Crypto Stock Token: What It Really Means and Why It Matters

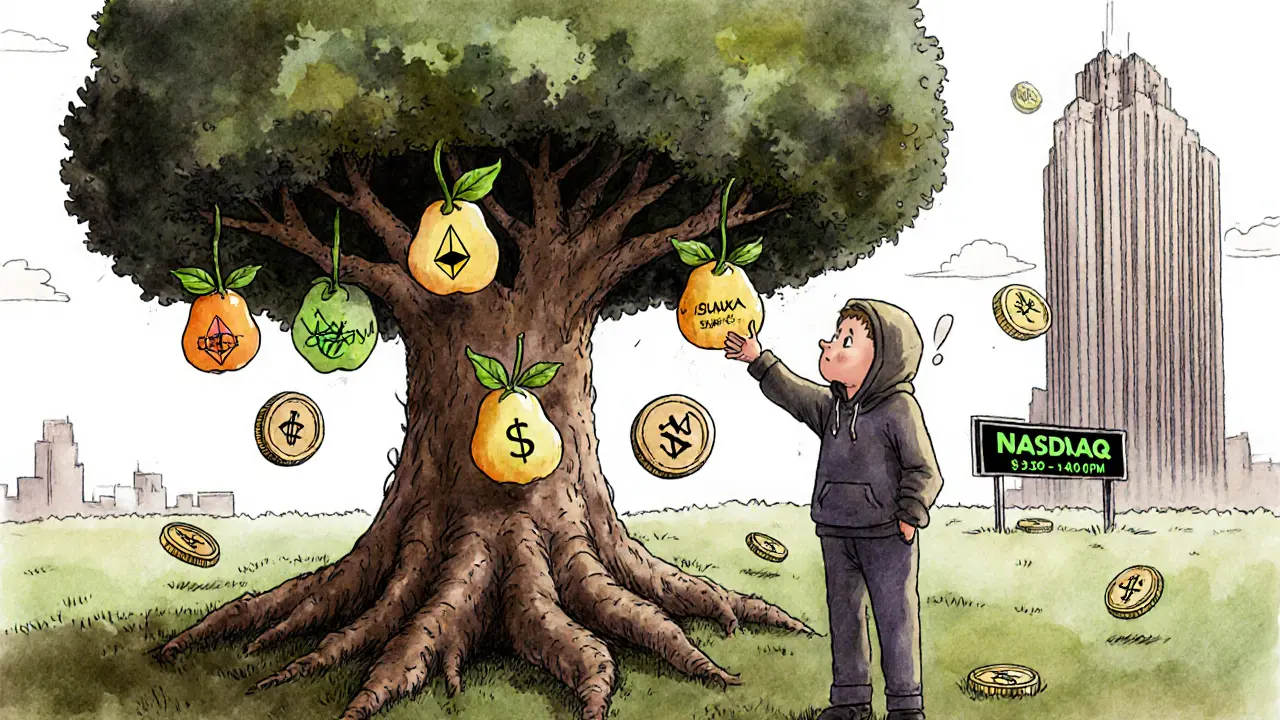

When you hear "crypto stock token," you might think it’s a new kind of investment—something between a stock and a cryptocurrency. But here’s the truth: crypto stock token, a misleading term that blends outdated financial concepts with blockchain tech. Also known as tokenized equity, it doesn’t exist as a standard category in real crypto markets. There’s no official definition. No exchange lists it. No regulator recognizes it. What people usually mean is either a cryptocurrency, a digital asset built on a blockchain like Ethereum or Solana—or a confused attempt to describe a token, a unit of value issued by a project that may represent access, ownership, or utility. But calling it a "stock token"? That’s where things go off the rails.

Stocks are shares in a company, regulated, with legal rights like dividends or voting. Tokens? They’re code. They might give you access to a service, a share of revenue, or nothing at all. Projects like PoolTogether (POOL), a no-loss lottery protocol where users earn rewards without risking principal or CAD Coin (CADC), a Canadian dollar-backed stablecoin regulated by FINTRAC have clear use cases. They don’t pretend to be stocks. Meanwhile, scams and low-effort projects throw around terms like "stock token" to sound legit. You’ll see it in fake airdrops like TRO (Trodl), a non-existent token used in phishing campaigns or zombie coins like Quotient (XQN), a dead project with zero activity since 2017. If someone says "buy this crypto stock token," ask: What’s the actual token? What does it do? Who’s behind it? If they can’t answer, walk away.

The confusion between stocks and tokens isn’t just annoying—it’s dangerous. People lose money thinking they’re buying ownership when they’re really buying a gamble. Real crypto projects don’t need the word "stock" to sound valuable. Look at Bitfinex, a professional exchange with deep liquidity but no retail-friendly safety nets or HashKey Exchange, a licensed Hong Kong platform trusted by institutions. They don’t use buzzwords. They show transparency, audits, and real features. That’s what matters. The posts below cut through the noise. You’ll find clear breakdowns of actual tokens, exchanges, airdrops, and scams—no fluff, no fake labels, just what’s real and what’s not.

What Is Starbucks Tokenized Stock (Ondo) (SBUXon)? The Real Story Behind the Crypto-Like Stock Token

- 8 Comments

- Dec, 4 2024

SBUXon is a blockchain token by Ondo Finance that tracks Starbucks stock price but isn't actual stock. It offers 24/7 trading and fractional ownership but suffers from zero liquidity, regulatory risk, and minimal adoption.