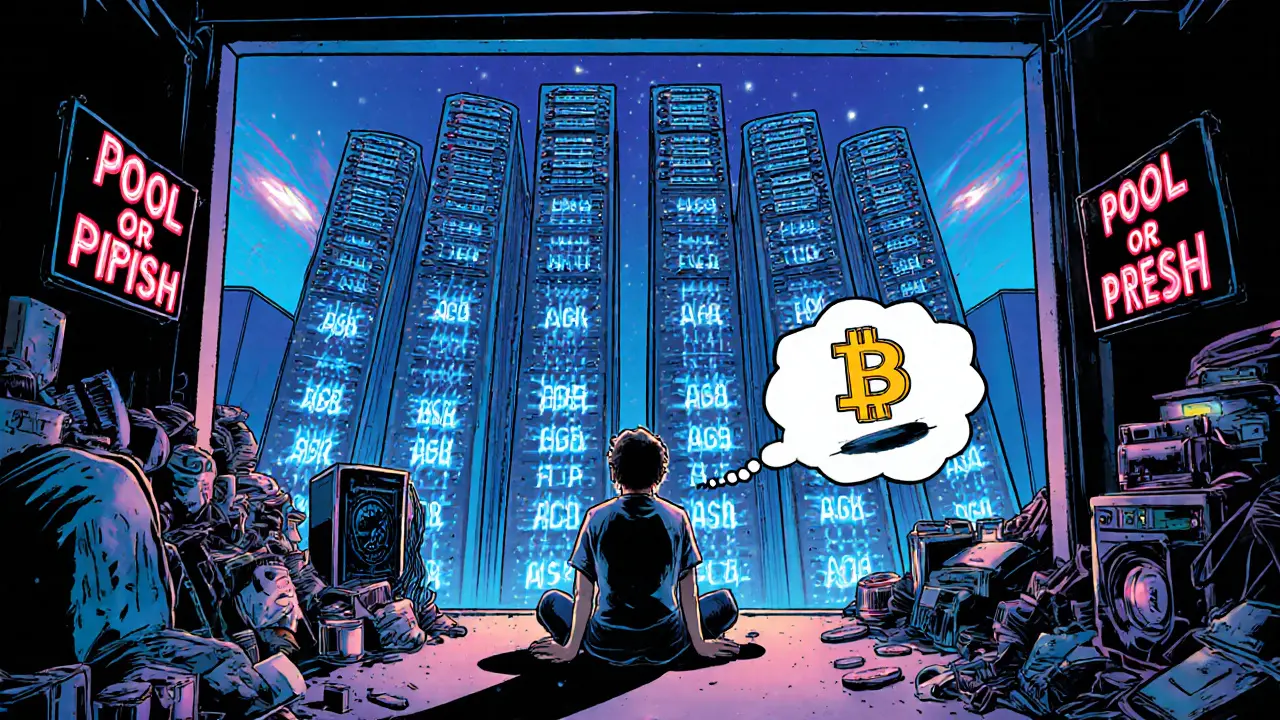

When you hear Bitcoin mining, the process of verifying Bitcoin transactions and adding them to the blockchain using powerful computers. It's not digging for digital gold—it's solving complex math puzzles to earn new Bitcoin and keep the network secure. Without mining, Bitcoin wouldn’t exist. It’s the engine behind the whole system, and it’s changing fast.

Blockchain, a public, tamper-proof ledger that records every Bitcoin transaction depends entirely on miners to update it. Every ten minutes, a group of miners competes to solve a cryptographic puzzle. The winner gets to add the next block of transactions and is rewarded with newly minted Bitcoin. This isn’t just technical—it’s economic. Miners invest in mining hardware, specialized machines like ASICs designed to run Bitcoin’s algorithm faster than regular computers, pay for electricity, and hope the reward covers their costs. In places like Venezuela and Nigeria, where power is cheap or banking is broken, mining isn’t optional—it’s survival. In China, it was banned outright. In the U.S., states like Texas and Georgia became hotspots because of low energy prices and pro-crypto policies.

But it’s not just about who can afford the machines anymore. crypto regulations, government rules that control how, where, and if mining can happen are reshaping the industry. Some countries tax mining income. Others shut down operations over energy use. A few, like El Salvador, even use it to power national projects. The truth? Mining is no longer just for tech enthusiasts. It’s a global industry shaped by politics, energy grids, and market prices. The miners who survive aren’t the ones with the biggest rigs—they’re the ones who adapt fastest.

What you’ll find here isn’t theory. It’s real stories: how Venezuela’s state-run mining system collapsed under corruption, why exchange inflows signal miners are selling, and how regulations in Nigeria and China forced miners underground. You’ll see which projects are dead ends, which exchanges are risky, and how people are still making money despite the odds. This isn’t about hype. It’s about what’s actually happening on the ground—and what you need to know before you even think about joining.

Future of Mining Pool Industry: How Bitcoin Pools Are Evolving in 2025 and Beyond

- 9 Comments

- Oct, 2 2025

In 2025, mining pools are the only way to profitably mine Bitcoin. Discover how Neopool, ViaBTC, and F2Pool are leading the industry with smarter tech, lower fees, and new features like staking and AI-driven optimization.