Crypto Exchanges Nigeria: Best Platforms, Risks, and How to Stay Safe

When people in Nigeria talk about crypto exchanges Nigeria, online platforms where users buy, sell, and trade digital currencies like Bitcoin and stablecoins. Also known as crypto trading platforms, they’ve become essential tools for millions trying to protect their savings from inflation and bypass broken banking systems. With over 22 million users and $59 billion in transaction volume, Nigeria isn’t just adopting crypto—it’s relying on it.

These exchanges aren’t just for speculators. Most users turn to them to buy stablecoin Nigeria, digital tokens pegged to the US dollar or other stable assets to avoid local currency crashes like USDT or USDC. They use these to pay for goods, send money to family overseas, or hold value when the naira drops. Peer-to-peer peer-to-peer crypto, direct trades between individuals without a central middleman platforms dominate here because traditional banks often block crypto-related transactions. That’s why platforms like Paxful and Binance P2P are more popular than big-name exchanges with strict KYC.

But it’s not all smooth sailing. Many exchanges operating in Nigeria lack proper licenses, security audits, or customer support. Some disappear overnight. Others lock withdrawals after collecting deposits. That’s why knowing the difference between a real exchange and a scam site matters more than ever. Look for platforms with clear ownership, user reviews, and a track record of handling withdrawals—even during regulatory crackdowns. The Central Bank of Nigeria has banned banks from serving crypto firms, but that hasn’t stopped adoption. It’s just pushed it underground, where users rely on WhatsApp groups, Telegram channels, and local payment agents to move money in and out.

Regulation in Nigeria is messy. The government talks about banning crypto, then turns around and starts exploring its own digital currency. Meanwhile, everyday people keep trading. The result? A wild, fast-moving market where the best traders aren’t the ones with the most knowledge—they’re the ones who stay cautious, verify every platform, and never send funds without double-checking addresses.

What you’ll find below are real reviews of exchanges used by Nigerians right now. Some are trusted giants with global reach. Others are local platforms with shaky reputations. You’ll see which ones actually pay out, which ones have hidden fees, and which ones are outright scams. There’s no fluff—just what works, what doesn’t, and what you need to know before you send your next naira to a wallet.

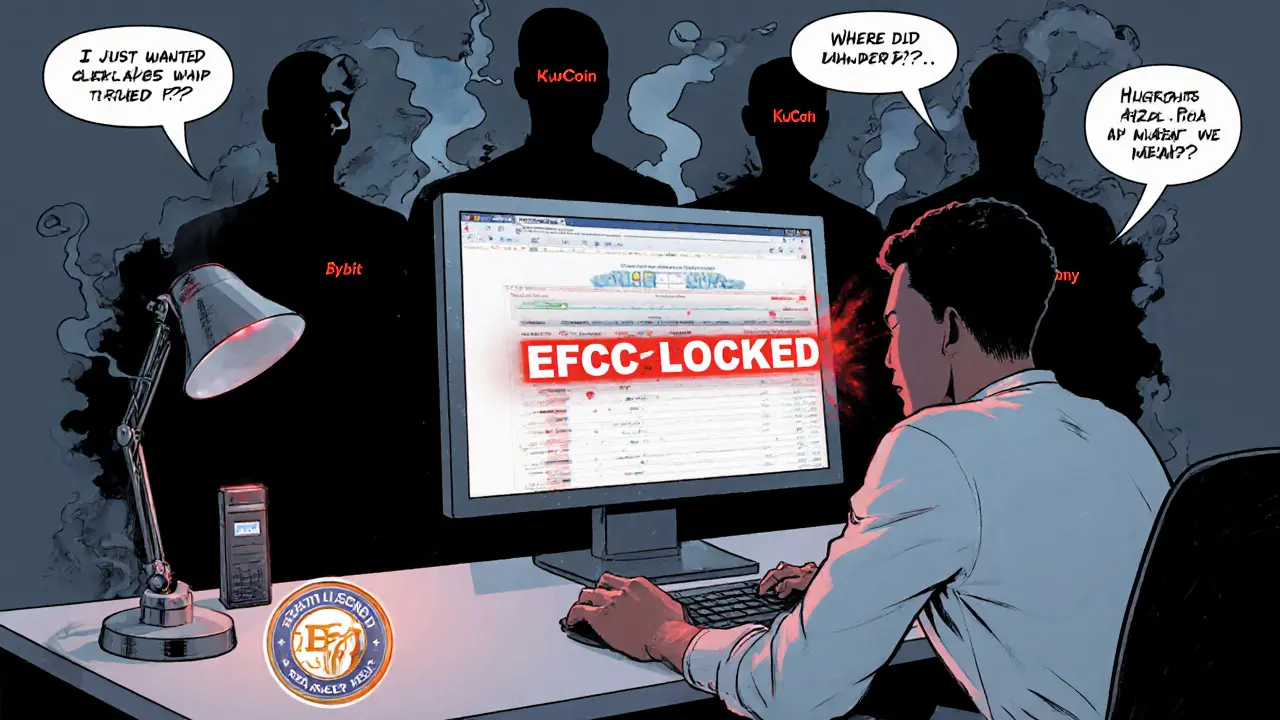

Crypto Exchanges to Avoid if You Are Nigerian in 2025

- 5 Comments

- Jun, 11 2025

In 2025, Nigeria requires all crypto exchanges to be licensed by the SEC. Only Quidax and Busha are approved. Using unlicensed platforms like Bybit or KuCoin risks account freezes, asset seizure, and lost funds. Know the rules before you trade.