Bybit Nigeria: What You Need to Know About Trading Crypto in Nigeria

When Nigerians look for a reliable place to trade crypto, Bybit Nigeria, a global crypto exchange widely used by Nigerian traders for its low fees and stablecoin support. Also known as Bybit, it’s one of the few platforms that lets users deposit and withdraw in Naira via peer-to-peer channels, even when banks block crypto transactions. This isn’t just about convenience—it’s survival. With inflation hitting over 30% and traditional banking services unreliable, millions in Nigeria turn to crypto not to get rich quick, but to protect their savings and send money home.

Bybit Nigeria isn’t a separate entity—it’s the Nigerian user base of the global Bybit, a crypto exchange offering derivatives, spot trading, and staking with strong liquidity. What makes it stand out here is how it adapts to local needs. Users trade USDT, a stablecoin pegged to the US dollar and widely used in Nigeria to avoid currency collapse to buy Bitcoin, avoid Naira depreciation, or pay for services overseas. Unlike local exchanges that sometimes freeze withdrawals, Bybit has maintained consistent access—even during Nigeria’s 2021 banking restrictions on crypto.

But it’s not all smooth sailing. Nigeria’s crypto regulations Nigeria, a shifting legal landscape where the central bank bans banks from servicing crypto firms but doesn’t criminalize personal ownership creates gray zones. Bybit doesn’t require ID for basic trading, which helps users stay under the radar—but it also means no protection if something goes wrong. Still, with over 22 million crypto users in Nigeria and $59 billion in annual transactions, people are choosing platforms like Bybit because they work, not because they’re perfect.

What you’ll find below are real stories and warnings from Nigerian traders: how to avoid fake airdrops pretending to be linked to Bybit, why some claim to have "Bybit bonuses" that are scams, and which coins locals actually trade daily—not the hype coins, but the ones that keep the lights on. You’ll see how people use Bybit to send remittances, hedge against inflation, and even pay for school fees—all without touching a bank. This isn’t speculation. It’s everyday life.

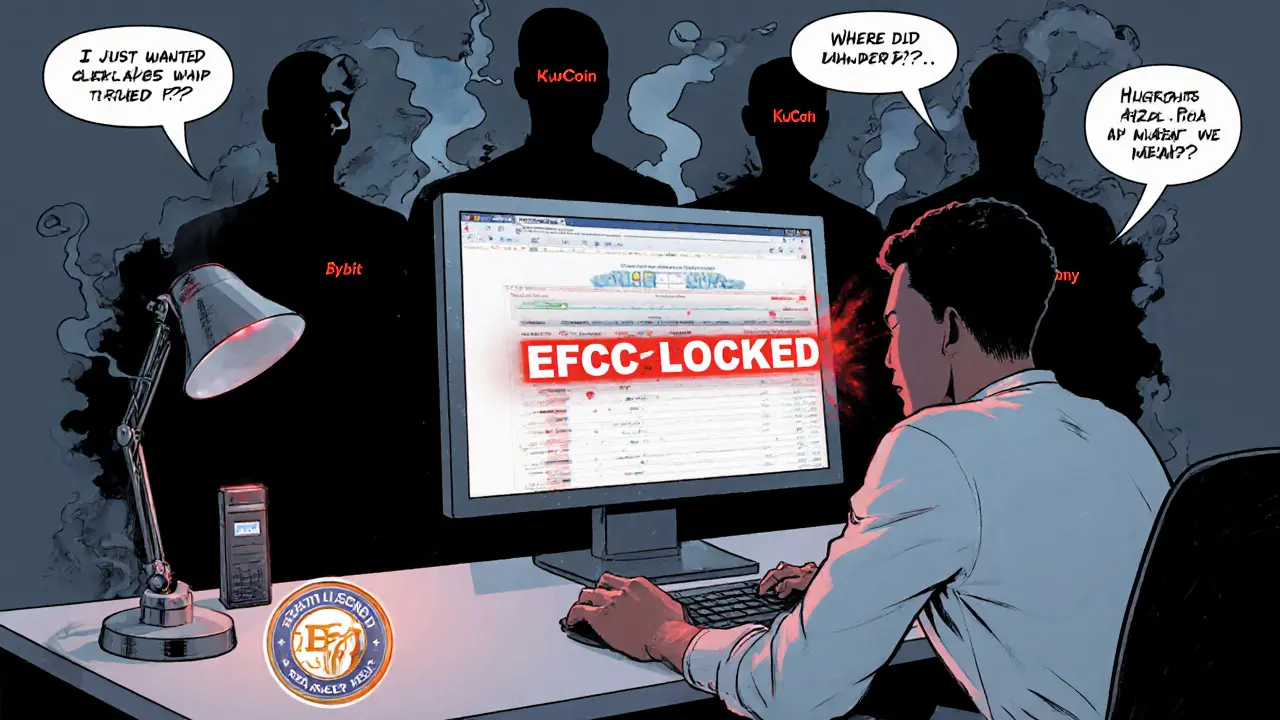

Crypto Exchanges to Avoid if You Are Nigerian in 2025

- 5 Comments

- Jun, 11 2025

In 2025, Nigeria requires all crypto exchanges to be licensed by the SEC. Only Quidax and Busha are approved. Using unlicensed platforms like Bybit or KuCoin risks account freezes, asset seizure, and lost funds. Know the rules before you trade.